The Hidden Factors That Determine Your Coin's Value

Determining a coin's worth goes far beyond simply glancing at its face value. A complex interplay of factors contributes to a coin's potential market price, elevating everyday pocket change to the status of treasured collectibles. A seemingly ordinary coin can hold significant value due to its rarity, condition, or historical context. Understanding these hidden factors is crucial for both experienced numismatists and those just starting their collecting journey.

Rarity and Mintage Figures

One of the most critical factors influencing a coin's worth is its mintage. This refers to the total number of coins of a specific type produced within a given year. Coins with lower mintage figures are typically scarcer and, consequently, more valuable.

Furthermore, die varieties, subtle variations in the coin's design caused by wear and tear on the minting dies, can further amplify a coin's rarity and appeal. These subtle distinctions, often undetectable to the untrained eye, can significantly increase a coin's value.

Condition: More Than Just Looks

A coin's condition plays a vital role in determining its worth. Unlike other collectibles where value tends to increase steadily with condition, a coin's value can increase exponentially with even minor improvements in grade. A near-perfect coin can be worth considerably more than a similar coin showing slight wear. However, even worn coins can retain value, particularly if they represent a rare date or mint mark.

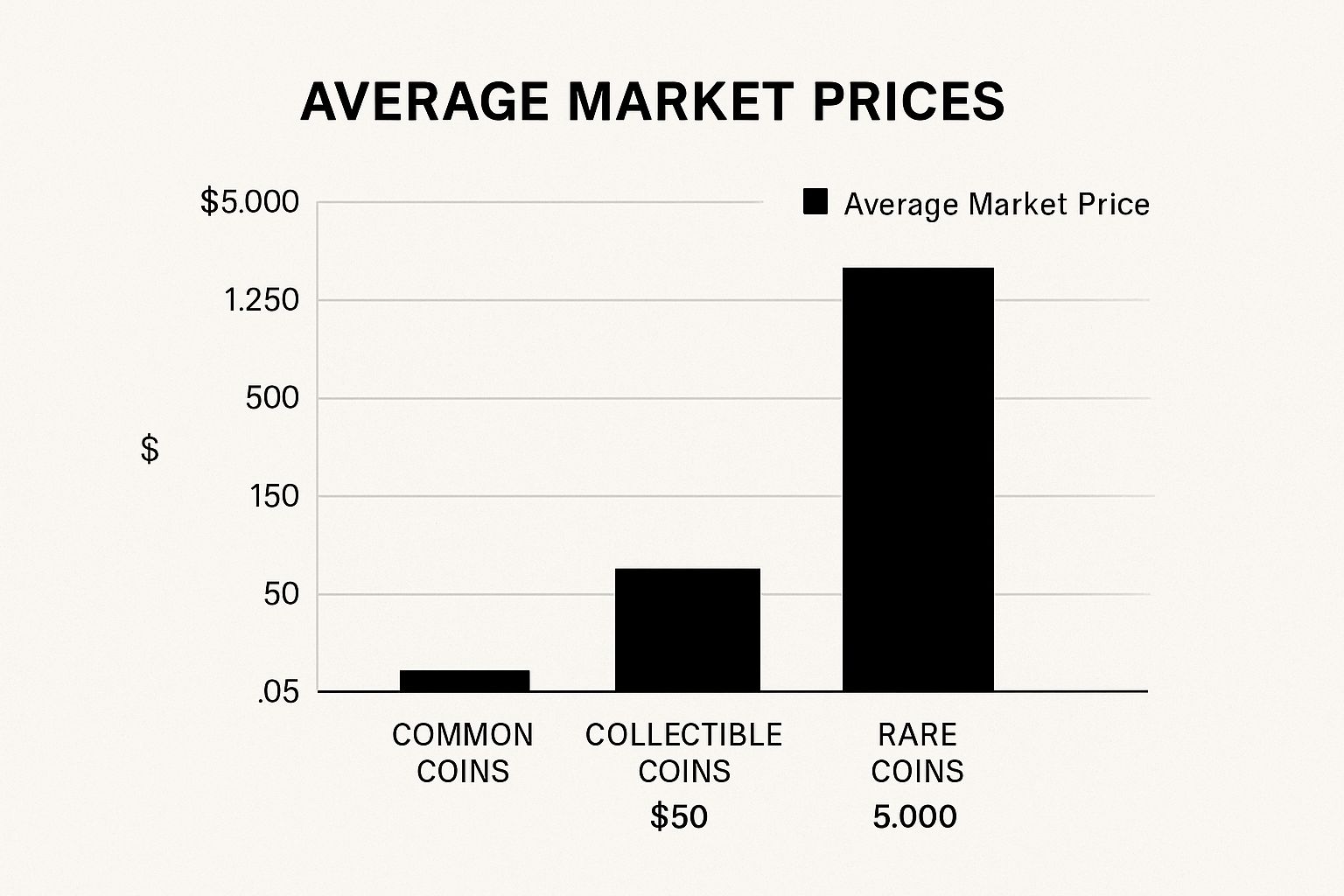

This chart illustrates the significant price differences between various coin categories based on rarity. Common coins typically stay close to their face value, while collectible and rare coins often command substantially higher prices, reflecting the principles of supply and demand in the numismatic market.

To further understand the factors influencing coin value, let's examine the following table:

Key Factors Affecting Coin Value This table outlines the primary factors that determine a coin's market value and their relative impact on pricing.

| Value Factor | Impact Level | Description |

|---|---|---|

| Rarity | High | Scarcity due to low mintage or die varieties significantly increases value. |

| Condition | High | Even slight improvements in grade can exponentially increase a coin's worth. |

| Historical Significance | Medium | Association with important events or figures can add value. |

| Market Trends | Medium | Collector demand and economic conditions influence overall market pricing. |

This table highlights the interconnectedness of these factors. While rarity and condition often have the most substantial impact, historical context and market trends also contribute to a coin's overall value.

Historical Significance and Market Trends

Beyond rarity and condition, historical context can significantly influence a coin's value. Coins linked to important historical events, royal commemorations, or unique periods in British history frequently command premium prices.

Furthermore, the overall market for British coins, both rare and common, is subject to fluctuations driven by collector demand and general economic conditions. For example, the value of rare coins in the UK can shift considerably over time, as observed between 2002 and 2012 when the value of the top 200 rarest coins was tracked. Find more detailed statistics here. This emphasizes the importance of understanding market dynamics and seeking professional appraisals when evaluating a coin's potential worth.

Identifying Undervalued Coins

Identifying undervalued coins requires careful observation and a thorough understanding of the factors that affect their value. By considering mintage figures, die varieties, condition, historical context, and current market trends, you can develop the expertise to identify hidden gems and potentially profitable investment opportunities. This knowledge distinguishes casual collectors from those who consistently uncover undervalued pieces.

Mastering the Art of Coin Identification

Proper identification is paramount when determining a coin's worth. It's the foundation of accurate valuation. This process involves careful examination, from deciphering faded inscriptions and dates to recognizing subtle mint marks and varieties that can significantly impact a coin’s value.

Deciphering the Clues: Key Characteristics

Correctly identifying a coin involves examining several key features. Begin with the country of origin. Look for identifying marks, emblems, or inscriptions that reveal the issuing nation. Next, determine the denomination. Is it a penny, shilling, or crown? Even worn coins often retain enough detail to identify these basic elements.

The date is also crucial. A coin’s age significantly influences its value. Older coins are typically rarer, but even recent coins can be valuable if they have low mintage figures or specific errors. Finally, examine the mint mark, a small letter or symbol identifying the specific mint where the coin was produced. Different mints can have different rarity levels, affecting the coin’s overall value.

Tools of the Trade: Resources for Identification

A variety of resources are available for a deeper dive into coin identification. Reference books provide detailed images and descriptions of coins from different eras and regions. Online databases offer searchable catalogs and forums where you can compare your coin with verified examples.

For example, Cavalier Coins Sitemap can be a helpful resource. Understanding the factors that influence a coin’s value shares similarities with valuing stocks. For more on stock valuation, see this article on stock valuation.

Furthermore, magnifying glasses and loupes allow close examination of fine details, helping you spot mint marks, die varieties, and other subtle indicators. The following table provides a more detailed look at these essential tools.

To help you choose the right resources, the table below provides a comparison of tools and resources needed for proper coin identification.

Essential Tools for Coin Identification

| Tool/Resource | Purpose | Recommended For | Approximate Cost |

|---|---|---|---|

| Reference Books | Detailed information and images of coins | All collectors | $20 - $100+ |

| Online Databases | Searchable catalogs and forums for comparison | All collectors | Free - Subscription based |

| Magnifying Glass | Examining fine details like mint marks and die varieties | All collectors | $10 - $50+ |

| Loupe | Close-up examination of minute details | Serious collectors and professionals | $25 - $200+ |

This table summarizes the essential tools and resources for coin identification, ranging from readily available options like magnifying glasses to more specialized tools like loupes, along with approximate costs.

Spotting Rarities: Error Coins and Variants

Beyond standard identification, keep an eye out for error coins. These are coins with minting errors, like off-center strikes, double-strikes, or brockages (mirror-image impressions). Such errors can dramatically increase a coin’s value, transforming an ordinary coin into a desirable rarity.

Die varieties, subtle variations in a coin’s design caused by die wear or modifications, can also impact value. While often overlooked by beginners, experienced numismatists know these seemingly insignificant variations can sometimes increase a coin’s worth considerably. Mastering these identification techniques is essential for accurate valuation. This careful examination prevents costly misidentification and reveals the true potential value within your collection.

The Condition Conversation: Understanding Grading

The difference between a £50 coin and a £5,000 coin often comes down to its condition. Even small differences in wear and tear, barely visible to an untrained eye, can significantly change a coin's value. Understanding how numismatic grading works is key to knowing what your coin is worth.

Decoding Numismatic Grading

Professional coin grading services use a numerical scale, typically from 1 to 70, to evaluate a coin's condition. A 70 represents a perfect, unblemished coin, while lower numbers indicate more wear. But this seemingly objective system has its subtleties. Professional graders don't always agree, and understanding why is important.

The Subjectivity of Grading

Grading standards provide guidelines, but there's a subjective element involved. Two graders might see the same coin differently, based on their interpretation of wear, marks, or the coin’s overall appeal. This is why researching and selecting reputable grading services is crucial, especially for valuable coins. For less valuable coins, learning to grade yourself can be helpful.

Spotting Trouble: Cleaning and Toning

Two things that greatly impact a coin's grade – and therefore its value – are cleaning and toning. Cleaning, even when done carefully, can create tiny scratches that drastically lower a coin's value. Artificial toning, often an attempt to improve a coin’s look, can also be harmful. Learning to distinguish between natural toning, a desirable effect of environmental exposure, and artificial toning is a valuable skill.

This image shows the visual differences in coin conditions. Notice how even slight wear can change a coin’s appearance and affect its grade. Developing a sharp eye for these subtle changes will help you assess your coin's condition more accurately.

Condition Rarity: An Untapped Opportunity

Understanding condition rarity is another important factor in valuing coins. This happens when high-grade examples of a common coin are actually quite scarce. For instance, a common Victorian-era coin in perfect condition might be very valuable simply because so few survived in that state. Smart collectors look for and take advantage of these condition rarity opportunities.

When to Seek Professional Grading

While developing your own grading skills is useful, professional grading is often recommended for rare or valuable coins. A professionally graded coin, sealed in a protective case, is easier to trade and often sells for more. Knowing when professional grading is worth the cost is a good skill to have. This often depends on the coin's potential value and your collecting goals. Professional grading provides assurance, particularly when handling high-value items.

Navigating Today's Coin Market Valuation Resources

Beyond basic price guides, a world of resources exists for discerning coin collectors. These resources offer crucial pricing intelligence often missed by simpler guides. This section explores how auction archives, dealer networks, and specialized databases help answer the question: "How much is my coin worth?"

Unpacking Auction Results: A Historical Perspective

Auction archives offer a wealth of information, revealing actual prices realized for similar coins. Websites like Sixbid and NumisBids provide access to past auction catalogs and results. Examining these records helps you understand how specific grades, varieties, and market conditions influence final sale prices.

For example, comparing prices of two seemingly identical George V sovereigns, one pristine and one showing wear, reveals the impact of condition on value. Studying past auctions gives you a historical context for current market pricing.

Tapping into Dealer Networks: Real-Time Market Insights

Dealer networks provide a snapshot of current market prices. Reputable dealers like Cavalier Coins Ltd often publish online inventories with asking prices. This real-time market activity data supplements historical auction information.

Building relationships with experienced dealers offers valuable insights into emerging trends and specific coin varieties. This personalized guidance is invaluable, especially for collectors focusing on niche numismatic areas.

Exploring Specialized Databases: A Deeper Dive

Specialized numismatic databases offer detailed information on mintages, die varieties, and historical context – crucial factors influencing a coin's worth. Resources like the Coinoscope Visual Search and the NGC Coin Explorer allow comparison with verified examples.

This ensures accurate identification and informed valuation. Understanding these finer details is key to accurately assessing a coin's true value.

Reconciling Price Discrepancies

It's common to find conflicting valuations for similar coins. Auction results might show a wide range, and dealers may have different asking prices. Understanding these disparities involves considering the context of each sale.

Auction frenzy can inflate prices, while private sales might be more moderate. Looking at multiple sources and understanding market dynamics is crucial for a realistic estimate.

Market Timing: Riding the Waves of Value

Market timing significantly impacts coin values. Seasonal fluctuations, like increased demand around holidays, can create temporary price spikes. Longer-term collecting trends also play a role. For instance, renewed interest in pre-decimal British coins could drive up prices in that segment.

Additionally, the UK cryptocurrency market's projected growth to USD 619.0 million by 2030, with a CAGR of 11.1%, reflects a shift toward digital assets, potentially influencing the traditional coin market. Explore this topic further here. This necessitates monitoring specific market segments relevant to your collection.

Building Your Valuation Strategy

Developing a personalized valuation strategy involves identifying the most relevant indicators for your coins. Track recent auction results for similar pieces, compare prices from multiple reputable dealers, and consult specialized databases.

This comprehensive approach provides a more accurate picture of your coin’s potential value than general price guides. This allows you to recognize opportunities and make informed decisions about your collection. By integrating these resources and understanding market dynamics, you'll be well-equipped to answer "how much is my coin worth?" and maximize your potential in numismatics.

Traditional Coins vs Cryptocurrency: Value Dynamics

The world of collecting is constantly changing. Alongside traditional numismatics, the digital realm of cryptocurrency has become a prominent asset class. This naturally leads to questions about value: how much is my coin worth, whether it's a tangible artifact or a digital entry on a blockchain? This comparison explores the similarities and differences between these two distinct, yet increasingly interconnected, markets.

Tangibility and History vs. Digital Innovation

Traditional coins offer a tangible link to the past. Holding a Roman denarius or a Victorian shilling connects you to a piece of history. Their value comes from factors like rarity, condition, and historical significance. Cryptocurrency, in contrast, represents digital innovation. Its value is tied to market forces, technological advancements, and community adoption.

For example, a rare coin’s value might rise due to its association with a major historical event. Meanwhile, a cryptocurrency's value can surge based on a software update or a growing user base. Both are affected by market volatility, but the underlying factors are very different.

Bridging the Two Worlds: Collectors and Investors

These two seemingly separate worlds are increasingly merging. Collectors are using cryptocurrency profits to purchase rare coins, while some numismatic principles, like scarcity and provenance, are influencing digital asset strategies. This overlap highlights the growing recognition of both traditional and digital assets as viable investment options.

You might be interested in: Our Blog Articles for further reading on collecting.

Market Forces and Value Drivers

Both traditional coins and cryptocurrencies are influenced by market forces. However, how these forces affect their respective values differs. The UK cryptocurrency market provides a good example. By 2025, an estimated 5 million people in the UK, or roughly 1 in 10 Brits, will own cryptocurrency. The market is expected to reach £3 billion by 2028, illustrating the rising popularity of digital currencies. Explore this topic further.

Liquidity, Authentication, and Preservation

Traditional coins can present challenges regarding liquidity. Selling a rare coin involves finding the right buyer and navigating authentication procedures. Preservation is also essential, as a coin's condition directly impacts its value. Cryptocurrency generally offers better liquidity, with numerous exchanges facilitating quick transactions. However, security and safe storage are crucial in the digital world. Authentication relies on blockchain technology, not physical inspection.

Determining "Worth": A Multifaceted Approach

Ultimately, figuring out a coin's worth, whether physical or digital, involves a multifaceted approach. For traditional coins, rarity, condition, and historical context are key. For cryptocurrency, market trends, technological developments, and community sentiment play important roles. Understanding these dynamics helps collectors and investors navigate both markets effectively and make sound decisions about their assets.

When to Seek Professional Coin Appraisal Services

Knowing how much your coin is worth is essential. But not every coin requires the expertise of a professional appraiser. This begs the question: when is self-assessment enough, and when should you consult an expert? Understanding this distinction can save you money and empower you to make informed decisions about your collection.

Self-Valuation vs. Professional Appraisal: Recognizing the Difference

For commonly circulated coins, readily available resources like online price guides and dealer catalogs are often sufficient for determining approximate value. For instance, a common 1980s 50 pence piece likely doesn't need a professional appraisal. However, for rare coins, those with potential historical significance, or coins in exceptional condition, a professional assessment is crucial.

This is because subtle details like grading, die varieties, or historical context can significantly impact a coin's value. These nuances are often difficult for non-experts to recognize. This underscores the importance of experienced numismatists who can accurately assess these characteristics and their impact on market value.

Casual Opinions vs. Formal Appraisals: Understanding the Weight

A quick opinion from a coin dealer is different from a formal appraisal. While a dealer can provide a general idea of worth, their opinion doesn’t hold the same weight as a documented appraisal from a qualified professional. For insurance, estate planning, or a high-value sale, a formal appraisal is indispensable.

This formal documentation provides validated proof of your coin's value, which is essential for legal and financial matters. It serves as official documentation, protecting your investment and ensuring fair transactions.

Preparing for a Professional Appraisal: Ensuring Accuracy

Before seeking a professional appraisal, proper preparation ensures a smooth and accurate assessment. Clean your coins gently using appropriate methods. Avoid harsh chemicals or abrasive materials that could damage the surface and reduce their value. Organize your collection logically, grouping similar coins to make the appraiser's examination more efficient.

Also, gather any relevant documentation, such as previous appraisals, certificates of authenticity, or records of the coin's history (provenance). This supporting information adds credibility to the appraisal and provides valuable context.

You might be interested in: Cavalier Coins Collections Sitemap.

Choosing a Reputable Appraiser: Key Considerations

Choosing a qualified and trustworthy appraiser is paramount. Look for membership in professional numismatic organizations, such as the British Numismatic Society, and relevant accreditation. Check for client testimonials and verify their experience appraising similar coins.

Don't hesitate to ask questions about their appraisal process, fees, and the documentation they provide. Transparency is key. Be wary of appraisers offering unrealistically high valuations or pressuring you to use their services. Thorough research and careful selection are crucial.

Cost Expectations and Service Levels: Understanding the Investment

Appraisal costs vary depending on the coin’s value, complexity, and the appraiser’s experience. Expect to pay more for complex appraisals of rare coins. Some appraisers charge a flat fee per coin, while others use an hourly rate. Discuss these costs upfront to avoid surprises.

Different service levels are often available. A basic appraisal might simply determine the current market value. A more comprehensive service might include detailed research and documentation of the coin's provenance and historical significance. Choose the service that best meets your needs.

Using Your Appraisal: Making Informed Decisions

A professional appraisal is more than just a number; it empowers you to make informed decisions about your collection. It provides the necessary data for insurance coverage, supporting fair market value claims in case of loss or damage.

For estate planning, an accurate appraisal ensures equitable distribution of assets. It also informs selling decisions, providing confidence when negotiating prices. A professional appraisal is an investment in your collection’s future, offering invaluable knowledge and guidance.

Maximizing Returns When Selling Your Valuable Coins

Knowing how much your coin is worth is only the first step. Factors like timing, presentation, and choosing the right selling venue can significantly impact your final profit. This section explores strategies to maximize your returns, using practical examples and expert advice.

Choosing the Right Selling Platform

The ideal platform depends on your coin's type and value. For common coins and less valuable collectibles, online marketplaces like eBay can be effective. For rarer or more valuable coins, consider specialized options.

-

Auction Houses: Auction houses like Spink and Baldwin's of St. James's are perfect for high-value coins, connecting you with serious collectors. These established venues offer authentication and secure transactions, building buyer trust.

-

Dealer Networks: Reputable coin dealers, such as Cavalier Coins Ltd, provide expertise and personalized service. They often specialize in specific numismatic areas, allowing for targeted marketing.

-

Private Transactions: For extremely valuable coins, private sales offer discretion and potentially higher profits. However, they require careful due diligence and secure handling.

Negotiation Techniques and Authentication

Whether you're working with a dealer or a private buyer, strong negotiation skills are essential. Research comparable sales to determine a realistic price range. Be ready to support your valuation based on the coin's rarity, condition, and historical significance.

-

Documentation is Key: Providing authentication from reputable grading services like PCGS or NGC adds value and credibility. This reassures buyers and justifies higher prices. For especially valuable coins, understanding appraisal services is crucial. The principles discussed regarding antique watch appraisal offer helpful parallels.

-

Presentation Matters: Display your coins in protective cases that highlight their best features. High-quality photos and detailed descriptions increase their appeal and encourage better offers.

Pre-Sale Preparations and Pitfalls to Avoid

Meticulous preparation is vital before selling. Carefully clean your coins using appropriate methods. Avoid harsh chemicals that could damage the surface and reduce value. Document the coin’s denomination, date, mint mark, and any unique features.

-

Research is Essential: Understand market trends and comparable sales to set realistic price expectations. Overpricing can deter buyers, while underselling loses you money.

-

Avoid Common Mistakes: Improper cleaning is a major pitfall, potentially scratching the surface and significantly decreasing a coin's value. Be wary of unsolicited offers that seem too good to be true – they could be scams.

Post-Sale Considerations: Taxes and Reinvestment

After selling, consider the tax implications. Capital Gains Tax may apply to profits from collectibles, so consult a tax advisor. If reinvesting your profits, explore other numismatic areas or diversify into related collectibles like banknotes or medals.

- Building a Legacy: Selling valuable coins can be a significant financial event. Use the proceeds wisely to expand your collecting interests, secure your financial future, or create a valuable legacy for future generations.