Why Your Coins Need More Than Basic Home Insurance

Let's be honest, a coin collection isn't just loose change. It's a carefully curated piece of history, a testament to artistry, and often, a significant investment. But what happens when the unexpected occurs? A house fire, a break-in, even a simple accident could erase years of dedicated collecting in a flash. This is where the shortcomings of standard home insurance policies really show.

Most homeowner's insurance provides minimal coverage for collectibles, often with surprisingly low limits. This means if your collection is worth more than that limit, you’re on the hook for the remaining loss.

For instance, consider a collector with a valuable sovereign set worth thousands of pounds. A standard policy might only cover a small portion of its true value, leaving a huge financial gap. And this isn't just a hypothetical situation. I've talked to many collectors who learned this the hard way after suffering a loss. One collector, after a devastating house fire, discovered his insurance only covered a tiny fraction of his collection’s value – a massive financial blow.

This coverage gap isn't just about dramatic events like fires or burglaries. Subtler dangers, like humidity damage or even accidental loss during a move, can also seriously impact a collection’s worth. These incidents are often excluded or barely covered under standard home insurance. It's a slow, creeping threat to your investment.

Furthermore, in the UK, demand for coin collection insurance is rising because collectible coins are becoming increasingly valuable. The UK coin collecting market is projected to grow between 2025-2031, fueled in part by growing interest in rare and limited-edition coins. As the market expands, so does the need for specialized insurance that truly meets collectors' needs. Discover more insights.

So, what can you do? Coin collection insurance is designed specifically for the unique risks collectors face. It offers comprehensive protection against a wide array of problems, ensuring your collection’s value is safeguarded, no matter what life throws your way. For more details, check out our guide: Top Coin Insurance Guide 2025: Protect Your Numismatic Collection. Protecting your collection isn't just about insurance; it's about protecting the passion and effort you’ve invested in building something truly special.

Getting Your Collection's Value Right For Insurance

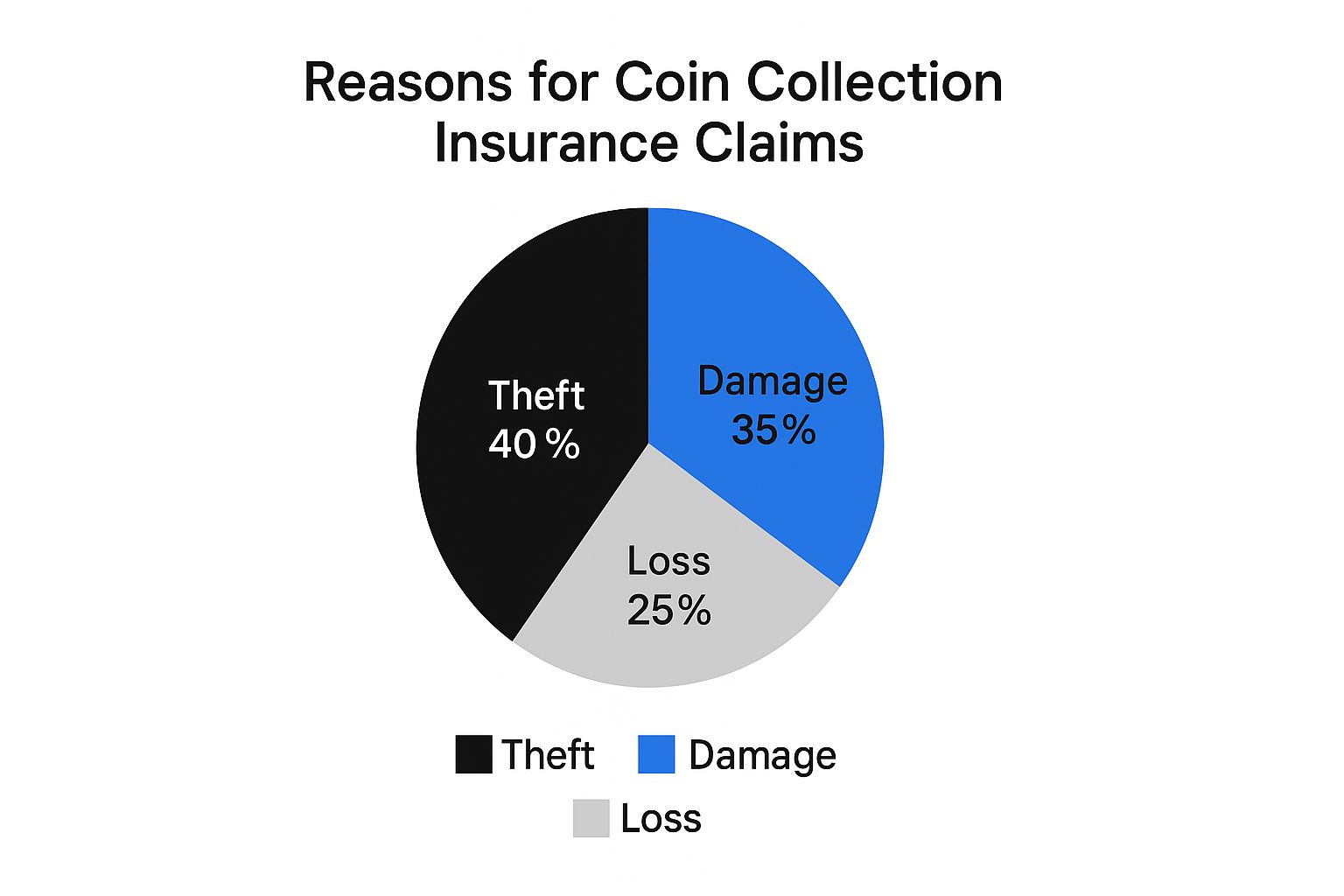

This infographic paints a clear picture: theft (40%), damage (35%), and loss (25%) are the main culprits behind coin collection insurance claims. Theft and damage really stand out, making robust security and proper storage absolutely essential. Now, let's dive into figuring out your collection's true worth – a crucial step in getting the right insurance coverage.

Valuing your collection accurately isn't just about remembering what you originally paid. It's about understanding the current market value and making sure you're covered for potential increases in value. Think of it like insuring a classic car – its value can change dramatically over time.

One trap many fall into is relying solely on outdated price guides. They're a good starting point, but market values are constantly shifting. A coin worth £50 a few years ago might be £100 today, or it could have gone down in value. So, how do you keep up?

Regularly checking online marketplaces like eBay, auction results, and dealer catalogs is key. This gives you a real-time feel for what your coins are actually selling for. Cavalier Coins offers some great tips on valuing old coins: How to Value Old Coins: Expert Tips for Collectors. For particularly valuable coins, a professional appraisal is a smart move. Think of it as an investment in protecting your investment.

Understanding Coin Valuation

Speaking of professional appraisals, let's talk about the different ways you can assess the value of your collection. There's no one-size-fits-all approach. The best method depends on factors like the size of your collection, the value of individual coins, and your budget. To help you navigate this, I've put together a comparison table outlining the various valuation methods.

To help you understand the various ways you can value your collection, I've put together a handy comparison table. It breaks down the different approaches, their costs, accuracy, and when each method is most suitable.

Coin Valuation Methods Comparison

| Valuation Method | Cost Range | Accuracy Level | Best Used For | Time Required |

|---|---|---|---|---|

| Online Price Guides | Free - £20/month | Low - Moderate | Common coins, initial estimates | A few minutes per coin |

| Dealer Price Lists | Free | Moderate | Getting a sense of current market trends | Varies depending on dealer |

| Auction Records | Free - Paid subscriptions | High | Researching past sales of similar coins | Varies depending on research depth |

| Professional Appraisal | £50 - £200+ per hour | Very High | High-value coins, insurance purposes | A few days to several weeks |

As you can see, each method has its pros and cons. While online price guides are readily available and free, they may not be as accurate as a professional appraisal. For a high-value collection, the investment in a professional appraisal is almost certainly worth the cost.

The Growing Importance of Insurance

The growing interest in collectibles suggests a rise in demand for specialized insurance in the UK. The global coin collection market hit USD 10.74 billion in 2024 and is expected to grow significantly by 2032. This trend likely reflects the situation in the UK. This report offers more insights. This growth underlines the importance of adequate coin collection insurance. Don’t just insure for what you paid – insure for what your collection is actually worth today. This proactive approach will prevent you from being left short financially if the unexpected happens.

Finding Insurance That Actually Delivers When You Need It

So, you've put in the work and figured out what your collection is really worth. Now comes the crucial part: finding the right insurance. Trust me, this isn't something you want to skimp on. A good coin collection insurance policy is like a safety net, and you need one that won't let you down when you need it most.

Let's be honest, not all insurance policies are created equal. There can be a lot of hidden gotchas, especially when it comes time to make a claim. One of the biggest things to look for is the type of coverage offered. Agreed value policies are the holy grail for coin collectors. You and the insurer agree on your collection’s value upfront, which means no nasty surprises if disaster strikes. If there's a total loss, you get the agreed amount, no questions asked. This is a world away from standard homeowner's insurance, which often factors in depreciation—meaning you might get much less than your collection is truly worth.

Another critical thing to consider is worldwide coverage. This is especially important if you travel with your coins, take them to shows, or send them off for grading or appraisals. You want them protected wherever they go. I've heard horror stories about collectors losing valuable coins in transit and then finding out their insurance only covered losses at home. Don't let that be you.

Navigating the Fine Print

Here's where things can get complicated. The fine print of an insurance policy is where the real details hide. Deductibles, exclusions, and specific conditions can make a huge difference. For example, some policies have higher deductibles for theft than they do for fire damage. Knowing these details upfront can save you major headaches later. My advice? Read those policy documents carefully. Or, even better, talk to an insurance broker who specializes in collectibles. They can translate the insurance jargon and help you get the coverage that fits your specific needs.

The UK coin collecting scene is thriving, with tons of clubs, events, and online platforms making it easier than ever to buy, sell, and trade. This also makes having solid coin collection insurance even more important. For instance, you need to make sure you’re covered when you buy coins online and they’re shipped to you. Discover more about coin collecting insurance solutions.

Securing Comprehensive Coverage at Reasonable Rates

Don't worry, getting the right insurance doesn't have to cost a fortune. Here are a few tips for getting good coverage at a reasonable price:

- Bundle your coverage: If you’ve got other valuables, like jewelry or art, see if you can insure them all under the same policy. This can often get you a discount.

- Increase your security: Investing in good security measures, like alarms and safes, can lower your premiums. Insurers see this as a lower risk, and they'll often reward you for it.

- Document your collection meticulously: Keep detailed records, including photos and appraisals. This shows insurers you’re serious about protecting your collection and makes the claims process much smoother.

Before we wrap up, I've put together a helpful table comparing some major UK insurers that offer coin collection coverage. Take a look – it might give you a good starting point for your research.

UK Coin Collection Insurance Providers Comparison

| Insurance Provider | Coverage Types | Maximum Limits | Specialties | Average Premium |

|---|---|---|---|---|

| Assetsure | Agreed Value, All Risks, Worldwide | £10,000,000 | High-Value Collections, Worldwide Coverage | Varies based on collection value |

| Chubb | Scheduled Items, Blanket Coverage | Varies | Fine Art & Collectibles, Global Network | Typically higher premiums |

| Hiscox | Agreed Value, All Risks | Varies | High Net Worth Individuals, Specialist Valuations | Mid-to-High range premiums |

| Aviva | Specified Items, All Risks | Varies | Flexible Coverage Options, Online Management | Varies based on policy |

Note: This table provides a general overview and should not be considered financial advice. Always contact insurers directly for accurate and up-to-date information.

By understanding the ins and outs of coin collection insurance, reading the fine print, and using a few smart strategies, you can protect your precious numismatic treasures without breaking the bank. Knowing your collection is safe and sound is worth its weight in gold (or, well, silver and copper!).

Building Documentation That Survives Claims Scrutiny

Imagine this: a pipe bursts, flooding your home and damaging your precious coin collection. When you file a claim, your insurance company asks for proof of ownership and value. You confidently hand over a handwritten list and a few blurry phone pics. Sadly, that might not cut it. Many collectors think a simple inventory is enough, but coin collection insurance claims demand serious documentation. This isn't just paperwork for the sake of it—it's your financial safety net when disaster strikes.

Why Detailed Documentation Matters

Insurance companies, understandably, scrutinize claims carefully. They need to verify the loss and make sure they're paying out correctly. A vague inventory or some generic photos leaves room for doubt, which can delay or even deny your claim. Imagine trying to claim a rare 1933 Double Eagle with only a written description—the adjuster would likely be skeptical. Robust documentation is your best defense against this.

The Power of Photography

Clear, high-resolution photographs are crucial. Think of them as visual fingerprints for your coins. They document the coin's condition, unique features, and any identifying marks. A good photo can prove authenticity and support your valuation. When photographing your coins, consider these tips:

- Invest in a macro lens: Even a smartphone can take amazing close-ups with a macro lens.

- Use a neutral background: Black or white backdrops make the coin's details stand out.

- Capture multiple angles: Photograph the obverse (front), reverse (back), and edge. For instance, with a 1909-S VDB Lincoln Cent, capture the "S" mint mark and the VDB initials clearly.

- Include a ruler or scale: This shows the coin's size and provides valuable context.

Beyond Digital: The Importance of Physical Records

Digital storage is handy, but it's not foolproof. Hard drives fail, cloud accounts get hacked, and phones get lost. That's why physical backups are essential. Printed inventories, appraisal certificates, and even receipts should be stored securely, in a fireproof location separate from your collection. It’s like having a spare car key—you hope you never need it, but you're thankful when you do.

Keeping Your Documentation Current

Your collection changes, so your documentation should too. When you buy or sell coins, update your records immediately. This may seem tedious, but it’s much easier than recreating your collection's history after a loss. I know a collector who uses a Google Sheets spreadsheet. He logs every transaction, noting the date, price, and seller. This system has been a lifesaver during insurance renewals and even helped him recover stolen coins. A well-documented collection isn't just about insurance; it's about protecting your investment and the passion you've put into it.

Security Measures That Actually Prevent Losses

This image shows a wide array of coins, really driving home how much variety and potential value a collection can hold. Protecting these treasures isn't just about insurance; it's about a whole approach to security. Think of insurance as your financial safety net – it helps after a loss. Good security, however, is your first line of defense, helping prevent that loss in the first place.

Storage Solutions: Balancing Access and Security

When it comes to storing your collection, you're juggling two things: easy access so you can enjoy your coins, and solid protection against theft and damage. A simple wooden box might work for a beginner, but as your collection grows in value, a safe becomes essential.

Look for a safe with a high fire rating and a way to bolt it down so it can't be easily carried off. That extra layer of protection can make a real difference.

For truly valuable collections, a bank vault or a professionally installed home vault is the gold standard. This takes away the temptation for opportunistic theft and provides that extra buffer against fire and environmental hazards. The trade-off, of course, is less frequent access.

Alarm Systems: Real Protection Versus Expensive Gadgets

A good alarm system is a bit like a watchful guard dog – a great deterrent for thieves. But not all alarm systems are equal. A basic perimeter alarm might suffice for some, but for high-value coins, you’ll want something more robust.

Think motion sensors, glass-break detectors, and a direct link to a monitoring service. I remember talking to a collector whose alarm system not only alerted him to a break-in, but actually scared the would-be thief off before they could even get inside.

Consider adding cameras inside and outside your home, too. They let you keep an eye on things and provide crucial evidence if a theft does occur. Just remember, a well-maintained and regularly tested system is key.

Environmental Controls: Preserving Your Coins and Your Peace of Mind

Things like temperature swings and humidity can be silent killers for a coin collection. Too much humidity can lead to corrosion and tarnish, while temperature fluctuations can cause cracking. To avoid this, invest in humidity control devices and keep the temperature where you store your collection stable.

You might find this interesting: Mastering the Craft: Top 5 Tips When Collecting Coins. For your more delicate coins, airtight capsules or specially designed holders can offer that extra layer of protection against the elements. These preventative measures help maintain the condition – and the value – of your collection.

Protecting your collection isn't about being paranoid. It's about being a responsible collector. It's about safeguarding the time, effort, and passion you've invested in your coins. By taking these steps, you can rest easy knowing your treasures are safe and sound.

Mastering The Claims Process When Disaster Strikes

When disaster strikes—a fire, a burglary, or a flood—dealing with insurance can feel overwhelming. Especially when it comes to something as specialized as a coin collection. Knowing how to navigate the coin collection insurance claims process can make all the difference. This isn't about being negative, it's about being prepared. Think of this as a friendly chat, sharing some hard-won wisdom from collectors who’ve been through it.

The Critical First Steps

After a loss, the first few steps are crucial. If there’s been theft or vandalism, contact the police right away. Then, immediately notify your insurance company. Don't wait! Most policies have deadlines for reporting. I once knew a collector who had a significant theft but delayed reporting it, which put his entire claim at risk. Learn from his mistake! Document everything meticulously. Take photos of the damage and keep any damaged items (obviously, within reason—don't hang onto a waterlogged coin box if it's a health hazard).

How Insurance Companies Investigate

Understanding how insurance companies investigate claims can help you prepare. They’ll want to see all your documentation: your inventory, photographs, and any appraisals. This is where detailed record-keeping really pays off. Imagine trying to claim a rare gold sovereign without a clear photo and accompanying documentation. The insurer might question its very existence, let alone its value. Solid documentation strengthens your case immensely. For larger claims, insurers often bring in their own appraisers. Be ready to discuss your collection and its value with them. They may also investigate the circumstances of the loss, looking for any signs of negligence or fraud.

Common Claim Mistakes

Even legitimate claims can be derailed by a few common mistakes. Inadequate documentation is a big one. A scribbled list on a napkin won’t cut it when you’re claiming a valuable collection. Clear photos and detailed records are essential. Another mistake is exaggerating the value of your collection. Honesty is truly the best policy here. Inflated values will raise red flags and could even lead to a denied claim. Finally, never dispose of damaged items before the insurer has inspected them. Doing so could invalidate your claim.

Working With Adjusters and Appraisers

Working effectively with adjusters is key. Be polite, professional, and organized. Provide all requested information promptly. Remember, adjusters aren’t necessarily numismatists. Be patient and explain things clearly. If the insurer’s appraisal undervalues your collection, don’t hesitate to challenge it. This is where your own professional appraisals become invaluable. Negotiating a fair settlement is a process. Be prepared to present your evidence and justify your valuation. Sometimes, bringing in your own expert can be extremely helpful.

Real-World Examples: Successes and Disputes

Let's look at a couple of real-world scenarios. One collector, after a house fire, had meticulously documented his collection. This made the claims process incredibly smooth, and he received a fair settlement within weeks. However, another collector, who wasn’t as organized, faced a long and drawn-out dispute, ultimately settling for far less than his collection was worth. These examples underscore the importance of preparation and accurate documentation. Your coin collection insurance policy is there to protect you. By understanding the claims process, avoiding common pitfalls, and being proactive, you can ensure a smoother, less stressful experience and a fair outcome should disaster strike.

Your Action Plan For Complete Collection Protection

Protecting your prized coin collection isn't about crossing your fingers and hoping for the best. It’s about having a solid plan. Think of it like building a fortress around your treasures, brick by brick. This section is your blueprint, complete with practical advice you can use right now. We'll cover prioritizing your actions, setting realistic goals, and making those all-important checklists.

Prioritizing Your Protection Plan

First things first, take stock of where you’re at right now. Do you have any insurance at all? Is your collection documented? Where do you keep it, and how secure is it? If your collection is small, maybe just carefully documenting everything and finding a secure storage spot is enough for the moment. But if you’ve got a larger, more valuable collection, you'll need to up your game with things like specialized coin collection insurance.

For example, let's say you've got a small collection of circulated coins. A detailed inventory with photos and a good, solid storage box might be perfectly adequate. But if you're holding onto rare or valuable coins, a professional appraisal and specialized insurance are non-negotiable. Seriously, don’t put this off! The small effort you make now can prevent a major headache (and potentially a financial hit) down the road.

Building Your Timeline

Creating a realistic timeline is key. Don’t try to tackle everything at once. Break the process down into bite-sized pieces. Maybe dedicate a weekend to photographing your coins, and another to updating your inventory. Researching insurance providers might take a couple of weeks. If you have a large collection, spread these tasks out over a few months. Consistency and steady progress are what matters most.

Creating Actionable Checklists

Checklists are lifesavers when it comes to staying organized. They help you make sure absolutely nothing slips through the cracks. Here's a simple example to get you started:

- Documentation: Photograph each coin (front, back, and the edge). Create a detailed inventory (coin type, date, mint mark, condition, and estimated value). And remember to store your records securely, both physically and digitally. Backups are your friend!

- Security: How secure is your current storage? Is it fireproof? Burglar-proof? Think about researching alarm systems or security cameras. Also, consider environmental controls like humidity and temperature to prevent damage.

- Insurance: Start researching specialized coin collection insurance providers like Numismatic Guaranty Company (NGC), get some quotes, and compare coverage options (things like agreed value and worldwide coverage are important). Make sure you read the fine print!

Remember, this is just a starting point. Tailor your checklist to your specific needs and the size of your collection. As your collection grows and changes, so should your protection plan.

Take that first step today. Start with just one item on your checklist, and build from there. Knowing your collection is truly protected brings invaluable peace of mind. Check out Cavalier Coins for more resources and to connect with other collectors. It's a great community to be a part of.