Before you even think about selling your silver coins, the first and most critical step is to understand exactly what you have. This isn't just about counting coins; it's about knowing their story and potential. Getting this right is the foundation for a successful sale, ensuring you don't accidentally let a rare, valuable piece go for its simple metal weight.

Your first job is to figure out if your coins are valued for their bullion content or their numismatic (collector) appeal.

Understanding What You Own Before You Sell

Jumping into the market without a clear inventory is like sailing without a map. You might end up somewhere, but it's unlikely to be where you wanted. A silver coin's value comes from two very different places, and recognising which applies to your collection is paramount.

The most common source of value is a coin's intrinsic metal content, what we call its bullion value or "melt value." This is the baseline worth, determined purely by the weight and purity of the silver inside, tied directly to the daily silver spot price. Modern coins like the Silver Britannia or American Silver Eagle are classic examples, mainly bought and sold for the silver they contain.

On the other hand, some coins possess a numismatic value—the price a collector is willing to pay. This value can soar far beyond the melt price, driven by a cocktail of different factors.

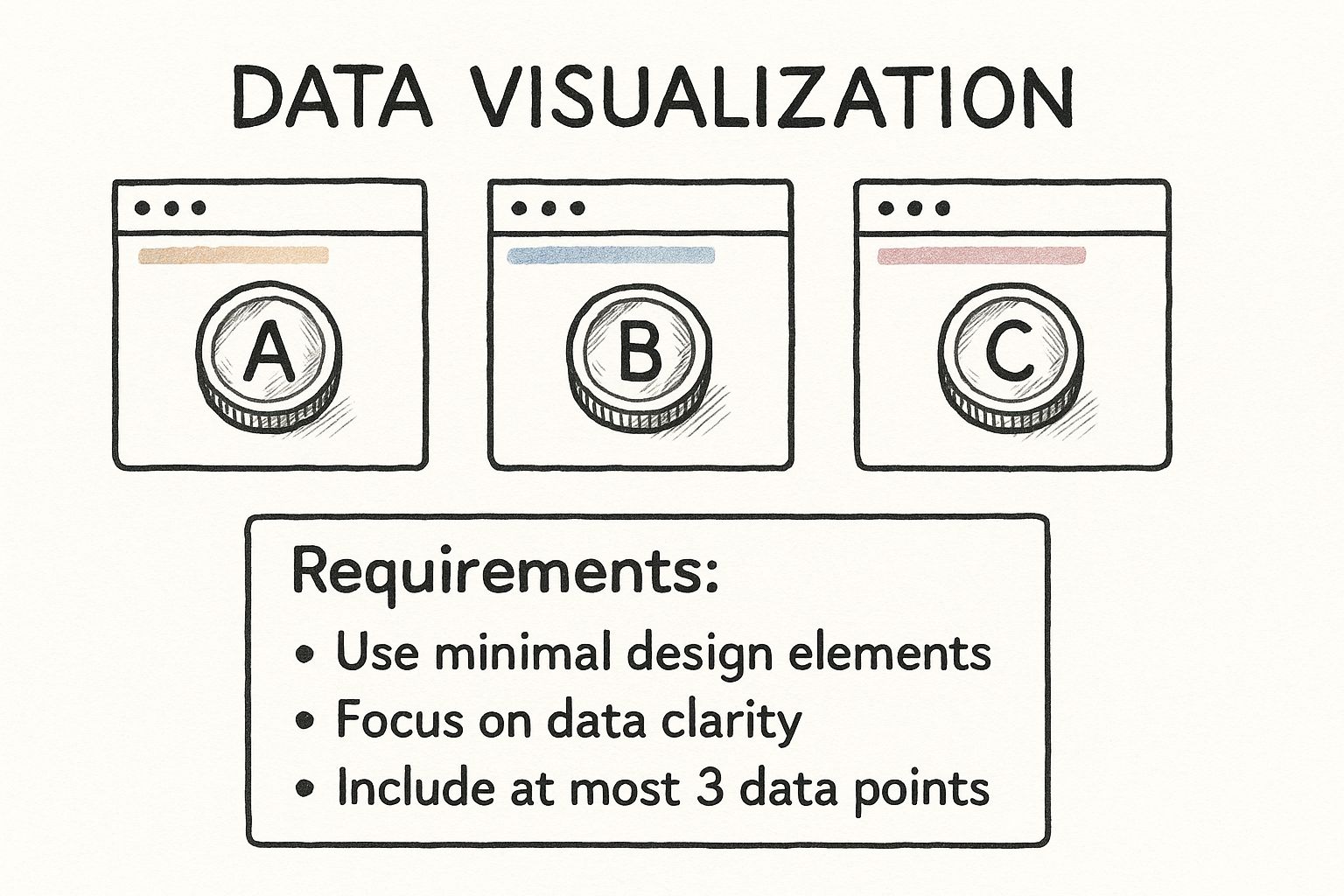

To help you get a quick sense of your collection, here’s a simple breakdown.

Bullion vs Numismatic Value At a Glance

A quick comparison to help you identify the potential value of your silver coins.

| Attribute | Bullion Coins (Melt Value) | Numismatic Coins (Collector Value) |

|---|---|---|

| Primary Value Source | Silver content (weight and purity) | Rarity, condition, and historical demand |

| Typical Examples | Modern investment coins like Silver Britannias, Maple Leafs, or "junk silver" (pre-1947 UK coins) | Old, rare coins, error coins, or high-grade commemorative issues |

| Price Fluctuation | Follows the daily spot price of silver | Driven by collector market trends, can be stable or increase independently of metal prices |

| Appearance | Often in good condition, but wear doesn't erase its core value | Condition is critical; a pristine coin is worth far more than a worn one |

This table should give you a starting point for sorting your coins into two piles: those valued for their metal and those that might be special. Now, let's dig into what makes a coin special to a collector.

Key Drivers of Numismatic Value

A coin's collector value is a puzzle made of several pieces. If you can learn to spot these, you'll be able to find the hidden gems in your collection.

- Rarity: Simply, how many were made? A coin with a low mintage, especially from a specific year or mint, is naturally scarcer and more desirable.

- Condition: A coin in pristine, uncirculated condition will always command a higher price than one that is worn, scratched, or damaged. Whatever you do, never try to clean your coins. This can destroy their natural patina and slash their value.

- Historical Significance: Does the coin mark a specific event or represent a unique period in history? Coins tied to important moments often carry a premium.

- Mint Mark: Look for a small letter on the coin. This indicates where it was produced. For the same coin type and year, some mint marks are far rarer than others, creating a huge price difference.

The best way to start is by organising your collection. Group similar coins together and use a good magnifying glass to carefully check each one for its date, mint mark, and overall condition.

A classic mistake is treating all silver coins as equal. Take the American Mercury Dime. A common date from the 1940s might only be worth its silver melt value, a few pounds at most. But a 1916-D Mercury Dime, a famous rarity, can be worth thousands of pounds. This is exactly why proper identification is so crucial.

This initial evaluation doesn’t mean you need to become a professional grader overnight. The goal is to build a solid foundation of knowledge. By separating your obvious bullion from potentially valuable numismatic pieces, you arm yourself against lowball offers and put yourself in a position to find the right buyer for each type of coin.

How to Accurately Value Your Silver Coin Collection

Figuring out what your collection is actually worth is, without a doubt, the most important part of selling. A solid valuation is your best defence against lowball offers and gives you the confidence to negotiate for a fair price. If you don't know the true value of your coins, you're flying blind.

It all starts with getting to grips with the two parts of a coin's value. The first is its basic metal value, what we call the 'melt value' or bullion value. Think of this as the absolute floor price, calculated from the live silver spot price, the coin's weight, and its purity. This is the minimum your coin should ever sell for.

A good example is a standard one-ounce silver coin with 99.9% purity. Its melt value is directly linked to the current price of one ounce of silver. It's a simple calculation that gives you a solid starting point.

Going Beyond the Melt Value

But the real skill in valuation is figuring out the numismatic value—what a keen collector will pay over and above the silver content. This is where the real profit potential is, but it's based on a more complex mix of factors. A coin's history, rarity, and condition can make it worth many times its weight in silver.

So, what drives this collector premium?

- Rarity and Mintage: How many were ever made? Coins with low production numbers for a certain year or from a specific mint are naturally harder to find and, therefore, more sought after.

- Condition and Grade: A coin in flawless, uncirculated condition will always command a much higher price than one that’s been heavily handled. The difference can be huge.

- Historical Context: Does the coin mark a major event or come from a significant time in history? Coins with a great story behind them often carry a higher premium.

- Provenance: A documented ownership history, especially if it includes a well-known collector, can add serious value.

Grasping these factors is the difference between selling a rare coin for £25 (its melt value) and £2,500 (its true collector value). You don't need to be a professional grader, but knowing what to look for is vital. If you want a deeper dive, our article on how to value old coins gives expert tips specifically for collectors.

Using Real-World Data for Valuation

To set a realistic price, you need to consult reliable sources. Forget about guesswork from forum posts or old price guides. Experienced collectors and dealers use current, data-driven information.

The most trustworthy benchmarks are recent, verified sales. Online auction archives, like those from major auction houses or even eBay’s sold listings, give you a real-time view of what buyers are actually paying for coins just like yours.

When you're doing your research, make sure you're comparing like with like. A standard 2024 Silver Britannia won't have the same market value as a limited-mintage 2005 edition with a one-off design. The coin's own history is a perfect illustration of this.

Take the Silver Britannia coin, a favourite for UK investors. From 1997 to 2012, these coins were made from 95.8% silver. But from 2013 onwards, The Royal Mint upped the purity to 99.9% fine silver. On top of that, mintages were limited before 2013 but became unlimited after that to satisfy investor demand. This history means a pre-2013 Britannia often has a much higher numismatic premium than a modern bullion version.

Here you can see some of the different Silver Britannia designs, highlighting the kind of visual variations that collectors hunt for.

The design variety, especially on coins from odd-numbered years before 2013, is a key reason they are so collectable and stand apart from standard bullion.

By pulling together an understanding of melt value, the drivers of numismatic value, and real-world sales data, you build a powerful and complete valuation. This is the best tool in your arsenal, allowing you to walk into any negotiation—whether it's with a local dealer or an online buyer—feeling confident and in control.

Choosing the Right Place to Sell Your Coins

Figuring out where to sell your silver coins is just as critical as knowing what they're worth. The channel you pick has a direct impact on your final payout, how quickly you get your money, and how much legwork you have to do. Getting this right is all about matching the venue to your specific coins and what you want to achieve.

The best path forward really depends on what you have in your collection. A local coin shop might be the perfect spot to quickly offload common bullion coins, like Silver Britannias, where the price is pinned to the daily silver spot price. On the other hand, if you're holding a certified, rare Victorian-era coin, a specialist auction house will almost certainly bring in a much better result by putting it in front of serious collectors.

Let's break down the most common selling channels in the UK, weighing up their pros and cons to help you make a smart decision.

Exploring Local and National Dealers

Your local coin shop is often the most straightforward option. There's a real convenience to walking in with your coins and walking out with cash. These dealers are brilliant for common bullion and what's known as "junk silver" (that’s pre-1947 UK silver coins), as they buy based on weight and the current silver price. The whole process is quick, secure, and needs very little effort from you.

The trade-off, of course, is the price. A local dealer has overheads to cover—rent, staff, and insurance—and they need to turn a profit. You should expect an offer that’s a bit below the spot price, usually somewhere between 90% and 98% of the melt value. For numismatic coins, their offer will be a wholesale price, which is quite a bit less than what they'll sell it for.

National bullion dealers work in a similar way but on a bigger scale, sometimes offering slightly better rates for bullion because they deal in high volumes. Many will let you post your coins to them for a valuation and payment, which is handy if you don't have a reputable local shop nearby.

Expert Tip: Always get quotes from at least two or three different dealers before you sell. Prices can vary more than you'd think, even for standard bullion. That small percentage difference can really add up if you're selling a larger amount.

The image below gives you a sense of how different online options cater to different selling goals.

You can see how marketplaces, auction houses, and direct dealer sites each have their own unique role to play in your selling journey.

Comparing Silver Coin Selling Channels in the UK

Understanding the benefits and drawbacks of each selling option is key to making an informed choice. This table breaks it down to help you decide which path is right for your collection.

| Channel | Best For | Potential Return | Speed of Sale | Effort Level |

|---|---|---|---|---|

| Local Coin Shop | Common bullion, "junk silver," immediate cash needs | Lower | Immediate | Very Low |

| National Dealer | Bulk bullion sales, convenience if no local shop | Lower to Medium | Fast | Low |

| Online Marketplace | Semi-rare coins, reaching a broad audience | Medium to High | Variable | High |

| Specialist Auction | High-value, rare, and certified coins | Highest | Slow | Low |

Ultimately, the best approach often involves a mix of these channels, tailored to the specific coins you're selling.

Leveraging Online Marketplaces and Auctions

Taking your collection online opens it up to a global audience, which can really push up the final sale price, especially for coins that have collector appeal.

- Online Marketplaces (e.g., eBay): As the biggest marketplace for coins, eBay can be incredibly effective. The auction format can spark a bidding war for sought-after items, driving the price well beyond what a dealer might offer. You have total control over the listing and pricing. The catch? It takes a lot of effort. You'll need to take high-quality photos, write detailed and accurate descriptions, and sort out secure packaging and shipping. Don't forget to account for the fees, which can be around 10-13% of the final sale price.

- Specialist Auction Houses: For your high-value, rare, or certified coins, a specialist auction house is often the best way to go. They already have a list of serious, vetted collectors who are prepared to pay top prices. The auction house does all the heavy lifting—from professional photography and cataloguing to marketing and payment. Their expertise adds credibility to your items, but it comes at a price. Their commission, the "seller's premium," can be anywhere from 15% to 20%.

Choosing between these routes involves a clear trade-off between potential return and the effort required. For a deeper dive into the specifics, our guide covering where to sell old coins offers top options for 2025 provides more detailed insights. In the end, the right place to sell your silver coins is the one that best suits what you're selling. A diversified strategy—using a dealer for your bullion and an online auction for numismatic pieces—is often the way to get the best overall return.

How to Time the Market and Understand Price Trends

When it comes to getting the best price for your silver coins, timing is everything. While no one has a crystal ball to predict the market’s absolute peak, you can learn to read the signs. Understanding the big-picture forces that move silver prices will help you spot favourable windows to sell.

This knowledge shifts you from being a passive seller, simply accepting whatever price is offered, into a proactive one who can make a strategic, informed decision.

Decoding the Key Market Drivers

The price of silver is incredibly sensitive to global economic shifts. By keeping an ear to the ground on a few key factors, you can get a much better feel for when the conditions are ripe for a sale.

- Inflation: When the cost of living climbs and the value of currencies like the Pound Sterling drops, investors often run to the safety of tangible assets like silver and gold. This rush increases demand and can push prices up, making high-inflation periods a potentially great time to sell silver coins.

- Currency Strength: Silver is a global commodity priced in US Dollars (USD). This means the price you see in the UK is directly affected by the GBP/USD exchange rate. If the Pound weakens against the Dollar, the silver price here can rise, even if the base dollar price hasn’t moved.

- Economic Stability: In times of economic jitters or geopolitical turmoil, silver earns its reputation as a ‘safe-haven’ asset. Investors buy it to shield their wealth from a shaky stock market, which in turn drives up demand and, you guessed it, the price.

You don’t need to become an economist overnight. Just paying attention to financial news about these three areas will help you start to see the patterns that create a strong seller’s market.

Using Price Charts and Ratios to Your Advantage

Your most powerful tool is historical data. Looking at how prices have behaved in the past gives you vital context for what’s happening right now and helps you spot emerging trends. You can find free, real-time and historical price charts on almost any bullion dealer's website.

The price history of silver in the UK tells a dramatic story. Prices have swung wildly over the years, from a historic low of just £0.51 per troy ounce to an all-time high soaring around £29.26 per ounce. That’s an eye-watering increase of over 3600% from its lowest point. This volatility is exactly why timing matters so much for bullion coins like Silver Britannias. To get a better grasp of these movements, you can explore detailed UK price charts tracking the market over decades.

Here’s a chart that shows just how much silver prices have fluctuated in the UK over time.

This chart makes it clear. You can visually see the peaks and valleys, which represent the windows of opportunity that have opened and closed for sellers over the years.

Another fantastic tool is the gold-to-silver ratio. It's a simple calculation: how many ounces of silver does it take to buy one ounce of gold?

Historically, this ratio has averaged around 50:1, but it can fluctuate wildly. When the ratio is high (say, 90:1), it suggests silver is cheap compared to gold, making it a better time to buy. But when the ratio is low (e.g., 40:1), it suggests silver might be overvalued—presenting a potentially brilliant opportunity to sell.

You can track this ratio on most bullion dealer websites for a quick, at-a-glance check on silver's relative value. By combining your awareness of economic trends with practical tools like price charts and the gold-to-silver ratio, you build a solid foundation. You’ll be far better equipped to recognise a seller's market and make your move with confidence.

Preparing and Negotiating Your Sale Like a Pro

This is where all your preparation comes together. Knowing your coin's value is one thing; getting that price is another. The way you present your coins, handle negotiations, and finalise the deal can make a massive difference to your final payout.

If you’re selling your silver coins online, think of your photos as your shop window. You wouldn't believe how many sellers kill a potential sale with blurry, dark pictures. You don't need a fancy studio, though. A modern smartphone, a bit of natural light, and a plain background are all you need for crisp, appealing photos that give buyers confidence.

Your description is just as important. Be clear, honest, and give all the details: the coin's year, any mint marks, and notable features. Crucially, point out any flaws like scratches or dings. Honesty builds trust from the start and saves you from potential disputes down the line.

Mastering the Art of Negotiation

Whether you're face-to-face with a dealer or messaging an online buyer, negotiation is a bit of a dance. You want the best price, but you don't want to come across as unreasonable. Walking into that conversation armed with solid valuation research is your greatest strength.

It’s often a good idea to let the buyer make the first offer. This gives you a starting point. If their offer is fair and lines up with what you found in your research, brilliant. If it’s a lowball offer, don’t get offended – it’s a common opening tactic.

Here are a few professional ways to respond:

- “Thanks for the offer. Based on my research into recent sales for a coin in this condition, I was thinking something closer to [Your Target Price].”

- “That’s a little lower than I was expecting. Is there any movement on your price?”

- “I appreciate the offer, but I have received others closer to what I'm asking. I would need you to come up to at least [Your Minimum Price] for me to consider it.”

The secret is to stay polite but firm. You can turn down a bad offer without slamming the door on the conversation.

A classic mistake is letting emotions take over. Remember, this is a business transaction. If you can't agree on a price that works for you, be ready to walk away. There's always another buyer. Knowing your walk-away price before you start negotiating is a massive advantage.

Understanding the historical context of silver prices can also give you an edge. The UK market for silver coins has always been linked to the wider economy. Prices have swung wildly over the centuries, with silver rising from pennies to tens of pounds per ounce during major events like the world wars.

Here’s a snapshot of silver's historical price journey, which can help you get a better sense of market peaks and troughs.

The chart clearly shows just how much the value can fluctuate, highlighting why timing your sale and negotiating from a position of knowledge is so important. If you're dealing with a larger collection, have a look at our guide on how to sell old coins for the best price for more advanced strategies.

Finalising the Transaction Securely

Once you've settled on a price, the last step is to make sure the payment and delivery go off without a hitch. This is about protecting both you and the buyer.

For payments, stick to secure and verifiable methods. If you're selling in person, cash is ideal. For online sales, use trusted platforms that offer seller protection, like PayPal (Goods & Services) or a dealer’s secure payment system. It’s wise to avoid things like bank transfers with people you don’t know.

Finally, don't skimp on the shipping. Tossing a valuable coin into a standard envelope is asking for trouble.

- Secure the Coin: Place it in a non-PVC coin flip or a small, padded bag first.

- Add Padding: Wrap the secured coin in bubble wrap so it doesn't rattle around.

- Use a Sturdy Box: A small, strong box offers much more protection than a simple mailer.

- Insure Your Parcel: For any coin of real value, always use a tracked and insured service like Royal Mail Special Delivery. The small extra cost is worth it for the peace of mind.

Taking these final, careful steps ensures all your hard work pays off and the sale ends on a positive note for everyone involved.

Frequently Asked Questions About Selling Silver Coins

As you get closer to selling your silver coins, a few final questions often crop up. Getting clear, simple answers can give you the confidence to finalise the sale and help you sidestep some common blunders that could end up costing you.

How Much Do Dealers Pay for Silver Coins?

What a dealer will offer you really comes down to the type of coin you have. For common bullion coins, like a Silver Maple Leaf or American Eagle, you can expect an offer based on a percentage of the current silver spot price – usually somewhere between 90% and 98%. This small margin covers the dealer's business costs and is often influenced by their current stock levels and general market demand.

It’s a different story for numismatic or collector's coins. Here, the offer is built on rarity, condition, and how sought-after it is, which can push the value far beyond the coin's simple silver content. It always pays to get a few different quotes to make sure you’re getting a fair market price.

Should I Clean My Silver Coins Before Selling Them?

In a word: no. You absolutely should not. Cleaning coins, even with something as seemingly harmless as a soft cloth, can create thousands of tiny scratches that strip away the original surface lustre and the natural toning (patina) that develops over time.

Collectors and dealers prize coins in their original, untouched state. Any cleaning, no matter how well-intentioned, will torpedo a coin's numismatic value. It's genuinely one of the most expensive mistakes a seller can make.

The golden rule among collectors is simple: a cleaned coin is a damaged coin. Just leave them as they are to preserve their full value.

Is There Tax on Selling Silver Coins in the UK?

Yes, there can be, but there are some very important exceptions to be aware of. Certain UK legal tender coins, most notably Silver Britannias, are exempt from Capital Gains Tax (CGT) for UK residents.

However, this tax benefit doesn't apply to all silver coins, particularly those from other countries, or to any silver bars. It is crucial to check the latest HMRC guidelines or have a quick chat with a financial advisor to fully understand your tax position before you sell.

At Cavalier Coins Ltd, we provide expert advice and fair market prices for a wide range of world coins and banknotes. Whether you're a seasoned collector or just starting, explore our extensive collection or contact us for a valuation at https://www.cavaliercoins.com.