Working out the value of a rare coin isn’t always straightforward. A coin’s true worth is a delicate balance of its history, its physical state, and how much the market desires it. A simple penny can be just that—a penny—or it could be a treasure worth thousands. It all comes down to a few key factors every serious collector needs to get to grips with.

What Really Determines Rare Coin Values

Ever wondered why one old penny is only worth its face value, while another fetches a small fortune at auction? The secret is in a fascinating interplay of factors, much like valuing a classic car. You wouldn't just look at the make and model; you’d consider its condition, how many were ever built, and the story behind it.

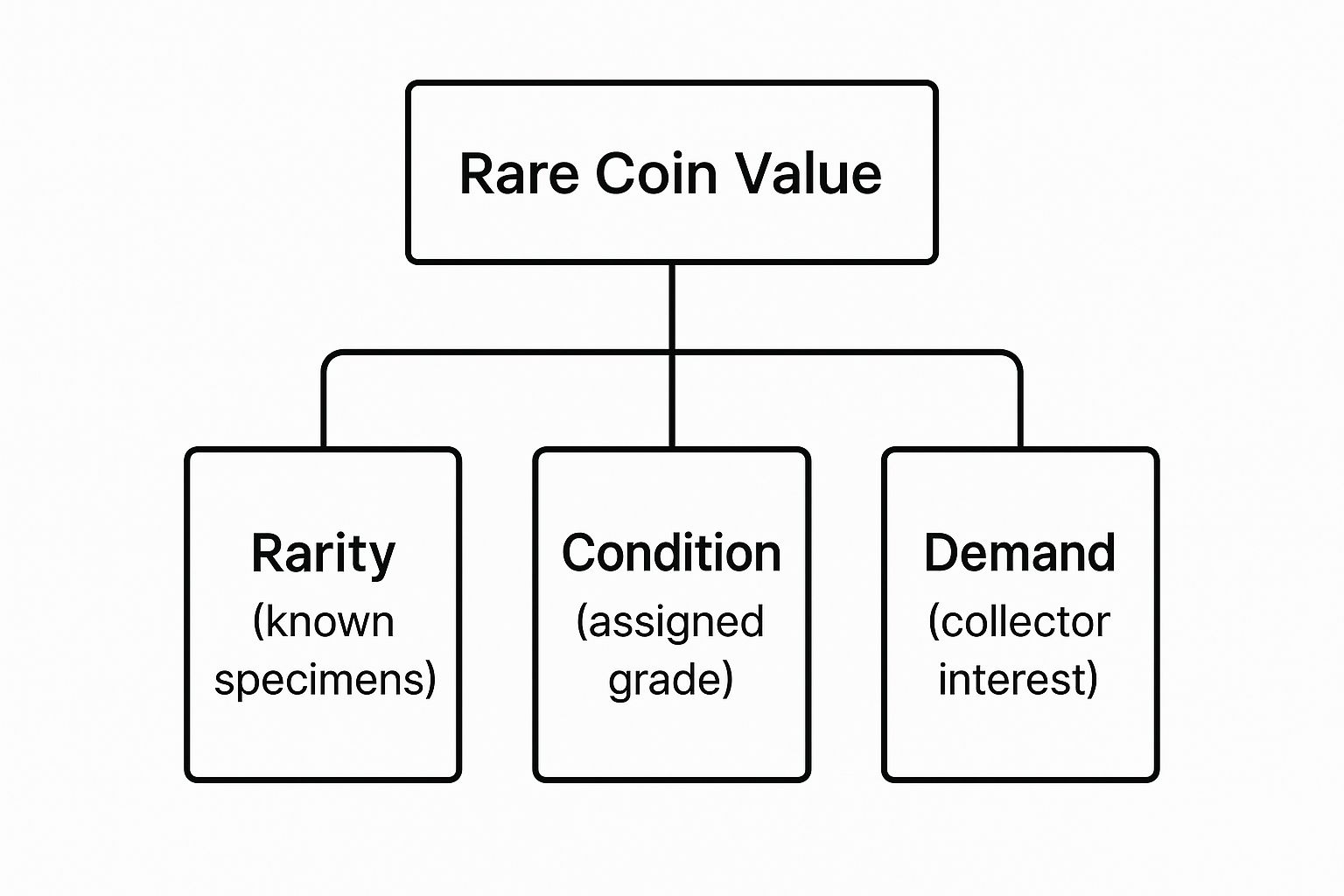

For rare coins, this boils down to three core pillars. Grasping these is the first, most crucial step for any aspiring collector. Without this foundation, you’re essentially navigating the market blindfolded.

The Three Pillars of Coin Valuation

Every coin's journey from loose change to a prized collectible is governed by the same set of principles. These aren't secret formulas locked away in a vault; they are simple concepts that, once you understand them, give you a solid framework for assessing any coin that comes your way.

Here’s what really drives a coin’s value:

- Rarity: This is more than just how many coins were initially minted. True rarity is about survival. How many have actually made it through the years in a collectible state? Countless coins have been melted down, lost to time, or damaged beyond repair, making the few remaining examples far scarcer than the original mintage numbers might suggest.

- Condition: This is what we call the 'grade' in the numismatic world. It’s a precise measure of the coin's physical state. Even the slightest wear, an almost invisible scratch, or a single fingerprint can dramatically slash a coin's value. A pristine, untouched coin will always command a much higher price than the exact same coin showing signs of circulation.

- Demand: At the end of the day, a coin is only worth what someone is willing to pay for it. Demand is all about collector interest. This can be sparked by a coin’s historical importance, its beautiful design, or the simple popularity of a particular series. When you have high demand chasing a very limited supply, that's when you see truly exceptional market values.

To put it simply, these three elements work together to establish what a coin is really worth.

As you can see, a coin’s value isn’t down to a single factor, but the powerful combination of all three. A quick way to remember these core drivers is with the summary table below.

The Three Pillars of Coin Valuation

| Pillar | What It Means for Value |

|---|---|

| Rarity | How many were minted versus how many survive today. Fewer surviving examples in good condition mean a higher potential value. |

| Condition | The physical state or 'grade' of the coin. A pristine, uncirculated coin is always worth more than a worn equivalent. |

| Demand | How many collectors want the coin. Popular series or historically significant pieces create high demand, pushing prices up. |

Think of these pillars as a three-legged stool.

If one leg—be it rarity, condition, or demand—is weak or missing entirely, the stool collapses. A truly valuable coin needs all three elements to support a high valuation. A very rare coin in terrible condition or a common coin in perfect condition will almost never reach the top end of the market.

How Coin Grading Impacts Value

While a coin's rarity tells you how many might exist, its condition is what truly unlocks its value on the market. This is where coin grading comes into play, and it’s arguably the single most important factor in determining what a rare coin is worth.

Think of it as a detailed health check for a coin, documenting every tiny aspect of its preservation from the moment it was struck at the mint.

To anyone new to collecting, the world of grading can seem a bit baffling and full of unfamiliar jargon. The core idea, though, is quite simple. Picture a brand-new photograph, perfectly crisp and bursting with detail. Now, imagine that same photo after it’s been passed around for decades, folded, and left out in the sun. The image is still there, but it’s faded, creased, and has lost its original sharpness.

This is exactly what happens to a coin as it moves from hand to hand in circulation. Every transaction adds microscopic scratches, smoothes away the highest points of the design, and dulls the original mint lustre. Grading is simply the systematic process of evaluating this wear and tear.

Translating the UK Grading Scale

In the UK, we use a traditional grading scale to describe a coin’s condition. While there are many subtle points in between, getting to grips with the main tiers will give you a powerful tool for making an initial assessment. A coin's journey from perfection to heavy wear is a story told right there on its surface.

Here’s a breakdown of the key stages:

- Fleur de Coin (FDC): This is the absolute pinnacle of preservation. An FDC coin is flawless, looking exactly as it did the day it was struck. It has a full, unbroken mint lustre and no visible marks or wear, even when you look at it under magnification.

- Uncirculated (UNC): This is a coin that has never been in circulation but might have some minor imperfections, like small ‘bag marks’ from being stored with other new coins. Crucially, it still has its original lustre.

- Extremely Fine (EF): This coin shows only the slightest hints of wear, and only on the very highest points of the design. Much of the original detail and lustre are still present and sharp.

- Very Fine (VF): The coin has seen some light circulation, and there's noticeable but gentle wear on the high points. Key details, like strands of hair or the letters, are still clear.

- Fine (F): This grade shows moderate, even wear across the whole coin. The main design elements are still visible, but the finer details have started to merge and look a bit flat.

Below these grades, you'll come across terms like 'Very Good' (VG), 'Good' (G), 'Fair', and 'Poor', with each one representing progressively heavier wear where the designs become fainter and fainter.

The difference between one grade and the next can seem tiny to the naked eye, but in the world of rare coin values, it represents a monumental leap. A single grade increase, such as from Extremely Fine to Uncirculated, can cause a coin’s value to double, triple, or even increase tenfold.

This happens because high-grade examples are exponentially rarer than their lower-grade cousins. While millions of a particular Victorian penny may have been minted, only a tiny fraction—perhaps just a few hundred—survived in an Uncirculated state. For a deeper understanding of the nuances and specific criteria for each grade, you can check out our expert guide to UK coin grading.

The Real-World Impact of Grade on Value

Let's make this practical. Think about a highly sought-after coin like the 1933 Penny, of which only a handful are known to exist. A hypothetical example in 'Fine' condition might be valued in the tens of thousands of pounds. But if an 'Uncirculated' specimen were ever to surface, its value would rocket into the hundreds of thousands, purely because of its pristine condition.

This principle applies to more common coins, too. An Edward VII silver shilling might be worth £10-£15 in 'Fine' condition. That very same coin in 'Extremely Fine' could be worth £50-£70, and an 'Uncirculated' example could easily fetch over £200. The coin itself hasn't changed, but the level of preservation completely dictates the price.

By learning to recognise the visual clues of wear, you can start to train your eye. Look for the sharpness of the monarch's hair, the clarity of the details on the shield, and how much of that original shine is left in the blank fields of the coin. These observations are the first step to understanding why two seemingly identical coins can have drastically different values.

Understanding Scarcity and Mintage Numbers

If a coin's grade is its health report, then its scarcity is the very engine that drives the market for rare coin values. At first glance, this seems simple enough. A coin with low production numbers must be rare, and one with high numbers must be common. Right?

Well, not always. The real secret lies in understanding the critical difference between two key terms: mintage and survival rate.

Mintage is the official number of coins originally struck by the mint. It’s a fixed, historical figure, telling you exactly how many were created in the first place. But the survival rate is a much more dramatic—and often mysterious—number. It’s the best estimate of how many of those coins still exist today in a collectable condition. The gap between these two figures is where true rarity, and sometimes incredible value, is born.

The Story Behind the Numbers

A coin with a mintage in the millions might seem hopelessly common. But what if a huge portion of those coins were melted down by the government, lost in a shipwreck, or pulled from circulation just weeks after being issued? Suddenly, that high mintage figure becomes incredibly deceptive.

This is exactly why a coin’s story is so important. The journey it takes after leaving the mint is what determines its ultimate scarcity. Several factors can drastically reduce survival rates:

- Government Meltdowns: Throughout history, governments have recalled and melted down old coinage to create new currency, often erasing entire issues from existence.

- Wartime Hardship: Coins are often one of the first things to be hoarded or melted for their precious metal content during times of conflict and economic strife.

- Accidental Loss: Shipwrecks, fires, and simply being lost over the centuries have claimed countless coins, forever removing them from the pool available to collectors.

The most sought-after coins often have a perfect storm of circumstances behind them. They started with a low mintage, suffered a very low survival rate, and the few remaining examples are almost all in poor condition, making a high-grade specimen exceptionally valuable.

Rarity in Action: The 1819 Sovereign

A powerful British example is the 1819 George III Gold Sovereign. With an initial mintage of just 3,574 coins, it was already scarce from the moment it was struck. Its rarity was then magnified because most were shipped overseas as paper money became the preferred currency back home.

Fast forward to 1929, when a survey of over 100,000 sovereigns found only two from 1819, suggesting fewer than ten may survive today. This incredible scarcity, combined with its iconic design, makes it one of the most prized British coins. To find out more, you can explore the history of rare British coins on cpmcoins.com.

This dramatic drop from over 3,500 to potentially single digits is a perfect illustration of how survival rate, not just mintage, dictates true rarity.

Mintage vs. Survival: A Summary

To really cement your understanding, think about the relationship between these two critical concepts. They are not the same, and knowing the difference is vital for accurately judging a coin’s potential value.

| Concept | What It Tells You | Impact on Value |

|---|---|---|

| Mintage | The original number of coins produced by the mint. | A starting point. Low mintage is a good indicator of potential rarity, but it isn't the whole story. |

| Survival Rate | The estimated number of coins still existing today. | The true measure of scarcity. A low survival rate, especially in high grades, is what drives significant value. |

Ultimately, when you evaluate a coin, you must look beyond the official production figures. Dig into its history. Was it a short-lived design? Was it recalled? The answers to these questions will reveal its true scarcity and give you a much clearer picture of its place in the world of rare coins.

Discovering Valuable British Coins

It’s one thing to understand the theory behind coin rarity and grading, but the real excitement kicks in when you see it in action. This is where abstract ideas about condition and scarcity suddenly turn into real-world market value. Let’s take a look at a few iconic British coins where these factors collide, creating fascinating stories and even more remarkable price tags.

These examples really bring the principles of valuation to life. They show how a quirky backstory, a tiny minting error, or a surprisingly small production run can turn a simple piece of metal into a collector's prized possession.

The Kew Gardens 50p: The Modern Classic

The Kew Gardens 50p is probably the most famous rare British coin of the 21st century. Issued back in 2009 with a mintage of just 210,000, it’s the scarcest 50p piece ever intended for circulation. That tiny number immediately sets it apart from the millions of other commemorative designs out there.

Its value is a perfect lesson in supply and demand. As people became more aware of how rare it was, collectors began frantically checking their change, hoping to find one.

- In circulated condition: A Kew Gardens 50p can sell for between £150 and £200.

- In uncirculated condition: A perfect, untouched example can be worth much more, often fetching over £250.

The journey of this coin proves that you don't have to look back centuries to find treasure. Sometimes, it’s been hiding in our pockets all along.

A coin's value is often a narrative. The story behind its creation, its scarcity, or its unique features is what captures the imagination of collectors and fuels market demand, turning a common object into a prized possession.

The 1933 Penny: The Legendary Rarity

The 1933 Penny is the stuff of numismatic legend in the UK. There was no official mintage for circulation that year, so only a handful of 'pattern' or 'proof' examples were ever struck. It's thought that fewer than ten exist today, making it one of the most famous and almost unobtainable British coins.

Because it's so incredibly rare, putting an exact value on it is tough; one hasn't come up for auction in decades. However, its value is certainly in the hundreds of thousands of pounds. This coin is the ultimate example of how a near-zero survival rate creates a mythical status among collectors, pushing its potential rare coin values to astronomical levels.

Victorian Pennies: A Study in Grade

To see just how much condition affects value, you only need to look at 19th-century copper pennies. The prices for rare British copper pennies from this era can swing dramatically based on their year and grade. For example, an 1843 copper penny might be worth around £100 in fine condition, but that can leap to £2,000 in an uncirculated state and even £5,000 for top-tier specimens.

Similarly, the 1860 copper penny shows an incredible range, with prices starting from a few pounds in poor condition up to a staggering £40,000 for pristine proof examples. These massive valuation gaps hammer home how rarity and condition work together. For a deeper dive into historical prices, you can review valuation guides for British coins on coinworld.com.

This kind of data-driven look at real coins helps connect the dots, turning what you know in theory into a practical skill for spotting what makes a coin truly valuable in the UK market.

UK Rare Coin Value Examples by Grade

The following table illustrates just how dramatically a coin's condition can influence its market value. We’ve selected a few notable rare British coins to show the difference between a circulated 'Fine' grade and a pristine 'Uncirculated' grade.

| Coin | Key Date/Feature | Value in 'Fine' Condition | Value in 'Uncirculated' Condition |

|---|---|---|---|

| Kew Gardens 50p | 2009 | £150 | £250+ |

| Undated 20p | 2008 (Mule Error) | £50 | £100+ |

| Victoria 'Gothic' Crown | 1847 | £1,000 | £15,000+ |

| George V 'Wreath' Crown | 1934 | £200 | £2,500+ |

As you can see, the jump in value is immense. This is why professional grading is so critical for high-value coins; it provides a standardised assessment that gives both buyers and sellers confidence in the coin's quality and, ultimately, its price.

Finding Trustworthy Coin Valuations

Knowing what gives a coin its value is only half the battle. The other, arguably trickier half, is figuring out where to find reliable pricing information in the first place.

When you first start looking into rare coin values, it’s easy to feel overwhelmed. You'll find a dizzying array of opinions and wildly speculative prices on internet forums and social media. To really build confidence, you need to learn to use the same trusted tools that professional dealers and lifelong collectors rely on every day.

Think of it like getting a house valued. You wouldn't just grab the first online estimate you see. You'd look at what similar properties have actually sold for recently, talk to experienced estate agents, and check official market reports. Getting a solid coin valuation requires a similar, layered approach to land on a realistic market price.

The Holy Trinity of Valuation

To make sure you don't pay too much or, just as bad, sell for too little, you need to check your findings against three key sources. Relying on just one can give you a very lopsided view of what a coin is truly worth. By weaving together insights from all three, you can arrive at a much more accurate and defensible valuation.

These three pillars are:

- Official Price Guides: These are the essential reference books for the hobby. In the UK, the most respected guide is Spink’s “Coins of England & the United Kingdom”. It's published every year and gives you consensus values for every major British coin in various grades. Just remember, these are retail price guides, not a guarantee of what you’ll get when you sell.

- Recent Auction Results: This is where you see the real market in action. Looking up the "prices realised" from major auction houses like Spink, Noonans, or even specialised eBay auctions shows you exactly what other collectors were willing to pay for a specific coin, in a specific grade, very recently. This is hard data that reflects current demand.

- Professional Dealer Data: Established dealers are at the coalface of the market, buying and selling every single day. Many publish their own price lists or have huge online inventories you can browse. Seeing their asking prices for coins similar to yours gives you a strong feel for the current retail landscape.

By comparing a price guide's listing with recent auction results and dealer prices, you can triangulate a realistic value. If a guide lists a coin at £200, but auction results consistently show it selling for £150-£170, you know the true market value is likely in that lower range.

Putting It All Together

Once you've got your sources, the process is pretty straightforward. Start with the price guide to get a baseline figure. Next, dive into the archives of major auction houses and see what similar examples have fetched in the last six to twelve months. Finally, browse the websites of a few reputable dealers to check their current stock and asking prices.

This detective work protects you from bad information and empowers you to make much smarter decisions. It's a fundamental skill for any serious collector and is absolutely crucial for building a collection that holds its value over time. For more hands-on advice, we've put together seven tips for buying collectable coins that can help you put these principles into practice.

Protecting the Value of Your Collection

Owning a collection with high rare coin values is one thing, but preserving that worth is an entirely different challenge. Once you acquire a valuable coin, you become its custodian, responsible for protecting a small piece of history. Proper care isn't just about keeping it looking nice; it's the most critical factor in maintaining its financial and historical integrity for years to come.

Owning a collection with high rare coin values is one thing, but preserving that worth is an entirely different challenge. Once you acquire a valuable coin, you become its custodian, responsible for protecting a small piece of history. Proper care isn't just about keeping it looking nice; it's the most critical factor in maintaining its financial and historical integrity for years to come.

Think of a coin’s surface like a delicate photograph. The natural oils and acids from a single fingerprint can cause permanent, irreversible corrosion over time, etching themselves into the metal. This damage can dramatically reduce a coin's grade and, consequently, its market value. The first and most important rule is simple: never touch a coin’s face or reverse. Always hold it by its edges, preferably while wearing soft, lint-free cotton gloves.

Essential Handling and Storage Solutions

Beyond careful handling, your choice of storage is paramount. The wrong materials can actively damage your coins over the long term, a process collectors call "environmental damage". It's a silent threat that can slowly erode your investment.

To safeguard your collection, always use materials that are specifically designed for archival purposes. Here are the most trusted options:

- 2x2 Cardboard Flips: These are affordable and popular holders. Just make sure you choose brands that use Mylar windows, not those with soft, flexible PVC (polyvinyl chloride). PVC can degrade over time and release harmful chemicals that damage a coin’s surface.

- Archival-Safe Plastic Flips: These are entirely plastic and offer great visibility. Again, check that they are made from inert materials like Mylar or polyethylene. They are a staple for many dealers and collectors for good reason.

- Professional Grading Slabs: For your most valuable coins, encapsulation by a third-party grading service like PCGS or NGC is the gold standard. These sonically sealed, hard plastic holders provide the ultimate protection from handling and the environment.

Protecting your investment is a continuous process. Just as you wouldn’t park a classic car outside in the rain, you shouldn't leave valuable coins in an old biscuit tin or a damp drawer. A stable, dry environment is just as crucial as the holder itself.

Creating a Safe Storage Environment

Where you store your coins matters immensely. Drastic temperature swings and high humidity are enemies of preservation. A cool, dry place away from direct sunlight is ideal. Many serious collectors use a dedicated safe with desiccant packs to absorb excess moisture, ensuring the conditions remain stable.

Never clean your coins. This is a golden rule that cannot be overstated. Cleaning strips away the original surface and natural toning, or patina, which collectors value as proof of authenticity. An improperly cleaned coin is almost always worth significantly less than an untouched one.

For a complete overview of protecting your assets, you can explore our expert coin collection valuation tips for UK coins to ensure your preservation strategy aligns with market expectations. By combining proper handling with high-quality storage solutions, you actively protect your collection's value for the future.

Common Questions About Rare Coin Values

As you dive deeper into the fascinating world of numismatics, it’s only natural for questions to pop up. Think of this section as a quick reference guide, tackling some of the most common queries we hear from both new and experienced collectors. The answers build on what we’ve already covered about what truly drives rare coin values.

How Can I Get My Coins Professionally Valued in the UK?

Getting an official, expert opinion is more straightforward than you might think. A brilliant starting point is to find a local member of the British Numismatic Trade Association (BNTA). Dealers who belong to the BNTA follow a strict code of ethics, so you can trust you're getting an honest assessment based on what's happening in the market right now.

Another great option is to check with major UK auction houses, like Spink or Noonans. They often hold valuation days or offer free, no-obligation assessments. They do this hoping to find treasures for their next big sale, which gives you direct access to world-class expertise without any cost.

For a formal grade that solidifies a coin's value for insurance or a high-end sale, the ultimate step is submitting it to a third-party grading service. This is the most formal route and does involve fees and shipping, but it provides a definitive, universally recognised grade.

Will Cleaning My Old Coins Increase Their Value?

This is a big one, and the answer is almost always a hard no. In fact, cleaning a coin is one of the quickest ways to destroy its value and is a classic rookie mistake.

The natural toning and patina that a coin gathers over decades, or even centuries, is a key part of its story. Collectors see this as proof of its originality. Cleaning strips away that history, often leaving behind tiny, microscopic scratches and a harsh, unnatural shine that any experienced eye can spot a mile off. An improperly cleaned coin is always worth much less than an untouched one in the same condition.

The golden rule is beautifully simple: always leave coins as you found them.

Are Modern Royal Mint Commemorative Coins a Good Investment?

While the Royal Mint produces stunning commemorative coins, most aren't great investments if you're looking for rarity-driven value. They are usually produced in very large numbers to meet public demand and are sold at a price well above the value of the metal they contain.

Of course, there are famous exceptions. The 2009 Kew Gardens 50p, for instance, had a surprisingly small mintage, became incredibly hard to find, and is now highly valuable. But that's very much the exception, not the rule. Generally, these modern issues don't see a significant rise in value. The most reliable investments are almost always historically scarce coins with a long and proven track record of collector demand.

What Is the Difference Between Face Value and Numismatic Value?

Understanding this difference is the very heart of coin collecting. Face value is simply the amount stamped on the coin—what it was originally worth as money, like ‘One Penny’ or ‘Fifty Pence’. It’s the amount you could legally spend in a shop.

Numismatic value, on the other hand, is what a collector is willing to pay for it. This value has nothing to do with the number on the coin and everything to do with the key factors we've discussed: how rare it is, its physical condition (grade), its history, and current market demand. For a genuinely rare coin, its numismatic value can be thousands, even tens of thousands, of times higher than its face value. This is what transforms a pocketful of change into a prized collection.

Ready to find the next centrepiece for your collection or turn your passion into a venture? At Cavalier Coins Ltd, we offer a curated selection of rare and fascinating coins and banknotes from the UK and around the globe. Whether you're a seasoned collector or just starting out, explore our inventory and discover a piece of history. Visit Cavalier Coins today to browse our latest arrivals!