Before you even think about selling, you need to lay the groundwork. This isn't just about getting a good price; it's about making sure you don't get a bad one. Taking the time to figure out exactly what you have, what state it’s in, and what makes it tick is your best defence against undervaluing your collection. This prep work will set you up for a much more profitable sale down the line.

What You Need to Know Before You Sell

The first phase of selling your coins has nothing to do with finding a buyer. It’s all about becoming an expert on what’s in front of you. It doesn't matter if you've inherited a dusty jar of old sovereigns or meticulously collected modern commemorative coins; the starting point is always the same: identification.

Get yourself a simple spreadsheet or even just a notebook. For every single coin, log its denomination, the year it was minted, and any mint marks you can see. These tiny details can make a world of difference to a coin's value. A common British penny, for example, might be worth very little, but find one with a rare mint mark or from a year with a low mintage, and suddenly you’re looking at something far more interesting to collectors.

Assessing the Condition Honestly

Once you know what your coins are, you need to get real about their condition. Professional numismatists have a formal grading scale, but you can start with a simpler, honest approach. Look closely for signs of wear and tear, any obvious scratches, and especially any evidence of cleaning. Cleaning is a huge red flag; a harshly cleaned coin can lose a shocking amount of its value, sometimes as much as 90%, because the original surface and patina are gone forever.

One of the most common mistakes new sellers make is trying to 'spruce up' their coins. Please don't. Even a gentle wipe can leave micro-abrasions that a seasoned dealer will spot a mile off. It's almost always better to leave them as they are.

The goal here is to be brutally honest with yourself. Does the coin look like it just left the mint (Uncirculated), or are the finer details worn smooth from years in circulation? Your honest answer to this question has a direct impact on its market price.

Understanding Value Drivers

The final piece of your homework is to get a handle on what really drives a coin's value. It’s not just about the basics. Several other factors come into play, and you need to be aware of them.

- Rarity: This one’s straightforward. How many were made? A coin from a low-mintage year is naturally harder to find and, therefore, often more valuable.

- Historical Context: Does the coin mark a major event or come from a pivotal time in history? This story can add a huge amount of appeal for buyers who are looking for more than just a piece of metal.

- Metal Content: For bullion coins, like gold Sovereigns or silver Britannias, the value is intrinsically linked to the live spot price of the precious metal they contain.

- Collector Demand: Some coins are just hot property. Spending a bit of time on collector forums or looking at recent auction results will give you a feel for which coins are in high demand right now.

Putting in the effort to build this detailed picture of your collection is non-negotiable. It’s what turns you from someone who simply owns coins into an informed seller, ready to enter the market with confidence and secure the best possible price when selling your coins.

How to Accurately Value Your Coin Collection

Getting the price right is probably the single most important part of selling your coins. Ask too much, and they’ll just sit there. Ask too little, and you're leaving money on the table. Let’s walk through how to find that sweet spot so you get a fair, realistic price for your collection.

First up, you need to understand the difference between a rough guess and a proper valuation. For any coins that are particularly rare or valuable, getting them professionally graded is a smart move. Independent, third-party grading services give you an unbiased, official assessment of a coin’s condition and authenticity. This certification removes any doubt for potential buyers and usually lets you ask for a higher price, which often covers the grading fee and then some.

Of course, not every coin in a collection warrants that expense. For more common pieces, your time is better spent digging into some market research.

Researching Recent Sales Data

At the end of the day, a coin is only worth what someone is willing to pay for it right now. This is why looking at recent sales data is your best tool. You have to look past the prices in guidebooks and see what similar coins have actually sold for in the last few months.

A few places to check:

- Auction House Archives: Major auction houses often publish their past results online. Find coins that match yours in type, year, and—crucially—condition.

- Online Marketplaces: Sites like eBay have a brilliant "sold listings" filter. It’s an invaluable way to see real-world prices for a massive variety of coins.

- Dealer Websites: Many coin dealers list their stock with prices. These are retail prices, so they're on the higher end, but they give you a good feel for the market value.

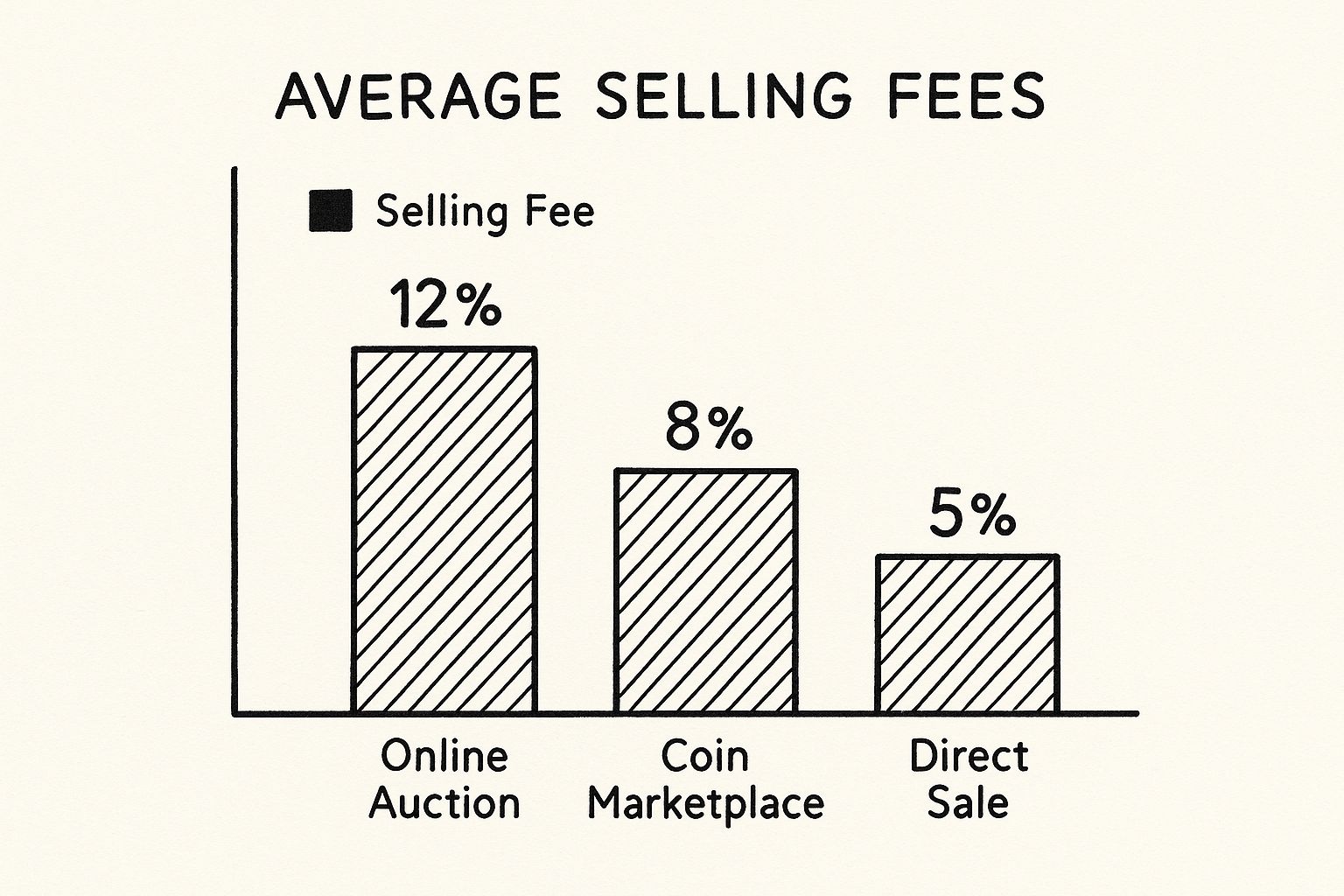

This chart shows how different selling methods can affect your final profit, mostly due to fees.

As you can see, selling directly often means lower fees, while online auctions tend to take a bigger slice. It's something you definitely need to factor into your pricing.

Before settling on a valuation method, it's worth comparing your options. Each approach has its own strengths and weaknesses, depending on what you're trying to value.

Comparing Coin Valuation Methods

| Valuation Method | Best For | Pros | Cons |

|---|---|---|---|

| Professional Grading | High-value, rare, or key-date coins | Provides unbiased, certified grade; Increases buyer confidence and sale price. | Can be expensive; Takes time to get the coin graded and returned. |

| Auction Archives | Getting a pulse on current market demand | Reflects real-world, recent sale prices; Great for specific and comparable coins. | Data can be skewed by single high-profile sales; Access may be limited. |

| Online Marketplaces | Common to mid-range coins | Huge volume of data; "Sold listings" show actual prices paid. | Can be flooded with fakes or poorly described items; Prices can vary wildly. |

| Dealer Price Lists | Quick reference and market ballpark | Easy to access; Gives a good sense of the retail market value. | These are asking prices, not sold prices; Reflects a dealer's markup. |

| Price Guides/Books | UK coins and establishing a baseline | Organised and comprehensive; Updated annually for the UK market. | Can become outdated quickly; May not reflect short-term market fluctuations. |

Ultimately, using a mix of these methods will give you the most accurate picture.

Leveraging UK Coin Market Resources

If you're selling British coins, you're in luck. The UK market is incredibly well-documented, with collectors always on the lookout for everything from ancient Celtic pieces to modern commemoratives. There are annually updated price guides published that provide detailed valuations for thousands of coins, helping you accurately price items based on condition, rarity, and current demand. To learn more, check out our guide on expert coin collection valuation tips for UK coins.

This kind of structured information is a massive help. To give you an idea, some of the 2025 price guides for British coins run to nearly 200 pages of detailed valuations—that’s how organised the UK's coin market is.

One of the biggest mistakes I see is people relying on a single source. Always cross-reference prices from at least three different places—say, an auction result, a dealer's listing, and a price guide—to land on a balanced and defensible price for your coin.

Taking this methodical approach strips the guesswork and emotion out of pricing. It gives you the solid data you need to price your coins with confidence and avoid the common pitfalls that cause sellers to lose out on what their collection is truly worth.

Choosing the Right Place to Sell Your Coins

Alright, you've got a solid idea of what your coin is worth. Now comes the big decision: where do you actually sell it? This isn't a minor detail. The path you choose will directly influence the price you get, the fees you pay, and how quickly you see the money.

Each option has its own rhythm and rules. There’s no single “best” way—it all comes down to what you’re hoping to achieve. Are you after a quick, no-fuss sale? Or is your main goal to squeeze every last pound out of the coin, even if it takes more time and effort?

Let’s walk through the main routes for selling your coins in the UK so you can figure out which one fits you best.

Selling Directly to a Local Coin Dealer

For many people, popping down to the local coin dealer is the most straightforward choice. It’s often the quickest way to turn your collection into cash. You can walk in, get an expert appraisal, and potentially leave with payment the very same day. No photos, no online listings, no trips to the post office.

The catch? The price. A dealer is a business and needs to make a profit, so they'll offer you a wholesale price—less than its full retail value. They're taking on the work of finding the final buyer. This is a brilliant option if you have a collection of low-to-mid-value coins and your top priority is a simple, immediate sale.

A reputable dealer will always be upfront about their offer and should be happy to explain their valuation. It’s smart to visit a couple of different shops to compare offers before you commit.

Using a Specialised Auction House

If you’re sitting on a truly rare, high-value coin or an impressive collection, an auction house is likely your best bet. These places are magnets for serious collectors and investors who are ready to compete for top-tier items. This competition can drive the final price well beyond what you'd get from a direct sale.

Of course, this route is a bit more involved. You’ll consign your coins to the auction house, which then takes care of everything from cataloguing and marketing to running the sale. There will be fees, usually a seller’s premium, and you won't get paid until the hammer falls and the buyer has settled up. For the right kind of coin, though, the potential for a spectacular price makes the wait and the fees entirely worth it.

Listing on Online Marketplaces

Platforms like eBay put you firmly in the driver's seat. You’re in charge of the price, the listing, and all communication with potential buyers. This hands-on approach can get you a price much closer to retail, as you’re effectively cutting out the middleman. Plus, you gain access to a huge global audience.

With that control comes responsibility. You’ll need to take excellent, high-quality photos and write detailed, accurate descriptions. You'll also have to manage packaging and arrange for insured shipping, which is crucial. Don't forget to factor in the platform's fees when setting your price.

For a deep dive into mastering this method, check out our complete success guide on how to sell coins in the UK.

Navigating Crypto Exchanges

For those dealing in the digital realm, centralised exchanges like Coinbase or Binance are the standard. These platforms offer fantastic liquidity, which means there’s always a ready market of buyers and sellers. This allows you to sell your assets almost instantly at the going market rate. The whole process is built to be simple, with user-friendly interfaces for placing your sell orders.

The UK is a prime location for this. Britain is a world leader in cryptocurrency adoption, which is great news for sellers. A 2025 report showed that an incredible 35% of the British population—that's roughly 24 million people—now own or use crypto. This high adoption rate fuels a buzzing marketplace with plenty of trading volume, making it much easier to cash out your digital assets.

Creating a Listing That Attracts Serious Buyers

How you present your coins can be the difference between a fast, profitable sale and a listing that gets completely ignored. After all the hard work identifying and valuing your pieces, this is the final, crucial step. It’s where you convince potential buyers that your coin is the one they've been searching for. At its core, it’s about building trust and showcasing genuine value.

The foundation of any great listing, especially when you are selling your coins online, is high-quality photography. Your photos have to do all the heavy lifting because a buyer can’t hold the coin and inspect it themselves.

Forget about using your phone's flash. It just creates a harsh glare that hides the very details a collector wants to see. Instead, find some natural, indirect light from a window or, if you’re getting serious, a simple light box works wonders. Place your coin on a neutral, non-reflective background—a piece of dark felt is perfect. You need crystal-clear shots of both the obverse (front) and reverse (back), and if you can manage it, a clear shot of the edge. Every scratch, mint mark, and subtle nuance of the coin’s surface must be visible.

Writing a Description That Sells

With compelling photos in hand, it’s time to write a description that’s clear, honest, and packed with the right information. You're not trying to be a novelist; you're providing the essential facts a serious collector needs to make an informed decision.

A well-structured and scannable description is key. Always lead with the most important details before you get into any interesting backstory.

- Essential Coin Details: Kick things off with the absolute basics. Clearly state the coin’s denomination, country of origin, year of mintage, and any visible mint marks.

- Condition and Grade: This is where honesty is non-negotiable. Be completely transparent about the coin's condition. Mention your own assessment of its grade (e.g., "appears to be in Fine condition") and point out any flaws like scratches, rim dings, or signs of cleaning. This is how you build confidence with buyers.

- Unique History: If the coin has any interesting provenance or historical significance, now’s the time to share it. A short, compelling story can really make your listing stand out from hundreds of others.

- Logistics: Don't forget the practical stuff. Clearly state your accepted payment methods, shipping costs, and whether you offer insured and tracked delivery.

One of the most common mistakes I see is vague or overly enthusiastic descriptions. Stick to the facts. A serious buyer is far more impressed by a detailed, accurate listing than by empty claims that a coin is "super rare and amazing."

This principle of clarity extends to the digital world, too. When you’re selling cryptocurrency on an exchange, your "listing" is the sell order you create. Understanding the difference between a market order (selling immediately at the current best price) and a limit order (setting a specific price you’re willing to sell at) is vital. A market order gets it done quickly, while a limit order gives you control, ensuring you don’t sell for less than you intended.

Whether you're crafting a physical listing or a digital sell order, getting the details right sets the stage for a successful sale.

Finalizing Your Sale and Getting Paid Securely

You’ve found your buyer and agreed on a price. That’s a fantastic result, but don't get ahead of yourself. The final steps are where a deal is truly cemented, and rushing this part can lead to some painful and costly mistakes. This is where a little careful planning makes all the difference, ensuring a smooth and secure transaction.

For anyone selling physical coins, getting paid safely has to be your number one priority. I’d steer well clear of any risky payment methods. Instead, stick to secure options like a direct bank transfer or a trusted third-party payment service. Whatever you do, never, ever ship a coin until you've confirmed the funds have fully cleared and are sitting safely in your account.

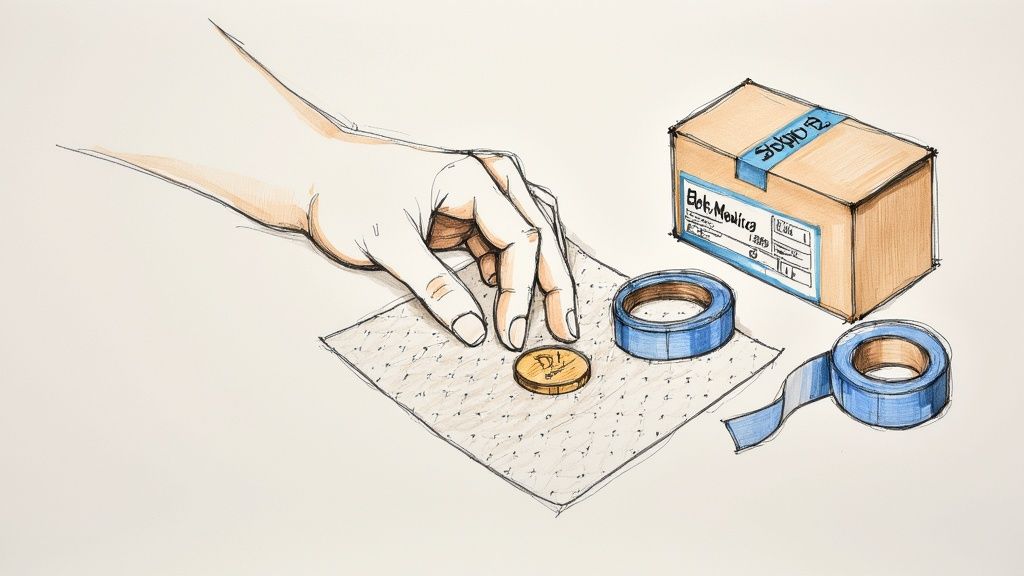

Once the payment is sorted, your focus shifts to packaging. A coin rattling around loose in an envelope is just asking for trouble.

- First, pop the coin into a soft, non-PVC flip or a proper capsule to protect it.

- Next, sandwich this between two solid pieces of cardboard. Tape them together so the coin has absolutely no room to move.

- Finally, place that secure package inside a padded bubble mailer.

This little bit of effort is what prevents scratches and dings, making sure the coin arrives in the exact condition your buyer is expecting.

Always use an insured and tracked shipping service, something like Royal Mail Special Delivery Guaranteed. The extra few quid gives you complete peace of mind and protects you against loss or damage in transit. For valuable items, this is non-negotiable.

Securing Your Digital Coin Sale

The process is a bit different but just as important when you’re selling your coins in the crypto world. Once you’ve sold your crypto on an exchange, the last step is to withdraw the fiat currency (like GBP) into your bank account. Keep a close eye on the exchange’s withdrawal fees, as they can definitely take a bite out of your profits.

If you’re transferring crypto before selling, the single most important rule is to triple-check the recipient's wallet address. One mistyped character can send your funds into the digital void, lost forever. There are no take-backs with crypto transactions.

The UK is a great place for these activities right now, as the market is expanding at a real pace. In 2024, the UK's cryptocurrency market was valued at around USD 334.3 million, with strong growth on the horizon. This growing environment offers sellers better security and accessibility. You can dig into the specifics of this market growth in a report from Grandview Research.

Keeping the Tax Man in Mind

Lastly, don’t forget about your legal duties. Here in the UK, profits from selling coins—both the physical kind and digital ones—can be subject to Capital Gains Tax (CGT) if they push you over your annual tax-free allowance.

Keeping meticulous records of your purchase price, sale price, and any fees you paid along the way (like auction commissions or exchange fees) is absolutely essential. This paperwork will be a lifesaver if you need to file a tax return. For a broader look at the whole journey, our complete success guide to selling coin collections is a fantastic resource to have on hand.

Common Questions About Selling Coins

When you’re thinking about selling my coins, a few final questions often pop up. It’s completely normal. Let’s walk through some of the most common ones to make sure you move forward with total confidence.

One of the biggest worries is getting the valuation right. Can you really trust your own research? While checking sold listings online gives you a solid starting point, for any coin that feels like it might be something special, getting a professional opinion is always a smart move.

Another frequent question is about where to actually sell. Is a local dealer better than an auction? It really boils down to what you value most.

- For Speed and Simplicity: Nothing beats a local dealer. You can often walk in, get an offer, and walk out with the money in a single afternoon.

- For the Best Price: An auction house or a carefully put-together online listing will usually fetch a higher final price. This route just requires a bit more time and effort on your part.

Are There Tax Implications When Selling Coins?

Yes, and this is something you absolutely need to be aware of. In the UK, any profit you make from selling collectable coins could be subject to Capital Gains Tax (CGT), but only if your total gains in a tax year go over your annual allowance.

This is exactly why keeping good records is so important. You’ll need to track what you originally paid for the coin, the final price it sold for, and any costs you had along the way, like auction fees or postage. This paperwork is your proof if you ever need to declare your gains.

Remember, it’s always your responsibility as the seller to understand and handle any tax obligations. If you’re ever in doubt, having a quick chat with a tax professional is the safest and smartest thing to do.

Finally, people often ask if it’s safe to post valuable coins. It’s a very valid concern, but one that’s easy to manage. Don’t ever skimp on postage. Always, always use an insured and tracked service like Royal Mail Special Delivery Guaranteed. The small extra cost is nothing compared to the potential loss of a valuable coin, and it gives both you and your buyer complete peace of mind.

Ready to take the next step in your coin-collecting journey? Whether you're buying, selling, or just browsing, Cavalier Coins Ltd offers a vast selection and expert support. Explore our collection and find your next treasure today!