Before you can even think about selling your rare coins, you first need a solid game plan. It boils down to three key stages: preparing and cataloguing your collection, getting an accurate valuation, and then picking the right place to sell—whether that's a specialist dealer, an auction house, or an online marketplace.

Getting that first step right is everything. Proper preparation is the foundation that ensures you don’t accidentally leave a small fortune on the table.

First Steps to Prepare Your Coins for Sale

Before you start looking for a buyer, you need to get to grips with what you actually have. This isn't just a quick tidy-up; it's a careful process of discovery and preservation that will directly influence the final price you get. I've seen it time and time again—rushing this part is a costly mistake.

The golden rule here is simple: handle your coins with the utmost care. Always hold them by their edges, gently pinched between your thumb and forefinger. This simple habit prevents the oils and dirt from your skin from smudging the delicate surfaces—the obverse (front) and reverse (back). A single fingerprint can, over many years, cause permanent corrosion.

The Cardinal Sin of Coin Preparation

Whatever you do, do not clean your coins. I can't stress this enough. It’s easily the most common and devastating mistake a new seller can make. Polishing, scrubbing, or using any kind of chemical cleaner will instantly strip away the coin's natural patina—that subtle layer of toning that builds up over decades or even centuries.

Serious collectors and dealers prize this original surface above almost anything else. Cleaning it is like taking sandpaper to a priceless antique table; you immediately obliterate its history, character, and a huge chunk of its value. Even a seemingly harmless wipe with a cloth can leave behind microscopic scratches (we call them hairlines), which any experienced eye will spot from a mile off, tanking the coin's grade and your potential profit.

A coin’s original, untouched surface is a massive part of its value. Professional numismatists can spot a cleaned coin almost instantly, and it will nearly always lead to a lower offer. Think of the patina as part of its story.

Creating Your Initial Catalogue

With those handling rules in mind, your next job is to create an inventory. This catalogue is your foundation for getting a proper appraisal and for putting together a compelling sales pitch later on. You’re essentially creating a detailed CV for every single coin in your collection.

For each coin, you’ll want to jot down these key details:

- Denomination: What was its face value (e.g., penny, crown, sovereign)?

- Year of Issue: The date stamped on the coin is vital for figuring out its rarity.

- Mint Mark: Look for a small letter or symbol. This shows where the coin was made (for instance, an "S" for San Francisco on US coins). Its presence—or absence—can change a coin's value dramatically.

- Country of Origin: Which nation issued the coin?

- Observable Condition: Make a quick note of anything that stands out. Is there heavy wear? Are there deep scratches? Or are the details exceptionally sharp? You're not expected to be a professional grader, but these initial observations are really useful.

This simple, organised list transforms a shoebox of old metal into a structured, understandable collection. It makes it much easier to research potential values and allows you to present your coins professionally to dealers or auction houses. It shows them you’ve done your homework.

Accurately Valuing Your Rare Coin Collection

Knowing what your coin is truly worth is the single biggest factor that separates a decent sale from a fantastic one. This isn't the time for guesswork or sentimentality. Successful selling is built on objective, evidence-based valuation, which is where professional coin grading and expert appraisals come into play.

A coin's value isn't just about its age or what metal it’s made of. It's a precise science, and experts scrutinise several key attributes to land on a final figure.

The Elements of Coin Value

When you get a coin valued, professionals are looking at a few critical things. The most important of these is the grade—a number, usually between 1 and 70, that sums up its physical condition.

To determine a coin's grade, experts assess:

- Strike Quality: How clearly was the design struck at the mint? A sharp, complete strike is what you want to see.

- Lustre: This is the original, delicate sheen on the coin's surface. It’s easily damaged and highly sought-after by collectors.

- Surface Preservation: Are there any marks, scratches, or other distractions? The cleaner the surface, the higher the value.

These factors combine to give a complete picture of a coin's quality. If you're serious about selling rare coins for the best price, understanding these elements is a must. You can dive deeper into this with our detailed guide on expert coin collection valuation tips for UK coins.

From personal experience, I've seen a high grade from a reputable company like the Professional Coin Grading Service (PCGS) or Numismatic Guaranty Company (NGC) double a coin's market value overnight. It simply removes all doubt for the buyer.

Professional Grading Versus Dealer Appraisal

So, does every single coin need to be sent off for professional certification? Not at all. It really comes down to the coin’s potential value.

For a collection of common, circulated coins, the grading fee might cost more than the coins are worth. In these cases, a fair appraisal from a trusted local dealer is usually the best approach. They can look at your collection as a whole and make a bulk offer based on their market expertise.

However, if you have a coin you believe could be particularly valuable or rare, professional grading is a game-changer. The coin is sealed in a tamper-proof holder (a "slab") with its official grade and details printed on the label. This provides undeniable authentication and makes the coin far easier to sell, especially online.

The difference a top grade can make is staggering. Just look at the 1971 5 pence coin. It seems like an ordinary decimal piece, but a rare version with a minting error, graded by a top-tier agency, sold at auction for an incredible $2.22 million. Its elite grade and verified rarity turned it into one of the most expensive British decimal coins ever sold. You can discover the full story behind this record-breaking coin sale.

Ultimately, an accurate valuation gives you the confidence and the evidence you need to negotiate from a position of strength. Whether you choose a dealer's appraisal or a formal grade, knowing your collection's true worth means you never have to accept a lowball offer again.

Choosing Your Best Sales Channel in the UK

You’ve got an accurate valuation in hand – brilliant. The next big question is where you’ll actually sell your rare coins. Truth be told, there isn't a single 'best' place for everyone. The right path for you will hinge on what you value most: speed, convenience, or getting the absolute top price. Each channel has its own set of trade-offs, and getting your head around these is the key to making a choice you won't regret.

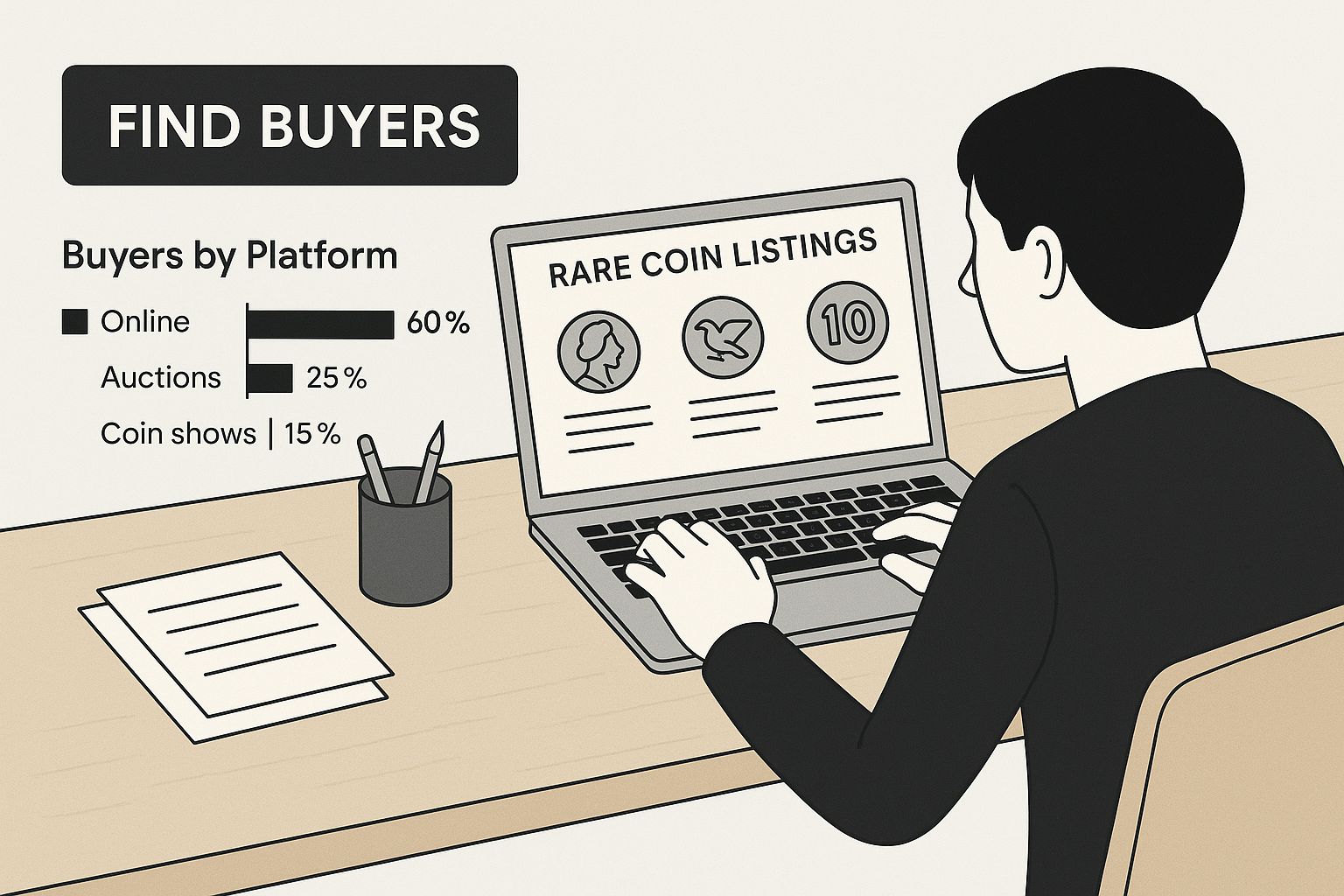

This graphic gives you a quick snapshot of what most sellers weigh up when deciding how to find the right buyers.

As you can see, connecting with the right audience is really the heart of a successful sale, whether you do it online or in person. Let’s dive into the three main avenues you can take here in the UK.

The Local Dealer Route

For many, selling directly to a local, specialist coin dealer is the quickest and most straightforward way to turn a collection into cash. It's a secure, face-to-face transaction with immediate payment. You can walk in with your coins and, if you agree on a price, walk out with money in your bank account. Simple as that.

The compromise here is the price you'll get. Dealers are running a business, after all, and they need to make a profit. They'll offer you a wholesale price, which will naturally be less than the full retail or 'catalogue' value. That margin covers their overheads and allows them to resell the coin. If you have common coins or speed is your main priority, this is an excellent, hassle-free option.

Expert Tip: I always recommend choosing a dealer who is a member of a recognised trade body like the British Numismatic Trade Association (BNTA). This gives you a layer of assurance that you're dealing with a vetted professional who operates under a strict code of ethics.

Selling Through an Auction House

If you have what you believe is a genuinely rare or high-value coin, a specialist auction house is often the best way to maximise its final price. These houses have access to a global network of serious, dedicated collectors who are prepared to compete fiercely for top-tier items. It's this competitive bidding that can drive the price far beyond what a dealer could ever offer.

This route, however, demands a good deal of patience and comes with significant costs. It can take months from the moment you consign your coin to the actual auction date, and then you have to wait to get paid. Auction houses also charge substantial fees, including a seller's commission (often 15-25% of the final hammer price) plus potential extra charges for things like photography and insurance.

Listing on Online Marketplaces

Platforms like eBay throw your listing open to a massive, worldwide audience of potential buyers. This can be a fantastic way to sell mid-range coins, and it gives you complete control over every aspect of the sale – from the listing and photos to the description and pricing strategy.

Of course, each of these options presents a different balance. Many sellers find that local rare coin dealers are invaluable for their deep knowledge of the UK market, which helps them accurately appraise coins based on specific rarity and condition. This expertise can save you from the classic mistake of undervaluing your items, something that can easily happen at a general pawn shop. While online platforms can reach more people and potentially achieve higher prices, they come with their own set of risks, like dealing with shipping, paying listing fees, and waiting for the right buyer to come along. If you'd like to get another perspective on these choices, you can explore this 2025 guide on selling rare coins.

To make this clearer, let's break down the pros and cons of each channel side-by-side.

Comparison of UK Coin Selling Channels

Choosing the right channel is a personal decision based on your specific coins and your goals. This table offers a straightforward comparison to help you weigh the advantages and disadvantages of each primary route in the UK.

| Selling Channel | Potential Price | Speed of Sale | Convenience & Effort | Associated Risks & Fees |

|---|---|---|---|---|

| Local Coin Dealer | Lower (Wholesale Price) | Very Fast (Often same-day) | High (Simple, direct transaction) | Low risk; no fees, but lower sale price. |

| Auction House | Highest (Market-driven) | Slow (Months) | Low (Auction house handles most work) | High fees (15-25% commission + extras); risk of no sale. |

| Online Marketplace (e.g., eBay) | Medium to High (Varies) | Varies (Days to weeks) | High (You manage the entire process) | Listing fees, final value fees, risk of non-payment or returns. |

Ultimately, whether you opt for the speed of a local dealer, the high-price potential of an auction, or the wide reach of an online marketplace depends on what's most important to you. There's no wrong answer, only the one that best fits your situation.

Crafting a Compelling Story for Your Coin

A successful sale is about more than just the technical specs of your coin; it's about the story it carries. Any dealer can list a coin with its date and grade, but learning how to present it with a compelling narrative is what hooks serious collectors. This is often the difference between a quick sale and a record-breaking one.

High-quality photography is completely non-negotiable. You don’t need a fancy studio, but you absolutely must capture every last detail. The right lighting and a few clever angles can transform a flat, lifeless image into a dynamic preview of the real thing, making the coin feel tangible even through a screen.

But fantastic photos are only half the battle. Your description needs to do the heavy lifting, taking a potential buyer on a journey. This is your chance to connect with them on an emotional level.

Weaving a Narrative That Sells

Think beyond the basic facts. What’s your coin’s history? Was it struck during a significant historical period? Is it part of a famous hoard, or does it feature a unique, sought-after minting error? These are the details that truly ignite a collector's imagination.

For example, don't just write "1889 Morgan Silver Dollar, AU Condition." Instead, try something far more engaging: "This 1889 Morgan Silver Dollar boasts sharp details and original lustre. Struck in the final, turbulent years of the Wild West, this coin is a tangible piece of American frontier history." See the difference? You’ve just transformed a piece of metal into a coveted historical artefact.

This storytelling approach is crucial when you sell rare coins, as it helps buyers feel good about paying a premium. For a deeper dive into writing listings that sell, check out our complete success guide on how to sell coins in the UK.

The Power of Provenance and Rarity

The history of ownership, or provenance, can send a coin's value soaring. If you can trace its ownership back through previous collections—especially well-known ones—you add a layer of prestige that collectors are more than willing to pay for. This documented history confirms its authenticity and deepens its allure.

Rarity, of course, is the other major driver of price. It’s simple supply and demand: the fewer examples of a coin that exist, the more fiercely people will compete to own one. When you combine rarity with a solid provenance, the effect on value can be extraordinary.

A coin's story is its unique selling proposition. It’s what distinguishes your coin from dozens of others on the market and creates a sense of urgency and desire in the mind of the buyer.

This powerful mix of scarcity and story has led to some astonishing results right here in the UK. Take the 1933 penny, for instance. Known for its extreme scarcity and royal connections, a verified specimen fetched approximately £72,000 at auction. This sale is a perfect example of how verified rarity and historical significance can turn a simple coin into a major asset. You can discover more about this remarkable coin and its sale on YouTube.

By weaving these elements—history, rarity, and provenance—into a compelling narrative, you’re not just selling an object. You're creating an emotional connection that elevates buyer interest and can make a huge difference to the final price you achieve.

Finalizing The Sale Safely And Securely

A deal isn't really done until the coin is safely in its new home and the money is cleared in your bank account. This final stage is all about nailing the logistics. Get this part right, and you can be sure all your hard work pays off without any last-minute headaches.

Let’s start with getting paid. For any online sale, secure platforms are your best friend. Think PayPal, but always using their ‘Goods & Services’ option, or a proper escrow service. These act as a middleman, holding the funds until both you and the buyer are happy, which offers a great layer of protection. If you’re selling to a dealer in person, a direct bank transfer is usually the cleanest and safest way to go.

Crucial Insight: Be wary of payment methods that are easily reversed or hard to trace. Personal cheques or certain money transfer apps can be a red flag. Scammers have been known to use these methods to claw back their payment after you’ve already posted the coin.

Secure Packaging And Shipping

Once the payment is confirmed, your attention has to shift to packaging. The goal here is twofold: protect the coin from any possible damage in transit and make sure the package itself doesn’t scream “expensive item inside!”

Here’s a practical checklist I use for packing every coin I send:

- First Layer of Defence: The coin should be in a soft, non-PVC plastic flip. If it’s already in an official graded slab, just leave it in there.

- Add Rigidity: I then sandwich this flip between two sturdy pieces of cardboard and tape them together tightly. This is vital to stop the coin from bending or rattling around.

- Keep it Discreet: Place your cardboard-wrapped coin inside a plain padded envelope or a small, unassuming box. The key is to make it look as boring as possible. Whatever you do, never write words like "coins," "valuable," or "bullion" on the packaging.

Shipping is absolutely not the place to try and save a few quid. Always, always use a service that provides full tracking and insurance to the coin’s value. Within the UK, Royal Mail Special Delivery is the gold standard for this. It gives you a clear paper trail and complete financial peace of mind should the worst happen and the package goes missing. You can learn more about the logistics involved with the top options where you can sell old coins and how they differ.

Finally, for any private sale, it's wise to create a simple bill of sale. This doesn't need to be complicated. Just a document noting the date, a clear description of the coin, the final sale price, and the names and signatures of both you and the buyer. It's a simple step, but it provides invaluable proof of the transaction and protects everyone involved.

Your Top Questions About Selling Coins Answered

Diving into the world of numismatics can feel like a lot to take in, especially when you're looking to sell. It's only natural to have questions, and many newcomers often share the same worries about getting it right. Let's tackle some of the most common queries head-on with some clear, practical advice.

Should I Sell My Coins All at Once or Piece by Piece?

This is a classic dilemma, and honestly, the best answer depends entirely on what’s in your collection. Think of it as a strategic choice between maximising value and being efficient.

If you’ve got a few real standout pieces – maybe a rare sovereign or a key-date Victorian crown – then selling them individually is almost always the way to go. Taking these star players to a specialist auction or offering them to a high-end dealer gives each coin the spotlight it deserves. This focus is what helps you achieve the best possible price for each one.

On the other hand, what if you're sitting on a huge collection of more common, lower-value coins? Selling them as one job lot is a much more practical move. Dealers are often keen to buy in bulk to build their inventory, and it saves you a monumental amount of time and hassle compared to listing hundreds of individual items online.

How Do I Sell an Inherited Collection I Know Nothing About?

Inheriting a coin collection can feel overwhelming, but the very first step is simple: don't do anything. Specifically, fight any urge to clean or polish the coins. This is the fastest way to slash their value. Your first real task is to create a basic inventory.

Just make a simple list of each coin, noting its denomination, date, and country of origin. Once you have this catalogue, your next move is to get a professional appraisal.

The most reliable way to get an honest assessment in the UK is to consult a member of a recognised trade organisation, such as the British Numismatic Trade Association (BNTA). Their members are vetted professionals who work to a strict code of ethics.

An expert can look over your list and the coins themselves, giving you a proper understanding of their worth. This puts you in a strong position to make an informed decision before you sell a single thing.

Are There Tax Implications When Selling Coins in the UK?

Yes, there certainly can be, and it’s a vital point to get your head around. The tax rules change depending on the type of coin you're selling.

Most coins produced by the Royal Mint that are considered UK legal tender are exempt from Capital Gains Tax (CGT). This is great news for anyone selling popular investment coins like Gold and Silver Britannias or Gold Sovereigns. This exemption is a big reason why they are so popular with UK-based investors and collectors.

However, the story is different for other coins. Pieces from foreign countries, ancient coins, or rare historical items that aren't UK legal tender might be subject to CGT. You would only be liable if your total capital gains for the tax year go over the annual exemption allowance.

If you have a valuable collection that includes non-exempt coins, it’s always a smart move to speak with a tax advisor. They can give you clear guidance based on your personal situation.

At Cavalier Coins Ltd, we are passionate about helping collectors build and manage their collections. Whether you are looking to sell a single rare piece or a large inherited collection, we offer expert advice and fair market prices. Explore our services and current listings at Cavalier Coins.