Ever wondered why one old coin could be worth a fortune while another is just pocket change? It’s a great question. The value of a rare coin isn't just about how old it is; it’s more like a puzzle, pieced together from four crucial clues. A coin's final worth hinges on its rarity, its condition, its unique history, and the current collector demand.

What Really Drives a Coin's Value?

Figuring out what a coin is worth is a bit like being a detective for historical artefacts. Each element gives you another clue to its ultimate market value, pushing its price tag far beyond the simple metal it’s made from. We’ll walk through each of these core components, showing you how experts look at a coin not just as currency, but as an object with a price shaped by a fascinating mix of influences.

The Four Pillars of Coin Valuation

Think of these four factors as the legs of a table—if one is weak or missing, the whole structure can wobble, and the value can drop dramatically. Getting a handle on these concepts is the first step any collector takes towards accurately pricing a coin.

These pillars are:

- Rarity and Mintage: This is the most straightforward factor. How many coins were originally made? And, perhaps more importantly, how many are thought to still be around today? A low survival rate can create immense scarcity, even for a coin that started with a high mintage.

- Condition or Grade: You could have two identical coins, but they might have wildly different prices based purely on their physical state. A pristine, uncirculated coin will always fetch a premium over one that's worn, scratched, or damaged. It's all about preservation.

- Historical Significance and Provenance: What story does the coin tell? A coin struck during a pivotal moment in history, or one that was once owned by a famous collector, carries an extra layer of value that isn't just about the coin itself. This story can significantly elevate its worth.

- Collector Demand: At the end of the day, a coin is only worth what someone is willing to pay for it. Market trends and the popularity of certain types of coins or historical series play a massive role in driving prices up or down.

A common misconception, often fuelled by online videos, is that any old penny or slightly unusual-looking quarter could be a hidden treasure. In reality, the very top end of the market is incredibly exclusive. The highest price ever paid for a rare coin at auction was £15.2 million ($18.9 million), a testament to a perfect storm of extreme rarity, flawless condition, and incredible historical importance.

Why Rarity and Mintage Matter Most

When it comes to figuring out what a rare coin is worth, one factor stands head and shoulders above the rest: scarcity. At its heart, the value of a collectible coin is a simple story of supply and demand. The fewer there are, the more people will want to own one, which naturally pushes the price higher.

It all begins with a coin's mintage – the total number of pieces that were originally struck by the mint.

Think of it like a famous artist releasing a limited-edition print. A run of 10,000 prints will be fairly easy to find and affordable. But what about a special release of only 100? That immediately becomes far more exclusive and sought-after. It’s the exact same principle with coins. A low mintage figure lays the foundation for rarity right from the start.

How Mintage Defines Value from Day One

Getting a handle on production numbers is the first crucial step in any valuation. Even modern coins can fetch high prices if their mintage is surprisingly low. For instance, some commemorative UK coins that were issued for general circulation had tiny production runs, turning them into modern rarities that collectors are always hunting for.

The table below shows just how powerful a low mintage can be for some popular modern UK £2 coins.

| Coin Name | Year | Reason for Rarity | Scarcity Index Rank |

|---|---|---|---|

| Commonwealth Games (Northern Ireland) | 2002 | Lowest £2 mintage | 1 |

| Commonwealth Games (Wales) | 2002 | 2nd lowest £2 mintage | 2 |

| Commonwealth Games (England) | 2002 | 3rd lowest £2 mintage | 3 |

| Commonwealth Games (Scotland) | 2002 | 4th lowest £2 mintage | 4 |

As you can see, the direct link between a low production number and a high scarcity ranking is undeniable. The 2002 Northern Ireland Commonwealth Games £2 coin is a perfect example, remaining the rarest £2 coin in circulation almost entirely because of its tiny mintage. This scarcity has locked in its top spot on scarcity indices, proving just how much limited production fuels value.

From Mintage to Survival Rate

Mintage tells you how many coins started their journey, but the real rarity comes down to how many have survived in good condition. Over the years, coins get lost, damaged, or even melted down, shrinking the available supply even further. A coin with a high mintage can still become rare if very few have survived the test of time.

The ultimate measure of rarity isn't just the mintage figure but the known population of surviving examples, especially in high grades. This is why a coin that seems common on paper might be incredibly scarce in pristine condition, creating a huge price gap between worn and uncirculated examples.

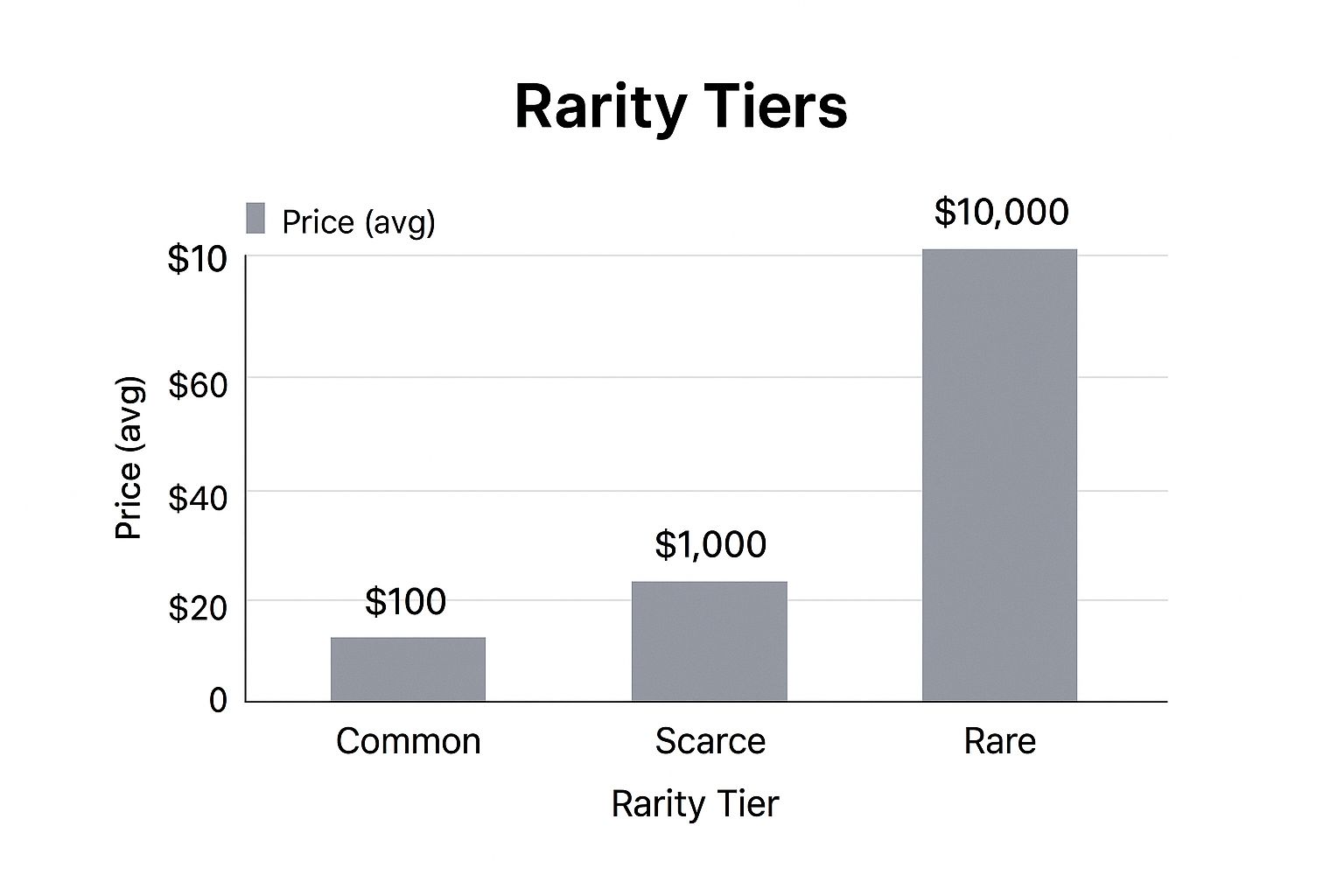

This infographic clearly shows how a coin's value explodes as its scarcity increases.

As the chart illustrates, the jump in average value from "Common" to "Rare" is exponential. It really hammers home why scarcity is the most powerful force in the market. While a low mintage sets the stage, it's the potent mix of rarity, condition, and historical significance that can create truly astronomical values. You can dive deeper into some of these incredible pieces by reading our guide on the most valuable coins in the world.

How a Coin's Condition Shapes Its Price

You can have two seemingly identical coins, yet one might fetch a few pounds while its twin commands thousands. What explains this enormous gap? It’s not always rarity or historical significance, but something much more immediate: its physical condition, or what collectors call its 'grade'.

Think of it like a vintage comic book. A copy that’s been folded, read, and loved for decades is still a fantastic piece of history. But an identical copy, sealed away from day one and kept in pristine, mint condition, is exponentially more valuable to a serious collector. This exact principle is a cornerstone of pricing in the world of rare coins.

In numismatics, the smallest details can make the biggest difference. Tiny, almost invisible scratches, minor wear on the high points of the design, or a loss of the original shine from the mint can slash a coin's value.

Understanding the Grading Scale

To bring some order to this, professional grading services use a detailed scale to standardise a coin’s condition. While the full scale has many nuances, it can be simplified into a few key tiers every collector should get to know. Learning this language is vital for making sense of price guides and auction results.

Here’s a simplified look at the grading spectrum:

- Poor (P) / Fair (F): The coin is so heavily worn that much of the detail is smooth. Often, it's only identifiable by its basic shape and outline.

- Good (G) / Very Good (VG): Most major design elements are visible, but the coin is clearly well-worn. The rims are often weak and some lettering might be faint.

- Fine (F): All the main details are clear, and you can even make out some of the finer points. You’ll see moderate, even wear across the whole coin.

- Very Fine (VF): The coin shows only light wear, mostly on the highest points of the design (like a monarch's cheek or crown). Most of the original detail is still sharp.

- Extremely Fine (EF): Details are very sharp, with just the slightest traces of wear that you might only spot under magnification. A lot of the original mint lustre may still be present.

- Uncirculated (Unc) / Mint State (MS): This is a coin in perfect condition, with absolutely no signs of wear. It looks just as it did the day it left the mint, with full lustre and razor-sharp details.

How Grade Drastically Impacts Value

The financial leap between these grades isn't a steady climb; it's exponential. The difference in price between a 'Fine' and a 'Very Fine' coin might be double, but the jump from 'Extremely Fine' to 'Uncirculated' can be tenfold or even more.

Condition is the ultimate multiplier. A rare date in poor condition might be valuable, but that same rare date in Uncirculated condition could be a life-changing discovery. The fewer high-grade examples that exist, the more intense the competition becomes.

You can see this effect clearly in the market for 19th-century UK pennies. An 1856 penny from the London Mint, for instance, might retail for around £110 in Very Fine (VF) condition. That very same coin in a pristine Uncirculated (Unc) state can soar to £3,000.

Likewise, an 1860/59 overstrike penny ranges from £900 in Fine condition to an incredible £7,000 in Uncirculated grade. It’s a perfect illustration of how preservation creates enormous value. To get a better feel for these trends, it helps to look at more historic UK penny values.

The Hidden Value in a Coin's History

Sometimes, the story a coin has to tell is just as important as its rarity or physical condition. This is where historical significance and provenance—the coin’s documented ownership history—come into play. These factors add a powerful, intangible layer of value, turning a simple piece of metal into a direct link to our past.

It’s a bit like owning a guitar once played by a rock legend. The instrument itself has a certain value, of course. But its connection to a famous person and iconic moments in music history elevates its worth to a completely different stratosphere. The exact same principle applies to rare coins; a compelling backstory can add a very significant premium.

The Power of Provenance

You can think of a coin's provenance as its family tree. A detailed record showing it was once part of a famous collection, owned by royalty, or discovered in a notable hoard provides solid authentication and, crucially, a unique narrative. This documented history gives collectors immense confidence and makes the coin far more desirable.

A coin with a strong provenance isn't just an artefact; it's an artefact with a verified biography. This paper trail can dramatically boost its market value, particularly for top-tier coins where the story is everything.

Coins Tied to Pivotal Moments

Certain coins are exceptionally sought after simply because they were struck during critical moments in history. Their value is intrinsically tied to the events they represent, making them miniature historical documents you can actually hold in your hand.

Some fantastic examples of historically significant UK coins include:

- The 1644 Charles I Oxford Crown: Struck in Oxford during the height of the English Civil War, this coin was minted from silver plate donated by Oxford colleges to fund the Royalist war effort. It even features a detailed view of the city beneath the King on his horse.

- The 1937 Edward VIII Sovereign: These coins were never officially released into circulation because of Edward VIII's abdication. The handful of pattern pieces that exist are forever linked to one of the biggest royal scandals of the 20th century, making them incredibly valuable.

- The 1847 Victoria 'Gothic' Crown: Widely regarded as one of the most beautiful British coins ever minted, its design represents the absolute pinnacle of Victorian artistry and the height of the British Empire.

A coin's history is its unique selling point. While thousands of coins might share the same date and denomination, one with a documented link to a famous collector or a pivotal event stands completely alone. This is where a coin’s value moves beyond mere numismatics and into the realm of true historical artefacts.

Exploring Legendary High-Value UK Coins

Theory is one thing, but to really get a feel for how rare coin pricing works, let's look at some of the true titans of UK numismatics. These are the coins that command eye-watering prices at auction. By breaking down why they are so valuable, we can see the principles of rarity, condition, and history come alive.

A coin’s story might start with its mintage numbers, but it’s the survival rate and the historical drama behind it that often write the final, most valuable chapters. The prices for rare UK coins, especially historic gold sovereigns and special issues, can reach incredible heights. These aren't just old bits of metal; they are scarce survivors of pivotal moments in British history.

Take the fabled 1937 Edward VIII Gold Sovereign. With just a tiny handful known to exist, it’s one of the UK’s most sought-after coins. Its valuation, sitting around £1,000,000, is a direct result of its extreme rarity combined with its inseparable link to the abdication crisis.

Then you have something like a 1917 George V Gold Sovereign. While many were minted, very few high-grade examples have survived, which is why a top-quality specimen can fetch close to £30,000. These examples show perfectly how rarity and a compelling backstory dramatically drive up the price. For a deeper dive, you can find more insights on these rare UK coins on AtkinsonsBullion.com.

The Apex of UK Coin Valuation

These legendary coins are the ultimate case studies in how value is created. Each one tells a story where scarcity, exceptional preservation, and historical significance collide to produce an astronomical price tag. This is the point where a coin stops being just currency and transforms into a treasured artefact.

The table below gives you a snapshot of some of these top-tier coins and the main reasons behind their impressive valuations.

Valuation of Top-Tier UK Rare Coins

A comparison of some of the most valuable UK coins, highlighting the key factors that contribute to their estimated market price.

| Coin Name | Key Valuation Factor | Estimated Value (£) |

|---|---|---|

| 1933 George V Penny | Extreme Rarity (Pattern Coin) | 72,000 - 100,000+ |

| 1703 Queen Anne 'Vigo' Crown | Historical Significance (Battle Treasure) | 250,000 - 300,000+ |

| 1937 Edward VIII Sovereign | Rarity & Royal History (Abdication) | 1,000,000+ |

| 1847 Victoria 'Gothic' Crown | Artistic Merit & Rarity in Top Grade | 15,000 - 50,000+ |

This comparison makes it clear that while rarity is a must, the reason for that rarity is what truly captures the imagination of collectors. Whether it’s a pattern coin that was never meant for circulation or a piece struck from captured treasure, the story is what makes it priceless.

A coin's legend isn't just about its age; it's about its journey. The most valuable pieces are those that have survived against all odds, carrying with them the echoes of major historical events and the aura of extreme scarcity.

Looking closely at these examples gives you a practical framework for understanding the market. By applying these lessons, you can start to see your own collection through the eyes of an expert. To hone your skills even further, take a look at our guide on expert coin collection valuation tips for UK coins.

A Practical Toolkit for Pricing Your Coins

Ready to put theory into practice and start evaluating your own collection? Let's walk through a straightforward approach to get you started. We’ll cover how to properly identify your coins, dig up trustworthy mintage figures, and perform a basic condition check. Think of this as your starter kit for graduating from a curious collector to a genuinely informed one.

The very first step, without fail, is accurate identification. Before you can even begin to think about a coin's value, you have to know precisely what you're holding. This means figuring out its country of origin, its denomination, and most importantly, the exact year it was struck.

Once you’ve pinned that down, the next piece of the puzzle is its mintage and survival rate. How many were made in the first place? And, just as crucial, how many are thought to still be around today, especially in decent condition? This initial research is fundamental; it’s where you start to get a real sense of a coin's potential scarcity.

Essential Resources for Accurate Pricing

Armed with the basic details of your coin, it’s time to turn to the pros and their resources. Using a mix of different sources is the best way to get a balanced and reliable estimate of what your coin might be worth on the current market.

Your go-to toolkit should include:

- Online Price Guides: Websites like the PCGS Price Guide or the NGC World Coin Price Guide are fantastic. They maintain huge databases with prices based on professionally graded coins.

- Auction House Archives: Checking the realised prices from major auction houses like Heritage Auctions or Stack's Bowers gives you a dose of reality. This is real-world data showing what collectors are actually paying.

- Reputable Coin Dealers: Never underestimate the value of a good relationship with an established dealer. They can offer an expert opinion based on day-to-day market trends and their own sales experience.

Remember, the prices you see in guides are typically retail estimates for certified, professionally graded coins. The value of a "raw" or ungraded coin will often be lower because its condition hasn't been verified by a third-party expert.

Finally, you need to circle back to the coin's condition. Take a good, honest look at it. Compare what you see to the grading standards we talked about earlier. Is it heavily worn down (what we'd call Fine), or does it still have most of its sharp details (Extremely Fine)?

For a deeper dive, our guide on how to value old coins offers expert tips for collectors. By combining solid identification, mintage research, a realistic condition assessment, and a bit of market snooping, you'll be able to price your coins with newfound confidence.

Common Questions About Rare Coin Pricing

Diving into the world of rare coin pricing can feel a bit daunting at first. It's completely normal to have questions, and we've found that most newcomers share the same uncertainties. To help build your confidence, this final section tackles some of the most frequent questions we hear from collectors.

Think of it as your quick-reference guide to cement the key ideas we've gone over. These answers should clear up any lingering doubts and get you ready to start your own valuation journey.

Can I Get Rich From My Pocket Change?

It’s the question on everyone’s mind, often sparked by a viral video or a sensational headline. While finding a modern coin in your change worth a fortune is technically possible—like the famously rare 2009 Kew Gardens 50p—it is extraordinarily unlikely. Most stories you hear about a penny or a quid being worth millions are just myths.

The reality is that the vast majority of coins in circulation are worth exactly their face value. True treasures are defined by the trifecta of extreme rarity, top-tier condition, and historical significance, a combination that almost never appears in everyday change.

Is My Old Coin Automatically Valuable?

This is a common misconception. While a 200-year-old coin is certainly a fascinating piece of history, its age alone doesn't guarantee a high value. Its price is still driven by rarity, condition, and demand from other collectors.

For example, many ancient Roman coins were minted in huge numbers and are still quite common today, especially in heavily worn conditions. One of these might only be worth a few pounds. On the flip side, a much more recent coin with a tiny mintage or a famous error can be worth thousands. It always comes back to supply and demand.

How Much Is Grading Really Worth?

Sending a coin off for professional grading isn't always the right call. You have to remember that grading costs money, so it’s a financial calculation. If a coin's potential value is only around £50, spending £30 on grading just doesn’t make sense.

However, for a coin that could be worth hundreds or even thousands, professional grading is absolutely essential. It provides an objective, third-party stamp of approval on its authenticity and condition, which is precisely what serious buyers demand. A high grade from a top service like PCGS or NGC can be the key to unlocking a coin’s true market value.

Ready to explore the world of rare coins or get an expert opinion on your collection? The team at Cavalier Coins Ltd is dedicated to helping new and experienced collectors alike. Browse our extensive selection of rare coins and banknotes from around the world.

Discover your next treasured piece today at https://www.cavaliercoins.com.