So, you've decided to sell a coin collection.So, you've decided to sell a coin collection. It doesn't matter if it's a collection you inherited or one you've spent years building yourself—parting with it is a significant moment. The most important thing to realise right now is that a little bit of thoughtful preparation can make a massive difference to the final price you get.

Before you even think about putting a price on anything, let’s get the basics right. The first step, and it's a big one, is to resist a very common temptation.

Getting Your Coin Collection Ready for Sale

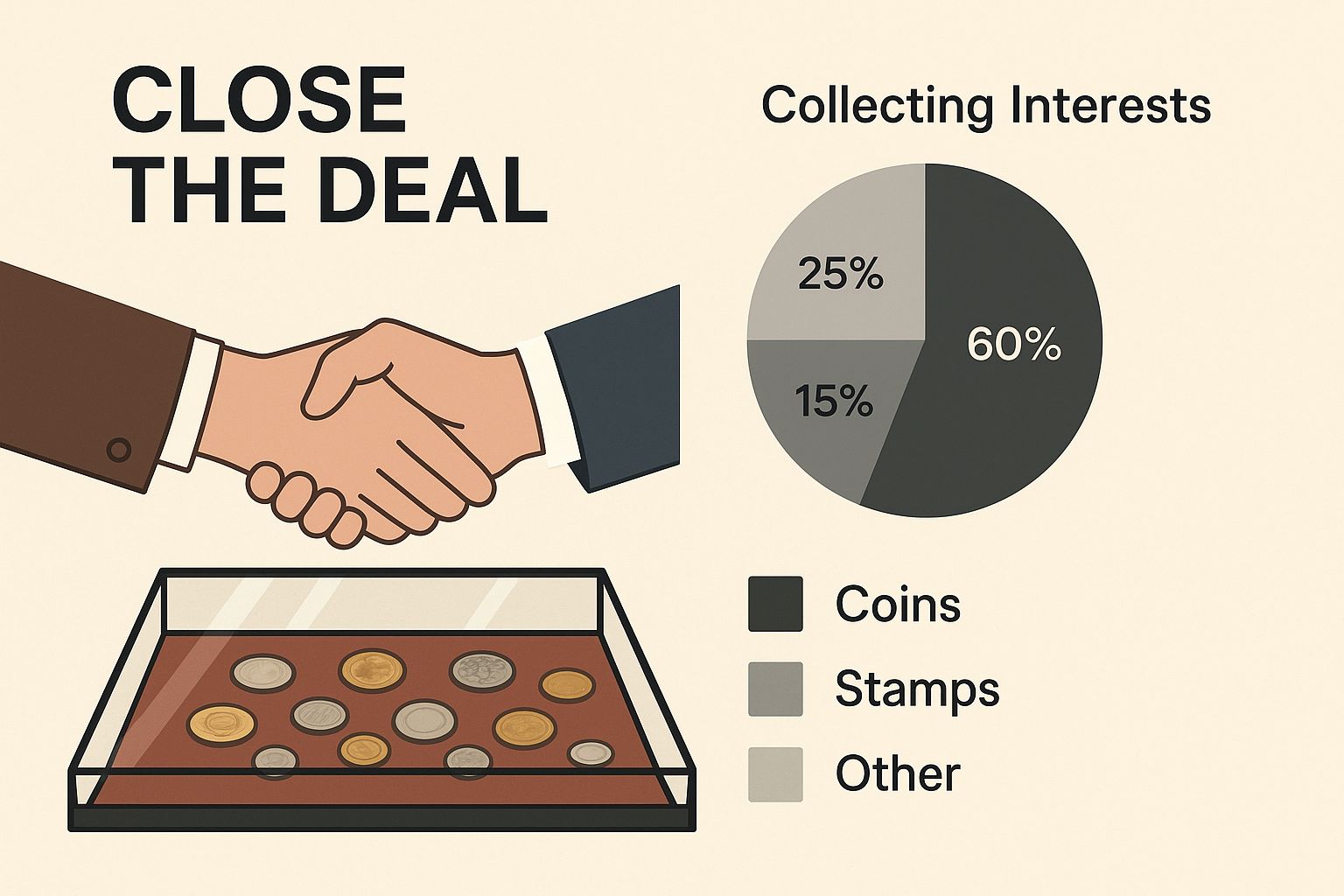

A well-presented and organised collection immediately signals to a potential buyer—whether it’s a dealer or a fellow collector—that this is a serious lot. Taking the time to do this groundwork now will save you headaches later and, more importantly, put you in a much stronger negotiating position.

The Golden Rule: Don't Clean Your Coins

I can't stress this enough. It might seem like a good idea to polish up those old coins to make them look shiny and new, but it's one of the most damaging things you can do. You could literally wipe hundreds, or even thousands, of pounds off their value in seconds.

Collectors and experts prize a coin's original surface. The natural toning that develops over many years, known as patina, is a key part of its history and authenticity. The moment you use a cloth, a polish, or any chemical, you create tiny scratches and strip that patina away. To a trained eye, a "cleaned" coin sticks out like a sore thumb, and its value can plummet by 50% or more. What was once a rare collectible becomes little more than its scrap metal value.

My Advice: Leave them as they are. The grime, the tarnish, the toning – that's all part of the story. Numismatists (coin experts) want to see that history intact. Your job is to preserve their potential, not to make them gleam.

Create a Simple, Clear Inventory

Once you’ve put the cleaning cloths away, the next job is to figure out exactly what you have. This doesn't have to be a complicated, high-tech process. A simple spreadsheet or even a physical notebook is perfectly fine. This list will become your single most important tool for getting an accurate valuation and for every conversation you have with buyers.

To start, just lay everything out and start sorting. It often makes sense to group coins by country first, then by their value (denomination), and finally by year. This simple bit of organisation makes the whole collection much less intimidating for you and any expert you show it to.

What to Record in Your Inventory

For each coin, try to jot down these key details:

- Country of Origin: Is it a British, American, or Roman coin?

- Denomination: What is its face value (e.g., One Penny, 50 Pence, One Sovereign)?

- Year of Issue: The date stamped on the coin.

- Mint Mark: Look for a small letter that shows where it was made (this isn't on all coins).

- Condition Notes: Be honest. Make a simple note like "very worn," "looks uncirculated," or "has a deep scratch."

Before you start, it helps to have a clear plan. This quick checklist summarises the initial steps and explains why they're so crucial for a successful sale.

Initial Coin Collection Preparation Checklist

| Action | Why It Matters | Key Tip |

|---|---|---|

| Do Not Clean Coins | Cleaning destroys the original surface (patina), which can halve a coin's value. | Step away from the polish. Natural toning is highly desirable to collectors. |

| Create an Inventory | A detailed list is essential for accurate valuation and for discussions with buyers. | Use a simple spreadsheet or notebook. You don't need fancy software to start. |

| Organise Logically | A sorted collection is easier and faster for an appraiser to evaluate. | Group coins by country, then denomination, then year. It saves everyone time. |

| Handle with Care | Fingerprints and drops can cause damage, especially to high-grade coins. | Wear soft cotton gloves if possible and always hold coins by their edges. |

| Take Clear Photos | Good photos are vital if you plan to sell online or seek remote appraisals. | Use natural, indirect light and a plain background. Get clear shots of both sides. |

Following this checklist sets you up properly from the very beginning. It’s a professional approach that dealers and serious collectors will recognise and appreciate.

This preparation work is more important than ever. The global coin collecting market was valued at around $18.10 billion in 2023, and the UK has seen similar strong growth. With a surge of interest in tangible, historical assets, a well-documented collection has never been more appealing. You can find out more about how market trends could impact your collection's value at AH Coin Co.. Taking these steps transforms a box of old money into a properly presented asset, ready to achieve its true market price.

How to Figure Out Your Coin Collection’s Value

Now that you’ve got your collection organised and an inventory in hand, we get to the big question: what’s it all worth? When you're selling a coin collection, understanding its true value is your biggest advantage. It's what separates a fair price from a disappointing one.

Every single coin can have three different types of value, and believe me, they can vary dramatically.

- Face Value: This one’s simple. It’s the denomination stamped right on the coin, like ‘One Pound’ or ‘50 Pence’. For the modern, circulated change in your pocket, this is usually all it’s worth.

- Bullion Value: This is key for any coins made from precious metals like gold or silver. Its value is simply the weight of the precious metal multiplied by the current market price (often called the ‘spot price’). A British Gold Sovereign, for instance, will always be worth at least its weight in gold, no matter its condition.

- Numismatic Value: Here’s where things get interesting. This is the collector’s value, which is driven by rarity, condition, historical significance, and market demand. This value can rocket past a coin's face or bullion value, sometimes by thousands of times.

The real trick to a successful sale is pinpointing which of your coins have genuine numismatic value. That’s where the profit is.

Understanding Grade and Condition

A coin’s condition, or its grade, is the single most important factor that dictates its numismatic worth. I can’t stress this enough. A tiny difference in wear can create a huge gap in price. For example, a common Victorian penny that’s heavily worn might be worth very little, but the exact same coin in pristine, uncirculated condition could fetch hundreds of pounds.

Grading is a complex skill honed over years, but you can definitely learn the basics to get a rough idea. Coins are generally categorised on a scale from 'Poor' (worn almost smooth) to 'Uncirculated' (perfect, looking just as it did the day it was minted).

A Real-World Example: Let's talk about the 1933 penny. In any condition, it's a famous rarity and incredibly valuable. There's also a 'pattern' version from that year, which was never meant for circulation and is one of Britain's most legendary coins—worth a fortune. Yet, a standard 1934 penny in worn condition is worth next to nothing. This just shows how a coin's date and its condition work together to create massive shifts in value.

For a much deeper dive into this, you can check out our guide on how to value old coins for collectors.

Using Price Guides and Getting an Expert Opinion

For a first pass at valuation, price guides and online resources are your best friends. A great starting point is looking up recent auction results on platforms like eBay—not just what people are asking for, but what coins actually sold for. This gives you a real-time feel for the current market.

However, for UK collectors, nothing beats a dedicated printed guide. The 'British Coin Market Values' guide, for example, is brilliant. It provides annually revised market prices for coins from the last 2,000 years of British history, helping you make properly informed decisions.

If your own research suggests you have some particularly valuable coins (let's say anything you think is worth over £300), it’s time to call in a professional. A reputable dealer can give you an appraisal, or for top-tier coins, an official grading service like PCGS or NGC can provide a definitive grade and valuation. Yes, it costs money, but for your best pieces, it adds a huge amount of value and buyer confidence. It's often an investment that pays for itself.

Finding the Right Place to Sell Your Coins

Knowing what your collection is worth is only half the battle. The other, arguably more crucial, half is finding the right person to buy it. There’s no single ‘best’ place to sell a coin collection; the right choice really boils down to what you have, its value, and how quickly you need the funds.

Choosing the right sales channel is the final, critical step in getting the best possible return for your coins. Let's break down your main options.

The Local Coin Dealer

For many, the most straightforward path is visiting a local coin dealer. This route is all about speed and convenience. If you want a simple, no-fuss sale, it’s hard to beat. You can often walk in with your collection and leave with cash in hand the very same day.

The immediate payment is a huge draw. But it's important to remember that dealers are running a business. They need to make a profit, so they'll offer a price below the full retail value to give themselves a margin for when they resell. This is a perfectly fair trade-off for the convenience they offer.

A dealer is a fantastic choice for lower to mid-value collections or if you're looking to sell common coins in bulk. Honestly, the time you'd spend trying to sell them one by one just wouldn't be worth the small extra profit.

Major Auction Houses

If you’ve discovered your collection contains some genuinely rare or high-value treasures, a major auction house like Spink or Dix Noonan Webb (now Noonans) is where you could see spectacular returns. These institutions have a global client base, attracting serious collectors and investors with deep pockets.

Be prepared for a much slower process. From consignment to the actual auction day and final payment, it can easily take several months. The fees are also significant. Commission rates often fall between 15% and 25% of the hammer price, which can come as a shock if you aren't expecting it. However, for a truly stellar coin, the fierce bidding at auction can push the price far beyond what any dealer could ever offer.

Selling Your Coins Online

Online marketplaces have thrown the doors wide open for anyone selling a coin collection. Platforms like eBay give you direct access to millions of potential buyers, but this freedom comes with its own set of responsibilities.

Expert Insight: Selling online puts you in the driver's seat, but it also means you're responsible for everything. You have to take high-quality photographs, write accurate and compelling descriptions, manage the listings, answer endless questions, and figure out secure, insured shipping. It's a serious time commitment.

Here’s a look at the most common online options:

- eBay: The undisputed giant with the biggest audience. It’s great for mid-range coins, but you need to be aware of the fees (typically around 13% of the final sale price plus a fixed charge) and the potential for dealing with difficult buyers.

- Specialist Forums: Websites like The Royal Mint Community have dedicated 'buy and sell' sections. Here, you're dealing with a knowledgeable crowd, which can be a real positive, but the audience is much smaller. Trust is everything in these communities.

Comparing Coin Selling Venues

To help you decide, here’s a quick comparison of the most common places to sell a coin collection. Think about what matters most to you—speed, price, or convenience.

| Selling Venue | Best For | Potential Fees | Sale Speed |

|---|---|---|---|

| Local Coin Dealer | Lower-value collections, bulk coins, and quick cash needs. | Buys at wholesale (below retail). | Very Fast (often same-day) |

| Major Auction House | Extremely rare, high-value, or certified coins. | High (15-25% commission). | Slow (can take several months) |

| eBay | Mid-range to moderately valuable individual coins. | Moderate (approx. 13% + charges). | Moderate (depends on listing) |

| Specialist Forums | Niche coins; selling directly to fellow collectors. | Low to none (platform dependent). | Varies widely |

Ultimately, the best venue is the one that aligns with your specific coins and your personal goals as a seller.

The market for selling coins is strong, supported by a healthy network of dealers, auction houses, and online platforms across the UK. Growth in the European coin market is projected to be robust, expanding at around 10.5% annually for the next few years. This trend creates a favourable environment for sellers. For a complete comparison of your options, you might find our guide on the top places to sell old coins in 2025 helpful.

Right, you’ve sorted and valued your coins. Now comes the part that can genuinely make or break a sale: presentation.

How you showcase your coins is about more than just looking professional; it’s about giving a potential buyer the confidence to pay top price. Think of it this way: a serious collector isn't just buying the coin, they're buying your story and the care you've put into it. A shoddy presentation screams "I don't know what I have," and that's an invitation for lowball offers.

Getting the Pictures Right

When you're selling online, your photographs aren't just pictures; they are your product in the eyes of a buyer. The good news is you don’t need a fancy camera setup. Your smartphone is more than capable, as long as you pay attention to a few key details. The goal here is clarity and honesty, not winning a photography award.

Clear, sharp images let buyers do their own grading. They can zoom in, inspect the surfaces, and feel confident in what they're bidding on. If your photos are blurry, dark, or out of focus, a buyer will immediately assume you're hiding something – scratches, cleaning, or other damage. They'll bid low to cover that risk, or simply move on.

Here are a few pointers I've picked up over the years:

- Find good, natural light. The best light for coin photography is the soft, diffused light you get near a window on an overcast day. Avoid direct, harsh sunlight at all costs, as it creates glare and deep shadows that obscure crucial details.

- Use a simple, neutral background. A plain white or black piece of card works wonders. It makes the coin the hero of the shot without any distracting colours or textures.

- Show everything. You absolutely must photograph the obverse (the ‘heads’), the reverse (the ‘tails’), and the edge. For more valuable coins, the edge shot is non-negotiable, as it can reveal filing, damage, or other alterations.

- Steady your shot. You don't need a professional tripod. Just resting your phone or camera on a stack of books will eliminate the slight shake from your hands that ruins sharpness.

A Pro Tip: If you can, always take coins out of their plastic flips or capsules for photos. That plastic is notorious for causing glare and hiding the very details a buyer wants to see. Just remember to handle the coins carefully by their edges.

Writing Descriptions That Sell

With great photos in hand, your next job is to write a description that tells the coin’s story. A good listing anticipates a buyer's questions and answers them upfront, building immediate trust. Be direct, be honest, and pull all the key information from the inventory you already created.

Your description needs to include:

- The coin's year, denomination, and country.

- Any mint marks you've identified.

- A straightforward summary of its condition. Mention the good stuff, like any remaining lustre or attractive toning, but also be upfront about any noticeable scratches, dings, or wear.

For example, don't just write "Old Victorian Penny." A much stronger, more trustworthy description is: "1888 Victoria Penny, in a good circulated condition. The details on the portrait and shield are clear, with even wear you'd expect for its age. No major scratches or edge knocks are visible." See the difference? That level of detail shows you know your stuff.

Packing and Shipping Securely

The sale isn't over until the coin is safely in the buyer's hands. How you pack and ship your coins is the final, crucial step. Getting this right protects your coins, your money, and your reputation.

Individual coins should always be placed in soft, inert holders (the cardboard and plastic ones known as 2x2 flips are perfect). Then, secure these inside a padded jiffy bag or, for multiple coins, a small, sturdy box. The key is to make sure they can’t rattle around and damage each other in transit.

For anything of value, and I mean anything over £20-£30, you must use a tracked and insured shipping service. A service like Royal Mail Special Delivery is the standard for a reason. It gives both you and the buyer complete peace of mind and provides proof of delivery, which is your best defence against any potential claims or disputes.

Common Mistakes to Avoid When Selling Coins

Dipping your toes into the coin market can feel a bit like navigating a minefield, especially if you're new to it all. One wrong move can unfortunately turn a potentially profitable sale into a very expensive lesson. Knowing what pitfalls to look out for is the best way to protect your investment and make sure selling your collection is a smooth, rewarding experience.

The biggest mistake, and one that absolutely bears repeating, is improper cleaning. Never, ever attempt to polish, scrub, or use any kind of chemical on a coin. You might think you're improving its appearance, but you're actually destroying its numismatic value in an instant. Collectors want originality; they pay for the history that's etched into the coin's natural surface and patina. Cleaning wipes that history away, leaving behind microscopic scratches that are glaringly obvious to any expert. A moment of good intention can cost you hundreds, if not thousands, of pounds.

Another classic trap is accepting the very first offer that comes your way. This is particularly dangerous when dealing with unsolicited approaches or dealers who seem a bit too keen. A quick offer can feel like an easy victory, but more often than not, it's a sign that your coins are worth a lot more than you're being told.

A Word of Caution: A professional, reputable dealer will want you to do your homework. They'll explain their offer clearly and won't pressure you into making a snap decision. If an offer feels rushed or too good to be true, treat it as a massive red flag. Always give yourself time to get a second, or even a third, opinion before you agree to anything.

Overlooking the Fine Print

When you sell through an auction house or an online platform like eBay, the fees can take a serious bite out of your final payment if you're not paying attention. It’s easy to get carried away by a high hammer price, only to be brought back to earth with a thud when you see the final figure.

Always read the terms and conditions with a fine-tooth comb.

- Auction houses typically charge a seller's premium, which can be anywhere from 15-25% of the final sale price.

- You might also face extra charges for lotting, photography, or insurance.

- Online marketplaces have their own fee structures to get your head around.

Understanding these costs upfront is the only way to accurately work out what you’ll actually receive.

Selling Everything in Bulk

Selling an entire collection as one single lot is certainly convenient, but it's rarely the most profitable way to do it unless you have a complete, curated set. The reality is that most collections are a mix of common, lower-value coins and a few standout "key date" or high-grade specimens.

The best strategy is almost always to cherry-pick these star coins and sell them individually. Once you've maximised their value, you can sell the remaining common coins as a group to a dealer. This hybrid approach gets you the best price for your best pieces, without creating too much work for the rest.

For more on this, you can check out our detailed guide on the seven key errors to avoid when collecting coins. Sidestepping these common slip-ups puts you firmly in control, ensuring you walk away with the best possible price for your collection.

Got Questions About Selling Your Coin Collection? We've Got Answers

Stepping into the world of selling a coin collection, especially one that's been carefully built over years, naturally brings up a lot of questions. Getting clear, honest answers is the only way to move forward feeling confident you're making the right move. Let's tackle some of the most common queries we hear from sellers.

Should I Get My Coins Professionally Graded Before Selling?

This is a big one, and the answer isn't always straightforward. For the bulk of most collections – the common date coins, the circulated pieces – professional grading just doesn't make financial sense. You could easily spend more on the grading fee than you'd add to the coin's value.

But, there's a flip side. If your own research points to a particularly rare or high-value coin in your possession, then getting it graded is a very shrewd move. As a rule of thumb, if you suspect a coin could be worth over £300, professional authentication is worth every penny. A coin slabbed by a top-tier service like PCGS or NGC isn't just a coin anymore; it's a guaranteed article, and that certainty can dramatically increase its final sale price.

For most mixed-value collections, a well-organised inventory and sharp, clear photos will do the job perfectly well.

Is It Better to Sell My Collection All at Once or Coin by Coin?

The right path here really hinges on what kind of collection you have. If you’re sitting on a complete, curated set – say, a full run of UK sovereigns from a particular monarch – selling it as a single unit can often bring a premium. Collectors will frequently pay more for the convenience of buying a finished set in one go.

For a more typical, mixed collection that has a few star players amongst a lot of common coins, you'll almost always get a better total price by being strategic. The best approach is to cherry-pick your most valuable "key date" or high-grade coins and sell those individually. After you've got the best possible price for them, you can then bundle the remaining, lower-value coins together as a 'lot' and sell them to a dealer for a fair bulk price.

Our Experience Shows: The "hybrid" approach usually gets the best results. Sell the stars of your collection one by one, and then sell the supporting cast in bulk. It’s the perfect balance of maximising profit without creating endless work.

How Do I Find a Trustworthy UK Coin Dealer?

Finding a dealer you can trust is absolutely essential. A fantastic starting point is to look for dealers registered with the British Numismatic Trade Association (BNTA). To be a member, dealers have to abide by a strict code of ethics, which gives you a great deal of assurance.

Beyond that, look for dealers with a real, physical shop, a long-standing reputation, and a good number of positive online reviews. Don't ever feel pressured to sell on your first visit. Get a second or even a third opinion on your collection’s value; any reputable dealer will completely understand and respect you for doing your due diligence.

What About Tax? The Implications of Selling a Coin Collection in the UK

This is a crucial point that's often overlooked. The good news is that in the UK, most coins classified as legal tender are exempt from Capital Gains Tax (CGT). This includes many of the most popular investment coins, like Gold Sovereigns and Silver Britannias.

However, if you make a profit from selling other types of coins, like historical or foreign issues, that profit could be subject to CGT if your total capital gains for the tax year go over the annual allowance. Tax rules can get complicated, so for advice tailored to your personal circumstances, it's always best to check the official gov.uk website or have a chat with a qualified financial advisor.

At Cavalier Coins Ltd, we're passionate about helping collectors, whether they're buying or selling. If you're looking to part with a collection or find that one special piece you've been searching for, we provide expert guidance and a superb selection. Visit Cavalier Coins Ltd today to explore our collections and learn more.