Figuring out what a rare coin is worth goes far beyond just its age or the metal it's made from. True rare coin valuation is a delicate balance of its physical state, how many were made (rarity), its place in history, and what collectors are looking for right now. It's a complex process where a coin's story and how well it's been preserved are just as important as what it's made of.

What Really Makes a Coin Valuable

Before you can put a price on a coin, you need to get to grips with the core things that prop up its market value. Think of it like appraising a classic painting. The artist's reputation, the condition of the canvas, how many similar pieces exist, and how many people want to hang it on their wall all blend together to set its final price. A coin is really no different.

The art of rare coin valuation is about looking past the date and denomination. Seasoned numismatists look at a combination of factors that, together, paint the full picture of a coin's worth. These elements are the bedrock of all coin pricing, whether you're looking at a common Roman bronze or a special commemorative 50p piece.

The Four Pillars of Coin Value

Getting your head around these key areas is the first real step to appraising your collection with any confidence. Each pillar leans on the others; a coin has to score well across several categories to command a high price.

- Condition and Grade: This is probably the single most important factor. A coin in perfect, uncirculated condition can be worth hundreds, sometimes thousands, of times more than the very same coin that's seen a bit of wear and tear.

- Rarity (Mintage): It’s simple supply and demand. If a coin had a low original mintage figure—meaning very few were ever struck—it's naturally scarcer and, in most cases, more sought-after.

- Market Demand: At the end of the day, a coin is only worth what someone is willing to pay for it. Collecting trends, anniversaries of historical events, and general buzz can cause demand for certain coins to skyrocket, pushing their prices up.

- Historical Significance: Coins that tell a story, mark a pivotal moment in history, or feature a famous minting error often carry a premium. This "story value" adds a layer of appeal that pure numbers just can't capture.

The image below, from Wikipedia's entry on coin collecting, shows just how broad the world of numismatics is, spanning ancient and modern coins from across the globe.

This sheer variety highlights why valuation is so nuanced. Every coin you see there would be judged against a different historical backdrop and a unique set of collector demands. An ancient Greek stater has a completely different appeal to a modern American dollar, yet both are ultimately assessed using those same core principles: condition, rarity, and demand.

A common myth, often spread by sensational online videos, is that any old coin is an instant treasure. The reality is quite different. The highest price ever paid for a single coin at auction was a staggering £15.5 million ($18.9 million) for the unique 1933 Double Eagle, proving that only the absolute best and rarest pieces reach those kinds of dizzying heights.

How Condition and Grading Impact Value

When it comes to figuring out what a rare coin is worth, one factor stands head and shoulders above the rest: its physical condition. The state of preservation is often the single most important piece of the puzzle in any rare coins valuation. It can create a staggering difference in price between two coins that are otherwise completely identical. One might be worth a few quid, while its perfectly kept twin could fetch thousands.

It’s a bit like having two copies of a valuable first-edition book. Imagine one has been thumbed through countless times, with a creased spine and dog-eared pages. The other is pristine, looking like it’s never even been opened. They're the same book, but the immaculate copy is worth exponentially more. This exact principle applies to coins.

The Sheldon Scale: The Universal Language of Grading

To bring some order to assessing a coin’s condition, the numismatic world relies on the Sheldon Scale. This is a 70-point system that acts as a universal language, allowing collectors and dealers everywhere to describe a coin's state of wear, from heavily battered to absolutely perfect.

The scale starts at P-1 (Poor), where the coin is so worn it’s barely identifiable, and goes all the way up to MS-70 (Mint State 70). An MS-70 coin is flawless, with no visible imperfections, even when viewed under magnification. A coin graded MS-65 is considered a "Gem," and anything from MS-60 and up is broadly described as "Uncirculated."

For any serious collector, getting to grips with these grades is essential. The jump in value between grades can be massive. For example, a Victorian silver crown in a circulated grade like VF-20 (Very Fine) might be worth a respectable sum. However, the very same coin in MS-63 condition could be worth ten times that amount. The difference is all in the tiny details – the shimmer of original mint lustre versus the subtle scuffs from being passed around.

If you'd like to go deeper into the nuances of grading here in the UK, our expert guide to British numismatic value offers a much more detailed look.

To make this a bit clearer, here’s a simplified table breaking down the main grading categories. We've included an analogy to a first-edition book to help bring the concepts to life.

Coin Grading Scale Explained

| Grade Range | Abbreviation | Description | Analogy (First-Edition Book) |

|---|---|---|---|

| 60–70 | MS | Mint State. Perfect or near-perfect; no signs of circulation. | Pristine; never opened, sharp corners. |

| 50–58 | AU | About Uncirculated. Only the slightest hint of wear on the highest points. | Read once; looks new but has a creased spine. |

| 40–45 | XF/EF | Extremely Fine. Light wear is visible across the design. | Gently used; minor scuffs on the cover. |

| 20–35 | VF | Very Fine. Moderate wear, but major design elements remain clear. | Well-read; pages are soft, some dog-ears. |

| 1–15 | G/AG/F/P | Good/About Good/Fair/Poor. Heavy wear, with details often worn smooth. | Heavily used; torn cover, stained pages. |

This table gives you a general feel for how a coin’s journey—from the mint to a pocket and eventually to a collection—is reflected in its grade and, ultimately, its market price.

Third-Party Grading: The Gold Standard of Trust

While you can certainly learn to assess a coin's grade yourself, the market puts the most faith in a professional, independent opinion. This is where third-party grading (TPG) services step in.

Companies like the Professional Coin Grading Service (PCGS) and the Numismatic Guaranty Company (NGC) are the global leaders in this field. They provide an impartial authentication and grading service, after which they encapsulate the coin in a sealed, protective plastic holder often called a "slab." This slab clearly displays the coin's details and, crucially, its official grade.

A professional grade from a top-tier service like PCGS or NGC does more than just confirm a coin's condition; it provides peace of mind. This trusted, impartial assessment guarantees authenticity and allows the coin to be traded on a global market with confidence, often increasing its liquidity and final sale price significantly.

This process of "slabbing" has become a cornerstone of the modern rare coin market. It takes the guesswork and subjectivity out of grading and assures buyers that they’re getting exactly what’s described. This protects their investment and helps preserve the coin for future generations, creating the confidence that underpins the entire market.

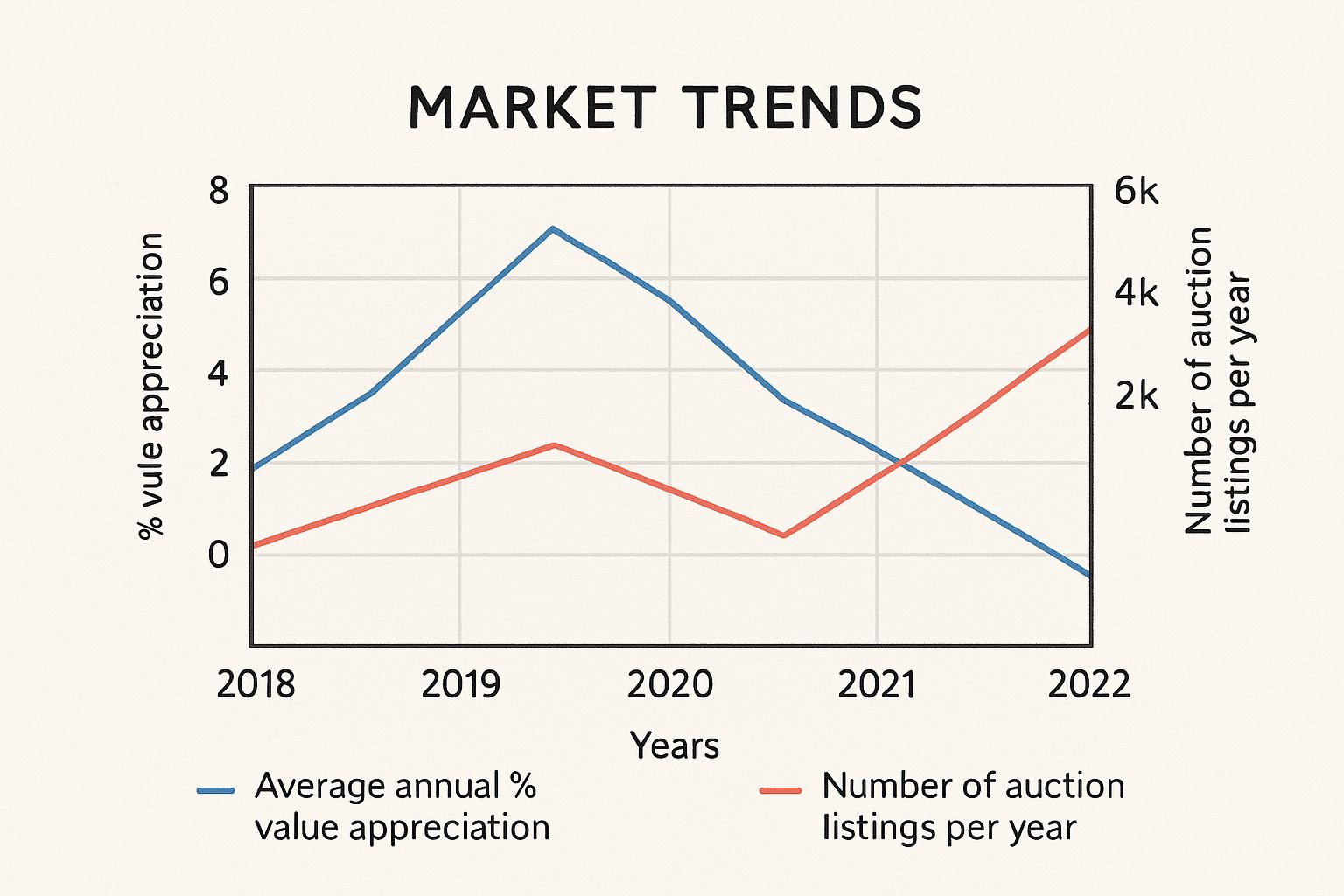

The image below shows the relationship between value and the number of high-grade coins sold at auction between 2018 and 2022.

As you can see, a steady rise in auction listings for professionally graded coins goes hand-in-hand with a stronger annual appreciation in their market value. It's a clear illustration of just how important certified grading has become in building collector confidence.

Understanding Scarcity and Mintage Figures

At its heart, what makes a rare coin valuable is simple economics: supply and demand. Just like anything else people collect, from classic cars to fine art, an item’s rarity is a massive factor in its price tag. When you have lots of collectors all trying to get their hands on very few coins, the value is only going to go one way.

The most direct way to gauge a coin's rarity is to look at its mintage figure. This is simply the official number of coins a mint produced in a given year. A low mintage is an immediate red flag for scarcity, making a coin a potential collectible from the moment it leaves the press.

But it’s not always that straightforward. True scarcity has more layers than just a single number, and to really get a feel for a coin's value, you need to understand two very different types of rarity.

Absolute Rarity versus Conditional Rarity

Getting your head around the difference between these two ideas is one of the keys to spotting hidden gems. They are two separate roads a coin can travel down to become highly desirable.

- Absolute Rarity: This is all about the total number of coins that were ever made. If a coin had a tiny original mintage, it's considered absolutely rare. The most extreme example is the famous 1933 Saint-Gaudens Double Eagle – only one is legally in private hands today.

- Conditional Rarity: This is a bit more subtle. It describes a coin that might have a high mintage, but where very, very few have survived in top-notch condition. A common Victorian penny, for example, isn’t absolutely rare by any means. But finding one that looks like it just left the mint? That's incredibly difficult, making it conditionally rare.

Think about it: millions of a particular coin might have been struck, but if nearly all of them were passed from hand to hand for decades, getting worn, damaged, or eventually melted down, a perfect, untouched example becomes a prize. This is a common story for older coins that saw a lot of use.

Here’s an analogy: a limited-edition supercar is absolutely rare because only a handful were built. A standard family saloon from the 1970s isn't rare at all. But if you found one today with almost no miles on the clock, still in showroom condition, it would be a sensation. That's conditional rarity.

How Mintage Figures Create Modern Collectibles

You don’t have to peer back through centuries to see this principle in action. In recent years, The Royal Mint's decision to release official mintage figures for coins in circulation, especially the popular commemorative 50p and £2 series, has sparked instant collecting frenzies.

The moment the data shows a particular coin has a low mintage, eagle-eyed collectors and the public start pulling them out of their change. Suddenly, a modern coin can become more valuable than one centuries older, purely because we know for a fact how few are out there.

The 2009 Kew Gardens 50p is the classic example. With a mintage of just 210,000, it’s one of the scarcest 50p coins around. As a result, it regularly sells for over £150 – a staggering jump from its 50p face value.

A coin's date is not a reliable indicator of its value. A 2,000-year-old Roman coin can be purchased for a few pounds because millions were minted and many have survived. Conversely, a modern coin with a tiny mintage can be worth hundreds of times its face value just months after its release.

This isn’t just about 50p pieces. The 2022 £1 coin, for instance, is a big deal because of its very low mintage. Only 7,735,000 were released into general circulation, making it the rarest £1 coin you might find in your pocket. Its value is also boosted by its place in history as the last £1 coin to feature Queen Elizabeth II before the 2023 switch to King Charles III’s portrait, adding another layer of collector appeal.

Learning how to find and make sense of mintage figures is a cornerstone skill for any collector. These numbers give you the context you need to judge a coin’s potential scarcity and are almost always the first step in a proper valuation.

The Human Element of Market Demand

A coin’s physical condition and rarity are only two-thirds of the story. The final, and arguably most unpredictable, piece of the puzzle is people. A coin is only worth what someone is willing to pay for it, and that introduces the fickle, fascinating human element into the valuation equation.

Think of it like the fine art world. One year, a particular artist or style might be the talk of the town, sending auction prices through the roof. A decade later, tastes shift, and a different movement captures the public’s imagination. The coin market works in a remarkably similar way. What collectors are passionate about right now has a direct and powerful impact on what your collection is worth.

This demand isn’t just random; it’s often triggered by real-world events. A major historical anniversary, a royal wedding, or even a popular film can suddenly shine a spotlight on a particular coin series. Coins that were once quietly sitting in collections can become hot property overnight, proving that value is as much about storytelling and cultural connection as it is about mintage figures.

Gauging the Market Temperature

So, how do you get a feel for something as fluid as collector interest? The simple answer is to follow the money. Keeping a close eye on the results from major auction houses and sold listings on popular online marketplaces gives you a live snapshot of what’s happening. These platforms don’t just show what sellers are asking, but what buyers are actually paying.

A steady climb in the selling prices for a specific type of coin is a clear signal that demand is on the rise. This data is the pulse of the market, helping you spot which areas are heating up and which might be starting to cool down. It’s a vital skill for anyone serious about getting an accurate valuation.

The most interesting thing about market demand is how it can turn a high-mintage coin into a de facto rarity. When a sudden spike in interest outstrips the number of coins available on the market, even a coin minted in the millions can become surprisingly hard to find, pushing its value up.

We’ve seen this happen with modern UK coins. The 2025 Bee £1 coin is a perfect example. Despite a huge mintage of around 30.855 million, collector fever has been so intense that its median selling price shot up to almost £13 in August 2025. It just goes to show that when demand is strong enough, even "common" coins can become scarce in the marketplace. You can read more about this coin's incredible story in this piece on the UK’s current rarest £1 coin from The Westminster Collection.

The Global Marketplace Effect

The internet has completely changed the game for coin collecting. What used to be a hobby that relied on local dealers and weekend fairs has exploded into a truly global marketplace. A collector in America, Australia, or Japan can now easily find and buy rare British coins, massively increasing the number of potential buyers.

This worldwide connection has had a huge impact on demand, especially for UK coins that have international appeal. Coins featuring the Royal Family, marking major historical events, or displaying iconic British symbols often attract collectors from all over the globe. This international interest adds another powerful layer of upward pressure on prices, pushing the value of certain UK coins far higher than a purely domestic market ever could.

Finding Value in Errors and Varieties

In the carefully controlled world of coin production, sometimes things go wonderfully wrong. For a numismatist, a mistake can be far more valuable than perfection. This exciting part of rare coin valuation is all about the hunt for error coins and die varieties, where unique imperfections aren't just accepted—they're highly prized.

Think of it like a misprinted stamp or a book with a page printed upside down. The flaw is what makes the item rare and desirable. In numismatics, these imperfections generally fall into two distinct categories, and knowing the difference is key to spotting a potential treasure in your change.

Mint Errors vs Die Varieties

While both create unusual coins, they come from different types of production faults. Grasping this distinction helps you understand why one anomaly might be a one-off curiosity while another creates a whole new collectible category.

- Mint Errors are accidental, one-off flaws that happen during the striking process. These are like random accidents on the production line. Examples include a coin being struck off-centre, a piece of foreign metal getting struck into the coin (known as a 'brockage'), or a coin being struck on the wrong planchet (the blank metal disc).

- Die Varieties are consistent anomalies found on multiple coins. This happens when the die used to strike the coins is itself flawed. A famous example is a 'doubled die', where a date or lettering appears to be stamped twice, slightly offset. Because the faulty die strikes many coins before being replaced, a die variety is a repeatable, identifiable type.

One of the best-known British examples is the 1983 'New Pence' 2p coin. A small number were mistakenly struck using an old die that still had the words "New Pence" instead of "Two Pence." This consistent error created a famous die variety that is now keenly sought by collectors.

The Value of Imperfection

The financial potential of these minting anomalies can be astonishing. While most minor errors might add a small premium, a major mistake can transform a common coin into a five or six-figure collectible. It just goes to show that even coins with a face value of a few pence can hold extraordinary worth.

The real excitement of hunting for errors lies in the possibility of discovery. While famous varieties are well-documented, new ones can still be found, turning a pocketful of change into a moment of genuine numismatic significance.

For instance, the market places a huge premium on significant minting mistakes. Several UK coins have achieved remarkable valuations, such as a 1993 one penny coin with a major minting anomaly which fetched around $2 million in a private sale. Another example is a 1995 penny with a rotational minting error that sold for $1.43 million, highlighting just how seriously collectors take these imperfections. You can find more details about these incredible sales and other high-value error coins in this video overview on valuable modern pennies.

Of course, with high values comes the importance of verification. Getting any potential error coin professionally authenticated is vital to confirm it’s a genuine mint mistake and not just post-mint damage. To learn more about identifying these fascinating pieces, check out our guide to discover valuable error coins and their hidden treasures. This knowledge will help you develop a keen eye for spotting valuable mistakes.

How to Get Your Coins Appraised

You've got a handle on the key factors like condition, rarity, and demand. Now for the final piece of the puzzle: getting a solid valuation. Let’s walk through how to approach a rare coins valuation with confidence, from doing your homework to calling in the experts.

The first step is a bit of DIY research right from your kitchen table. Get your hands on a good price guide, like the annual Spink 'Coins of England & the United Kingdom'. These books are invaluable, giving you a baseline of catalogue values for different grades. It's the best way to get a rough idea of what you have and set some realistic expectations from the start.

Seeking a Professional Opinion

Once you've done your preliminary research, it's time to speak to a professional. There are really two paths you can take, and the right one for you will depend on the size and potential value of your collection.

- Local Coin Dealers: A trusted local dealer is a brilliant first stop for quick, informal appraisals, especially for more common or mid-range coins. They can give you an immediate opinion and might even make you an offer on the spot. Just remember, their offer will naturally be below the retail price to account for their profit margin.

- Major Auction Houses: If you suspect you have something truly special—a high-value, rare, or very specialised collection—then an auction house like Spink or Dix Noonan Webb is the way to go. They employ world-class specialists and have a global network of serious collectors, which often translates into a much higher sale price, even after accounting for the seller's commission.

Whatever you do, and this is the cardinal rule for every collector, never clean your coins. Trying to polish or scrub them, no matter how carefully, will inflict a web of microscopic scratches, destroying the original surface and patina forever. This damage is irreversible and can slash a coin's value by 50% or more in a heartbeat.

Best Practices for the Appraisal Process

To make sure you get the most accurate valuation and keep your collection safe, stick to these simple but essential rules.

- Handle with Care: Always, always hold a coin by its edges. Never touch the flat faces. The oils and acids on your fingertips can cause permanent corrosion and leave fingerprints that eat into the metal over time.

- Come Prepared: A little organisation goes a long way. Before you see an appraiser, group your coins by type, country, or metal. It shows you're serious and makes the expert's job much easier, leading to a smoother and more precise assessment.

- Get a Second Opinion: For any collection of significant value, it’s just good sense to get at least two appraisals from different, reputable sources. This helps to confirm the valuation and gives you the confidence you’re getting a fair market price.

Figuring out the appraisal process can feel like a lot to take in, but it doesn't have to be. By combining your own research with advice from trusted experts, you can get a confident and accurate picture of your collection's true market worth. To dig deeper into how these different factors come together, you can learn more about the value of a coin collection in our detailed guide.

Frequently Asked Questions

When you’re starting out in the world of rare coins, a few questions always seem to pop up. Getting good, clear answers is the first step to becoming a confident collector. Here, we'll tackle some of the most common queries with practical advice you can use right away.

Should I Clean My Old Coins Before Getting Them Valued

In a word: no. This is probably the biggest and most costly mistake a new collector can make.

Cleaning a rare coin, even just a gentle wipe with a soft cloth, creates tiny, almost invisible scratches called "hairlines." These scratches do permanent damage to the coin's surface, stripping away its original mint lustre and the natural patina that has developed over time. This damage instantly sinks the coin's grade and, with it, its value. Any professional numismatist or grading service will spot a cleaned coin a mile off.

How Can I Tell if a Coin Is a Fake

Spotting a counterfeit takes a bit of practice and a keen eye. The best first step is to compare your coin with a known genuine example. You can find high-quality images in a dealer’s online stock or on the image libraries of the main grading services.

Here are a few tell-tale signs to look out for:

- Mushy Details: Fakes often look a bit soft or blurry. They just don't have the sharp, crisp strike of a genuine coin.

- Incorrect Weight: Get yourself a precise digital scale. Counterfeits are frequently made from cheaper base metals and will almost always be slightly off-weight.

- Wrong Lustre and Edges: The coin’s shine might look odd or unnatural. Also, check the reeding (the grooves around the edge) – on fakes, it often looks poorly defined or uneven.

When it comes to a valuable coin, the only way to be 100% sure is to send it for professional authentication. A top-tier grading service like PCGS or NGC will verify its authenticity as part of their grading process.

Where Are the Best Places to Research Coin Values

To get an accurate picture of a rare coin’s valuation, you need to look at a few different places. Relying on a single source can be misleading.

- Annual Price Guides: Books like Spink's 'Coins of England & the United Kingdom' are fantastic. They give you a solid baseline of catalogue values for different grades and are an essential tool for any UK collector.

- Online 'Sold' Listings: This is a crucial step. Searching for your coin in the 'sold' or 'completed' items on eBay shows you what people are actually paying for it today. This real-world price is far more useful than what someone is hoping to get for it.

- Auction House Results: For the really high-grade or truly rare coins, the websites of major auction houses like Heritage Auctions or Spink are the place to go. Their archives of past results give you the most accurate view of what the top end of the market is doing.

A certificate of authenticity is only as good as the person or company that issued it. A generic certificate from an unknown online seller is basically worthless. On the other hand, the 'certificate' you get when a coin is slabbed by a trusted third-party grader like PCGS or NGC is the global gold standard. It guarantees both authenticity and condition, which can dramatically increase a coin’s value and makes it much easier to sell.

At Cavalier Coins Ltd, we are passionate about helping both new and experienced numismatists find the perfect pieces for their collections. Explore our extensive selection of rare and interesting coins and banknotes from around the world. Visit https://www.cavaliercoins.com to discover your next treasure.