So, what really gives a Gold Sovereign its value? It’s not just one thing. A sovereign’s worth is a blend of two crucial elements: the raw value of the gold it contains, known as its bullion value, and what a collector is willing to pay for it, which we call its numismatic value.

While the gold content sets a solid price floor, it's the coin's unique story—its history, rarity, and condition—that can send its total value soaring far beyond its weight in gold.

What Really Determines Sovereign Coin Values

Think of a Gold Sovereign's value as having two layers. The foundation is its bullion content. This is a simple calculation based on the day's market price for gold, giving the coin a reliable baseline worth that moves with global economic currents. It’s a tangible asset you can track.

But the second layer, the numismatic value, is where the real story begins. This is what elevates a simple piece of gold into a historical artefact.

It’s like comparing a brand-new family car to a rare, vintage model from a tiny production run. Both will get you from A to B, but one has a rich history, a dedicated following, and a scarcity that dramatically inflates its price tag. That’s the magic of collectability.

The Blend of Bullion and Collectability

Several factors feed into a sovereign's appeal to collectors, each adding a premium on top of its basic gold weight. It’s this combination that creates the final price you see on the market.

Here are the key drivers behind a sovereign's numismatic value:

- The Monarch: Coins from shorter reigns, like those of Edward VII or George V, are often harder to find than those from Queen Victoria's long and prolific era.

- The Mint Mark: Sovereigns weren't just made in London. They were struck across the British Empire, in places like Sydney (S), Melbourne (M), and Pretoria (SA). Coins from these long-closed branch mints are often highly sought-after.

- The Year of Issue: Some years had incredibly low mintages, while others are tied to major historical events, making them far more desirable to collectors.

- Physical Condition: This one is absolutely paramount. A pristine, uncirculated sovereign will always fetch a much higher price than one that clearly shows scuffs and signs of wear from its journey through time.

The Gold Sovereign’s dual identity as both a solid investment and a fascinating collectible is what gives it such enduring appeal. Each one contains 0.2354 troy ounces of 22-carat gold and has been minted almost without a break since 1817, packing a huge amount of history into a small package.

Getting to grips with these dynamics is the first step. You can dive deeper by exploring our expert strategies to find coin value.

Understanding a Sovereign's Gold Bullion Value

The Royal Mint's official page drives home the Sovereign's status as a world-class bullion coin, celebrated for its gold content and investment appeal. It reminds us that beneath the history and artistry, every Sovereign has a core value tied directly to the global gold market.

Before we get into the nuances of dates, monarchs, and mint marks, we need to start with the basics. Every single Gold Sovereign has a foundational, real-time value. This is its bullion value—what the actual gold inside it is worth on the open market at this very moment.

Think of it as the coin’s financial bedrock. It’s a price floor that its value simply won't drop below.

Calculating this is surprisingly straightforward. A standard, full Sovereign coin contains precisely 0.2354 troy ounces (or 7.32 grams) of pure gold. To find its bullion value, you just need to multiply that weight by the current spot price of gold.

For instance, if the spot price of gold is sitting at £1,800 per troy ounce, the bullion value of one Sovereign would be:

£1,800 (spot price) × 0.2354 (gold content) = £423.72

This simple sum gives you a solid baseline for any Sovereign, at any time.

Why Gold Content Matters for Stability

This direct link to the price of gold is what makes the Sovereign such a trusted asset, especially when markets get choppy. Its value isn't just based on a collector's whim; it's anchored to a real, tangible commodity traded all over the world.

When economic turbulence hits, or inflation starts to bite, investors have historically turned to physical gold to protect their wealth.

Because the Sovereign’s worth is tied so intimately to gold, it ebbs and flows with these major financial tides. If a global event sends gold prices soaring, the baseline value of every Sovereign in existence goes right up with it—from a common, modern version to a genuinely rare historical piece.

This dual identity—part historical artefact, part bullion asset—gives the Sovereign a unique resilience. While a collector might pay a significant premium for rarity, its gold content ensures it always holds substantial intrinsic worth. It’s a reliable store of wealth, plain and simple.

Grasping this principle is the first and most important step in valuing any Sovereign. It separates the coin's raw material value from the more complex factors like history and condition that drive collector demand.

While the bullion price provides the foundation, the fascinating layers of rarity and condition are built on top of it. For a wider look at valuation principles, our expert guide on how to value old coins offers some fantastic additional context. Ultimately, this connection to the financial world makes holding a Sovereign feel like you own a small, solid piece of the global economic stage.

The Hidden Factors That Create Collector Value

This is where things get really interesting. Beyond the straightforward value of its gold content, a sovereign's journey into a true historical treasure begins. We're now entering the world of numismatics, where seasoned collectors see far more than just a piece of metal. They see a story, and it’s this narrative that creates powerful demand and can send a sovereign's value soaring far above its basic bullion price.

Think of it like a first-edition book. A modern paperback tells the exact same story, but the original printing carries a weight of history, a sense of occasion, and a scarcity that makes it exponentially more valuable. A sovereign’s numismatic, or collector, value works in precisely the same way. It all comes down to four key pillars: the monarch, the year, the mintage, and the mint mark.

These are the elements that transform a coin from a simple gold investment into a tangible piece of history. For example, a coin minted during the incredibly short reign of Edward VIII is a 'holy grail' for collectors. Why? Sheer, undeniable rarity.

The Monarch and Year of Issue

The face on the coin is your first clue. A long and prosperous reign, like Queen Victoria's, meant billions of sovereigns were produced over the decades. As a result, many of them are relatively common today. On the other hand, a sovereign from the shorter reigns of George V or Edward VII is often much scarcer and, therefore, more desirable to a collector.

The year it was struck is just as crucial. A coin’s production history has been a central part of Britain's monetary system ever since the Great Recoinage of 1816. Official records show that in 1817 alone, over 3.2 million Sovereigns were struck to tackle coin shortages after the Napoleonic Wars. Details like this help collectors pinpoint specific years of high and low production. If you fancy a deep dive, you can explore the full sovereign mintage figures from BullionByPost.

This historical context is exactly why some years are more sought-after than others.

Mintage and Mint Marks

Mintage is simply the total number of coins produced in a specific year, at a specific mint. As you might guess, a low mintage figure is the classic recipe for rarity. If only a few thousand coins were ever struck, finding one in good condition today can be a serious challenge, and that scarcity drives its price way up.

Just as important is the mint mark—a tiny letter that reveals exactly where the coin was made. The British Empire was vast, and sovereigns were minted all over the globe, not just in London.

A tiny letter stamped on a sovereign can dramatically alter its value. A 'P' for Perth, 'M' for Melbourne, or 'SA' for Pretoria tells a story of colonial history, instantly making the coin rarer than one struck in London the very same year.

These branch mints, dotted around places like Australia, Canada, India, and South Africa, are now all closed. This adds yet another layer of historical significance. A sovereign from a defunct colonial mint isn't just a piece of gold; it's a relic of a bygone era. Collectors are more than willing to pay a substantial premium for that tangible piece of the past.

How a Coin's Condition Drastically Affects Its Price

Ever wondered why two seemingly identical Gold Sovereigns—same year, same monarch, same mint—can have wildly different price tags? The answer, in a single word, is condition. A coin's state of preservation is one of the most powerful multipliers of its numismatic value, capable of turning a common coin into a prized specimen.

Think of it like a first-edition comic book. A copy that was read, folded, and passed around for years is still a fantastic find. But a pristine copy, kept sealed and untouched since the day it was printed? That exists on an entirely different level of value. The story is the same, but the condition dictates the price. This logic applies perfectly to sovereign coin values.

The Science of Coin Grading

Coin grading is simply the formal process of evaluating a coin's physical state. Experts aren't just giving it a quick glance; they're looking for very specific signs of wear and tear. This includes everything from microscopic scratches to the loss of fine detail on the highest points of the design, like the monarch's hair or the dragon's scales.

This detailed assessment determines where a coin falls on a standardised grading scale. The difference between grades can be subtle to an untrained eye, but it can easily translate to a difference of hundreds, or even thousands, of pounds in the final valuation.

A few key elements graders always assess include:

- Surface Preservation: Are there distracting scratches, scuffs, or 'bag marks' from clinking against other coins?

- Lustre: Does the coin still have its original mint sheen, or has circulation dulled its finish?

- Strike Quality: How sharply was the coin originally minted? A crisp, well-defined strike is always more desirable.

- Eye Appeal: This is a more subjective but absolutely crucial factor. It’s the overall visual impact and beauty of the coin.

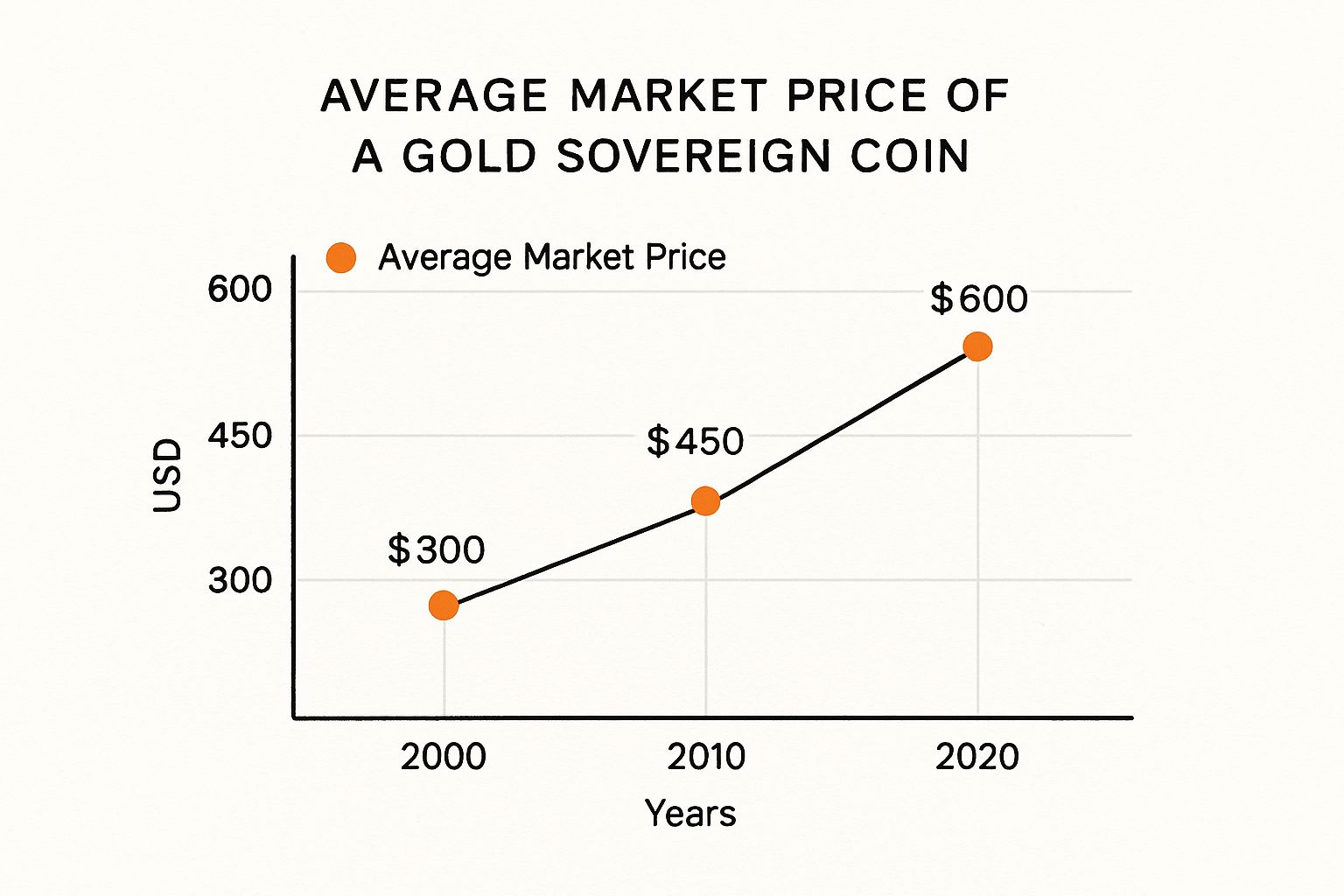

This chart tracks the average market price of a gold sovereign coin, showing its impressive and steady growth in value over two decades.

The visualisation clearly shows a consistent upward trend. In fact, its value more than doubled between 2000 and 2020. This really highlights why preserving a coin’s condition is vital for maximising its long-term investment potential.

To help you get a better handle on what these terms mean, here’s a quick rundown of the standard UK grading classifications.

Sovereign Coin Grading Scale Explained

| Grade | Abbreviation | Description of Condition |

|---|---|---|

| Uncirculated | UNC | A perfect coin with no signs of wear, retaining its full original lustre. |

| Almost Uncirculated | AUNC | Extremely light friction or rubbing on the highest points. Still has most of its mint lustre. |

| Extremely Fine | EF | Light wear is visible on the high points, but all major details are still sharp and clear. |

| Very Fine | VF | Moderate wear on details, with some flatness on the highest points, but still a desirable coin. |

| Fine | F | Considerable wear all over. The main design is visible but details are worn away. |

| Very Good | VG | Heavily worn, but the monarch, date, and main designs are still legible. |

| Good | G | Very heavily worn. The design is outlined, but most details are gone. |

| Fair | F | The coin is identifiable but extremely worn, often with damage. |

| Poor | P | Barely identifiable, with just enough detail to recognise the coin's type. |

As you can see, the difference between an UNC coin and even an EF one is significant, and the price will reflect that.

A sovereign graded as "Uncirculated" has never been used in commerce and retains its original mint lustre. Even a tiny amount of wear, dropping it to "Extremely Fine," can significantly reduce its collector premium.

Proper handling is the first step in protecting your investment. You should always hold a coin by its edges, never by its face, as the natural oils and acids from your skin can cause irreversible damage over time. Storing your coins in acid-free holders or capsules will shield them from environmental damage and accidental scratches, preserving their condition and, ultimately, their value for years to come.

Tracking Sovereign Values Through Economic Shifts

Gold Sovereigns are fascinating things. They’re much more than just old coins; they're like little economic barometers, each one telling a piece of modern financial history. Their value doesn't exist in a bubble. Instead, it’s a pretty reliable indicator of global economic confidence, rising and falling with the tides of market stability and investor fear.

If you look at how major world events have nudged sovereign prices over the last few decades, a clear pattern starts to form. Time and time again, these coins prove their worth as a resilient, safe-haven asset.

The Flight to Tangible Security

When things get shaky in the economy, people instinctively look for security in assets they can physically hold. It's a natural reaction. When stock markets tumble or currencies look weak, the solid, tangible security of physical gold becomes incredibly attractive. This "flight to quality" is a well-known phenomenon in financial circles, and the Gold Sovereign is often a prime beneficiary.

Take moments of crisis, like the 2008 global financial crash or the more recent spikes in inflation. These events consistently drive up the demand for gold. As investors rush to buy, that increased demand naturally pushes the value of sovereigns upwards, often leaving other assets in the dust.

The sovereign's strong performance during economic downturns isn't just a coincidence; it's a reflection of what the coin actually is. It’s a government-backed coin with a specific, guaranteed gold content, which offers a level of trust and stability that paper assets just can't compete with in a crisis.

This consistent historical performance is why it's earned a reputation as a cornerstone of any well-diversified investment strategy. The coin's value isn't just about what collectors are willing to pay; it's deeply interwoven with the health of the entire global economy, making it a powerful tool for preserving wealth.

Sovereigns as Economic Indicators

The price history of the British Gold Sovereign really shows these powerful economic and geopolitical forces at play. The 2008 financial crisis, for instance, triggered a huge surge as investors scrambled for the safety of gold. During that year, the Sovereign's maximum price jumped to £142.27. Fast forward to more recently, and we've seen fears of inflation and widespread uncertainty propel prices to all-time highs, with the Sovereign hitting £455.96—a dramatic leap from just £269.37 in 2020. You can dig deeper into this data by exploring how market patterns have shaped the Gold Sovereign's price.

This relationship gives us a few key takeaways, whether you're a collector or an investor:

- Inverse Correlation: Sovereign values often move in the opposite direction to traditional financial markets. When stocks are down, gold—and by extension, sovereigns—tends to be up.

- Inflation Hedge: During times of high inflation, the cash in your pocket buys less and less. Gold, however, has a long history of holding its value, which makes sovereigns an effective way to protect against rising prices.

- Geopolitical Sensitivity: Global conflicts and political instability also create uncertainty, which only enhances the appeal of gold as a stable place to store your wealth.

By connecting these historical dots, you get a much clearer picture of why sovereign coin values are so dynamic. They aren't static museum pieces but living assets that react in real-time to the world's economic pulse, reaffirming their status as a timeless safe haven.

How to Get an Accurate Valuation for Your Sovereign

Ready to find out what your sovereign is really worth? Thankfully, getting a reliable valuation isn't some dark art; it's a clear, manageable process. The first steps are something you can do right at home, putting the knowledge you’ve already gained to good use.

Start by having a really good look at your coin. Your first mission is simple identification. What’s the year? Which monarch is on the 'heads' side? Squint a little closer – can you see any tiny mint marks? These basic details are the first clues to your coin's story and how rare it might be. Next, give it an honest grade, keeping those official standards in mind.

Initial Research and Professional Insight

With these core facts noted down, it's time to head online. Reputable price guides and the sold listings from numismatic auction sites are brilliant for getting a preliminary idea of sovereign coin values. This will give you a rough ballpark figure and a feel for where your coin fits into the current market. But this is just the beginning of the journey.

For any coin that seems particularly old, rare, or is in stunning condition, a DIY valuation simply won't cut it. The tiny, subtle details that can add thousands to a coin's value are only visible to a trained eye. A professional appraisal is the only way to unlock its true market potential.

The final, and most important, step is to get an expert involved. You need to find a reputable coin dealer or a certified appraiser. Their hands-on experience is something you just can't replace. They can properly authenticate the coin, assign a precise grade, and give you an accurate, up-to-the-minute market valuation based on what collectors are actually paying right now.

A professional will spot all the nuances—the lustre, the quality of the strike, the almost invisible signs of wear—that online guides can never fully capture. To help you prepare for this, you can find some excellent pointers in these expert coin collection valuation tips for UK coins. Taking this final step gives you the confidence to make an informed decision, whether you plan to sell, insure, or just hold onto your fantastic piece of history.

Common Questions About Sovereign Coin Values

Dipping your toes into the world of Gold Sovereigns often sparks a few questions. Getting straight answers is key to really understanding what drives sovereign coin values and feeling confident, whether you're a seasoned collector or just starting your investment journey.

Let's tackle some of the most common queries, giving you practical insights that build on what we've already covered.

Are All Gold Sovereigns Hugely Valuable?

Every single Gold Sovereign is valuable, no doubt about it. Each one contains 0.2354 troy ounces of gold, which gives it a solid baseline value tied directly to the spot price of gold. But the headline-grabbing prices you hear about? Those are reserved for a very small, elite group of coins.

The truly huge values are found in the rare sovereigns. Rarity isn't just a vague term; it comes down to a few specific things:

- Low Mintage Numbers: Some years, the mint simply didn't produce very many.

- Key Historical Years: Coins minted during significant events often attract more interest.

- Specific Mint Marks: Sovereigns struck at now-closed colonial mints can carry a real premium.

- Exceptional Condition: A coin graded as Uncirculated (UNC) will always be worth far more than the same coin that's seen a lot of wear.

So, while a common-date sovereign in average shape will trade for a price very close to its gold content, a rare one can be worth many, many times more.

Is Selling a Gold Sovereign Tax-Free in the UK?

Yes, and for UK residents, this is a massive advantage. Gold Sovereigns struck after 1837 are considered British legal tender. Because of this special status, they are completely exempt from Capital Gains Tax (CGT) when you decide to sell them.

On top of that, they are also VAT-free when you buy them, as they qualify as investment-grade gold. This makes them an incredibly tax-efficient asset for UK collectors and investors looking to protect their wealth.

The double-whammy of being exempt from both VAT and CGT makes the Gold Sovereign one of the most tax-friendly investments you can find in the United Kingdom, boosting its appeal far beyond its metal or collector value.

How Can I Spot a Fake Sovereign Coin?

Knowing what to look for is your best defence. Thankfully, genuine sovereigns have very precise specifications you can check right away. The first step is to get out the scales and callipers. A real sovereign should weigh 7.98 grams and measure 22.05mm in diameter. If your coin is off by any significant margin, that’s a huge red flag.

Next, get up close and personal with the design. Really study the monarch's portrait and the classic St. George and the Dragon scene. Fakes often look a bit soft or blurry, lacking the sharp, crisp detail you'd see on a genuine coin from The Royal Mint. If you have even the slightest doubt, especially with a potentially valuable coin, get it checked by a reputable dealer. Their experience is the best protection you have against getting caught out by a counterfeit.

At Cavalier Coins Ltd, we are passionate about helping collectors find authentic, high-quality coins to enhance their collections. Explore our extensive selection of rare and interesting world coins and banknotes by visiting https://www.cavaliercoins.com.