Discovering Your Coin's Hidden Value

Before you even think about where or how to sell your coins, the first thing you need to do is figure out what you’ve actually got. It's a step many sellers skim over, often leaving a lot of money on the table because they mistake a rare variety for a common piece. The key isn't just a quick online search; it's about learning to look at your coins like a seasoned collector would.

Before you even think about where or how to sell your coins, the first thing you need to do is figure out what you’ve actually got. It's a step many sellers skim over, often leaving a lot of money on the table because they mistake a rare variety for a common piece. The key isn't just a quick online search; it's about learning to look at your coins like a seasoned collector would.

This means you’ll want to get friendly with a magnifying glass. It’s probably the most important tool you'll have for spotting the tiny details that can send a coin's value soaring. We're talking about subtle die cracks, doubled letters or dates, and nearly invisible mint marks that a casual glance will always miss. For example, a tiny "S" mint mark on an old coin could be the difference between a £5 piece and one worth £500. It’s all about training your eye to catch these profitable little quirks.

Understanding Condition and Rarity

The two main pillars holding up any coin's value are its rarity and its condition, also known as its grade. A coin might be extremely common, but if it’s in almost perfect, uncirculated condition, it can still fetch a good price. On the flip side, a very rare coin can lose a huge chunk of its value if it's covered in scratches, has been cleaned, or is otherwise damaged.

Cleaning a coin is one of the biggest mistakes a new seller can make. It strips away the original surface, or patina, which instantly makes it less desirable to collectors. In the UK, the market for British coins is particularly sensitive to these factors. Prices can change based on yearly demand and new finds. For anyone serious about getting the best price, keeping up with these changes is essential. You can find guides detailing market values for both pre-decimal and decimal coins, which dealers use to price their stock. A coin in top condition could be worth hundreds of pounds, while its more common, circulated version might only be worth a few. To get a sense of how this works, you can explore the latest UK coin values on mags-uk.com and see how condition impacts what people are willing to pay.

Grading's Impact on Selling Price

To really see how a coin's condition affects your bottom line, it helps to understand how professionals categorise them. Even a small difference in grade can cause a massive leap in its selling price. The table below gives you a clear idea of how the same coin’s value can change dramatically based on its physical state.

Coin Condition Grading Impact on Value

A comparison showing how different condition grades affect the same coin's selling price, from poor to mint condition

| Condition Grade | Description | Value Multiplier | Example Price Range |

|---|---|---|---|

| Poor/Fair | Heavily worn, major details are gone. | 0.5x - 1x | £1 - £2 |

| Good (G) | Very worn, but main design is visible. | 1.5x - 2x | £3 - £4 |

| Fine (F) | Moderate wear, with clear details remaining. | 5x - 8x | £10 - £16 |

| Very Fine (VF) | Light wear, with sharp lettering and design. | 15x - 25x | £30 - £50 |

| Extremely Fine (EF) | Almost no wear, sharp details, some lustre. | 40x - 60x | £80 - £120 |

| Uncirculated (UNC) | No signs of wear, full original lustre. | 100x+ | £200+ |

As you can see, a coin in Uncirculated (UNC) condition can be worth over 100 times more than the same coin in Poor condition. This is why spending time to accurately assess your coin's grade before listing it for sale is so important—it directly influences the price you can realistically ask for and expect to get.

Finding Your Coin's Perfect Marketplace

Once you understand what your coin is and what it's worth, the next big decision is figuring out where to sell it. This is a common stumbling block for many sellers who assume all platforms are the same. In reality, the same coin can fetch a wildly different price depending on the audience it reaches. It’s less about luck and more about matching your coin to its ideal marketplace. For instance, a rare Roman denarius might get lost in the shuffle on a general auction site but could ignite a bidding war at a specialised historical auction house.

Your aim is to put your specific coin in front of the right buyers. Think of it like fishing: you wouldn't use the same bait for a minnow as you would for a shark. In the same way, the platform that works wonders for modern bullion coins could be entirely unsuitable for a collection of Victorian pennies.

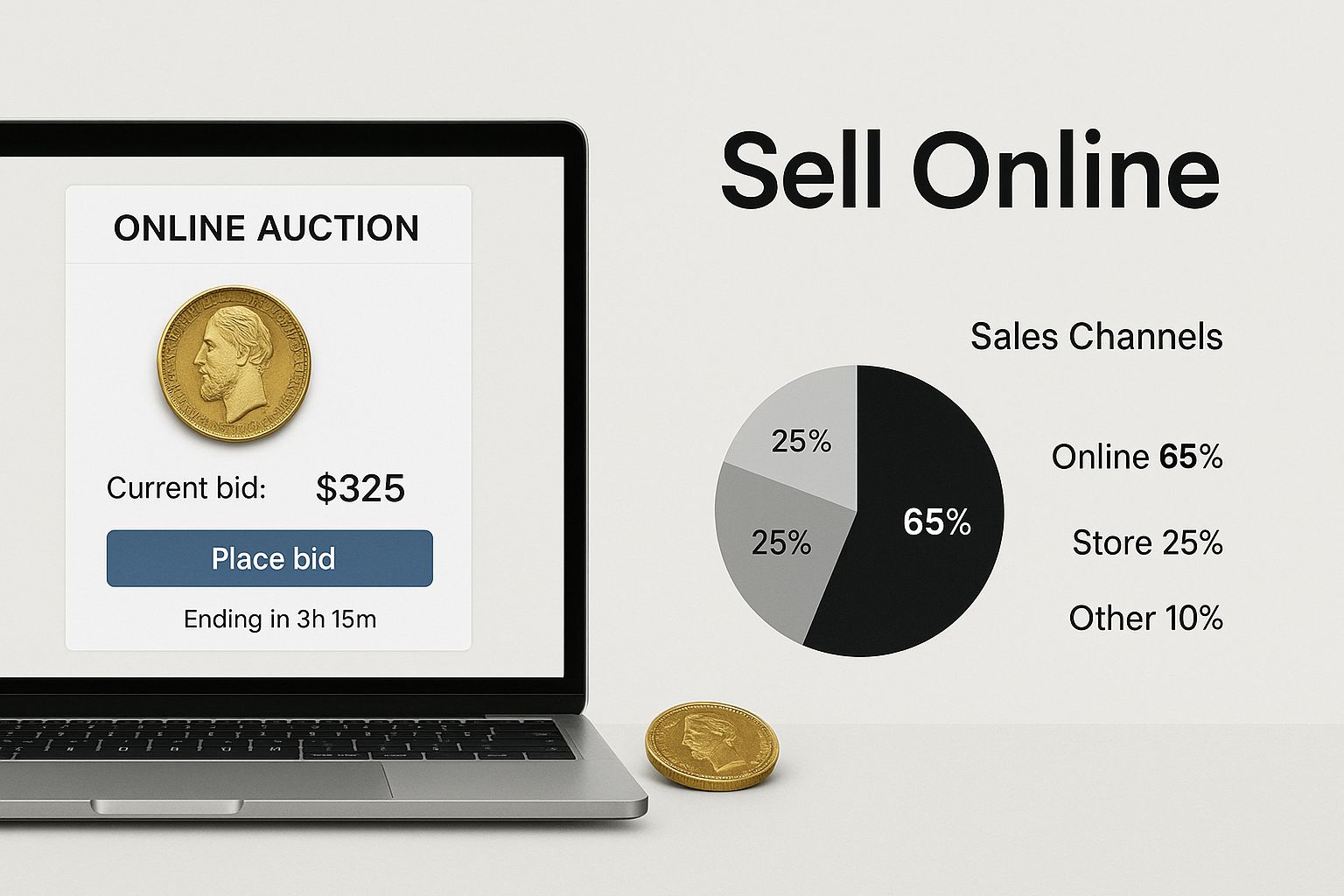

The image below shows the clear difference between selling online and selling directly to dealers, highlighting which approach suits different kinds of coins.

This visual highlights that online auctions are brilliant for widely recognised, high-demand coins, whereas dealers offer a simpler route for less common pieces or entire collections.

Online Auctions vs. Specialist Dealers

Online marketplaces like eBay can be a fantastic place to sell if you understand how to sell a coin to a large, diverse audience. Sales data reveals that some coin categories on major platforms can achieve sell-through rates exceeding 1,500%. This points to a huge and active base of buyers. However, this environment is best suited for coins that are easily identifiable and have an established market value, such as British Sovereigns or American Silver Eagles. The sheer number of potential buyers drives competition, which can push the final price higher.

To help you weigh your options, here's a breakdown of some popular platforms.

Platform Comparison for Coin Selling

This table provides a detailed comparison of different selling platforms, including their fees, audience reach, security, and the types of coins that sell best on each.

| Platform | Best For | Seller Fees | Audience Size | Security Level |

|---|---|---|---|---|

| eBay | Common & popular coins (e.g., modern bullion, well-known series) | 10-15% (variable) | Massive (Global) | Moderate (Buyer/seller protection) |

| Specialist Auction Houses | Rare, high-value, or niche coins (e.g., ancient, medieval) | 15-25% (incl. buyer's premium) | Niche (Targeted collectors) | High (Expert verification) |

| Coin Forums | Specific series or themed coins; peer-to-peer sales | 0-5% (often subscription-based) | Small (Highly engaged) | Low to Moderate (Reputation-based) |

| Local Coin Dealers | Quick sales, bulk collections, less common items | N/A (Price offered is net) | Local (Walk-in) | High (In-person transaction) |

This comparison shows a clear trade-off: platforms like eBay offer enormous reach but come with significant fees and are best for mainstream coins. Specialist venues provide access to dedicated collectors for a higher commission, which can be worthwhile for unique items.

On the other hand, for more niche items—think ancient coins, medieval hammered silver, or unusual error coins—a specialist dealer or a targeted auction house is often the better choice. These experts have curated contact lists of serious collectors who are actively looking for those specific pieces and are prepared to pay a premium. They appreciate the subtle details that a casual online bidder might overlook. If you'd like to dive deeper, you can explore these top options for where to sell old coins. Making the right choice at this stage is a crucial step towards getting the best possible price for your coin.

Crafting Listings That Convert Browsers into Buyers

This is where all your hard work on valuation and choosing the right platform pays off. The difference between a coin that sells quickly for a great price and one that sits there for weeks often comes down to how you present it. Think of your listing as your coin's one and only sales pitch—it’s a mix of art and science that needs to be spot-on.

This is where all your hard work on valuation and choosing the right platform pays off. The difference between a coin that sells quickly for a great price and one that sits there for weeks often comes down to how you present it. Think of your listing as your coin's one and only sales pitch—it’s a mix of art and science that needs to be spot-on.

At the heart of every great listing is the photography. Buyers can't hold the coin, so your pictures need to do all the heavy lifting. You don't need a fancy studio, but you absolutely have to capture the coin's true character.

Photography That Sells

Your best bet is natural, diffused daylight. Avoid harsh, direct sunlight or a camera flash, as these create glare and can hide the very details a buyer is looking for. A simple, neutral background like a piece of black or grey felt will make your coin the star of the show.

Make sure you get these key shots:

- A crisp, clear photo of the obverse (the "heads" side).

- An equally sharp shot of the reverse (the "tails" side).

- A close-up of the date and any mint marks.

- An angled picture to show off the coin’s lustre and surface quality.

Taking sharp, high-resolution photos is non-negotiable. It builds trust and lets potential buyers zoom in and examine every detail, just as they would if they were holding it. Blurry, poorly lit pictures are a massive red flag for any serious collector.

Writing Descriptions That Build Confidence

Once your photos are ready, it's time to write a description that answers every question a buyer might have before they even think to ask. Honesty and detail are your best friends here. If you want to know how to sell a coin properly, your description needs to be more than just a title. Start with a clear headline including the coin's denomination, country, year, and any key features. For example, "Great Britain 1887 Victoria 'Jubilee Head' Silver Shilling."

In the main description, be upfront about the coin’s condition. Mention any visible scratches, edge knocks, or areas of wear. It's much better to point out minor flaws yourself than to have an unhappy buyer who feels they've been misled. Then, highlight what makes the coin special. Does it have a beautiful, even patina? Is the strike particularly sharp? Use words that collectors appreciate, like ‘lustrous’, ‘well-struck’, or ‘original toning’. A detailed listing not only informs but also reassures the buyer that you’re a knowledgeable and trustworthy seller. For more tips on presentation, you can find a complete success guide on how to sell coins in the UK that explores these points in more detail.

Navigating the Cryptocurrency Coin Revolution

When you think about selling coins, your mind might jump to old-fashioned metal discs. But these days, the coin-selling world has a massive digital wing. Assets like Bitcoin and Ethereum, alongside thousands of newer altcoins, have created a whole new market. Understanding how to sell a coin in this digital format requires a different approach and a fresh set of tools compared to traditional coin collecting. The market moves fast and the tech can seem a bit much at first, but for those who get the basics down, the opportunities are huge.

Forget about popping down to your local dealer or visiting an auction house. The action here happens on cryptocurrency exchanges. These are online platforms where people trade digital currencies around the clock. Your first big decision is figuring out which type of exchange suits you best.

Centralised vs. Decentralised Exchanges

You can think of a Centralised Exchange (CEX) as being similar to a high-street bank. Big names like Coinbase or Kraken are run by a company, have easy-to-use websites and apps, and offer customer support if you get stuck. They make it fairly straightforward to turn your crypto back into pounds and send it to your UK bank account. For most people starting out, this is the go-to option because it's convenient and feels secure.

On the flip side, you have Decentralised Exchanges (DEXs) like Uniswap. These platforms work without anyone in charge, using clever bits of code called smart contracts on the blockchain. This gives you more privacy and direct control over your funds. They can be a bit more technical to get the hang of, but they often list newer or less common coins that you won't find on the big centralised exchanges. Your choice really comes down to how comfortable you are with the tech and what kind of coin you're looking to sell.

Timing and Security in a Fast-Paced Market

The UK has seen a huge jump in people getting into crypto. By early 2025, it’s estimated that user numbers have shot past 40.44%, and that figure is only expected to climb. More people means more buyers and more activity, which is fantastic news if you’re a seller. But it also means you need a smart plan. Unlike physical coins, crypto prices can swing dramatically in just a few minutes. To avoid making rash decisions based on panic or excitement, successful sellers often use tools like limit orders, which automatically sell your coin once it reaches a price you've already set.

Above all, keep your assets safe. Always use two-factor authentication (2FA) on your exchange account and think about getting a hardware wallet to store any crypto you aren't planning to sell immediately. To get a better feel for market trends, you can discover more about the UK's crypto market growth on Statista.com.

Protecting Yourself While Maximising Profits

Once you’ve found someone keen to buy, you’ve reached the most delicate part of selling a coin. This is where the deal is done, and it’s a tricky balance between getting paid securely and giving your buyer a great experience. We’ve all heard the horror stories: a seller posts a valuable coin only for the payment to be clawed back, or a buyer falsely claims a perfect coin arrived damaged to try and get a partial refund. The key to avoiding these nightmares is to be proactive about your security.

This starts well before any money changes hands. You need to do a little homework on your potential buyers, especially if you’re selling privately through forums or social media. Take a look at their profile. Do they have a history of positive feedback? A buyer with a brand-new, empty profile who asks you to ship the coin before they’ve paid is a massive red flag. Always trust your gut; if a deal feels off, it probably is. It’s far better to walk away from a sale than to lose both your coin and your money.

Secure Payments and Safe Shipping

Choosing the right way to get paid is absolutely critical. For any online sale, your best bet is to use a platform that offers seller protection. For instance, using PayPal’s 'Goods and Services' option creates a clear record of the transaction and provides a resolution process if something goes awry. Direct bank transfers can work, but you should only accept them once the money is fully cleared in your account, which can take a few business days. Never, ever accept cheques for sales you make online; they are far too easy to forge or cancel. Some seasoned sellers I know have a strict policy against certain payment types just to sidestep the most common scams.

After the payment is confirmed and in your account, your next job is to package the coin properly. You have two main goals here: protecting the coin from damage and creating proof of its condition when you sent it.

- First, place the coin in a non-PVC, archival-safe holder or flip.

- Next, wrap this holder in a good layer of bubble wrap and put it inside a sturdy, padded envelope or a small, strong box.

- It’s a great idea to take a quick video on your phone while you’re packaging the coin. Show its condition clearly just before you seal the package.

- Always send your items using a tracked and insured shipping service. For high-value coins in the UK, Royal Mail Special Delivery is the gold standard. This gives you undeniable proof of postage and delivery, which is your lifeline if a dispute ever comes up.

Following these steps isn’t about being paranoid; it’s about being professional. It builds confidence with genuine buyers and provides a solid safety net for you. By documenting everything and using secure methods, you can make sure the final stage of the sale is as smooth as the rest. If you're selling off a number of coins, keeping meticulous records is crucial. For those dealing with larger disposals, you might find our guide on selling coin collections helpful, as it delves deeper into the logistics.

Timing the Market Like a Professional

If you ask a seasoned coin dealer about their biggest regret, you'll often hear a story about a collection sold too soon or a market peak they just missed. Learning how to sell a coin for the best possible price isn't about fortune-telling. It’s about understanding what drives a coin’s value and getting yourself in a position to act on it. Timing the market is a skill you can learn, built on careful observation and a dose of patience.

One of the most important signals, especially for coins made from precious metals, is the general economic climate. When financial uncertainty is high or inflation is on the rise, many investors turn to solid assets like gold and silver. This rush to safety increases demand and pushes up the spot price, which is the live market value of the raw metal. Selling a Gold Sovereign or a Silver Britannia when the spot price is on an upward trend can add a significant sum to your final price, completely separate from the coin's value to a collector.

Reading the Collector's Calendar

Beyond the price of gold and silver, the market for collectible coins has its own distinct rhythm. You can think of it like the seasons in retail. The lead-up to Christmas, for instance, often creates a spike in demand as people hunt for unique, memorable gifts. This is a brilliant time to sell any visually impressive coins or themed sets you might have.

In a similar way, major historical anniversaries can breathe new life into specific coins. A significant royal jubilee or the centenary of a wartime event can spark a wave of interest in related coinage, creating a perfect window of opportunity for you to sell.

Professional dealers don't just keep an eye on spot prices; they constantly check auction results and browse collector forums to get a feel for the current mood. When you see a particular type of coin consistently selling for more than its estimate at major auctions, that's a clear sign of a hot market. On the other hand, if similar coins are left unsold or only reach low prices, it might be a good idea to hold onto yours for a while. By paying attention to these cycles—economic, seasonal, and event-driven—you can stop making random sales and start making strategic ones. That shift almost always leads to a much better return.

Your Blueprint for Coin Selling Success

Turning your coins into cash with confidence isn't about luck; it's about following a proven path that works in the real world. I’ve seen what separates a successful sale from a disappointing one, and it boils down to consolidating insights from dealers, collectors, and everyday sellers into a few core principles. Whether you're handling a single coin you've inherited or a whole collection, these fundamentals are universal. A great outcome is about setting realistic expectations, knowing when to call in the experts, and spotting the red flags that tell you to pause and reassess.

Key Strategies for Success

The foundation of any good sale rests on a few key pillars. If you get one of these wrong, the whole process can become far more stressful and much less profitable. But get them right, and you'll see a fantastic result.

To get the best price for your coins, consistently focus on these critical areas:

- Mastering the Valuation: Don't just rely on a quick online search or a hopeful guess. Getting the value right means understanding the coin's grade, identifying key dates and mint marks, and factoring in current market conditions. A coin's condition can increase its value by 100 times or more, which shows why accurate grading is so important.

- Choosing Your Platform Strategically: The best place to sell a modern bullion coin is almost never the right place for a rare Roman denarius. Your choice of platform, whether it's a big online auction site or a specialist dealer, directly affects who sees your coin and the final price you'll achieve.

- Creating a Compelling Presentation: Your most powerful sales tools are high-quality photographs and a detailed, honest description. They build trust with potential buyers, allowing them to see the coin's quality for themselves. This reduces any hesitation and encourages more confident bidding.

- Ensuring Secure Transactions: Always protect yourself by using secure payment methods and shipping with tracking and insurance. This simple step safeguards both you and the buyer, making sure the final part of the deal goes smoothly and without any worries.

When to Call in a Professional

A big part of knowing how to sell a coin is recognising your own limits. If you find yourself with an exceptionally rare or valuable collection, the fee for a professional appraisal is often a small price to pay for the significant boost it can give to your final sale price. An expert can spot subtle details you might miss and provide certified documentation. This gives serious buyers the confidence they need to pay top-tier prices, potentially unlocking value you never even knew was there.

Ready to turn your collection into a success story? From rare finds to popular sets, Cavalier Coins offers the expertise and platform to help you connect with the right buyers. Explore our collections and discover how we can help you today.