At its core, the half sovereign's value is a fascinating blend of two separate elements: its basic worth as a piece of gold and its extra value as a collectible coin. This dual identity means that while every half sovereign has a baseline price, its unique history and condition can push its value far beyond the raw gold it contains.

Unpacking the Two Halves of Half Sovereign Value

To really get to grips with what your half sovereign is worth, you need to look at it from two different angles. First, there's its bullion value, which is simply the market price of the gold inside it. This value acts as the coin's price floor – it can never be worth less than the gold it’s made from.

The second, and often more interesting, part is its numismatic value. This is the premium that collectors are willing to pay for factors like rarity, historical importance, and the coin's physical condition. Think of it like a vintage watch. It has a certain value for its gold case, sure, but it’s the brand, its rarity, and how well it’s been preserved that truly determine its final price tag.

The table below breaks down these two key drivers of value at a glance.

Core Components of Half Sovereign Value

| Value Component | What It Means | Impact on Price |

|---|---|---|

| Bullion Value | The intrinsic worth of the pure gold in the coin, based on the live market price. | This sets the price floor. The coin’s value will always be at least this much. |

| Numismatic Value | The extra premium collectors will pay for rarity, condition, mint mark, and historical story. | This is what creates significant value, turning a piece of gold into a sought-after collectible. |

Understanding both of these aspects is absolutely crucial before you can put an accurate figure on any half sovereign.

The Gold Foundation: Bullion Value

Every half sovereign contains a precise, standardised amount of gold. This has been the case for centuries. Since their reintroduction back in 1817, each coin has been specified to contain exactly 0.1177 troy ounces (around 3.66 grams) of pure gold. That’s precisely half the gold content of its bigger brother, the full sovereign. You can dig into more of these historical specifications for British coins on official archives.

Because the gold content is fixed, calculating this base value is straightforward. It’s tied directly to the live market price of gold, often called the "spot price," giving you a solid, tangible starting point for any valuation.

The Collector's Premium: Numismatic Value

This is where the coin’s individual story really comes to life. A half sovereign minted in a year with very low production numbers, or perhaps one from a less common colonial mint, will naturally fetch a much higher price than a standard, common-date coin.

A coin's journey through time—its rarity, the mint it came from, and how well it has survived—is what separates a simple gold disc from a prized historical artefact. This is the essence of numismatic value.

Even tiny differences in its state of preservation, what we in the industry call the coin's "grade," can cause its value to multiply. Before we get into the nitty-gritty of calculating the exact gold price, having a firm grasp of these two core drivers is essential for accurately assessing any half sovereign you come across.

Calculating the Gold Value of Your Coin

Every single half sovereign, no matter how old or worn it might be, has a fundamental value rooted in the gold it contains. This is often called its ‘melt value’ or bullion value, and it’s the absolute rock-bottom price you should ever consider for your coin. Getting your head around this number is the first and most crucial step to becoming a savvy owner or buyer.

The calculation itself is pretty straightforward once you have the key numbers. A standard half sovereign weighs 3.99 grams. It’s not pure gold, though—it’s made from 22-carat gold, which has a purity of 91.67%. The Royal Mint did this on purpose, creating a stronger alloy to help the coins withstand the rigours of daily circulation.

A Simple Step-by-Step Calculation

To work out how much actual gold is in your coin, you just need to multiply its total weight by its purity.

- 3.99 grams (total weight) x 0.9167 (purity) = 3.66 grams of pure gold.

That figure, 3.66 grams (or 0.1177 troy ounces), is the magic number. To find the current melt value, you simply multiply this amount by the live market price of gold, which is known in the business as the "spot price."

So, let's say the spot price of gold today is £55 per gram:

3.66 grams x £55 = £201.30

This figure represents the coin's immediate, intrinsic worth. This basic process of checking the gold content and market price is always the starting point for valuation.

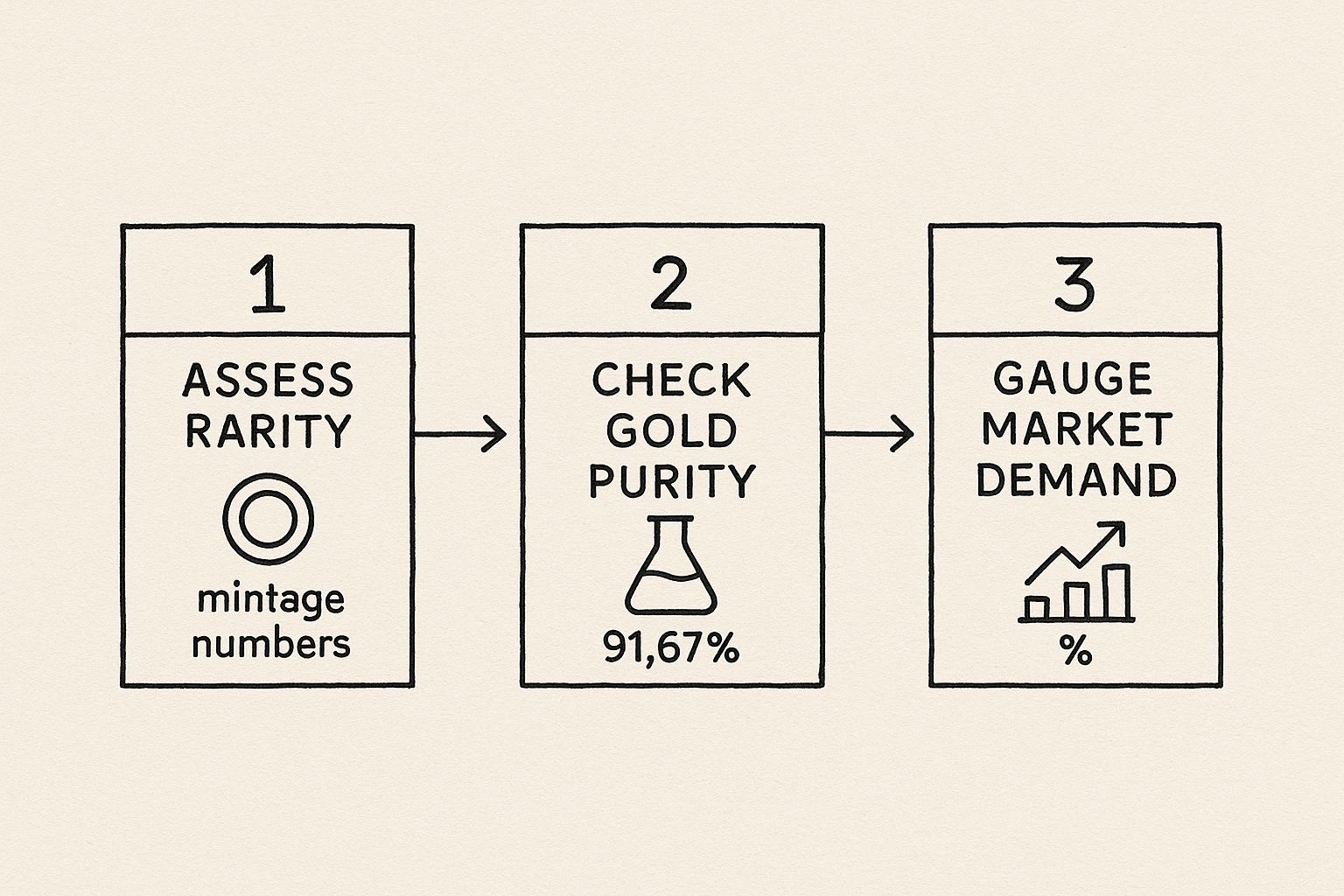

As you can see from the infographic, figuring out the value starts with its core components—like the gold—before moving on to other market factors. While the gold content provides the base price, a coin's story, rarity, and condition are what can truly build its final value.

Knowing the precise melt value of your half sovereign empowers you. It provides a non-negotiable price floor, ensuring that you can enter any discussion with a dealer or buyer with confidence, knowing the fundamental value of what you hold.

While this calculation gives you the essential bullion value, it's only one part of the story. For a deeper dive into the broader principles that apply to all coins, you can explore our complete guide on how to value old coins with expert tips for collectors. The next step is to understand the factors that can add a significant premium on top of this base gold price.

Exploring the Collector Premium Beyond Gold

While every half sovereign has a baseline value tied to its gold content, the real excitement for collectors begins where the bullion value ends. This is the world of numismatics, where a coin’s story, rarity, and origin can dramatically increase its worth. This collector premium is what transforms a simple piece of gold into a treasured piece of history.

Imagine you have two half sovereigns from the same monarch. At a quick glance, they look identical. Yet, one might be worth just a little over its gold price, while the other could fetch hundreds or even thousands of pounds. The difference boils down to this numismatic premium, which is driven by factors that create intense demand among collectors.

The Power of Rarity and Key Dates

The single biggest driver of numismatic value is rarity. It’s a simple concept: coins produced in very small numbers are naturally more sought after. This is why certain years, known as ‘key dates’, command such high prices. A low mintage might have been caused by economic hardship, a monarch’s short reign, or a change in minting policy at the time.

For instance, a half sovereign from a year where millions were struck will be relatively common. But one from a year when only a few thousand were made? That becomes a prized possession for anyone trying to complete a collection. This scarcity is the foundation of a half sovereign’s value beyond its weight in gold.

The half sovereign has a fascinating production history tied to Britain's economy. First issued in its modern form in 1817, it was struck almost continuously for circulation until 1926, with various colonial mints also adding to the total numbers. You can dive deeper into the coin's extensive history on Wikipedia.

The heart of numismatics is simple supply and demand. A coin's historical context often dictated its supply, creating the rarities that collectors passionately hunt for today. A low mintage number is a direct signal of potential high value.

Why Mint Marks Matter

Another vital piece of the puzzle is the mint mark. Not all half sovereigns were struck in London. As the British Empire expanded, it set up branch mints in its colonies to turn locally mined gold into official currency. To show where a coin was made, these mints stamped a small letter on it.

Common mint marks to look out for include:

- M for the Melbourne Mint in Australia

- S for the Sydney Mint in Australia

- P for the Perth Mint in Australia

- SA for the Pretoria Mint in South Africa

A coin’s mint mark can have a huge impact on its value. For any given year, a half sovereign from a colonial mint might be far rarer than its London-minted cousin, or sometimes the reverse is true. Learning to spot this tiny mark is crucial for determining an accurate half sovereign value, as it tells you so much about the coin's production run and its journey through history. A Sydney mint mark on a specific Victorian half sovereign, for example, could make it significantly more valuable than the exact same date without one.

How Coin Condition and Grading Affects Price

In the world of coin collecting, condition is everything. A half sovereign’s physical state, known as its ‘grade’, is one of the most significant factors driving its value beyond its basic gold content. Two coins from the same year and mint can have wildly different prices based purely on how well they have been preserved over time.

Think of it like buying a classic car. A model with its original paint, no scratches, and a pristine interior will command a far higher price than the exact same model that’s covered in dents and rust. Coins work in precisely the same way. The closer a half sovereign is to its original, mint-struck state, the more a collector will be willing to pay for it.

Understanding the Grading Scale

Coin grading uses a specific set of terms to describe a coin's level of wear. While it might seem like jargon at first, the system is logical. It simply measures how much of the original design detail remains. A coin that has seen heavy use in circulation will have its finer details worn smooth, whereas one kept safe since it was made will look sharp and new.

Key terms you will encounter include:

- Very Fine (VF): At this grade, the coin has seen some circulation but still retains most of its major details. You can clearly see the monarch’s main features, though some finer points like strands of hair may be worn.

- Extremely Fine (EF): Here, the coin shows only very light wear on its highest points. The design is sharp, and much of the original mint lustre—the shine from the minting process—is still visible.

- Uncirculated (Unc): This grade is for a coin that has never been used as money. It has no signs of wear and appears as it did the day it left the mint, with full lustre and sharp, complete details.

A subtle jump between these grades, especially for a rarer date, can cause the half sovereign value to multiply. The difference between an EF and an Uncirculated coin might look minor to an untrained eye, but to a serious collector, it can mean a difference of hundreds or even thousands of pounds. For a complete breakdown of what to look for at each level, you might be interested in our detailed coin grading guide for beginners and experts.

A coin's grade is its biography. It tells the story of its journey, from the moment of its creation to the present day. A higher grade means it has survived its journey with minimal damage, making its story—and its value—far more compelling.

Developing an eye for these subtle differences in condition is a practical skill that empowers you to better assess your own collection and spot potential bargains.

Identifying Valuable Key Dates and Mint Marks

Right, so you've got a handle on how a coin's physical condition can swing its price. Now we get to the really exciting part: the treasure hunt. This is where you put your grading knowledge to work and start looking at the coin's specific details—its date and mint mark—to see what you really have. When these three things line up perfectly, a simple gold half sovereign can transform into a rare prize that collectors will scramble for.

Some years are just famous in the coin world for being incredibly scarce. We call these 'key dates', and they simply represent years when the mint didn't produce very many coins. It's a classic case of supply and demand; with fewer coins out there for a growing number of collectors, the price has nowhere to go but up. For instance, half sovereigns from the early part of Queen Victoria's reign are notoriously tough to find in good shape, which makes them highly sought-after.

Spotting these key dates is the first step, but the next one is just as important: finding the mint mark.

Pinpointing the Mint Mark

Beyond the year it was struck, a tiny letter stamped on the coin tells you where it was made. At the peak of the British Empire, branch mints were set up in places like Australia and South Africa to turn locally mined gold into coins. Each of these mints used its own specific mark.

You’ll typically find the mint mark on the reverse (the "tails" side) of the coin. On the classic St. George and the dragon design, it's usually on the small patch of ground beneath the dragon. On earlier shield-back designs, it’s found below the shield. You'll need to look closely for these little letters:

- S for the Sydney Mint

- M for the Melbourne Mint

- P for the Perth Mint

- SA for the Pretoria Mint in South Africa

If you can't find a mint mark, it means your coin was struck at the Royal Mint in London. The presence (or absence) of one of these marks is a massive clue. For any given year, a half sovereign from a colonial mint could be far, far rarer than its London-made cousin, completely changing the half sovereign value.

A mint mark is like a coin's birth certificate. It tells you exactly where it started its life. For a collector, this part of its story is vital for understanding its rarity and historical context, often becoming the single biggest factor in its value.

Let’s see how this all comes together in the real world. A standard, common-date half sovereign will always be worth its weight in gold, but a key date or a rare mint mark can pile on a huge premium.

Half Sovereign Value Examples: Common vs Rare Coins

The table below gives you a snapshot of just how dramatically a key date and mint mark can push up a half sovereign's value, well beyond its basic gold price.

| Coin Example (Reign and Date) | Bullion Value (Approx.) | Collector Value (Approx.) |

|---|---|---|

| Common Date (e.g., 1911 George V) | £200 | £210 - £230 |

| Rare Date (e.g., 1893 Victoria 'Jubilee Head' with Melbourne 'M' Mint Mark) | £200 | £750 - £1,500+ |

The difference is staggering, isn't it? While the 1911 coin is a brilliant way to own gold, the 1893-M is a proper collector's piece. Because far fewer were made, the demand from collectors pushes its price into a completely different league, way beyond its metal content. Learning to spot these rare combinations is what separates a basic gold holder from a savvy collector, and it's the key to unlocking the hidden potential in any collection.

Smart Tips for Buying and Selling Sovereigns

Once you have a solid grasp of what drives a half sovereign's value, you can start turning that knowledge into a smart market strategy. Whether you're aiming to grow your collection or cash in on an investment, a few practical tips can help you avoid common traps and get the best possible result.

For buyers, the golden rule is to buy the coin, not the story. Be especially cautious with coins that look suspiciously shiny for their age. This is often a dead giveaway for harsh cleaning, a process that absolutely tanks a coin's numismatic value. You're looking for honest, even wear and sharp details. Steer clear of any pieces with obvious scratches, dings on the rim, or tell-tale signs of being prised out of old jewellery.

Where to Buy and Sell

Your choice of marketplace is absolutely critical. While big online auction sites might seem tempting with their vast listings, they are often flooded with fakes, misidentified coins, and coins with creatively optimistic grades.

For genuine peace of mind and guaranteed authenticity, always stick with reputable, established coin dealers. A trustworthy dealer stands behind the authenticity and grade of every coin they sell, offering a level of security you just won’t find anywhere else. You can find more advice in our guide covering seven tips for buying collectable coins.

When it's time to sell, your goal is to maximise your return. It helps to understand how dealers operate; they need to buy at a price that leaves them room to make a profit when they resell. For common, bullion-grade coins, this margin will be quite small.

If you're holding a truly rare or exceptionally high-grade half sovereign, getting it professionally graded by a third-party service can be a brilliant investment. The cost of grading is often easily covered by the significant jump in value and buyer confidence that a certified grade brings.

Ultimately, knowing the difference between bullion and numismatic value gives you real power when it's time to negotiate. By approaching the market with a clear-eyed strategy, you can confidently build a fantastic collection or sell your holdings for a fair price, making sure your journey in the coin world is both safe and rewarding.

Still Have Questions?

Even after getting to grips with the basics of half sovereign values, a few practical questions often pop up. Here are some quick-fire answers to the most common queries we hear from both new and experienced collectors.

What Is the Easiest Way to Find My Coin's Gold Value?

The fastest way to get a baseline value is to use an online gold calculator. You just need to punch in the half sovereign’s weight, which is 3.99g, and its gold purity, which is 22 carat (or 91.67%).

The calculator will give you the live bullion value based on the current market spot price. Think of this as the absolute minimum your coin is worth – its melt value.

Should I Sell to a Coin Dealer or a Jeweller?

For the best possible price, a specialist coin dealer is nearly always your best bet. A jeweller is primarily interested in the gold content and will usually only offer you the melt value for it.

A reputable coin dealer, on the other hand, has the expertise to spot any extra numismatic value. They'll assess its date, its condition, and its rarity, and will often pay a significant premium over the gold price if the coin is a sought-after piece.

Key Takeaway: A jeweller sees gold, but a coin dealer sees history. If you suspect your coin has any rarity or is in great condition, a dealer will recognise and pay for that extra value.

Are Modern Bullion Half Sovereigns a Good Investment?

Yes, they are an incredibly popular way to invest in physical gold. Modern bullion half sovereigns allow you to own gold in small, accessible, and easily tradable units.

A huge advantage for UK investors is their status as legal tender. This means they are completely exempt from both VAT and Capital Gains Tax (CGT), making them one of the most tax-efficient ways to add gold to your portfolio.

Does a Certificate of Authenticity Increase Value?

This really depends on where the certificate comes from. A certificate from a highly respected, independent grading service like PCGS or NGC absolutely adds value and gives buyers tremendous confidence. It’s an impartial, professional guarantee of the coin’s authenticity and grade.

However, a certificate issued by the person or shop you bought it from doesn’t carry the same weight. The real value lies in that unbiased, third-party assessment.

Ready to explore the world of rare and valuable coins? Visit Cavalier Coins Ltd to browse our curated collection of half sovereigns and other numismatic treasures. Find your next great addition at https://www.cavaliercoins.com.