That old box of coins gathering dust could be worth a lot more than you imagine. But turning that potential into actual profit all starts with some smart prep work. Before you even think about selling, you need to get a handle on what you've got and, crucially, how to handle it without causing any costly damage. A little organisation now makes the entire process of selling your coin collection smoother and much more profitable down the line.

Organising Your Coins for a Successful Sale

The groundwork you lay before a single coin is shown to a dealer can make a huge difference to your final sale price. Let's be honest, a disorganised pile of coins rattling around in a biscuit tin just screams "amateur" to any potential buyer. It also makes it impossible for you to know whether you’re holding onto common currency or a hidden treasure.

The first rule is simple but absolutely vital: handle your coins with care. Always, always hold them by their edges—never flat on their faces. The natural oils and dirt from your fingers can cause permanent, irreversible damage, especially to the delicate surfaces of uncirculated or proof coins. There’s a reason professionals use soft cotton gloves.

Creating Your Coin Inventory

Next up, you need to create a basic inventory. You don’t have to be a numismatic expert at this stage; the goal is just to get a clear overview of your collection. A simple spreadsheet is your best friend here.

For each coin, jot down the following details:

- Country of Origin: Where the coin is from (e.g., Great Britain, United States).

- Denomination: The face value (e.g., Penny, Half Crown, Dollar).

- Year of Minting: The date stamped on the coin.

- Mint Mark: Look for a small letter that shows where the coin was made, if there is one.

- Noticeable Condition: A quick, simple note like "shiny," "worn," or "tarnished" is fine for now.

This list becomes your roadmap. It helps you spot duplicates, group similar coins together, and gives you a solid checklist when you start researching values or talking to experts.

Taking the time to build a detailed inventory is the single most effective step you can take. It completely changes the dynamic, allowing you to walk into a negotiation with knowledge, rather than just hoping for a fair offer.

Choosing the Right Storage

Proper storage isn’t just about being tidy; it’s about preservation. Storing coins correctly prevents the scratches, environmental damage, and general wear that can chip away at their value.

Here are a few common and affordable options:

- 2x2 Cardboard Flips: These are cheap and cheerful holders with a clear window. They’re perfect for individual coins and you can write key details on the cardboard frame.

- Coin Albums: If you're organising a specific series, like a full set of pre-decimal pennies, an album is an excellent choice. They offer good protection and look great.

- Inert Plastic Tubes: Got a lot of the same type of coin, like bullion? Tubes are a secure and space-saving way to store them.

Presenting your collection in an organised, well-protected way signals to buyers that these coins have been cared for. That builds trust and can directly lead to better offers. This sort of preparation is more important than ever, as the global coin collecting market is expanding. In the UK, interest is projected to grow annually by over 6% to 8% through 2035, largely thanks to online platforms giving sellers a much wider reach. You can learn more about the coin collecting market trends and what it means for sellers like you.

How to Determine Your Coin Collection's True Value

Once your collection is neatly organised, you've reached the most crucial stage: figuring out what your coins are actually worth. When it comes to selling, a solid valuation is your single most powerful negotiating tool. It's what stands between you and a low-ball offer, ensuring you get a price that truly reflects the market value of your assets.

You've really got two ways to go about this. You can either roll up your sleeves and do the research yourself, or you can bring in a professional appraiser. The DIY route can be incredibly rewarding (and cheaper) for more common coins, but for a high-value or particularly complex collection, a professional is a must.

Core Factors That Drive Coin Value

A coin's value isn't just about how old it is; that's a common misconception. It's actually a much more nuanced assessment based on several key factors. Getting your head around these will give you a major advantage, whether you're researching alone or talking through an appraisal with an expert.

- Condition (Grading): This is, without a doubt, the most important factor. A coin in pristine, uncirculated condition can be worth hundreds, or even thousands, of times more than the very same coin in a worn state.

- Rarity: Simply put, how many were ever made? A low mintage number almost always drives the value up. Keep an eye out for errors, too—things like a double strike or a coin made from the wrong metal can create extreme rarity and value.

- Melt Value: For coins made from precious metals like gold or silver, the intrinsic value of the metal itself sets a price floor. You'll often hear this called its bullion value.

- Provenance and History: Can you trace the coin’s ownership? A piece that was once part of a famous, well-documented collection can carry a significant premium.

- Market Demand: Just like any other collectable, prices are driven by what buyers are looking for right now. A certain series of coins might be 'hot' for a few years, pushing prices up, before collectors turn their attention elsewhere.

Never underestimate the power of grading. A tiny, almost imperceptible difference in condition—say, the jump from "Extremely Fine" to "Uncirculated"—can cause a coin’s value to absolutely skyrocket. This is precisely where a professional opinion becomes invaluable.

Researching Values Versus Professional Appraisal

For a preliminary look, a resource like the Spink "Coins of England & the United Kingdom" catalogue is a fantastic starting point for British coins. It’s pretty much the industry standard here in the UK. If you combine that with checking recent sale prices on auction sites, you can piece together a pretty solid initial estimate. For more on this, you can check out some expert tips on how to value old coins to see the methods we professionals use.

However, for anything that seems particularly old, rare, or valuable, a DIY valuation comes with significant risk. It's all too easy to misidentify a key feature or misjudge a grade. This is your cue to turn to a professional.

In the UK, you'll want to find an expert who is a member of the British Numismatic Trade Association (BNTA). Their members are held to a very strict code of ethics, which gives you peace of mind that you're getting a fair and honest appraisal. An appraisal from a BNTA member provides you with credible, documented proof of value that dealers and auction houses will respect.

For your absolute top-tier coins, it's worth considering third-party grading. Specialist services like the Numismatic Guaranty Company (NGC) or the Professional Coin Grading Service (PCGS) will authenticate, grade, and then seal your coin in a secure, tamper-proof holder. This removes all subjectivity from the equation and can dramatically increase its saleability and final price, making it a very wise investment for your most prized pieces.

Where to Sell Your Coins for the Best Return

With a clear valuation in hand, you’re ready for the most crucial part of the process: choosing your marketplace. The best venue for you hinges entirely on your specific goals. Are you prioritising speed, convenience, or squeezing every last pound out of a particularly rare piece?

Each path offers a distinct trade-off. A local dealer provides instant cash, an auction house offers the potential for a top-tier price, and online platforms give you maximum control. There's no single 'best' answer—only the one that aligns perfectly with your collection and your circumstances.

Local Coin Dealers: The Fast and Simple Route

For many, walking into a local coin shop is the quickest way to turn a collection into cash. This is especially true for common British coins or standard bullion. Dealers know the market inside and out, can assess your collection on the spot, and you can often walk out with payment the very same day.

The trade-off, of course, is the price. A dealer is running a business and needs to build in a profit margin for when they eventually resell the coins. Because of this, their offer will likely be below the full retail value you might see in a price guide. For lots of people, this is a fair exchange for a hassle-free and immediate sale.

Auction Houses: Maximising High-Value Coins

If your collection contains exceptionally rare or high-grade coins, an auction house is where you’ll likely find the most enthusiastic bidders. Reputable auctioneers have a global client list of serious collectors who are prepared to compete for premium items. This competition can drive prices well beyond initial estimates.

However, this route requires patience and comes with its own costs. You’ll need to consign your coins and wait for the next scheduled auction, which could be months away. Auction houses also charge a "seller's premium," a percentage of the final sale price, which can range from 10% to over 20%. It’s crucial to factor this fee into your potential return.

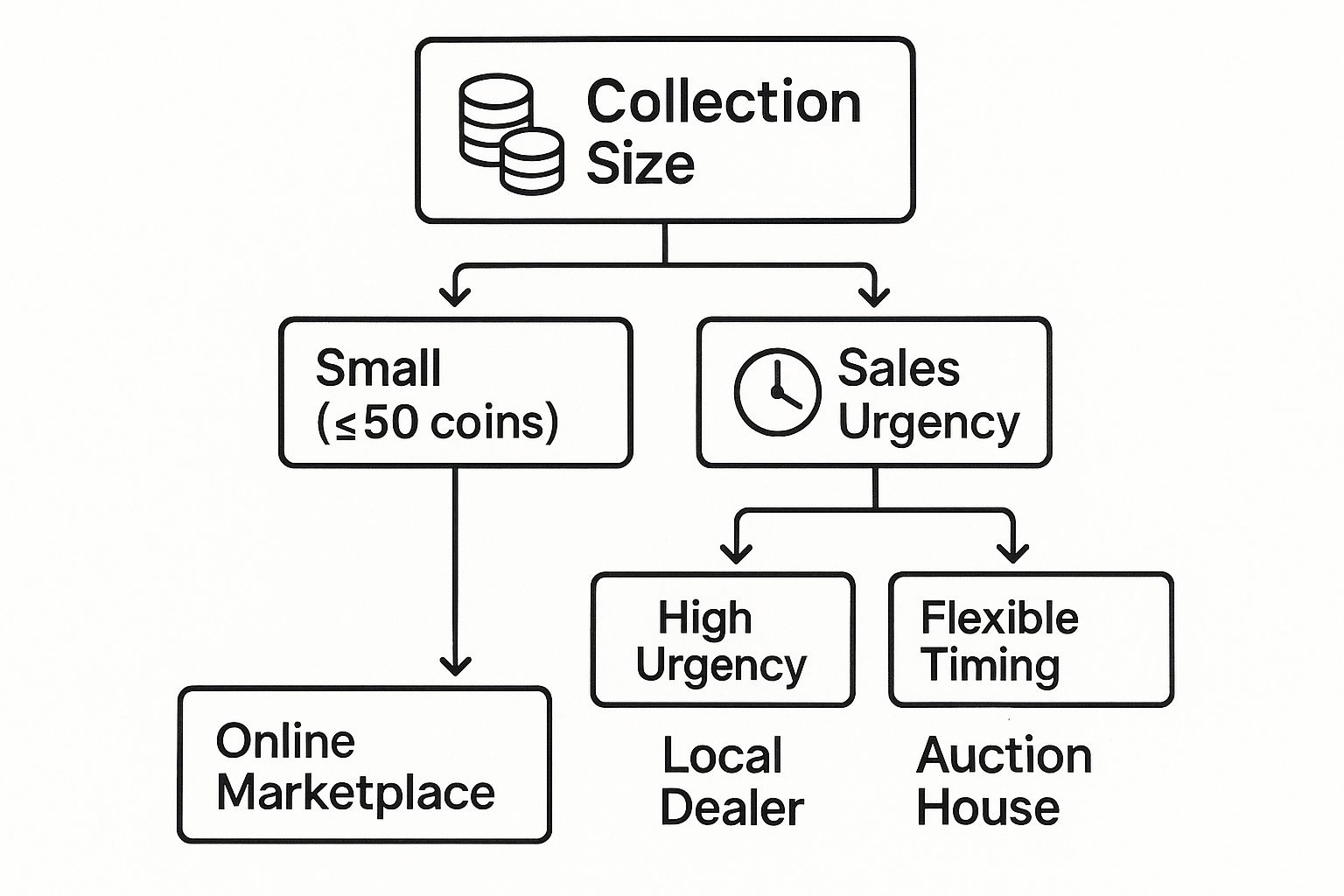

This decision tree can help you visualise the best starting point based on your collection's size and how quickly you need to sell.

As the chart shows, the right path often becomes clear when you weigh the size of your collection against your timeline.

Online Marketplaces: Taking Full Control

Platforms like eBay put you firmly in the driver's seat. You get to set the price, write the description, and handle the entire transaction from start to finish. This direct-to-collector approach can yield prices much closer to retail value.

This approach gives you the most control but also demands the most effort. You are responsible for everything from high-quality photography and accurate descriptions to secure packaging and dealing with customer queries.

Remember that online marketplaces charge listing fees and a final value fee, which will cut into your profit. Still, for those with the time and confidence, it can be a highly rewarding way to manage the sale.

To help you decide, this table breaks down the pros and cons of each venue.

Comparing Your Coin Selling Options

| Selling Venue | Potential Return | Speed of Sale | Seller Fees | Best For |

|---|---|---|---|---|

| Local Dealer | Lower | Very Fast | N/A (built into offer) | Speed, convenience, common coins |

| Auction House | Highest | Slow | High (10%-20%+) | Rare, high-value, certified coins |

| Online | Medium to High | Varies | Medium | Sellers who want full control & have time |

Ultimately, choosing where to sell is as important as the valuation itself. If you're still weighing things up, our guide on the top options for where to sell old coins offers a deeper comparison to help you choose wisely.

Navigating the Sale and Negotiation Process

This is where the rubber meets the road. Getting the final transaction right can seriously impact your bottom line. You’ve done your research, had your collection valued, and picked your selling channel. Now, it's about closing the deal, and this is where all that groundwork lets you negotiate from a position of strength, not just hope.

If you're selling online, think of your listing as your digital shop window. Success really boils down to two things: brilliant photos and a description that sells. Forget about using stock images; a serious buyer wants to see the exact coin they’re considering.

Grab a decent camera or even a modern smartphone and lay the coin on a neutral, soft background—a piece of felt is perfect. You'll need high-resolution shots of both the obverse (front) and reverse (back), plus any important details on the edge. Good lighting is an absolute must. Try to use natural light if you can, as it helps avoid nasty glare and shows the coin's true surface.

Writing Descriptions That Sell

Your description needs to be both honest and detailed. Start with the basics you've already recorded in your inventory: the country of origin, year, denomination, and any mint marks. Most importantly, you have to be completely straight about the coin's condition.

Point out any noticeable scratches, marks, or toning. Being upfront about a coin’s little imperfections builds trust with potential buyers and saves you headaches and disputes down the line. It's what separates reputable sellers from the rest, and it's something experienced collectors actively look for.

Remember, a potential buyer can't hold the coin in their hand. Your photos and description have to do all the heavy lifting, creating a complete and trustworthy picture that gives them the confidence to make an offer.

Handling Offers and Negotiation

Whether you're face-to-face with a local dealer or fielding messages from an online buyer, your research is your best friend. When an offer lands in your inbox, don't feel rushed to say yes. Take a moment. Check it against your valuation research and what similar coins have sold for recently.

If an offer comes in low, don't be afraid to make a sensible counter-offer. It’s all part of the dance. For example, if your homework suggests a coin is worth around £100 and someone offers £70, countering at £90 is a perfectly fair way to open up a conversation. The aim is to land on a price that feels fair for everyone.

- Be Polite and Professional: Keep your tone courteous, even if you think an offer is a bit cheeky.

- Justify Your Price: Briefly explain why you've valued your coin as you have, maybe pointing to a specific grade or a recent auction result.

- Know Your Floor Price: Decide beforehand what the absolute lowest price you'll accept is, and be ready to walk away if the offers just aren't there.

For a deeper dive into the whole process, from the first steps of preparation to the final handshake, our complete guide to selling coin collections is packed with even more practical advice.

Finalising the Sale Securely

Once you've shaken on a price, the last few steps are crucial for a smooth finish. Always insist on secure payment methods. For online sales, services like PayPal provide seller protection, which I’d highly recommend using. Never, ever agree to strange payment methods or send a coin before the payment has fully cleared.

Finally, you need to ship it securely and with insurance. Use a padded envelope or a small, sturdy box to protect the coin while it's in transit. For any valuable items, always use a tracked and insured service like Royal Mail Special Delivery. This gives you proof of postage and covers the item's value if it goes missing, protecting both you and the buyer and ensuring the deal ends on a high note.

Of course. Here is the rewritten section, crafted to sound like it was written by an experienced human expert, following all the provided guidelines.

Costly Mistakes to Avoid When Selling Coins

Sometimes, knowing what not to do is far more valuable than knowing what you should do. This is especially true when it comes to selling a coin collection. I’ve seen countless first-time sellers make simple, avoidable mistakes that ended up costing them dearly. By sidestepping these common blunders, you can protect the value of your assets and secure a much better outcome.

The single biggest, most heartbreaking mistake we see is people cleaning their coins. It seems like a good idea, right? You want them to look shiny and new for a potential buyer. But this impulse can be financially devastating.

A coin's original surface, or patina, is a delicate layer that forms over decades, sometimes even centuries. It’s a crucial part of its story and its authenticity. Aggressively scrubbing, polishing, or using chemical dips strips this patina away completely, leaving behind microscopic scratches that any expert can spot from a mile away. This well-intentioned 'cleaning' can utterly destroy a coin's numismatic value, reducing a rare, valuable piece to little more than its scrap metal worth.

A professional will never buy a cleaned coin for its full value. That original, untouched surface is proof of its journey through time. Once it’s gone, it’s gone forever—and it takes most of the collector value with it.

Unrealistic Price Expectations and Shoddy Research

Another major pitfall is getting your hopes up based on questionable online sources or hyped-up news stories. Just because you see a headline about a rare penny selling for a fortune doesn't mean the similar-looking one in your biscuit tin is worth the same. A coin's value is incredibly specific and hinges on its exact year, mint mark, and most importantly, its condition.

Failing to do solid research or consult a professional leads to two big problems:

- You might wildly overprice your collection and scare off genuine, serious buyers.

- Even worse, you could overlook a truly rare piece, dismiss it as common, and sell it for a tiny fraction of its actual value.

An accurate valuation is the absolute bedrock of a successful sale. With its rich numismatic heritage, the UK coin market can offer significant returns for those who come prepared. Coins from Roman Britain all the way to modern commemoratives attract serious investors, but only a well-researched collection will capture their interest. To get a better sense of what's possible, you can read more about why your coin hobby could be worth more than you think.

Overlooking the Hidden Costs and Finer Details

Finally, don't let the small details trip you up, because they really do add up. Poor record-keeping, for instance, can make it impossible to track what you actually have, leading to confusion and missed opportunities. It's also vital to fully understand the fee structure of whichever selling platform you choose.

Auction houses charge a seller's premium, and online marketplaces have final value fees. These percentages can take a significant bite out of your final payment. Always do the maths on these costs beforehand so there are no nasty surprises when it’s time to settle up.

Your Top Coin Selling Questions Answered

Even with the best-laid plans, selling a coin collection can throw a few curveballs your way. It's only natural to have questions, especially if this is your first time. We’ve pulled together some of the most common queries we hear from sellers to give you clear, practical answers and help you move forward with confidence.

Let's tackle some of the sticking points that can cause the most confusion, from timing the market to what to do with an inherited collection.

Is Now a Good Time to Sell a Coin Collection?

This is probably the question we get asked more than any other. While trying to "time the market" perfectly is a near-impossible task, the good news is that the coin market is generally very stable—certainly less volatile than many other investments. There’s almost always a strong demand for high-quality, rare, and historically important coins.

Right now, we're seeing sustained interest from collectors, especially for key-date British coins and popular bullion like gold Sovereigns and silver Britannias. This creates a very favourable environment for sellers. Ultimately, the best time to sell is when you've done your homework, organised your collection, and feel ready to get the best price.

What Is the Best Way to Sell an Inherited Coin Collection?

If you’ve inherited a collection, the single most important piece of advice is to simply slow down. It can be tempting to clean the coins or rush into a sale, but please resist the urge. You could be holding someone's life's work, and it deserves a careful, considered approach.

Start by creating that inventory we talked about earlier. Since you might not know the collection’s history or what makes a particular coin valuable, getting a professional appraisal is your most critical step.

For inherited collections, we strongly recommend seeking an expert opinion from a British Numismatic Trade Association (BNTA) member. They have the experience to spot overlooked rarities and can provide a certified valuation. This gives you a clear picture of its true worth before you even think about selling.

Do I Have to Pay Tax When I Sell My Coin Collection in the UK?

Understanding the potential tax implications is absolutely vital. The rules in the UK can be quite specific. For instance, certain British legal tender coins, such as gold and silver Britannia coins, are completely exempt from Capital Gains Tax (CGT). This makes them particularly appealing to investors and collectors alike.

Most other coins, however, are classed as 'chattels'—basically, personal possessions. If you sell a single coin for more than the current CGT chattel exemption threshold (which is £3,000 for the 2024/2025 tax year), you may need to pay tax on the profit. Because everyone's situation is different, it's always best to speak with a financial advisor for guidance tailored to you. It's the only way to be sure you're fully compliant.

At Cavalier Coins Ltd, we're passionate about helping collectors at every stage of their journey. Whether you're looking to sell a cherished collection or find that perfect piece to complete a set, our expertise is at your disposal. Explore our selection of rare coins and banknotes from around the world at https://www.cavaliercoins.com.