Figuring out what an old coin is worth is a fascinating mix of science and art. It comes down to a blend of its rarity, historical significance, and physical condition. Age isn't everything; a common Roman coin might be worth less than a rare 20th-century penny that looks like it just left the mint.

Starting Your Old Coin Valuation Journey

Ever found a dusty old tin of coins and wondered if you’ve struck gold? The world of old coin valuation can feel a bit daunting at first, but it really just boils down to a few core principles that separate everyday pocket change from a true collector's prize.

It’s a journey that quickly changes your perspective. You stop seeing them as simple metal discs and start appreciating them as miniature historical artefacts. The first big realisation is that a coin's story is just as crucial as what it's made of. Its value is shaped by the narrative it carries—the monarch it depicts, the era it survived, and just how many of its siblings are still out there.

The Four Pillars of Coin Value

To get a true sense of any coin's value, you need to look at it through four different lenses. Each one plays a distinct role, and sometimes, a weakness in one area can be completely overshadowed by strength in another. For example, a coin with a very high mintage (meaning it's quite common) can still fetch a high price if it's in perfect, uncirculated condition.

Think of these as the bedrock of any serious valuation.

Understanding these four factors is fundamental to assessing the value of any old coin. They work together to paint a complete picture, guiding you from initial identification to a realistic market price.

| Factor | Its Role in Valuation | Practical Example |

|---|---|---|

| Identification | You have to know exactly what you're holding. This means the country, denomination, date, and any specific mint marks. | Is it a 1933 penny or a 1933 halfpenny? One is a legendary rarity, the other is common. The details are everything. |

| Condition (Grade) | This is all about the physical state of the coin. Wear, scratches, and damage drastically reduce its value. | A heavily worn Victorian silver shilling might only be worth its silver content, while a pristine one could be worth hundreds of pounds. |

| Rarity (Scarcity) | How many were originally made, and how many are thought to still exist? Low survival rates almost always drive up demand. | The 1951 Penny had a mintage of only 120,000, making it scarce and sought-after by collectors compared to other years. |

| Market Demand | A coin is ultimately only worth what someone is willing to pay. Collector trends can cause values to soar or stagnate. | A surge in interest for pre-decimal British coins could temporarily inflate the prices of sixpences and florins. |

By mastering these pillars, you develop the discerning eye needed to properly analyse your collection and understand its true potential.

A key takeaway for any beginner is that condition is king. A common 1960s British penny in flawless, 'uncirculated' condition can be far more desirable to a specialist collector than a heavily worn, 200-year-old coin.

Correctly Identifying Your UK Coins

Before you can even think about what an old coin might be worth, you’ve got to play detective. A coin's identity is stamped right on its surface, and learning to read this metallic language is the first, and most important, step. Every single detail, from the monarch's portrait to tiny marks you can barely see, tells a piece of its story and, ultimately, shapes its value.

Take a Victorian penny, for example. That portrait of Queen Victoria is more than just a picture; it's a timestamp. Are you looking at the young ‘Bun Head’ design or the more mature ‘Old Head’? Those subtle differences place the coin in completely different periods of her long reign and can massively impact how rare it is.

The date is more than just a number, too. A 1918 penny is quite common, but find a 1918-H penny, and you’re onto something. That small 'H' next to the date is a mint mark, showing it was struck at the Heaton Mint in Birmingham, and it’s a much scarcer coin. It’s these specific details that an old coin valuation really hinges on.

A Systematic Approach to Identification

To avoid making costly mistakes, it pays to be methodical. Don’t just give the date a quick glance. Get a good magnifying glass and some strong light, and really examine the whole coin. A proper check ensures you don’t miss that one tiny detail that could be the difference between a few quid and a few hundred.

Start with the big, obvious features before you zoom in on the finer points.

- The Monarch: First, identify the king or queen. This immediately narrows down the historical era.

- The Denomination: Is it a penny, a shilling, or maybe a half crown? Pre-decimal coins can be confusing, so confirming what you have is essential.

- The Date: Get a clear read on the full year. It’s easy for a worn number to look like another.

- Mint Marks & Varieties: Now for the fun part. Look for small letters (like 'H' for Heaton or 'KN' for King's Norton) or tiny differences in the design. These often point to a much rarer—and more valuable—version of an otherwise common coin.

One of the most common mistakes I see is someone confusing a standard issue coin with a rare variety. A 1946 sixpence, for instance, is incredibly common. But a 1952 sixpence is a key date and is worth significantly more. Without looking closely, you’d never spot the difference.

Essential Tools for the Collector

While a sharp eye is your greatest asset, you'll need some backup. Guesswork is a surefire way to end up disappointed. Seasoned collectors and professional numismatists rely on specific resources to confirm what they’ve found, and you should do the same.

A good coin catalogue is indispensable. I always recommend getting a copy of the Spink Coins of England & the United Kingdom guide. These books are packed with detailed information on dates, mintage figures, and known varieties for almost every British coin ever made. For quick checks on the go, websites like Numista offer huge, user-built databases with images and specs.

By combining your own careful examination with information from trusted sources, you build a solid foundation for an accurate valuation. This disciplined approach is what separates a casual hobbyist from a serious collector. It’s the only way to be truly certain about what you’re holding in your hand.

How a Coin's Condition Determines Its Value

In the world of coin collecting, there's one golden rule that trumps almost all others: condition is king.

A coin's physical state, what we call its grade, is very often the single biggest factor driving its final price. It might sound surprising, but a common coin that's been perfectly preserved in mint condition can easily be worth more than a genuinely rare coin that's been knocked about and heavily worn from circulation.

This is why understanding grading is so crucial. It’s the shared language collectors and dealers use to talk about a coin's preservation, from its original shine to the tiniest of scratches. To a beginner, a handful of old pennies might all look the same, but a trained eye can spot the subtle differences in wear that separate a £5 coin from a £500 one. It’s a skill that turns a casual glance into an informed assessment.

Decoding the UK Grading Scale

Here in the UK, we grade coins on a scale that runs from 'Poor' all the way up to 'Uncirculated' (UNC). Each step on this ladder represents a specific amount of wear and tear. Getting to grips with these grades is a fundamental part of valuing your collection accurately.

Let’s break down the key stages you’ll encounter:

- Poor (P) / Fair (F): The coin is in rough shape. It's so heavily worn that the date and main features are barely legible. It usually has significant damage and is only really valuable if it's an exceptionally rare piece.

- Good (G): Still very worn, but you can clearly make out the main design and the date. Don't expect to see any of the finer details, though; they’ve been completely smoothed away over time.

- Very Good (VG): The design is much clearer now. Major elements are visible, but you’ll still see considerable wear across the entire surface of the coin.

- Fine (F): Now we're getting somewhere. Details are much sharper, with about 50% of the original design elements showing clear definition. The highest points of the design, however, will be noticeably flat from wear.

- Very Fine (VF): The coin only shows light wear on its highest points. Most of the design remains crisp and clear, with a lot of the original detail still present.

- Extremely Fine (EF): Wear is very minimal and you'd likely need a magnifying glass to spot it on the very highest points of the design. The coin also holds on to much of its original shine.

- Uncirculated (UNC): This is the top tier. The coin is in perfect, as-minted condition. It shows absolutely no signs of wear and has its full, original, brilliant lustre.

One of the most important things to look for is lustre. This is the original, unique sheen a coin has the moment it’s struck at the mint. A coin can have very few scratches but lose a huge amount of its value if that lustre has been dulled by cleaning or improper handling.

When to Seek Professional Grading

While you can absolutely learn to grade your own coins with a good degree of accuracy, there are times when calling in the professionals is a smart move. If you have a coin you suspect is either exceptionally rare or in an incredibly high state of preservation, getting it officially graded is a wise investment.

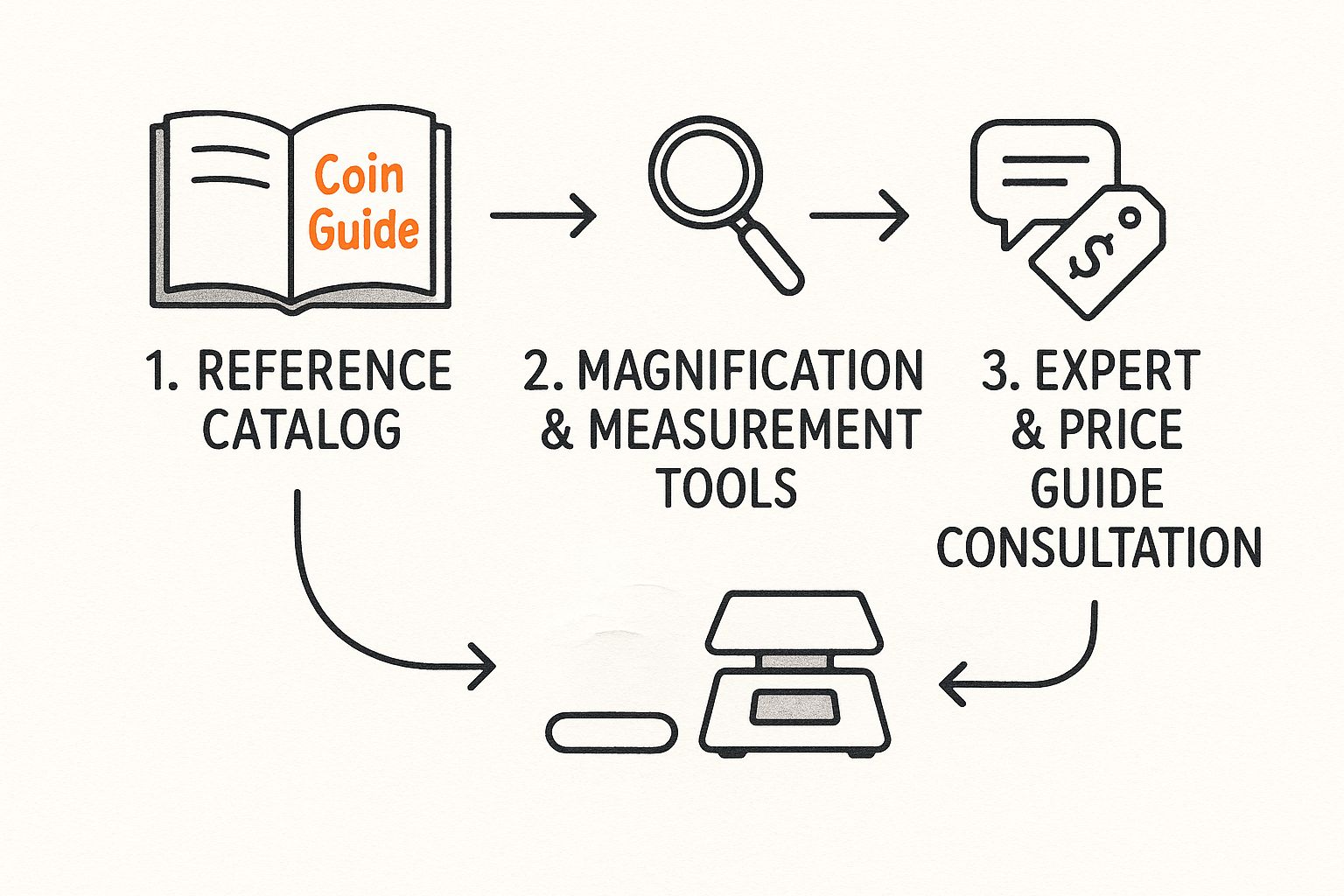

This infographic lays out the general process you'd follow when you think you might have a valuable coin on your hands.

As you can see, a reliable valuation is a mix of your own research, a close physical examination, and, when necessary, an expert's opinion.

Grading services like the Professional Coin Grading Service (PCGS) or Numismatic Guaranty Company (NGC) will authenticate and grade your coin before sealing it in a protective plastic case, or "slab," with its official grade displayed on the label. This process removes any guesswork about the coin’s condition and authenticity, which often makes it much easier to sell and can significantly increase its market value.

Keep in mind that grading costs money, so it’s usually reserved for coins already worth at least a few hundred pounds. For a deeper dive into this, you can find our expert tips for collectors on how to value old coins and work out if professional grading is the right next step for you.

Discovering Rarity and Historical Significance

This grainy image shows the almost mythical 1933 George V penny, a coin that perfectly captures what true rarity is all about. While millions of pennies rolled off the presses in the years around it, the strange story behind this particular date elevates it to legendary status among collectors.

Beyond a coin's physical condition, its rarity and historical context are what really spark the imagination. This is where valuing an old coin shifts from a technical exercise into a thrilling piece of detective work.

It’s a question every collector asks: why is one Georgian penny worth a few quid while a seemingly identical one commands thousands? The answer, almost without fail, is wrapped up in its scarcity and the story it has to tell.

Don't assume rarity is just about age. A Roman coin is undeniably ancient, but many are surprisingly common and can be bought for a modest sum. Real scarcity comes down to a mix of two key ingredients: a low initial mintage (the total number of coins struck) and a low survival rate. A coin could have been minted in huge quantities, only to be recalled and melted down by the Royal Mint, leaving just a handful for today’s collectors.

Mintage and Survival Rate

The original mintage figure is your first major clue. A coin struck in a year with a tiny production run is immediately more interesting. Take the 1951 Penny, for example. With a mintage of just 120,000, it’s a key date for collectors, especially when compared to the millions of pennies produced throughout the 1940s.

But mintage figures only tell half the story. The survival rate is where things get interesting. Major historical events—wars, economic downturns, or a government’s decision to pull a currency from circulation—can transform a common coin into a precious rarity. To get a feel for these pivotal moments, exploring a brief history of British coins can give you some fantastic context.

A crucial part of valuing an old coin is realising you're holding a historical artefact. It’s a direct link to a specific monarch, a turning point in history, or a unique economic situation. This historical weight is often what creates the intense demand that sends its value soaring.

The Power of a Story

Sometimes, a coin’s value is sealed by a single, unforgettable narrative. You won’t find a better example in the UK than the 1933 George V Penny.

At the time, the Royal Mint was sitting on a surplus of pennies and decided against producing any for general circulation that year. However, a tiny number—believed to be only seven—were minted for purely ceremonial reasons. This extreme scarcity has made it the UK’s most famous and sought-after penny, with known examples selling for over £70,000.

This single story holds a vital lesson for any collector: you have to look beyond the coin itself and dig into the circumstances of its birth.

Key Rarity Indicators to Investigate:

- Low Mintage Years: Was the coin from a year with unusually low production numbers?

- Key Dates: Certain dates, like the 1952 sixpence, are famously scarce and always in demand.

- Historical Events: Was the coin minted during a war, a change of monarch, or a major currency reform?

- Recalled Coins: Was the coin ever officially withdrawn from circulation, meaning very few could have survived?

By digging into these details, you move beyond a simple physical check-up and start to understand the deeper, more exciting factors that shape a coin’s genuine market worth.

How Mint Errors Can Create Unexpected Treasures

Sometimes, the most valuable coins aren't the oldest or the shiniest. They're the ones that were made ‘wrong’. Welcome to the fascinating world of error coins, a corner of numismatics where a simple mistake during the minting process can turn a common piece of pocket change into a serious collector's prize. An old coin’s valuation can absolutely skyrocket when an interesting flaw is discovered.

It’s important to understand these aren't just damaged coins; they are genuine errors that happened right at the Royal Mint. Think of it like a factory producing thousands of identical items, but every so often, one slips through with a unique quirk. For collectors, these quirks aren't defects. They're features that create rarity and can fetch some truly impressive prices at auction.

Training your eye to spot these anomalies is a skill that can pay dividends, helping you uncover hidden gems in your own collection or even in a handful of change. A seemingly minor flaw might just be the very thing that gives a coin its surprising value.

Understanding Key Types of Mint Errors

Not all errors are created equal, of course, but some of the most sought-after types have popped up throughout UK coinage history. Knowing what you’re looking for is the first step in spotting a potential treasure.

- Off-Centre Strikes: This happens when the coin isn't sitting perfectly between the dies when it’s struck. The result is a design that’s partially missing, with a blank, unstruck area of metal showing. Generally, the more off-centre the strike, the more dramatic and valuable the coin becomes.

- Double Strikes: Just as the name implies, the coin gets struck more than once. This creates a fascinating, almost ghost-like or overlapping image. A clear, bold double strike is a rare and highly prized find for any collector.

- Mules: A 'mule' is one of the most famous types of error coins. It’s created when two dies that were never meant to be paired together are used to strike a coin. One of the best-known modern UK examples is the 2014 'mule' £2 coin, which was mistakenly struck using the wrong portrait of Queen Elizabeth II for that year's design.

How Errors Drive Astonishing Valuations

The UK coin market places a massive premium on these minting mistakes, especially when you find one on a popular coin or an issue with a low mintage. A really striking example of this involves a rare variant of the 1988 one penny coin featuring Queen Elizabeth II. This coin had a rare minting anomaly, and its discovery led to some incredible results.

In fact, recent verified auction sales have seen these ultra-rare 1988 pennies go for as high as $2.41 million—a mind-boggling figure for something originally worth just one pence. This incredible price is driven by the coin’s unique combination of a royal connection, extreme rarity, and a verifiable mint error. That's a trifecta that collectors will fight over. You can watch the story behind this multi-million dollar penny to see how these amazing finds are verified.

The key takeaway here is that the significance of the error really matters. A tiny, barely noticeable flaw might add a small premium, but a major, visually arresting mistake like a mule or a dramatic off-centre strike is what creates a truly valuable collectible. Always check your coins closely—you just never know what you might find.

Determining a Coin's Current Market Price

Alright, you've identified your coin and have a solid idea of its grade. Now for the exciting part: finding out what it's actually worth on the open market. This is where your homework connects with the real world, showing you what fellow collectors and dealers are willing to pay for a coin like yours right now. It takes a bit of digging, but it’s the only way to be sure you know its true value.

Your first port of call should always be the established price guides. For anyone dealing with British coins, the annual Spink Coins of England & the United Kingdom catalogue is the bible. It gives you comprehensive price listings for every grade, providing a fantastic baseline. While online databases like Numista can be useful, remember that their value estimates are often crowdsourced and may not be as reliable as professional guides.

Looking Beyond the Catalogue

A price guide is a great starting point, but the coin market is anything but static. Prices can shift based on collector demand, recent discoveries, or market trends. To get a truly accurate picture, you need to see what coins have actually sold for recently.

This is where auction results become your best friend. Major auction houses like Spink & Son or Baldwin's of St. James's publish their past results online. Sifting through these archives to find a coin that matches yours—both in type and grade—gives you hard proof of its current standing in the market.

Don't forget the online marketplaces, either. eBay's "sold items" filter is an incredibly powerful tool for seeing what everyday collectors are paying. If you want to dive deeper into this research process, have a look at these expert coin collection valuation tips for UK coins for some extra guidance.

It's absolutely vital to cross-reference multiple sources. A single price in a catalogue is a good clue, but confirming it with two or three recent, comparable auction sales gives you a much more robust and defensible valuation.

Understanding Different Price Points

As you do your research, you'll come across several different types of prices. It’s crucial to understand what each one means. Not all "values" are the same, and knowing the difference will help you manage your expectations, whether you're looking to buy or sell.

Key Price Types to Recognise:

- Retail Price: This is the price tag you’d see on a coin in a dealer’s shop. It includes their markup to cover business costs and, of course, their profit.

- Auction Price (Hammer Price): This is the final bid a coin achieves at auction. It’s a pure reflection of market demand but doesn't include the extra buyer's premium (an additional percentage fee the winner has to pay).

- Dealer Offer (Wholesale Price): This is the price a dealer would likely offer to buy your coin from you. It will naturally be lower than the retail price because they need room to make a profit when they sell it on.

By looking into all these areas, you'll establish a realistic price range rather than a single, rigid number. This empowers you to go into any transaction—buying, selling, or just appreciating what you have—with the confidence that comes from truly understanding your coin's place in the market.

Answering Your Common Coin Valuation Questions

When you first dip your toes into the world of numismatics, it’s completely natural to have a lot of questions. Getting good, clear answers from the start can save you from making some costly mistakes and really helps build your confidence. Let’s walk through some of the most common queries I hear from new collectors.

One of the first things people want to do is make their old coins look bright and shiny again. This brings us to a really critical point.

Should I Clean My Old Coins Before Valuation?

The short answer to this is a firm and absolute no. You should never, ever clean old coins. Any attempt to polish or scrub them can create tiny, microscopic scratches and, even worse, strip away the natural toning, or patina, that has built up over many years.

Experienced collectors truly prize this patina. They see it as proof of a coin's originality and journey through history. Wiping it away can slash the coin’s market value, and the damage is completely irreversible. My best advice? Always present coins for valuation exactly as you found them.

Think of a coin's natural patina like the original finish on a piece of antique furniture. Stripping it away to reveal bare wood might make it look 'cleaner', but you've just destroyed a huge part of its historical character and, with it, its value.

Is It Worth Getting My Coins Professionally Graded?

This one really comes down to the specific coin you're holding. For coins that are potentially high-value, genuinely rare, or in exceptionally good condition, professional grading is a very smart move.

A trusted grading service like PCGS will authenticate your coin and assign it an official grade. This often boosts its market value and makes it much easier to sell to serious collectors. On the other hand, for common, low-value coins, the cost of grading—which can often be £30 or more per coin—will likely be more than the coin is actually worth.

Where Is the Best Place to Sell Old Coins?

The right place to sell really depends on your coin's value and how quickly you need the cash. Every option offers a different mix of speed, convenience, and the final price you’ll achieve.

- Reputable Coin Dealers: This is your fastest option. They offer immediate payment, but keep in mind they buy at wholesale prices so they can make a profit.

- Specialised Auction Houses: You can achieve much higher prices for rare and sought-after items here. However, they take a commission, and the entire process can take a fair bit of time.

- Online Marketplaces: These platforms connect you directly with a global community of collectors. You can get great prices, but it takes more effort and a bit of caution to ensure a safe transaction.

At Cavalier Coins Ltd, we provide a trusted platform for both new and experienced collectors to buy and sell with confidence. Explore our extensive collection of rare and interesting coins and banknotes at https://www.cavaliercoins.com.