When it's time to buy foreign currency, your best bet is often a specialist online broker. They almost always offer the most competitive exchange rates and keep their fees low. Of course, high-street banks and the Post Office are there for convenience, but you'll usually pay a premium for it. This guide will walk you through the real differences, moving beyond just the sticker price to help you find genuine value.

Understanding Your Currency Exchange Options

Choosing where to get your travel money is a balancing act between cost, speed, and convenience. While popping into your local bank branch feels easy and familiar, the reality is that digital providers often deliver far better value simply because they have lower overheads. The right choice really hinges on what you need—are you a holidaymaker grabbing some spending money, a collector hunting for specific notes, or a business making a large purchase?

To make a smart decision, you have to compare providers on a few key points. It’s not just about the exchange rate. You need to look at hidden fees, delivery options, and what security measures are in place. For a solid overview of the main players in a specific region, you can dig into resources that cover the top foreign exchange South Africa options.

It's no secret that the UK is the world's epicentre for foreign exchange trading, with the average daily turnover hitting an incredible $4,745 billion. For collectors and dealers, this is a crucial piece of information. It explains why sourcing foreign currency through reputable UK channels is so important; that sheer volume guarantees competitive pricing and a steady supply of notes. The Bank of England's own foreign exchange survey backs this up with some fascinating insights.

Here’s a quick breakdown of where you can go:

| Provider Type | Best For | Main Drawback |

|---|---|---|

| Online Brokers | The best exchange rates & lowest fees | You need to plan ahead for delivery |

| High-Street Banks | Sheer convenience & a trusted name | Poor exchange rates are common |

| Bureaux de Change | Getting cash on the spot, right now | Rates can be all over the place, especially at airports |

| Specialist Dealers | Collectors & bulk buyers of specific banknotes | Not designed for standard travel money |

Ultimately, finding the best place to buy foreign currency just means matching a provider's strengths to your own priorities. If you're getting ready for a trip, have a look at our range of holiday money to see how a specialist can help travellers, too.

Decoding Exchange Rates and Hidden Costs

Getting a good deal on foreign currency all comes down to understanding the real cost of your transaction. It’s easy to get sidetracked by flashy signs and marketing promises, but the secret lies in focusing on the numbers that truly matter, starting with the interbank rate.

The interbank rate is essentially the wholesale price—the rate banks use when they trade massive amounts of currency with each other. As a regular customer, you’ll never get this rate. Instead, every currency provider adds a margin on top, and this is known as the spread. The spread is their profit, and it's the biggest single cost you’ll pay.

The Myth of Commission-Free Currency

You’ve probably seen the signs: "0% commission" or "commission-free" currency exchange. While it sounds like a brilliant deal, it's often just a clever bit of marketing. The fee hasn’t vanished; it’s simply been absorbed into a less favourable exchange rate. A wider spread means you get less foreign currency for your pounds, making it a hidden, invisible commission.

The most important figure to compare is the final amount of foreign currency you will receive for your pounds. A provider offering a poor rate with "zero commission" is almost always more expensive than one with a transparent fee and a competitive rate.

Looking back at historical data shows just how much these rates can vary. Last year, the average GBP to USD rate hovered around 1.338419. While specialist UK retailers manage to keep their spreads quite close to this interbank level, you’ll find airport kiosks and high-street bureaux often add markups exceeding 5-10%. That’s a hefty hidden cost. You can explore more about historical exchange rates to see these trends for yourself.

How a Small Difference Adds Up

Let’s see how this plays out in the real world. Imagine you want to convert £1,000 to Euros, and the interbank rate is €1.18.

- Provider A (Online Broker): Offers a rate of €1.16. The spread is small. You receive €1,160.

- Provider B (Airport Kiosk): Offers a "commission-free" rate of €1.11. The spread is much larger. You receive €1,110.

That tiny difference in the exchange rate just cost you €50. This effect gets magnified on larger transactions for business needs or bulk collecting. This is exactly why carefully checking the spread is the key to finding the best places to buy foreign currency and making sure you get the most for your money.

Comparing Your Main Currency Exchange Options

When it comes to swapping your pounds for foreign currency, you're always making a trade-off between price, convenience, and speed. Not all providers play by the same rules, and knowing the pros and cons of each is the key to getting the best deal for your specific needs. Let's break down the main players on the UK market.

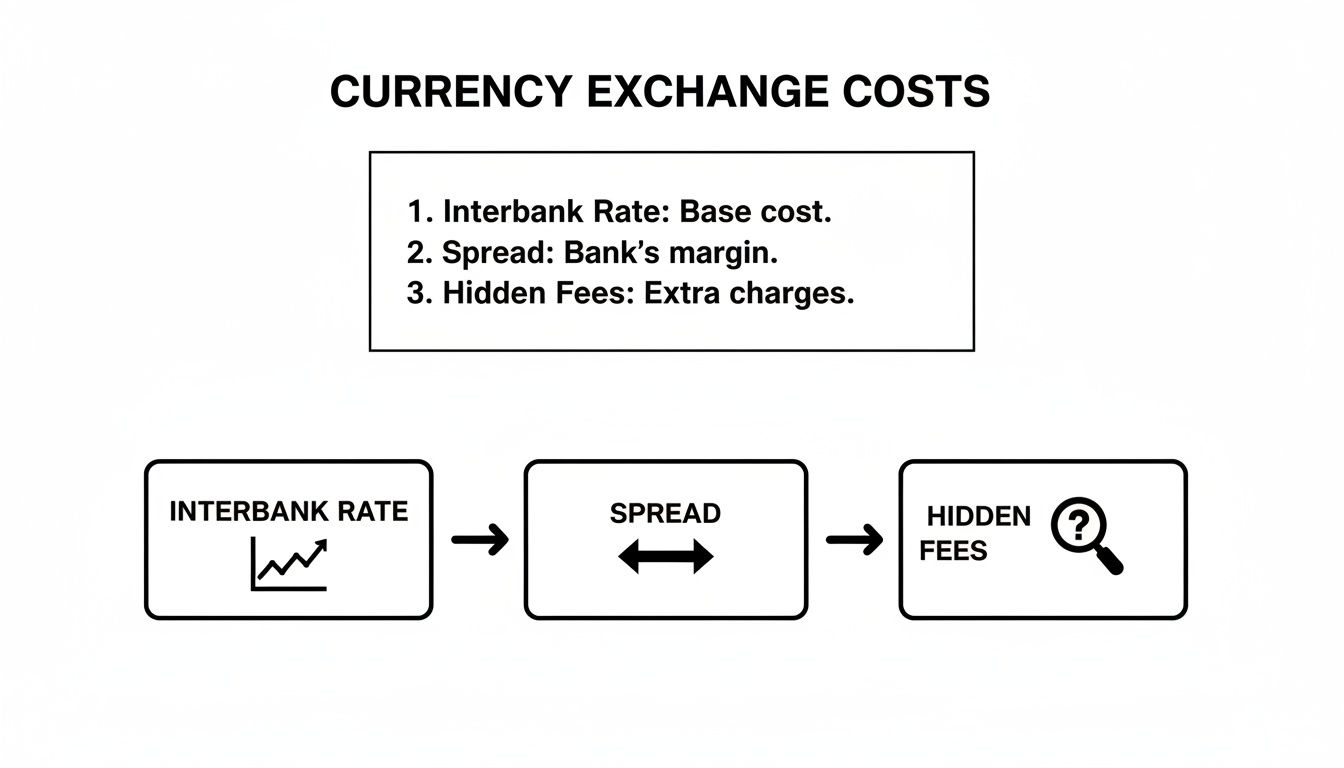

Before we dive in, it helps to understand exactly what you're paying for. Every currency exchange transaction has a few core components that determine the final cost.

This visual breaks it down nicely. The final cost you pay is a mix of the provider's markup on the real exchange rate (the "spread") and any extra fees they decide to tack on, which are often buried in the small print.

High-Street Banks: The Familiar Choice

Walking into your local bank branch feels safe and familiar, which is a big draw for many people. The process is usually very straightforward, and you can often walk out with your holiday money the same day or pick it up the next.

However, that convenience comes at a pretty steep price. Banks are notorious for offering some of the least competitive exchange rates out there. Their spreads can easily be 2-5% wider than specialist providers, a difference that really adds up on larger transactions. You're paying a premium for the name you know.

When it makes sense: Imagine you're a cautious traveller who prefers face-to-face service and you need cash for a trip next week. In this case, your bank is a reliable, if expensive, option. For last-minute needs where peace of mind outweighs getting the absolute best rate, it can do the job.

Online Currency Brokers: The Value Leaders

For savvy travellers who plan ahead, online currency brokers have become the undisputed champions of value. Because they operate digitally, their overheads are much lower than a high-street bank's, and they pass those savings directly on to you with much tighter exchange rate spreads.

The only real catch is that you can't leave it until the last minute. Most online services need a few working days to process your payment and securely deliver the cash to your door. The rates are fantastic, but it's not an option for that spontaneous weekend getaway.

Bureaux de Change: The High-Street Alternative

Often found on high streets or tucked inside department stores, bureaux de change offer a sort of middle ground. You get the instant cash-in-hand service of a bank, but often with slightly better rates. The catch is that their rates can vary wildly from one location to another, so shopping around is essential.

You need to be especially wary of any bureau located in a prime tourist trap or, worst of all, at the airport. These places know they have a captive audience and will offer some of the most punishing exchange rates you’ll find anywhere. A bureau in a competitive city centre will almost always give you a better deal than one at Heathrow Terminal 5.

Currency Provider Comparison At a Glance

To help you weigh up your options quickly, here's a direct comparison of the most common providers. This table summarises the key differences in costs, convenience, and typical use cases.

| Provider Type | Typical Exchange Rate Spread | Common Fees | Best For | Avoid If |

|---|---|---|---|---|

| Online Broker | 0.5% - 2% | Delivery charges on small orders | Planners seeking maximum value for their money | You need currency in less than 48 hours |

| High-Street Bank | 2% - 5% | Often fee-free for account holders | Last-minute needs & those who prefer in-person service | You are exchanging a large amount of money |

| Bureau de Change | 1.5% - 4% | Commission fees, admin charges | Instant cash needs when on the high street | You haven't compared rates with other local options |

| Airport Kiosk | 5% - 15% | High commission, poor rates | Absolute emergencies only | You care about value at all; it's a last resort |

In short, if you have time on your side, an online broker will consistently get you the most foreign currency for your pounds. For those moments when you absolutely need cash now, a well-chosen high-street bureau de change or even your bank can be a practical, albeit more expensive, alternative. And the airport kiosk? That should always be your last resort, reserved for true travel emergencies when you have no other choice.

A Specialist Approach for Collectors and Bulk Buyers

For the average holidaymaker, buying foreign currency is a simple game of finding the best rates and lowest fees. But when you’re a numismatist (a collector) or a bulk reseller, the whole equation changes. Your typical high-street bank or online broker is set up for one thing: providing circulated, usable banknotes for travel. This model completely misses the mark for anyone who sees the currency itself as the real asset.

When you’re acquiring banknotes for a collection or for inventory, factors like face value take a backseat. The real drivers of value are the note’s physical condition, its rarity, specific serial numbers, and its historical provenance. A standard currency exchange just isn't equipped to deal with these specifics. This is exactly where specialist dealers like Cavalier Coins find their essential niche.

Unlike travel money services, specialist dealers are much more like art galleries or antique merchants. Their expertise isn't just in exchanging money, but in sourcing, grading, and curating currency based on its collectible merit.

Why Specialists Excel for Serious Buyers

A specialist dealer brings a distinct set of advantages to the table that you just won't find anywhere else. They give you access to currency that has been professionally graded for quality, often offering pristine, uncirculated notes that are worlds away from the worn bills you'd get from a standard exchange.

The key differences are night and day:

- Focus on Condition: Specialists grade their banknotes, so you know precisely if a note is uncirculated (UNC), about uncirculated (AU), or has other important characteristics.

- Rarity and Provenance: They can tell you about a banknote's history, its print run, and its significance—all crucial details for determining its long-term value.

- Curated Sets: Many offer themed or historical sets, which are perfect for building a collection around a specific interest.

For a collector, buying a rare banknote from an airport kiosk is like buying a vintage painting from a hardware shop. Sure, the transaction might be possible, but the context, expertise, and assurance of quality are completely missing. You need a source that understands and values the item for what it truly is.

This specialised focus ensures you’re not just swapping money; you’re acquiring a tangible asset that has the potential to appreciate over time. If you're just starting out in this fascinating hobby, having a read through a beginner’s guide to collecting world banknotes is a great way to get a handle on these nuances.

The Advantage for Bulk Purchases

Resellers and those buying in bulk also find huge benefits in working with specialist dealers. While a peer-to-peer platform might seem like a good place to source large quantities, it offers no consistency or quality control. Dealing directly with an expert like Cavalier Coins opens up several key advantages:

- Negotiated Discounts: Large orders often qualify for better pricing, giving resellers a healthier margin.

- Consistent Quality: You can source large volumes of banknotes in a specific, guaranteed condition, which is essential for maintaining inventory consistency.

- Expert Sourcing: Dealers have established networks to track down specific currencies or banknote series that are otherwise incredibly difficult to find.

At the end of the day, for anyone whose interest in foreign currency goes beyond holiday spending, a specialist dealer isn't just another option—it’s the only one that makes sense. They deliver the expertise, quality assurance, and access needed to build a valuable collection or a profitable resale business.

How to Choose the Right Provider for Any Scenario

Knowing the difference between currency providers is one thing, but applying that knowledge to your specific situation is what truly saves you money and hassle. The "best place to buy foreign currency" isn't a single answer; it changes entirely based on what you need and when you need it. Let’s walk through some common scenarios to see how these choices play out in the real world.

By putting yourself in these shoes, you can get a much better feel for the trade-offs between cost, convenience, and quality. Each scenario brings a different set of priorities to the forefront, leading to a very different recommendation.

The Last-Minute Traveller

Scenario: You’re flying out tomorrow morning and have just realised you have no local cash for a taxi when you land. Your priorities are speed and getting your hands on the money, period. The exchange rate is a distant second concern.

Options: Realistically, you're looking at your high-street bank or an airport kiosk. The bank might give you a slightly better rate, but the airport kiosk is a sure thing—it'll be open and ready for you right before you fly.

Recommendation: Head for the airport kiosk, but only for the bare minimum. Exchange just enough to cover immediate costs like that taxi ride and maybe a coffee—perhaps £50 worth. Yes, the exchange rate will be poor, but the convenience is unbeatable for a genuine emergency. You can always sort out the rest of your holiday money at a better-value spot later on.

The Methodical Holiday Planner

Scenario: The family holiday is two months away. You want to exchange £1,000, and your main goal is to squeeze every last drop of value out of it by getting the best possible exchange rate. You're organised and time is on your side.

Options: Your top contenders are a reputable online currency broker and maybe a quick comparison with the Post Office. An online broker will almost certainly offer a tighter spread, while the Post Office provides a trusted name with competitive, though rarely the absolute best, rates.

Recommendation: The online currency broker is the clear winner here. With weeks to spare, you can easily place an order for secure home delivery. On a £1,000 transaction, that better exchange rate will likely save you £30-£50 compared to a high-street bank. That’s more than enough for a nice family meal abroad.

Choosing the right provider is also about understanding their operational scope. When making your decision, it's helpful to see how providers handle different currencies across countries, as this can affect availability and rates for less common destinations.

The Serious Collector

Scenario: You're a numismatist building a collection of uncirculated banknotes from Southeast Asia. You couldn't care less about the face value for spending; your focus is entirely on the note's condition, rarity, and authenticity.

Options: Your search is really between a specialist dealer like Cavalier Coins and trawling through online auction sites. Auctions might occasionally unearth a hidden gem, but they come with huge risks when it comes to authenticity and accurate grading.

Recommendation: A specialist dealer is the only sensible choice for a serious collector. They provide expert grading, guarantee authenticity, and understand the subtle details that give a banknote its collectible value. This protects your investment and ensures you’re adding a genuine, high-quality asset to your collection. Authenticity is everything, so learning how to identify fake currency using an expert detection guide is a vital skill for anyone in this field.

As these scenarios show, there’s no one-size-fits-all answer. Your personal context—whether it's urgency, value, or quality—is the most important factor in choosing where to buy your currency.

Your Simple Checklist for Buying Foreign Currency

Before you jump into buying currency, it’s worth having a clear plan. Following a few simple steps can be the difference between getting a great deal and leaving money on the table. Think of this as your repeatable process for buying currency safely and cost-effectively, every single time.

-

Work Out What You Need: First things first, figure out exactly how much foreign currency you’ll require for your trip or what you need to complete your collection. A little planning here prevents over-buying or being caught short.

-

Check the Mid-Market Rate: This is your secret weapon. Before you do anything else, use an online converter to find the current, real exchange rate. This is the rate banks use to trade with each other, and it’s your benchmark for what a fair deal looks like.

-

Compare Providers (The Right Way): Don't get distracted by flashy headline rates. The only number that matters is the final amount of foreign currency you’ll receive after all spreads and fees have been factored in. Always compare the bottom line.

-

Look Out for Hidden Fees: Keep a sharp eye out for any extra costs. Things like delivery charges, administration fees, or minimum order fees can quickly eat into your total, especially on smaller purchases.

-

Place Your Order Securely: This is non-negotiable. Only ever use reputable, well-known providers that have secure payment systems and send you a clear confirmation once the transaction is complete.

-

Check Your Currency on Arrival: Once your money arrives, take a moment to double-check everything. Count the notes to ensure the amount is correct and give them a quick inspection to make sure they're in good condition.

A Few Final Questions on Buying Currency

Getting your head around the world of currency exchange can leave you with a few lingering questions. Let's clear up some of the most common ones so you can finalise your plans with confidence.

Should I Buy Currency in the UK or Abroad?

This is a simple one: it's almost always cheaper and safer to buy your foreign currency here in the UK before you set off. Once you’re abroad, especially at airports or in tourist hotspots, the exchange rates are notoriously poor and the fees can be surprisingly high.

By planning ahead and using a trusted UK-based provider, like an online broker or a specialist dealer, you’re tapping into a much more competitive market. The result? A better deal and far more transparency on what you're actually paying.

How Far in Advance Should I Order My Currency?

If you want the best rates from an online provider, it’s a good idea to order your currency at least a week before you travel. This gives plenty of time for your payment to clear and for the cash to be delivered securely to your door via tracked post.

Of course, some high-street banks or bureaux can offer same-day collection, but you'll definitely pay a premium for that last-minute convenience. And airport kiosks? They should be your absolute last resort—think emergency-only—as their rates are consistently the most expensive.

The trade-off is straightforward: the more time you give yourself, the more money you'll save. Rushing to buy currency at the eleventh hour is a surefire way to get less for your pounds.

What’s the Difference Between Travel Money and Collector's Currency?

This is a vital distinction to make. When you're buying money for a holiday, your only real concerns are the exchange rate and the currency's face value. The whole point is to get as much spending power as possible.

Collecting is a different game entirely. Here, the physical condition of the banknote is paramount—is it uncirculated? Other factors like its rarity, specific serial numbers, or its historical importance completely overshadow the simple face value.

That's why specialist dealers are so important for collectors. We source, grade, and value currency based on its numismatic merit, which is a specialised skill that standard travel money providers simply don't have.

Whether you are a seasoned numismatist or just beginning to build your collection, Cavalier Coins Ltd offers the expertise and high-quality, graded banknotes you need. You can explore our curated selection of world banknotes and coins at https://www.cavaliercoins.com.