Imagine holding a piece of history in your hand that also happens to be a powerful financial asset. That's really the heart of coin investing. Unlike stocks or digital currencies, these are tangible assets—a real store of value you can see and touch, which makes them a unique and fascinating addition to any investment strategy.

Why Investing in Coins Is a Timeless Strategy

Many shrewd investors have a habit of turning to rare and precious metal coins, especially when the economic winds start to change. It’s a bit like owning a unique piece of art that also happens to act as a hedge against inflation. The value isn't just locked in the metal; it's woven into the story, the scarcity, and the demand from fellow collectors. This dual appeal makes the world of coin investing a rewarding field to explore.

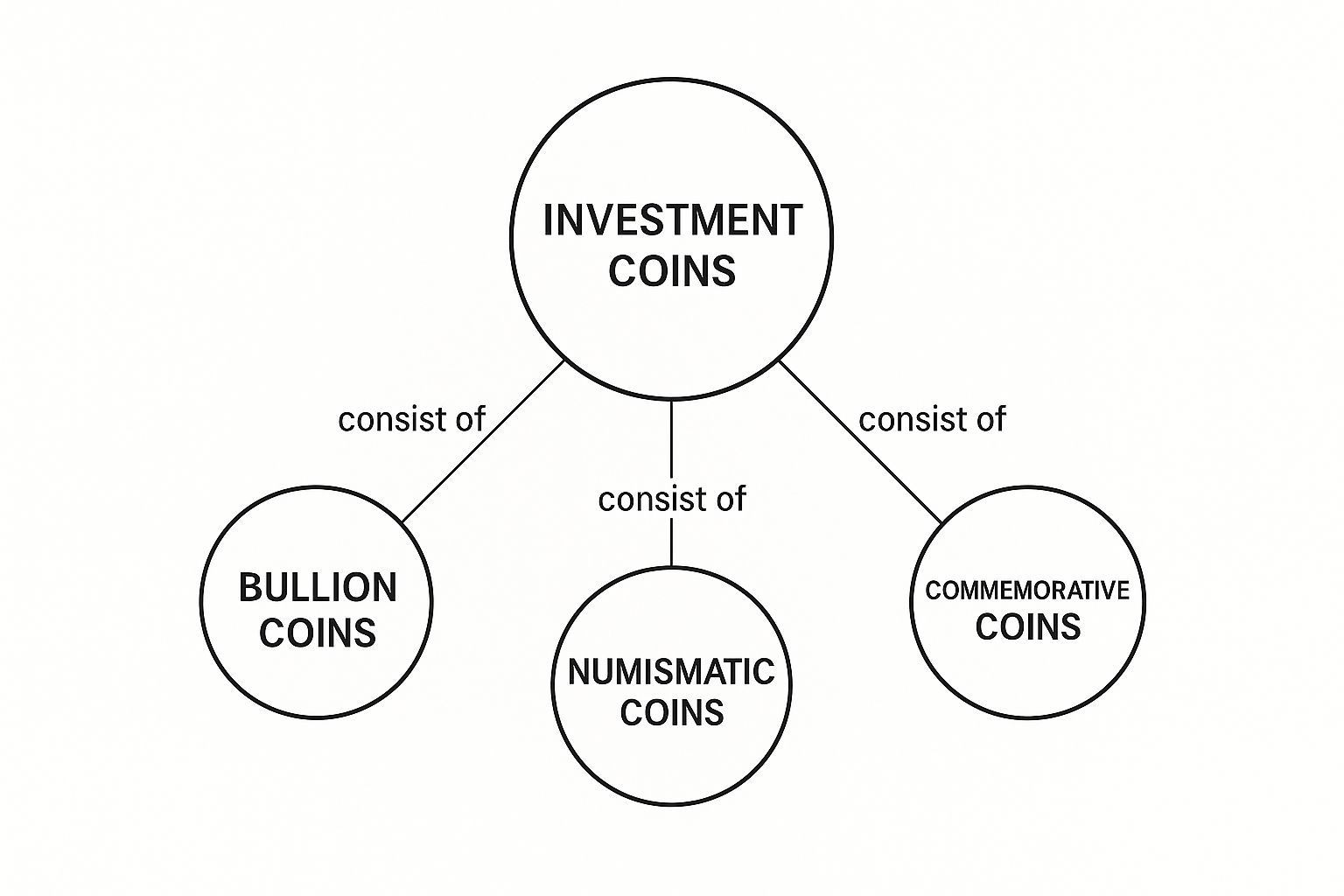

As you start to look into this area, you'll quickly realise there are two main paths you can take to build a portfolio. Getting your head around the difference is fundamental to making smart decisions that actually line up with your financial goals.

The Two Pillars of Coin Investment

The first path is investing in bullion coins. These are valued almost entirely for their precious metal content. A modern Gold Britannia, for example, will have a price that moves in lockstep with the live market rate of gold. They are a very direct, straightforward way to own physical precious metals in a format that’s guaranteed by a government mint.

The second path leads you to numismatic coins. These are prized for entirely different reasons: their rarity, historical importance, condition, and the sheer demand from collectors. A Victorian-era sovereign isn't just worth its weight in gold; its age, the tiny number that have survived, and its link to a famous monarch can make it exponentially more valuable. This is where the thrill of collecting truly meets the strategy of investing.

Key Takeaway: Bullion offers stability tied to commodity prices, while numismatics provides growth potential based on rarity and demand. A balanced portfolio often includes both.

The UK Market Context

The climate for investing in coins is often shaped by what's happening in the broader economy. Here in the UK, private and business investment has seen its fair share of ups and downs over the decades. This environment of fluctuating but generally positive investment growth has a real influence on the coin market, as investors tend to seek out tangible assets during periods of economic uncertainty or recovery.

For instance, business investment in the UK recently saw a quarterly rise of 5.9%, showing a renewed confidence that can easily spill over into alternative assets like coins. You can explore more data on UK investment trends to see how these forces shape the market.

This deep connection to the wider economy is exactly why coins have remained a cornerstone of diversified portfolios for generations. They aren’t just collector's items; they're recognised as a tangible asset class with a rich history of preserving wealth.

Bullion vs Numismatic: The Two Worlds of Coin Investing

When you first start exploring coin investing, you’ll quickly realise it’s a world with two distinct territories: bullion and numismatics. For any new investor, getting your head around the crucial difference between these two is the single most important first step. It's the key to making sure your strategy aligns with your financial goals right from the very beginning.

Think of bullion coins as a neat, standardised way to own precious metals. They're like miniature gold bars, but in a more convenient and recognisable coin form. Their value is tied almost entirely to the live market price—what’s known as the 'spot price'—of the metal they're made from. A modern Gold Britannia or a Canadian Maple Leaf, for instance, is a direct play on the price of gold. Their worth moves up and down daily with the global commodities market, making them a very straightforward and easy-to-sell way to own physical precious metals.

Numismatic coins, on the other hand, are a completely different beast. They’re more like rare antiques or fine art. While they are often made of gold or silver, their intrinsic metal value is usually just a small fraction of their total worth. Their price is driven by a whole different set of factors—ones that have more to do with history and scarcity than the daily metal markets.

To understand the potential of each, it helps to see them side-by-side.

Bullion vs Numismatic Coins: A Comparison for Investors

This table breaks down the core differences, helping you decide which path might better suit your investment style and what you hope to achieve.

| Characteristic | Bullion Coins (e.g., Gold Britannia) | Numismatic Coins (e.g., Victorian Sovereign) |

|---|---|---|

| Primary Value Driver | Precious metal content (spot price) | Rarity, condition, historical importance, and collector demand |

| Price Volatility | Tied to daily commodity market fluctuations | Less affected by daily metal prices; driven by collector market dynamics |

| Liquidity | High; easy to buy and sell globally at prices close to spot | Lower; finding the right buyer at the right price can take time |

| Potential for Returns | Moderate; follows the appreciation of the underlying metal | High; significant returns are possible for sought-after coins |

| Knowledge Required | Minimal; just need to track metal prices | Extensive; requires research into history, grading, and rarity |

| Historical Appeal | Low; primarily an asset class | High; each coin is a tangible piece of history with a story |

Ultimately, bullion is a passive investment in a commodity, while numismatics is an active investment in a collectible asset.

What Gives a Numismatic Coin its Value?

So, what exactly are those factors that can turn a simple piece of metal into a sought-after treasure? The true value of a numismatic coin comes from a compelling mix of several key elements.

- Rarity: This isn't just about how many were originally minted. The real question is, how many are known to have survived in good condition? A coin with a tiny survival rate is far more valuable than one that just had a low mintage number.

- Condition (or Grade): The physical state of a coin is absolutely paramount. A tiny, almost invisible scratch or the slightest hint of wear can slash its value. The price difference between a coin graded 'Very Fine' and one graded as 'Uncirculated' can easily run into thousands of pounds.

- Historical Significance: Does the coin have a story? Coins connected to major historical events, famous monarchs, or pivotal moments in time carry a serious premium. A coin from a short, dramatic reign, for example, tells a unique story that collectors are willing to pay for.

- Collector Demand: At the end of the day, a coin is only worth what someone is willing to pay for it. Certain series or types of coins can suddenly become incredibly popular, driving prices sky-high as a growing number of collectors chase a very limited supply.

For more practical advice on spotting value, our guide covering seven tips for buying collectable coins offers fantastic insight for building your collection wisely.

Which Investment Path Should You Choose?

So, which is right for you? There’s no single correct answer—it all boils down to your personal goals, your tolerance for risk, and how hands-on you want to be.

If you’re looking for a simple, liquid investment to hedge against inflation that’s directly tied to the price of gold or silver, then bullion is an excellent, no-fuss choice.

But if you’re fascinated by history, enjoy the thrill of the hunt, and are prepared to do your research, the world of numismatics offers far greater potential for truly significant returns. A rare Victorian sovereign isn’t just an investment in an ounce of gold; it’s an investment in scarcity, craftsmanship, and a tangible piece of human history.

How to Determine a Coin's True Value

So, what separates a common old coin worth a few pounds from a genuine historical artefact worth thousands? The answer isn't magic; it's about understanding the core factors that build a coin's numismatic value. This isn't just guesswork. It's a careful evaluation based on four key pillars that every serious investor must learn to recognise.

Getting your head around these elements is fundamental if you want to invest in coins for anything more than their raw metal content. It’s the difference between buying a simple commodity and acquiring a true collectible. The four pillars are rarity, condition, provenance, and demand. Each plays a critical role, and they often influence one another to create the final market price.

Pillar 1: The Truth About Rarity

When we talk about rarity, it’s easy to get fixated on the original mintage figure—the number of coins the mint produced in a specific year. And while that number is a decent starting point, it's only half the story. The kind of rarity that truly drives value is all about the survival rate.

Think of it like this: countless millions of Roman coins were struck, but how many survived 2,000 years buried in a field? How many Victorian pennies weren't simply melted down for their copper or worn so smooth they're barely recognisable? A coin with a high mintage but a tiny survival rate can be far rarer, and thus more valuable, than a low-mintage coin that was squirrelled away by collectors from the very beginning.

Pillar 2: Condition is King

In the world of coin collecting, the physical state of a piece—its condition or grade—is absolutely everything. A tiny, almost invisible scratch or the slightest hint of wear from being in someone's pocket can cause a monumental drop in value. The gap between two adjacent grades can easily be the difference between a £50 coin and a £5,000 one.

Coin grading follows a descriptive scale, from ‘Poor’ (you can barely tell what it is) all the way up to ‘Mint State’ or ‘Uncirculated’ (a perfect coin showing no wear at all).

A coin in Mint State (with MS-70 being the theoretical pinnacle) has never been in circulation and still has its full, original lustre. Even a coin graded as MS-63 is a brilliant, uncirculated piece, but the tiny imperfections that separate it from an MS-65 can represent a huge leap in price.

This is precisely why professional, third-party grading services are so vital for any high-value coin. They offer an objective, unbiased assessment of its condition, which gives investors the confidence they need to know what they're truly buying. For a closer look at this, our guide has more expert tips on how to value old coins.

Pillar 3: The Power of Provenance

A coin’s backstory, its documented history of ownership, is what we call its provenance. A solid, verifiable provenance can add a significant premium to a coin's value, transforming it from a simple historic object into a unique artefact with a story to tell.

Imagine two identical gold sovereigns, both in the same high-grade condition. One has no known history. The other can be traced back to the collection of a famous aristocrat or was recovered from a legendary shipwreck. The coin with the documented story will almost always fetch a higher price at auction because it has a uniqueness that simply can't be replicated.

Pillar 4: The Influence of Market Demand

At the end of the day, a coin is only worth what someone is willing to pay for it. Market demand can be fickle, often swayed by new research, popular culture, or collecting trends. A certain type of coin might suddenly capture the public’s imagination, causing prices to spike as more and more collectors chase a finite supply.

For instance, the numismatic market is constantly shaped by what collectors are after. Historical data shows that prices for items like official medals have risen and fallen based on collector interest. Gilt-bronze medals that once sold for five dollars later saw their prices drop to three dollars as demand shifted elsewhere, proving just how much market dynamics matter. Mastering these four pillars gives you the tools to assess a coin's potential and invest with the insight of a seasoned numismatist.

How to Navigate the Market and Avoid Costly Mistakes

Stepping into the coin market for the first time can feel a little intimidating, but it doesn't have to be. With the right know-how, you can invest with confidence and sidestep the common pitfalls that trip up newcomers. This section is all about building that confidence—your practical guide to buying safely and smartly.

The biggest risks for a new investor are pretty straightforward: paying far too much for a coin, falling for an increasingly convincing fake, or simply misunderstanding a coin’s grade. Knowing where to buy and what to look for is your primary line of defence. Your main options are reputable dealers, specialist auction houses, and online marketplaces, and each comes with its own set of rules and risks.

Where to Buy Your Investment Coins

Choosing where you buy your coins is just as critical as choosing which coins to buy. A trusted source isn't just a place to shop; it's a layer of security that protects your investment from the get-go.

- Reputable Coin Dealers: A dealer with a proper shop or a long-standing online presence has a reputation to uphold. They live and die by their name, so they have a vested interest in selling genuine, fairly priced coins. Their expertise is part of what you're paying for.

- Auction Houses: For high-value or exceptionally rare coins, specialist numismatic auction houses are often the place to be. They attract serious collectors, and the competitive bidding helps establish a fair, transparent market price. It’s a high-stakes environment but can be very rewarding.

- Online Marketplaces: Platforms like eBay can feel like a treasure trove with their huge selection, but they also carry the highest risk. This is where fakes and overpriced items are most common, so it demands a very sharp eye and an extremely cautious approach. It's not the best place to start.

Investor Tip: When you're just starting out, one of the safest things you can do is build a relationship with a trusted dealer. Look for members of an organisation like the British Numismatic Trade Association (BNTA). Their members are vetted and have to stick to a strict code of ethics.

The Non-Negotiable Role of Third-Party Grading

For any significant numismatic coin, professional third-party grading isn't a luxury—it’s an absolute necessity. Think of it as getting an independent, expert survey done before you buy a house. You just wouldn't skip it.

Companies like the Professional Coin Grading Service (PCGS) and the Numismatic Guaranty Company (NGC) are the gold standards in the industry. They authenticate a coin before sealing it in a tamper-proof holder, often called a "slab". This slab includes a label detailing the coin's grade, a unique serial number, and other key details.

Buying a "slabbed" coin gives you powerful protection. It confirms the coin is genuine and provides an objective, universally recognised assessment of its condition. This takes the guesswork out of the equation and protects you from sellers who might try to pass off a lower-grade coin as something much more valuable.

Spotting Red Flags and Dodging Bad Deals

Over time, you'll develop a gut feeling for what looks "off". This skill will save you a great deal of money and frustration. It's fascinating how even governments have historically tried to influence coin characteristics. For example, in the mid-1960s, the Royal Mint deliberately avoided bright, shiny finishes on some coins and even stopped using mintmarks to discourage hoarding by collectors. This was a direct response, mirrored from World War II, to ensure coins stayed in circulation rather than being pulled out as collectibles. You can discover more about how monetary policy has shaped UK coin collecting on archive.org.

This bit of history shows just how much the small details matter. Here are some modern red flags to watch for:

- Prices That Are Too Good to Be True: If a rare coin is listed for a fraction of its known market value, something is wrong. It’s almost certainly a fake, a replica, or has a serious, hidden problem.

- Poor Quality Photography: Legitimate sellers of valuable coins provide sharp, high-resolution images that show every single detail. Blurry or dark photos are a classic way to hide imperfections or the tell-tale signs of a forgery.

- Vague or Evasive Descriptions: A good seller should be able to give you clear information about a coin's history (provenance), its grade, and any flaws. A lack of detail is a major warning sign.

- Pressure to Buy Quickly: "This deal won't last!" is a classic high-pressure sales tactic. A good investment will still be a good investment tomorrow. Always give yourself time to do your research.

A Practical Plan for Building Your First Coin Portfolio

With a solid grasp of what makes a coin valuable and how to navigate the market, it’s time to move from theory into practice. Building your first coin portfolio is an exciting step, but it doesn't start with a lucky find—it starts with a clear plan.

The most successful collectors I know are the ones who begin with discipline. They define their boundaries and objectives before spending their first pound. This structure is what turns a simple hobby into a strategic investment.

First things first: set a realistic budget. This isn’t about how much you could spend, but how much you are truly comfortable dedicating to a long-term asset without causing any financial strain. Whether it's £50 a month or a more significant lump sum, knowing your limit keeps emotional decisions at bay and ensures your collecting stays enjoyable and sustainable.

Your budget naturally brings up the next question: what are your goals? Are you primarily interested in the slow, steady security that comes with precious metals? Or are you drawn to the thrill of the hunt for rare numismatic finds with major growth potential? Your answer will shape every single purchase you make.

Defining Your Starter Strategy

Once you’ve got a budget and a goal in mind, you can pick a starting strategy. There are countless paths to take, but for a beginner, it’s always wise to start with a narrow focus. This lets you build up deep knowledge in one specific area, rather than spreading yourself too thin.

Here are two popular and effective strategies for those just starting to invest in coins:

-

The Modern Bullion Approach: This is a fantastic way to get a real feel for the market. Start by purchasing modern UK bullion coins, such as a Silver Britannia or a Gold Sovereign. Their value is simple to track against the daily spot price of their metals, and they are incredibly easy to sell when the time comes. They are also exempt from Capital Gains Tax here in the UK, which is a significant advantage. It's a low-risk approach that teaches you the fundamentals of buying and selling physical assets.

-

The Focused Historical Niche: If it's the stories behind the coins that captivate you, pick a specific historical period to explore. This could be something like Roman bronze coins, which can be surprisingly affordable, or the coinage of a specific monarch, like Georgian-era copper. Focusing on one niche helps you become an expert, making you far better at spotting a bargain and recognising what true rarity looks like.

Key Insight: Don’t try to collect everything at once. Mastering a small corner of the coin world is far more effective than being a novice in all of them. Deep knowledge is your best tool for making smart investments.

The Power of Diversification

Even within your chosen area, the principle of diversification is vital. This doesn't mean you need to rush out and buy dozens of different coins straight away. It’s more about balancing risk and growth potential within your own portfolio.

A really well-rounded starter collection might blend the stability of bullion with the higher growth potential of a few select numismatic pieces. For example, your portfolio could be 80% bullion coins like Britannias to provide a solid, stable foundation. The remaining 20% could then be dedicated to a few carefully chosen historical coins from your niche. This structure gives you exposure to both the commodity market and the collector market, creating a much more resilient investment.

Securing Your Investment for the Long Term

The final piece of the puzzle is arguably the most important: protecting your physical assets. Unlike stocks and shares, coins can be lost, stolen, or damaged. Secure storage isn’t an afterthought; it’s an essential part of your investment strategy from day one.

Depending on the value of your collection, you have a few options:

- At Home: For a more modest collection, a high-quality, fire-proof safe that is securely bolted down can be a perfectly suitable option.

- Bank Safe Deposit Box: This offers a higher level of security for more valuable collections, protecting your assets from threats like theft and fire at home.

- Third-Party Vaults: For very high-value portfolios, specialist vaults provide top-tier, fully insured security and peace of mind.

Alongside secure storage, insurance is non-negotiable. Your standard home contents insurance policy may not fully cover a valuable collection, so you will almost certainly need to arrange a separate policy or an extension specifically for your coins. Always keep a detailed inventory with high-quality photos and all your purchase receipts. This documentation is indispensable, both for insurance claims and for when you eventually decide to sell.

Putting Knowledge into Action: Your Next Steps

You've now got the foundational knowledge to start your journey in coin investing. It all boils down to a few core ideas: the crucial difference between bullion and numismatics, the huge impact of a coin's grade and rarity, and the non-negotiable need to do your own research. With these concepts under your belt, you can move forward with real confidence.

The goal now is to turn that knowledge into deliberate action. Investing in coins is an incredibly rewarding pursuit, blending history, art, and finance, but that first step is always the most critical one. It's about taking what you've learned here and applying it in a small, manageable way.

Your rewarding adventure in coin investing starts not with a huge purchase, but with a single, deliberate action. It's about building knowledge and experience step-by-step.

A Checklist to Get You Started

To help you get the ball rolling, here is a simple checklist of practical actions. Just pick one that feels right for you and commit to doing it this week. This isn't about spending a lot of money; it's about actively engaging with the market and building your experience.

-

Visit a Reputable Dealer: Pop into a local coin shop, even if it’s just to have a look. Introduce yourself, ask to see a few things, and don't be afraid to ask questions. There's no better way to see the difference between grades with your own eyes.

-

Track a Single Coin: Pick a common, popular coin, like a UK Gold Sovereign, and follow its price online for a full month. This gives you a genuine, real-world feel for how the value of bullion-related coins can fluctuate day-to-day.

-

Read a Good Book: Find a well-regarded book on a specific niche that catches your eye, whether that's Roman silver or modern commemoratives. Deep knowledge is truly your greatest asset in this field.

-

Start a 'Type' Collection: Instead of chasing expensive rarities, why not try to collect one example of each British penny design from Queen Victoria to Queen Elizabeth II? It’s an affordable and fascinating way to learn about history and design changes without a hefty price tag.

As your collection grows, you'll eventually think about your exit strategy. Understanding how to sell properly is key. For a detailed breakdown, you can explore our complete guide on how to sell a coin collection to get the best return. This rewarding hobby is waiting for you.

Of course. Here is the rewritten section, crafted to match the human-written, expert tone and style of the provided examples.

Your Coin Investing Questions Answered

Dipping your toes into the world of coin investing is exciting, but it’s perfectly normal to have a few questions. We get it. To help you feel more confident as you start out, we've gathered some of the most common queries we hear from new collectors and answered them right here.

Is Investing in Coins Better Than Gold Bars?

This is a classic question, and the honest answer is: it really depends on what you want to achieve. Think of it this way: gold bars are a pure play on the price of gold. They’re straightforward, easy to track, and highly liquid.

Coins, on the other hand, offer more layers. Bullion coins, like the popular Gold Britannia, track the metal price much like a bar does, giving you a direct stake in gold itself. But then you have numismatic coins. These are the pieces where history, rarity, and collector demand come into play, offering the potential for returns that go far beyond the metal's value.

For many seasoned investors, the answer isn’t one or the other. They often choose to hold both, balancing the raw metal value of bars with the unique potential of collectible coins.

How Much Money Do I Need to Start?

You absolutely don't need a king's ransom to get started in coin collecting. It's a common misconception that you need thousands of pounds to build a worthwhile collection.

You can easily begin with a modern one-ounce silver bullion coin, like a Silver Britannia, which typically costs just a small premium over the current silver price. If you’re more drawn to the stories behind the coins, you could pick up common date Victorian pennies for just a few pounds each.

The golden rule is to start small. Learn the ropes, get a feel for the market, and then gradually build up your investment as your confidence and knowledge grow.

How Do I Sell My Coins When I Want to Cash In?

When the time comes to sell and hopefully realise a profit, you’ve got several reliable options. The best route often comes down to the type of coin you're selling.

- Bullion Coins: These are the easiest to sell. Most precious metal dealers will buy them back at a price linked to the live spot price of the metal. It's a quick and simple process.

- Numismatic Coins: Here, your options open up. You can sell to a specialist dealer who understands its value, consign it to a reputable auction house, or even sell directly to other collectors through online communities.

For a particularly rare or high-value coin, an auction house is often the best choice. They can connect your coin with a global audience of serious collectors, which can often drive the price higher. It never hurts to get a few quotes if you can.

Are Coins a Tax-Free Investment in the UK?

This is a fantastic question for any UK-based investor, and the answer is one of the biggest perks of collecting certain coins. Yes, some UK coins are indeed exempt from Capital Gains Tax (CGT).

To be specific, all British legal tender currency is exempt from CGT for UK residents. This includes sought-after coins like Gold and Silver Britannias and Gold Sovereigns. This tax-free status can make a huge difference to your final returns.

It's vital to remember, though, that this exemption doesn't apply to everything. Coins from other countries or non-legal tender items like medallions are usually subject to CGT. As always, it’s a good idea to chat with a financial advisor to understand exactly how the tax rules apply to your own portfolio.

Ready to explore the fascinating world of numismatics? Cavalier Coins Ltd offers an extensive selection of rare and collectible coins and banknotes to help you build your collection. Visit our online store today to find your next treasure.