Ever pulled an old coin from your pocket and wondered if you’ve stumbled upon a hidden treasure? It’s a common thought, but what really separates a piece of pocket change from a collector’s prize isn't just its age. It’s a fascinating mix of scarcity, condition, historical importance, and collector demand.

These four pillars are what can turn a seemingly ordinary coin into something worth anywhere from a few extra quid to, in rare cases, over a million.

What Determines a Coin's True Value

Figuring out what makes a coin valuable is more of an art than a science, and it certainly goes beyond a simple price list. It helps to think of it like valuing a classic car. A rare model in pristine condition with a famous first owner is always going to be more sought-after than a common one that’s seen better days. That same logic applies directly to the world of numismatics—the study and collection of coins.

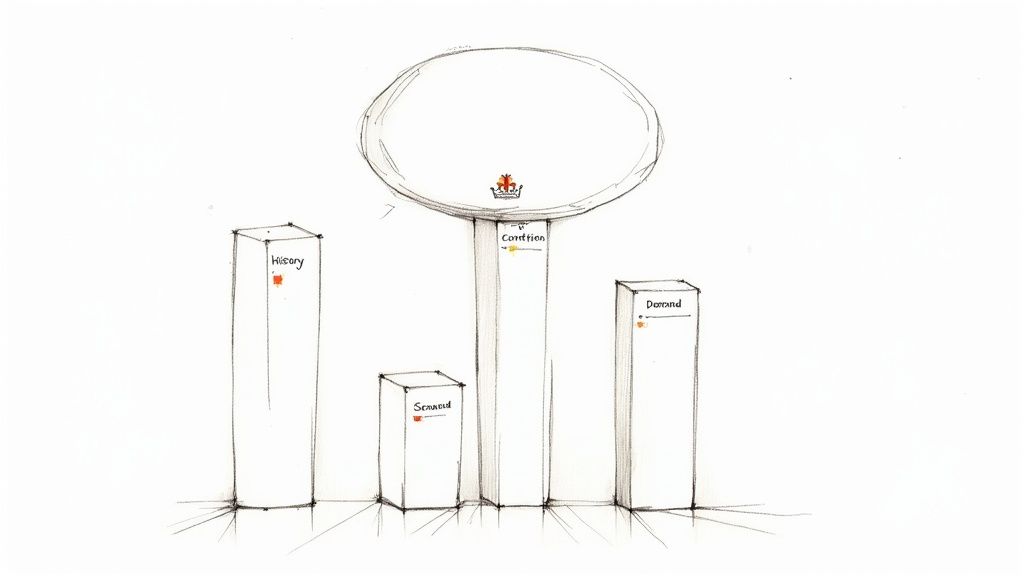

The process for determining the value of a rare UK coin rests on four key pillars. Each one interacts with the others, creating a complex but captivating market where a coin’s story can be just as important as its physical state. Getting your head around these concepts is the first real step toward spotting potential treasures with confidence.

The Four Pillars of Coin Valuation

A coin's ultimate worth is rarely down to a single attribute. Instead, it’s the combination of these key factors that really drives its price up in the market. Here are the core elements every budding collector needs to get to grips with.

To help you remember, here's a quick summary of the primary drivers behind a coin's market price.

Key Factors That Drive a UK Coin's Value

| Factor | Description | Impact on Value |

|---|---|---|

| Scarcity (Rarity) | The number of a specific coin that was originally minted or is known to still exist. | High. Coins with low mintage figures, like the 2009 Kew Gardens 50p, are naturally more valuable. |

| Condition (Grade) | The physical state of the coin, from heavily worn to perfect and uncirculated. | Very High. A pristine, uncirculated coin will always command a much higher price than the same coin with obvious wear and tear. |

| History (Provenance) | The story behind the coin, such as its connection to a major historical event or a short-reigning monarch. | Moderate to High. A compelling story adds a layer of appeal that serious collectors are often willing to pay a premium for. |

| Demand (Desirability) | How many collectors are actively trying to find and purchase the coin at any given time. | High. A coin is only worth what someone will pay. Popular designs or coins needed to complete a set often see very high demand. |

As you can see, it's the interplay between these elements that truly establishes a coin's place in the market.

A coin's value is a blend of its physical rarity and its emotional resonance. Collectors aren't just buying metal; they are acquiring a piece of history, a story captured in time.

By looking at a coin through the lens of these four pillars, you start to build a much more complete picture of its potential worth.

How Scarcity and Mintage Figures Drive Rarity

The golden rule of collecting is beautifully simple: the rarer something is, the more it’s likely to be worth. When it comes to coins, the most straightforward way to gauge rarity is by looking at the mintage figures – that’s the official number of coins The Royal Mint produced for a specific design and year. A low number is your first clue that you might be holding something special.

Think of it like concert tickets. If a band plays a stadium with 50,000 seats, tickets are easy to come by. But what if they announce a surprise acoustic set in a tiny 200-seat pub? Those tickets instantly become gold dust. It’s the exact same principle with coins. One with a mintage in the millions is just everyday pocket change, but a coin with a run under 500,000 is definitely worth a closer look.

Beyond the Official Numbers

But here’s where it gets interesting – the original mintage figure doesn’t tell the whole story. What happens to a coin after it leaves the mint can have a massive impact on its rarity today. Many coins become scarce for reasons that have nothing to do with how many were initially made.

The real measure is what we call the survival rate. Over the decades, countless coins are simply lost, badly damaged, or officially taken out of circulation and melted down. A coin that started life with a mintage of several million might only have a tiny fraction of that number still in a collectible condition, making the survivors much harder to track down.

Thankfully, The Royal Mint publishes its mintage figures, giving collectors an essential starting point for their research.

This data is how we know that the famous 2009 Kew Gardens 50p is so sought-after – its mintage was just 210,000.

When Rarity Reaches Legendary Status

Sometimes, a coin is born rare. It was never meant for public hands in the first place. These are often pattern pieces, trial coins, or special issues produced for a very specific, non-circulating purpose. The most famous example of all has to be the legendary 1933 George V Penny.

The 1933 Penny is often called the 'Holy Grail' of British coins. It wasn't needed for circulation, so only a tiny number—perhaps just six or seven—were ever created, mainly for ceremonial purposes and historical records.

This incredible scarcity has cemented its iconic status among collectors. Back in 2016, one of these pennies sold at auction for a jaw-dropping £72,000. It’s the perfect illustration of how a near-zero mintage can create unbelievable value. You can find more fascinating stories about this and other legendary coins over on Cavalier Coins.

Ultimately, this case highlights a crucial skill for any collector: learning to tell the difference between coins that are merely old and those that are genuinely, verifiably scarce.

Why a Coin's Condition Is So Important

Picture this: you've found two rare 19th-century pennies from the very same year. One has clearly been through the wars, its details worn smooth and its surfaces covered in tiny scratches. The other looks like it just fell out of the press at The Royal Mint this morning. They might be the same coin on paper, but their values could be worlds apart—we’re talking the difference between £10 and £10,000. This huge gap comes down to one crucial factor: condition.

In the world of coin collecting, the physical state of a coin, known as its grade, is one of the biggest drivers of its value. It's not enough for a coin to just be old; what really matters is how well it has survived its journey through time. Even the slightest flaws—faint wear on the high points of the monarch's portrait, tiny scratches, or a loss of that original factory shine—can slash its value in the eyes of a serious collector.

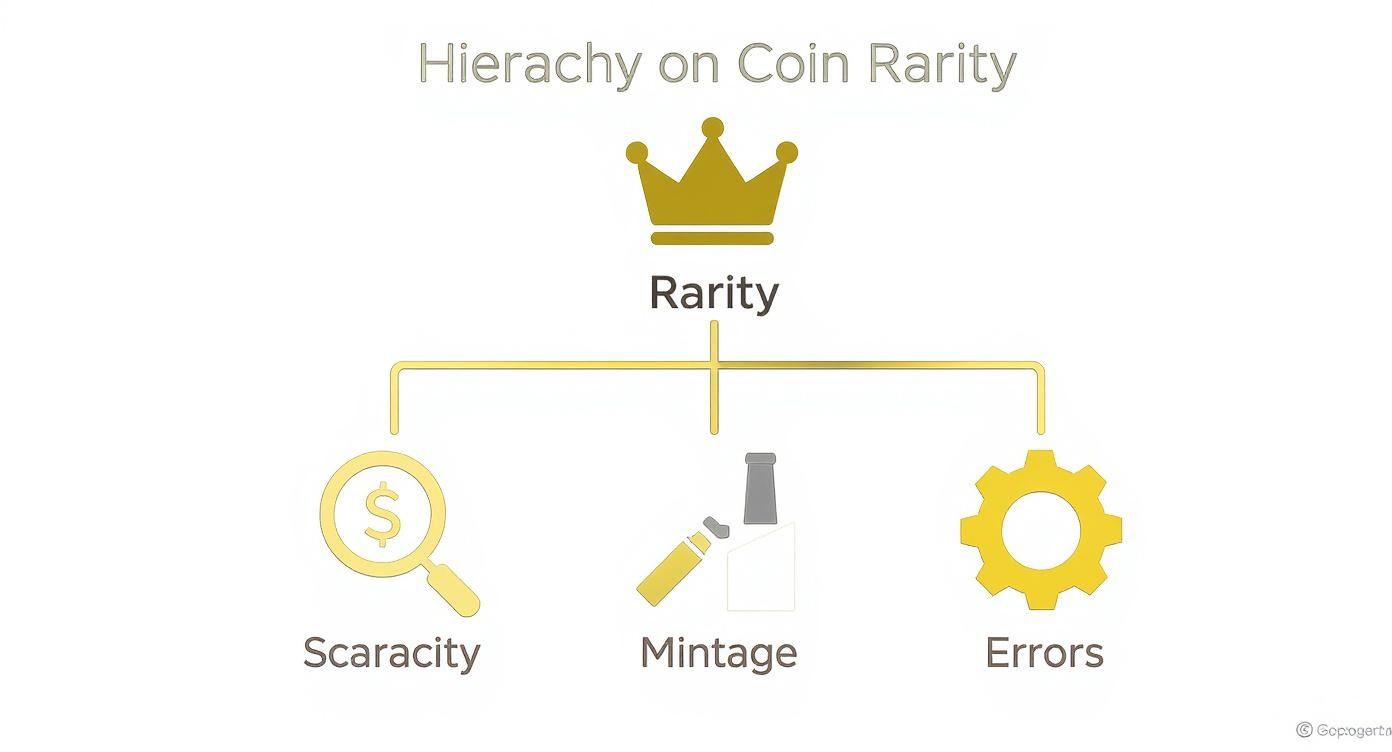

This hierarchy of factors, with rarity sitting right at the top, is the key to understanding what makes a coin truly desirable.

As you can see, while things like mintage numbers and fascinating errors contribute to a coin's rarity, the final price tag is always viewed through the lens of its condition.

From Poor to Perfect

So, how do we measure this? Coin grading is the standardised system used to describe a coin's condition, usually on a scale. While the pros use a highly detailed numerical system, most collectors and dealers use descriptive terms that are much easier to get your head around. Think of it as a quality inspection for a piece of history.

A coin in a higher grade isn't just better preserved; it’s a more faithful snapshot of the artist's original vision and the era it came from. This is what collectors are really paying a premium for.

A coin that's heavily worn, where the main features are barely visible, might be graded as Poor (P) or Fair (F). As you move up the ladder, you get to grades like Good (G), Very Good (VG), and Fine (F), where more and more of the original design becomes sharp and clear.

The Grades Collectors Chase

The real magic, and the serious money, happens at the top end of the grading scale. These are the coins that have been squirrelled away, protected from the rough and tumble of daily circulation. If you want to dive deeper into the nuances of each grade, our detailed guide on UK coin grading provides an expert look at British numismatic value is the perfect next step.

Here’s a simplified breakdown of the common grades you'll encounter.

A Simplified Guide to UK Coin Grades

| Grade | Abbreviation | Key Characteristics |

|---|---|---|

| Good | G | Heavily worn, but the main design and date are visible. Lettering is often flat. |

| Very Fine | VF | Moderate wear, but many finer details are still clear. A solid, collectable grade. |

| Extremely Fine | EF | Shows only the slightest wear on the highest points. Most details are sharp. |

| Uncirculated | UNC | No signs of wear at all. Looks brand new, though may have minor bag marks. |

| Proof | P | A specially manufactured coin with a mirror-like finish, not intended for circulation. |

For collectors, these top-tier grades are the ones that truly set pulses racing:

- Extremely Fine (EF): This coin has seen very little action. There are only the faintest signs of wear on the highest points of the design, and most of the intricate details are still crisp.

- Uncirculated (UNC): Just as it sounds—this coin has never been in circulation. It shows no wear and still has its original mint lustre, though it might have picked up small knocks from the minting process itself.

- Proof (P): This isn't strictly a grade but a special manufacturing process. Proof coins are struck multiple times with polished dies to create a flawless, mirror-like background and frosted design. They are made purely for collectors and represent the pinnacle of minting quality.

Ultimately, a coin's condition tells the story of its life. For collectors, the closer that story is to its very beginning, the more valuable it becomes.

The Power of History and Provenance

A coin is so much more than a bit of stamped metal; it’s a tiny time capsule. While things like rarity and condition are massively important, the story a coin tells can take its value from impressive right up to legendary. In fact, this story—its unique connection to history—is often what collectors are really paying for.

Coins linked to big historical moments, political chaos, or the short reigns of ill-fated monarchs have a special kind of magic. They’re a direct, physical link to the past, turning a simple collection into a private museum. A coin struck during a civil war, or to mark a coronation that never actually happened, holds a significance that goes far beyond its metallic value.

A Royal Crisis Captured in Gold

You’d be hard-pressed to find a better example of this than the 1937 Edward VIII Gold Sovereign. Its staggering value is tied almost entirely to the incredible story of a king who gave up his throne for love. Edward VIII abdicated before he was ever officially crowned, which meant that the coins designed with his portrait were never meant to see the light of day.

This pattern coin, created for a reign that never truly began, captures a defining moment in modern British history. Its extreme rarity is a direct result of this unprecedented royal crisis.

Only a tiny number of these trial pieces were ever made. That's why the 1937 Edward VIII Gold Sovereign is one of the most valuable coins in the UK, with only six known to exist and an estimated value of £1,000,000. Its story is everything. You can read more about this remarkable piece and other rare UK coins to see just how much history can impact value.

What Is Provenance and Why Does It Matter?

Tied closely to a coin's history is its provenance—basically, the documented history of who has owned it. Think of it as a coin’s CV or its family tree. A clear, well-documented, and prestigious ownership history can seriously ramp up a coin's desirability and, in turn, its price tag.

For instance, a coin that was once part of a famous, named collection or owned by a historical figure carries an extra layer of prestige. This paper trail gives buyers immense confidence in the coin’s authenticity and adds another fascinating chapter to its story.

When you learn to look at a coin, you start to see past the date and the face value. The real magic is in the rich history it carries, the narrative that makes it a true treasure.

Finding Valuable Coins in Your Pocket Change

While million-pound sovereigns tend to grab all the headlines, you don’t need to stumble upon a lost treasure chest to find a valuable coin. The reality is that genuine numismatic gems are still hiding in plain sight, jingling away in pockets, purses, and piggy banks all over the country. This modern-day treasure hunt has turned the simple act of checking your change into an exciting national pastime.

The focus here isn't on ancient gold but on modern currency—specifically the commemorative 50p and £2 coins released over the past few decades. The Royal Mint regularly issues these special designs to celebrate key events and cultural milestones, often with far smaller mintage figures than standard coins. It’s these limited runs that create scarcity and can turn everyday money into a collector's item.

Your Pocket Change Hit List

Certain coins have become almost legendary among collectors for their rarity, commanding prices that soar far beyond their face value. These are the key players to keep an eye out for every time you get change. Knowing what to spot is the first step in turning your loose coins into a potentially profitable hobby.

Here are a few of the most famous examples that could still be in circulation:

- The 2009 Kew Gardens 50p: This is the undisputed champion of modern rare coins. With a mintage of just 210,000, it's the scarcest 50p ever put into circulation. Finding one is a true collector's dream, with values often pushing past £150.

- The 2002 Northern Ireland Commonwealth Games £2: This coin was part of a four-coin set, but the Northern Ireland version had the lowest mintage at only 485,500. It's significantly scarcer than its English, Scottish, and Welsh counterparts.

- The 'Undated' 20p Mule Error: Back in 2008, a batch of 20p coins was mistakenly struck using the old obverse (the Queen's head) with the new reverse design. This mismatch meant the date was completely left off, creating a famous 'mule' error coin that is highly sought after.

Always check the date and design on your 50p and £2 coins. A single unusual piece could be the one that everyone is looking for, turning 50 pence into a significant sum.

Verifying and Valuing Your Finds

So, you think you’ve found a rare 50p. What’s the next move? The first step is to get a realistic idea of its current market value. Be wary of the wildly inflated prices you might see on some online marketplaces, as these are often just wishful thinking and can be very misleading.

A much smarter approach is to check the 'sold' listings on sites like eBay. This doesn't show you what people are asking for a coin; it shows you what people are actually paying for it right now, which is a far more accurate gauge of its true value.

For a deeper dive into specific designs, our guide on which 50p coins are worth money provides detailed information to help you identify and value your collection accurately. With a little knowledge and a keen eye, you can transform checking your change into an exciting and rewarding search for hidden gems.

Tools and Resources for Accurate Valuations

When it comes to putting a price on rare UK coins, guesswork is your worst enemy. It's the fastest way to either overpay for a new addition or, even worse, sell a hidden gem for a fraction of its true worth. To get it right, you need to think like an expert and use the same trusted resources they rely on.

The goal isn't to find the wildly optimistic prices you see on places like Facebook Marketplace. It's about discovering a coin's genuine market value. Online platforms can be a minefield, full of sellers listing common coins for thousands of pounds, just hoping an unsuspecting newcomer will bite. These listings create a completely false picture of what a coin is actually worth.

A coin's listed price is simply what a seller is asking. Its true value is what an informed buyer is consistently willing to pay. Always focus on actual sold prices, not ambitious asking prices.

Essential Printed Guides

For generations, the bedrock of any serious coin collector's library has been the printed catalogue. These books aren't just price lists; they're comprehensive guides built on decades of historical data and expert consensus.

In the UK, the undisputed champion is Spink’s ‘Coins of England & the United Kingdom’. This guide, updated annually, is packed with crucial details like mintage figures, known varieties, and estimated values across different grades. Think of it as the encyclopaedia of British numismatics. It’s an absolutely indispensable tool if you're serious about your research.

Navigating Online Valuations

To get a real-time pulse on the market, you'll need to turn to the web. The right online valuation tools and resources can make all the difference, but you need to know where to look. Reputable dealer websites and auction house archives are goldmines of information, showing you what coins are really selling for right now.

One of the most powerful and accessible methods is to check the ‘sold’ listings on platforms like eBay. This simple filter cuts through all the noise of speculative, overpriced listings and shows you the actual prices that real buyers have paid. It’s the closest you’ll get to an instant, accurate gauge of current demand.

By combining the historical knowledge from a guide like Spink's with the live market data from sold listings, you can build a complete and confident picture of what your coins are worth. To see how these principles apply to specific coins, take a look at our detailed list of rare UK coins and how their values are determined.

Common Questions About UK Coin Values

Stepping into the world of coin collecting always kicks up a few questions. It doesn't matter if you've been a numismatist for years or you're just starting out; getting solid answers helps you make better choices and protect the value of your collection. Let's tackle some of the most common queries we hear.

One of the first impulses a newcomer has is to try and "improve" a coin's appearance. You find an old, grimy coin and think a quick polish will do it a world of good. This is probably the single biggest mistake you can make.

Rule number one: you should almost never clean an old coin. Cleaning, even with the softest cloth, leaves behind microscopic scratches and, worse, strips away the natural patina that has built up over time. This patina is something collectors treasure, and removing it can absolutely tank a coin's market price. Experts want pieces in their original, untouched state.

Holding back on the urge to clean is vital for preserving the financial worth and historical integrity of any coin you find.

Getting Coins Professionally Assessed

If you have a coin you suspect might be worth a fair bit, getting a professional opinion is a smart move. It takes all the guesswork out of the equation and gives your coin an official, recognised status—which is crucial if you ever need to insure it or sell it.

You can send your coin to a respected third-party grading service. The two biggest names in the business are the Numismatic Guaranty Corporation (NGC) and the Professional Coin Grading Service (PCGS). Here's what they'll do:

- Authenticate the coin to make sure it's the real deal.

- Grade its physical condition using a standardised, internationally recognised scale.

- Encapsulate it in a secure, sealed holder (often called a 'slab') with a label detailing its grade and authenticity.

This official grading process doesn't just confirm its quality; it can often boost its value and makes it much easier to sell to serious collectors who put their trust in these services.

Where to Sell Your Rare Coins

Once you've got a handle on your coin's value, the next question is where to sell it. The best place really depends on the coin itself.

For the truly high-value pieces, your best bet is usually a specialised coin dealer or a reputable auction house. These professionals have established networks of serious collectors who are always on the lookout for premium items.

For more modern collectibles, like the sought-after rare 50p coins, online marketplaces can work well. The key here is to do your homework. Always research recent sold prices to set a realistic asking price. Don't be fooled by the wildly optimistic listing prices you often see—what a coin actually sells for is the only number that matters.

At Cavalier Coins Ltd, we offer a trusted place for collectors to both buy and sell with total confidence. Feel free to explore our extensive collection or get in touch for expert advice on your rare UK coins at https://www.cavaliercoins.com.