So, you’ve decided to sell your coin collection. To get the best price, you can't just jump straight in. The real secret is in the prep work: knowing exactly what you have, getting a handle on its real value, and then picking the right place to sell. Getting these first steps right is the difference between a disappointing sale and turning your collection into a tidy sum.

Your First Steps to Selling Coins Successfully

Before you even start thinking about pounds and pence, you need to get organised. This isn't about slapping a final price on everything just yet; it's about laying the groundwork and understanding the potential sitting in that box or album. I’ve seen too many new sellers rush this part, only to get a wildly inaccurate valuation later on.

The journey starts with how you handle the coins themselves. The natural oils and dirt on your fingers can permanently damage a coin's surface, which can seriously knock down its value.

Expert Tip: Always hold coins by their edges. Better yet, wear a pair of simple cotton or nitrile gloves. This small habit goes a long way in preserving the coin’s delicate finish. And whatever you do, never try to clean your coins. It almost always strips away their character and numismatic worth.

Sorting Your Collection Effectively

First things first, let's bring some order to the chaos. Sorting your coins into logical groups makes the whole process feel much less overwhelming. A good way to start is by dividing them by their origin and type.

Try making separate piles for:

- Common British Currency: Think post-decimalisation coins like your everyday pennies, 2p pieces, and 50p coins.

- Pre-Decimal Coins: This is where your old shillings, florins, crowns, and farthings go.

- Foreign Coins: Any currency that isn't from the UK.

- Proof or Uncirculated Sets: Any coins still in their original mint packaging.

Once they're sorted, you can start digging into what they are. Take a modern British 50p, for example. A quick search for its design and year will tell you if it's a standard coin from someone's change or a rare commemorative piece. That simple check can be the difference between 50p and a few hundred pounds.

Creating a Simple Inventory

Now, document what you have. This is a step many people skip, but it’s absolutely essential. You don’t need anything fancy; a basic spreadsheet will do the trick. This list isn't just for your own records; it's a vital tool when you go for a professional valuation or start listing your coins for sale.

For each of your more interesting coins, make sure your inventory includes:

- Denomination and Year: For instance, "George V Shilling, 1927."

- Country of Origin: Crucial for your foreign coins.

- Basic Condition Notes: Just use simple terms for now, like "worn," "clear details," or "shiny."

- Any Known History: Jot down if it was part of a specific set or an inherited collection.

By taking this organised approach, you've transformed a random box of coins into a properly catalogued asset. With this solid foundation, you’re now in a great position to get an accurate valuation and decide exactly where and how to sell for the best price.

Getting an Accurate Coin Collection Valuation

Before you even think about selling, you need to know what your coins are actually worth. This is, without a doubt, the most critical part of the entire process.

Get the valuation wrong, and you either leave a serious amount of money on the table or, just as bad, you overprice everything and struggle to find a single buyer. A solid understanding of your collection’s genuine market value is the foundation for a successful sale.

Professionals don’t just pull a number out of thin air. They assess a coin's price based on several key factors that, together, create a full picture of its desirability and what a keen collector would be willing to pay.

The Core Factors of Coin Value

The value of any collectable coin is rarely just about its age or the metal it's made from. It’s a combination of specific characteristics that seasoned numismatists look for.

Here are a few of the most important factors:

- Rarity and Mintage: It all starts with supply and demand. How many were originally produced? A coin with a tiny mintage, like the famous Kew Gardens 50p, is naturally more sought-after than one minted in the millions.

- Condition or Grade: This is perhaps the biggest driver of value. A pristine, uncirculated coin can be worth hundreds of times more than the exact same coin in a worn, circulated condition. Even tiny, seemingly insignificant scratches can have a huge impact on the final price.

- Historical Context: Coins that tell a story or are tied to a major historical event often carry a premium. For instance, a coin minted during the short reign of a monarch like Edward VIII can be particularly desirable to collectors.

- Metal Content: For some coins, especially those not considered rare, the value is tied directly to the precious metal they contain. This is known as its bullion value and is common for gold sovereigns and silver crowns.

To really get your head around how these elements affect pricing, it’s worth reviewing some expert coin collection valuation tips for UK coins. That knowledge will help you look at your own collection with a more realistic, professional eye.

Using Professional Resources for Pricing

While you can get a rough idea yourself, serious sellers always turn to trusted resources to price their coins accurately. This is where professional guides and grading services really prove their worth. They provide an objective, market-based perspective that buyers know and trust.

A fantastic starting point for any UK-based seller is an annual price guide. These books are invaluable, compiling real-world sales data from dealers all across the country.

One of the leading guides for British coins is British Coins Market Values. A resource like this gives you the current market prices for coins from Britain's extensive 2,000-year history of coinage, based on what dealers are actually paying.

When you’re selling physical numismatic coins, this kind of up-to-date market data is essential. The guide is updated each year by market experts, spans over 100 pages, and even includes practical advice on preservation and spotting fakes. It’s a tool that helps you price your collection with genuine confidence.

When to Consider Professional Grading For exceptionally rare or high-value coins, submitting them to a professional grading service like PCGS or NGC can be a very smart investment. These services authenticate and seal the coin in a protective holder (or 'slab') with a certified grade. This official grade removes any doubt for potential buyers and can significantly increase the final sale price, often more than justifying the grading fee.

Alright, you've got a good idea of what your coins are worth. Now for the big question: where do you actually sell them?

This decision is a crucial one. It's not just about the final price you get, but also about how quickly you can sell and how much legwork you're willing to put in. The best place to sell a rare Roman denarius is almost certainly not the same place you'd offload a bag of modern commemorative 50p coins.

Let’s walk through the main options available to sellers here in the UK. Each has its own rhythm and rules, its own pros and cons. We'll look at everything from the big online marketplaces to the quiet, specialist shops.

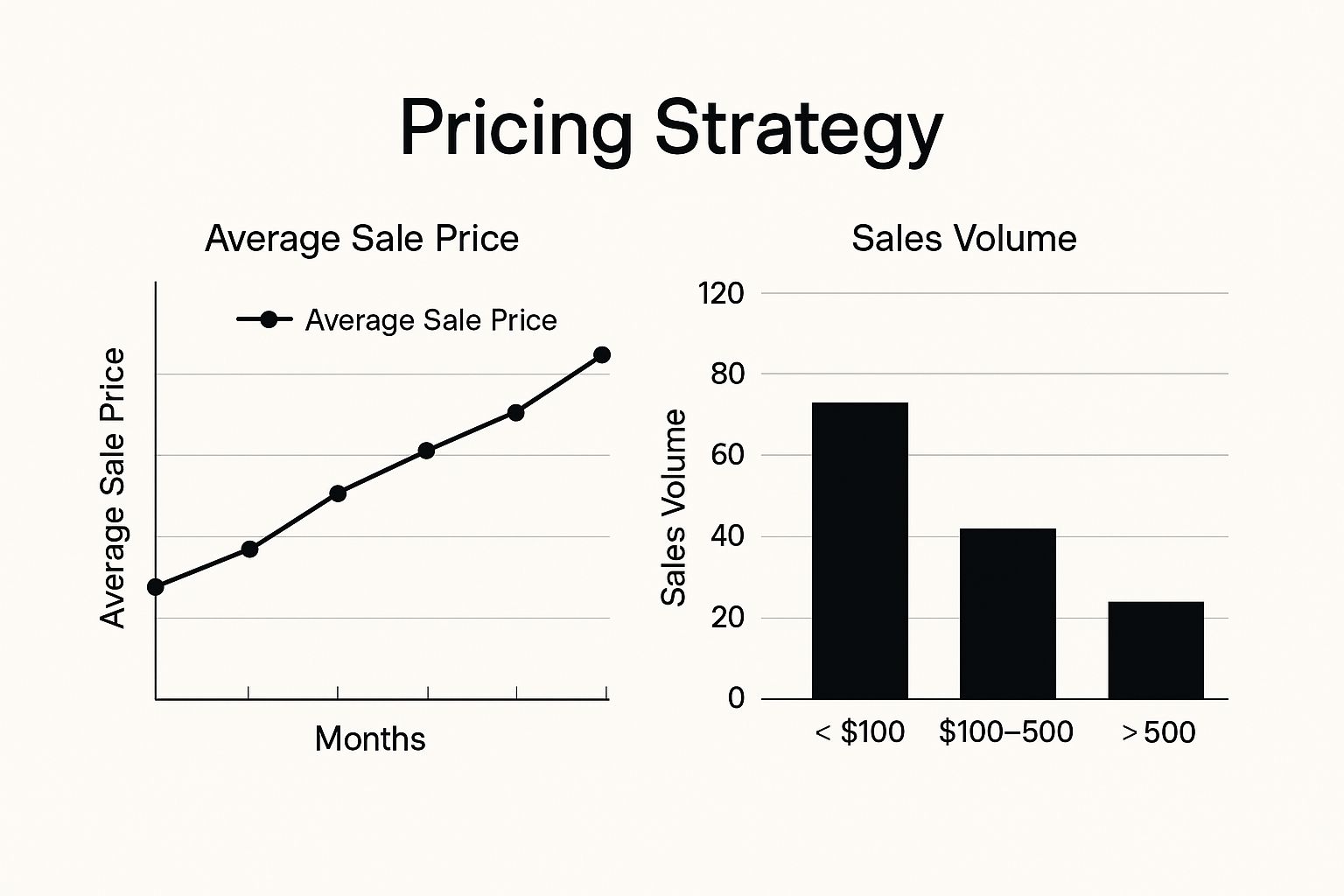

This chart gives you a quick snapshot of the collectable coin market over the last six months, showing average sale prices and how many coins are changing hands.

As you can see, the average sale price has held steady, and there's a really healthy volume of sales for coins under £100. It shows there’s a strong, active market for everyday collectables right now.

Online Auction Sites Like eBay

Platforms like eBay throw your coins in front of a massive, worldwide audience. That’s their biggest draw. For many people just starting out, it’s the default choice because it’s so accessible and you always have that chance of a bidding war pushing the price up on a hot item.

But make no mistake, getting a good result on eBay takes real effort. You’re the one doing all the work:

- Taking high-quality photos that honestly show the coin's condition.

- Writing detailed, accurate descriptions to give buyers confidence.

- Managing the listing, answering questions from potential bidders, and chasing payments.

- Packing the coin securely and handling the shipping.

Then there are the fees. eBay's fee structure usually involves an insertion fee to list the item and then a final value fee, which is a slice of the total amount the buyer pays, including postage. While the audience is huge, it’s also full of casual browsers. That means getting the absolute top price for a highly specialised coin is never a guarantee.

Specialist Coin Dealers and Shops

For a quick, clean sale, going directly to a professional coin dealer is often the simplest path. A reputable dealer will have a look at what you’ve got and make you a straightforward cash offer. If you value speed and convenience above all else, this is an excellent route.

The trade-off, of course, is the price. A dealer has to make a profit, so their offer will naturally be below the coin's full retail value. For common coins or selling in bulk, though, the efficiency can easily make it worthwhile.

This option is particularly good if you've inherited a collection and just don't have the time or the numismatic knowledge to sell every coin one by one. You walk away with a single payment and none of the fuss of creating dozens of online listings. For a more detailed breakdown, have a look at our guide on the top options for where to sell old coins in 2025.

Numismatic Auction Houses

If you're sitting on something truly rare, exceptionally high-value, or historically important, then a specialist numismatic auction house is where you want to be. These auctioneers have curated client lists of serious, high-spending collectors who are actively looking for top-tier coins.

They take care of everything—from expert cataloguing and professional photography to marketing your coin to their exclusive network of buyers. The catch is the cost. Their commission, often called a "buyer's premium," can be significant, typically falling between 15% and 25%. This is really a path reserved for coins valued in the hundreds, if not thousands, of pounds.

Think of it this way: you need to find the right marketplace with the right buyers. We can see a parallel in the digital world, where research shows that around 9% of the UK population now own cryptocurrencies. That trend just underscores how vital it is to choose a platform—whether for physical coins or digital assets—that has plenty of active, dedicated users.

Coin Selling Platform Comparison for UK Sellers

Choosing the right platform can feel overwhelming, so I've put together this table to help you compare the most common options at a glance. It breaks down what each one is best for, the typical fees you can expect, and the main pros and cons from a seller's perspective.

| Platform | Best For | Typical Fees (UK) | Pros | Cons |

|---|---|---|---|---|

| eBay | Common to mid-value coins, reaching a global audience. | Insertion fees + ~12.8% final value fee on total sale price. | Huge audience, potential for bidding wars, seller control. | High fees, requires significant effort, risk of non-paying bidders. |

| Specialist Coin Dealer | Quick sales, bulk collections, convenience over maximum price. | No direct fees, but offer will be below retail (~50-70% of value). | Fast, simple transaction, instant payment, no listing hassle. | Lower final price than selling direct, dependent on dealer's needs. |

| Numismatic Auction House | High-value, rare, and certified coins (£500+). | Seller's commission (15-25%), plus potential buyer's premium. | Access to serious collectors, expert handling, potential for record prices. | High commission, long sales process, not for lower-value items. |

| Online Forums/Groups | Direct peer-to-peer sales with fellow collectors. | Often free, but PayPal may charge ~3% for transactions. | No platform fees, knowledgeable buyers, build community connections. | Higher risk of scams, requires self-policing, smaller audience. |

Ultimately, the best choice depends on what you're selling and what you want to achieve. For a quick and easy clear-out, a dealer is fantastic. For a potential blockbuster sale of a rare sovereign, an auction house is the way to go. And for everything in between, platforms like eBay offer a powerful, if demanding, tool.

How to Create a Listing That Sells

Think of your listing as your 24/7 digital salesperson. It's working around the clock to find the right buyer, and the effort you put in here can be the difference between a quick, profitable sale and one that just sits there for weeks. You're essentially building a compelling case for why someone should buy your coin.

It all starts with the photos. In the world of online coin sales, images aren’t just important—they’re everything. A buyer can't pick up the coin and examine it, so your pictures have to do all the heavy lifting. They need to show every detail and build enough trust for someone to make a confident purchase.

Mastering Your Coin Photography

You don't need a professional studio to take great coin photos. Honestly, the camera on a modern smartphone is more than up to the task if you just get the basics right. The goal is clear, honest photography that captures the coin's beauty as well as any of its flaws.

Here's how I approach it:

- Use Diffused Natural Light: Get your coin near a window, ideally on an overcast day. This soft, natural light is perfect for avoiding the harsh shadows and glare that can hide a coin's true surface.

- Choose a Neutral Background: A simple piece of white, grey, or black card is all you need. This makes the coin the absolute centre of attention, with no distractions.

- Capture All Angles: This is non-negotiable. Buyers need to see the obverse (front), the reverse (back), and the edge. Make sure every shot is sharp and in focus.

- Show the Scale: If you're selling a less common coin, popping a familiar coin like a 1p next to it in one of the photos gives people an instant idea of its size.

A classic mistake is using your camera's flash. It creates a harsh, unnatural reflection that completely blows out a coin’s details. Always turn the flash off and rely on good ambient lighting instead. This one change makes a world of difference.

Writing Titles and Descriptions That Convert

With your photos sorted, it's time to write a title and description that will actually get your coin seen. The title needs to be a clear, keyword-rich summary of exactly what you're selling.

A title like "Old Silver Coin" is useless; it'll get completely lost. But a title like "1887 Queen Victoria Silver Crown - Jubilee Head - Good VF Condition" is powerful. It’s specific and packed with the exact terms that serious collectors are typing into search bars.

Your description should anticipate every question a buyer might have. Structure it clearly and cover the key details:

- Full Identification: Repeat the denomination, year, and monarch.

- Condition Details: Be honest and specific. If there are scratches, nicks, or obvious wear, mention it. Honesty builds trust and, just as importantly, prevents returns and disputes down the line.

- Provenance (if you know it): If the coin came from a well-known collection or a reputable dealer, it’s worth a brief mention.

- Terms of Sale: Clearly state your accepted payment methods and shipping details. Include the costs and mention if you're happy to combine postage for multiple buys.

For those tackling larger sales, our guide on selling coin collections provides a complete success plan, which goes into much more depth on strategy. By combining stellar photos with a detailed, trustworthy description, you create a listing that stands out and gives buyers every reason to click 'buy'.

Packaging and Shipping Your Coins Securely

Your job as a seller isn't over just because the money has landed in your account. The deal is only really done when that coin is safely in your buyer's hands. Trying to save a few pennies on packaging is a classic false economy; one little mistake can lead to a damaged coin, an unhappy buyer, and a complete loss on what was a great sale.

Nailing your shipping process does more than just protect your investment. It builds your reputation as a seller people can trust and want to buy from again. This is your no-nonsense guide to getting your coins posted securely within the UK.

Choosing the Right Protective Materials

Before a coin even sees the inside of a jiffy bag, it needs its own personal bodyguard. The aim here is to stop it from rattling about, protecting its delicate surfaces from the inevitable bumps and scrapes of transit.

Your first line of defence should always be an archival-safe holder:

- 2x2 Cardboard Flips: These are cheap, cheerful, and get the job done. Pop the coin in the window, fold it over, and staple the sides shut. Just make absolutely sure the staples are nowhere near the coin itself.

- Inert Plastic Flips: A step up in terms of sturdiness, these clear plastic holders give great visibility and protection, with no risk of chemical damage to the coin over time.

Once it's in a flip, whatever you do, don't just chuck it into a standard paper envelope. A coin will slice through thin paper in a heartbeat or get mangled by the postal service's sorting machines.

Preparing the Parcel for Transit

Right, now it's time to build a small, rigid package that can take a beating. This multi-layered approach is the secret to making sure your coin arrives looking exactly as it did when you listed it.

I always start by sandwiching the coin flip between two pieces of stiff cardboard, cut just a little larger than the flip. Tape this "sandwich" together securely so the coin has zero room to wiggle. This simple trick is what stops the coin from getting bent or dented in the post.

Now, that little cardboard package goes inside a padded or bubble-lined envelope. For anything of significant value, I'd go one step further and place that inside a proper rigid mailer for ultimate protection.

Crucial Tip: Always, and I mean always, include a packing slip inside the parcel. It should have the basic order details, like the item name and the buyer's address. If the main address label gets ripped off, this little piece of paper is the only thing that will help Royal Mail get the package to its destination.

Insurance and Declaring High-Value Items

If a coin is worth more than a few quid, getting the right insurance is completely non-negotiable. Standard post just won't cut it and offers virtually no cover for collectibles if things go wrong.

For any valuable coins, your go-to service in the UK is Royal Mail Special Delivery Guaranteed®. It's not just about getting a signature; this service provides proper consequential loss cover specifically for valuables. It is vital that you declare the item's true value when you post it. If you sold a coin for £500, you must select the insurance level that covers that amount to be fully protected.

This small step protects both you and your buyer, giving everyone complete peace of mind until that delivery is confirmed.

Common Questions About Selling Coins in the UK

Stepping into the world of coin selling often throws up a few common, but very important, questions. Getting the right answers from the start is the key to making sure your sale is not just profitable, but also runs smoothly and without any stress. From tax rules to figuring out what to do with an inherited collection, we'll walk you through it.

One of the most frequent things we get asked about is inherited collections. If you’ve been given coins by a relative, the very first step is to take a full inventory, just as you would with your own collection. Carefully document every single item before you even think about getting a professional valuation. You need to know exactly what you’re working with.

This methodical approach is your best defence against accidentally letting go of a rare gem for a fraction of its true worth. It also gives you a clear, overall value for the collection, which is vital for insurance purposes and for understanding any potential tax implications down the line.

Do I Need to Pay Tax on Coin Sales?

In the UK, the answer really depends on your personal situation. For most people selling a few odd coins here and there, you likely won't have to worry about tax at all. However, if you're selling coins and making a significant profit, you could be liable for Capital Gains Tax (CGT).

You have an annual CGT allowance, which means you can make a certain amount of profit each tax year before any tax is due. It’s always a good idea to keep detailed records of what you paid for a coin (or its value when you inherited it) and the price you sold it for. If you find yourself regularly buying and selling coins as a business activity, you’d need to register as a sole trader and handle income tax instead.

It's a common myth that all profits from a hobby are tax-free. If the total profit from selling your collectables in a tax year goes over your CGT allowance, you are legally required to declare it to HMRC.

How Can I Spot a Fake Coin?

Spotting fakes, or counterfeit coins, can be difficult, especially as forgeries get more and more sophisticated. That said, there are a few red flags you can look for yourself, without needing any specialist equipment.

- Check the Weight and Dimensions: A genuine coin has a very precise weight and size. A good set of digital scales can quickly tell you if a coin is too heavy or too light, which is one of the most common signs of a fake.

- Look for Seams: Fakes made from a cast are often created in two halves and then joined together. This process can leave a faint seam running around the coin's edge. Run your fingernail around it and see if you feel anything.

- Examine the Details: Genuine, struck coins have incredibly sharp, clear details. Fakes often look a bit soft, almost mushy, with poorly defined lettering and portraits.

The growing market for collectables isn't just limited to coins. We're seeing a similar boom in other assets. For instance, the UK has become a major hub for digital assets, with cryptocurrency ownership jumping from 18% to 24% in just one year. This shows there's a strong appetite for trading valuable assets, which only reinforces how important it is to verify what you have and be confident in what you're selling. You can discover more insights about this UK trend on Cointelegraph.

Whether you're selling a single rare coin or an entire collection, Cavalier Coins Ltd provides expert advice and a trusted platform for numismatists. Explore our extensive selection or contact us for a valuation at https://www.cavaliercoins.com.