The real two shilling value often catches people by surprise. A common florin might only be worth its modern face value of 10p, but a rare, high-quality example could fetch thousands of pounds. The coin's worth isn't just one number; it's a story told by its age, the metal it’s made from, and the life it has lived. This guide will help you read that story and figure out what your coin is really worth.

Unlocking the Real Value of Your Two Shilling Coin

It’s true that many old coins found tucked away in drawers are simply cupronickel pieces, holding more sentimental value than anything else. But the two shilling coin, also known as the florin, has a rich history that can translate into serious monetary worth. To uncover its true value, you need to start by looking at the three core pillars that every collector considers.

Think of it like a three-legged stool—if one leg is weak, the whole thing becomes less stable. In the same way, these three factors work together to determine a coin's final market price.

- Metal Content: First things first, is your coin made of silver or a common alloy? This is the most critical starting point.

- Rarity and Date: Was it minted in a year with low production numbers? Does it have a unique error that sets it apart?

- Condition (Grade): How much wear and tear has the coin seen? Is it crisp and clear or worn smooth?

To give you a quick idea of what this means in practice, here's a simple breakdown of potential values.

Two Shilling Value at a Glance

| Coin Era and Metal | Average Condition Value | High-Grade Collector Value |

|---|---|---|

| Pre-1920 (92.5% Silver) | £5 - £20 | £100 - £1,000+ |

| 1920-1946 (50% Silver) | £2 - £10 | £30 - £200+ |

| Post-1946 (Cupronickel) | 10p (Face Value) | £1 - £25+ (for rare dates) |

This table is just a starting point, of course. The real fun is in digging into the details of your specific coin.

The Importance of Silver Content

The most immediate factor driving a florin’s base value is what it’s made of. Any two shilling coin minted before 1947 contains silver, which gives it an intrinsic "bullion" value based on the current market price of the metal. This acts as a safety net, ensuring the coin is always worth more than its face value.

For example, florins struck before 1920 contain about 0.3364 troy ounces of 92.5% pure (Sterling) silver. As the silver market goes up and down, so does the base value of these coins. Even without any collector appeal, the silver in just one of these early florins can be worth several pounds.

A coin's bullion value is its baseline worth, determined purely by the market price of its constituent precious metals. For silver florins, this means their value will rise and fall with the global silver market, separate from any collector demand.

Ultimately, you need a detailed assessment to know if you're holding a common piece or a rare treasure. Learning how to identify and grade your coins properly is the first step on that journey. If you're keen to learn more, you can explore some expert strategies that actually work in our detailed guide.

The Florin: A Coin with a Surprising History

To really get a feel for the two shillings' value, you have to look past its silver content and into its fascinating story. The coin, much better known as the florin, wasn't just another piece of change. It was a bold peek into the future of British money, showing up more than a hundred years ahead of its time.

Its introduction back in 1849 was a very early, and quite radical, experiment in moving towards a decimal system. The florin was specifically valued at one-tenth of a pound. This simple fraction might sound normal to us now, but it was a revolutionary idea in a system built around 12 pennies to a shilling and 20 shillings to a pound.

This bit of history is absolutely vital for any collector trying to figure out why certain florins are so sought-after today. For a wider look at the evolution of our money, you can read our guide on the brief history of British coins.

The Controversial “Godless Florin”

The florin’s launch was anything but smooth. The very first design, minted only in 1849, sparked immediate public outrage. Why? It left out the traditional Latin phrase “Dei Gratia” (By the Grace of God) from Queen Victoria’s titles, quickly earning it the infamous nickname, the “Godless Florin.”

This controversy made the coin deeply unpopular. The public outcry was so loud, in fact, that the design was swiftly withdrawn. A new version appeared in 1851 with the religious inscription properly restored.

The sheer scarcity of the "Godless Florin" makes it one of the most desirable varieties for collectors. Its fascinating backstory—a real clash between tradition and modern thinking—translates directly into a much higher market value compared to other Victorian florins.

This unique history means that even a well-worn Godless Florin can be worth considerably more than a pristine coin from just a couple of years later. It's a perfect example of how a coin's story is often just as important as its physical condition.

A Bridge Between Two Currency Systems

The florin continued its role as a decimal pioneer right into the 20th century. When Britain finally got ready for full decimalisation in 1971, the florin’s value of one-tenth of a pound made it the perfect stand-in for the new 10p coin. This special position allowed it to act as a bridge, connecting the old £sd system with the new decimal one.

The British two-shilling coin was worth 24 old pence. For nearly a quarter of a century after the new ten-pence coin was introduced in 1968, both florins and 10p coins circulated side-by-side, sharing the same size and value. It wasn't until 1993, when the 10p coin was made smaller, that the florin was finally taken out of circulation, ending its long and influential journey.

How to Grade Your Coin Like a Professional

Ever wondered why two florins from the exact same year can have wildly different values? The answer, almost every time, comes down to one crucial factor: its grade.

In the world of coin collecting, 'grade' is simply the official term for the coin's physical condition. For any serious collector, a coin's state of preservation is just as important as its age or what it's made of. This directly impacts the final two shillings value.

Think of it like the tread on a car tyre. A brand-new tyre has deep, sharp grooves, promising the best possible performance. An old, worn tyre, on the other hand, is smooth and has lost its definition, making it far less desirable or valuable. Coins are graded on a very similar principle, with a scale that runs from pristine, untouched condition to heavily worn.

Grasping this concept is the first step toward assessing your own collection. The good news is, you don't need to be a seasoned expert to make a solid initial judgement. If you want to dive deeper, our comprehensive coin grading guide for beginners and experts breaks down the official standards in more detail.

From Uncirculated to Good: What to Look For

Professional graders use a highly detailed scale, but for most people, learning to spot the key visual differences between the main categories is enough to get started. These distinctions are what separate a coin worth a few pounds from one that could be worth hundreds.

The highest grades are always reserved for coins that show little to no evidence of having been used in day-to-day transactions.

- Uncirculated (UNC): This is a coin in perfect mint condition, looking exactly as it did the moment it was struck. It has zero signs of wear, and its original mint lustre—that unique shine—is fully intact. Every detail is exceptionally sharp.

- Extremely Fine (EF): Here, you'll see only the slightest friction or wear, and only on the very highest points of the design, like the strands of the monarch’s hair or the top of a shield. Much of that original mint lustre is still visible.

- Very Fine (VF): The wear is a bit more noticeable now, but it's still light. The major details remain clear and distinct, though the highest points of the coin are visibly flattened.

The difference between an Extremely Fine coin and a Very Fine one can sometimes double its market value. This is why paying close attention to the smallest details is so important for an accurate assessment.

Identifying Heavily Worn Coins

On the other end of the spectrum are the coins that have clearly had a long and busy life, jangling in pockets and passing through countless hands for decades. While they often have less collector value, they still carry an important part of the coin’s story.

Lower grades are assigned to coins that have obviously seen heavy circulation.

- Fine (F): This grade shows moderate and even wear across the entire surface. The main design elements are still visible, but the finer details, like individual hair strands or feathers, have started to merge together.

- Good (G): The design is now heavily worn. The lettering and date might be weak, but they are still readable. You can make out the main outlines of the monarch and the emblems, but most of the intricate details are long gone.

By carefully examining your two shilling coin for these specific signs of wear, you can make a confident first assessment of its grade. This initial evaluation is a fundamental skill for any collector, empowering you to better understand its potential place and value in the numismatic world.

Uncovering Key Dates and Rare Florins

Once you've got a handle on a coin's grade, the real treasure hunt begins: its date and specific variety. While plenty of florins are common, certain years had incredibly low mintages, turning them into prized finds that can dramatically increase the two shillings value. Spotting these key dates is what separates a casual enthusiast from a sharp-eyed collector.

Think of it like looking for a first-edition book. Millions of copies of a novel might be out there, but only a handful from that very first print run are truly valuable. It's the same with coins. Years like 1862 and 1863 are notorious for their scarcity and can command high prices, often fetching hundreds of pounds even in average condition.

But it’s not just about the year stamped on the coin. Sometimes, small minting errors or variations can turn an otherwise ordinary piece into a genuine rarity. These aren't defects; they're unique quirks that tell a fascinating story about how the coin was made.

Identifying Valuable Varieties

Sometimes the most valuable feature is a tiny detail most people would completely overlook. Seasoned collectors eagerly hunt for these variations, which can make a coin many times more valuable than its common counterpart. Learning to spot them is a crucial skill.

- Overdates: This happens when the mint punches a new date over an old one on the coin die, leaving faint traces of the original numbers behind. A classic example is the 1934/2 florin, where a '2' is just visible underneath the '4'.

- Die Cracks and Cuds: As coin dies wear down from use, they can develop cracks, which show up as raised, jagged lines on the coin's surface. A 'cud' is a more dramatic blob-like error that occurs when a piece of the die breaks off entirely.

- Misaligned Strikes: Every so often, a coin isn't perfectly centred when it's struck. This results in an off-centre design that is highly sought after by collectors for its uniqueness.

The most dedicated collectors always have a magnifying glass handy to examine their coins for these tiny, yet significant, details. A small, overlooked error can sometimes be the difference between a coin worth £1 and one worth £100.

Now, let's look at some specific dates and varieties that you should always keep an eye out for.

Valuable Two Shilling Dates to Look For

Here's a quick reference table of some key dates and notable varieties of the florin. Keep this list in mind when you're sorting through a collection, as you might just have a rare find on your hands.

| Year or Variety | Why It's Valuable | Typical Value Range (Fine to Uncirculated) |

|---|---|---|

| 1854 'Gothic' Florin | Known as the 'Godless' florin because it omits "Dei Gratia." | £50 - £800+ |

| 1862 & 1863 | Very low mintage years, making them extremely scarce. | £100 - £1,200+ |

| 1887 'Jubilee Head' | The first year of this new portrait; popular with collectors. | £20 - £250 |

| 1925 | The lowest mintage of any George V florin; a key date. | £75 - £900+ |

| 1932 | Another scarce year with a very low number of coins produced. | £150 - £1,500+ |

| 1951 Proof | Part of the Festival of Britain proof set; rare as a single coin. | £40 - £150 |

This is by no means an exhaustive list, but it highlights some of the big hitters in the world of florin collecting. Always remember that condition is king—an uncirculated example of a common date can sometimes be worth more than a heavily worn rare date.

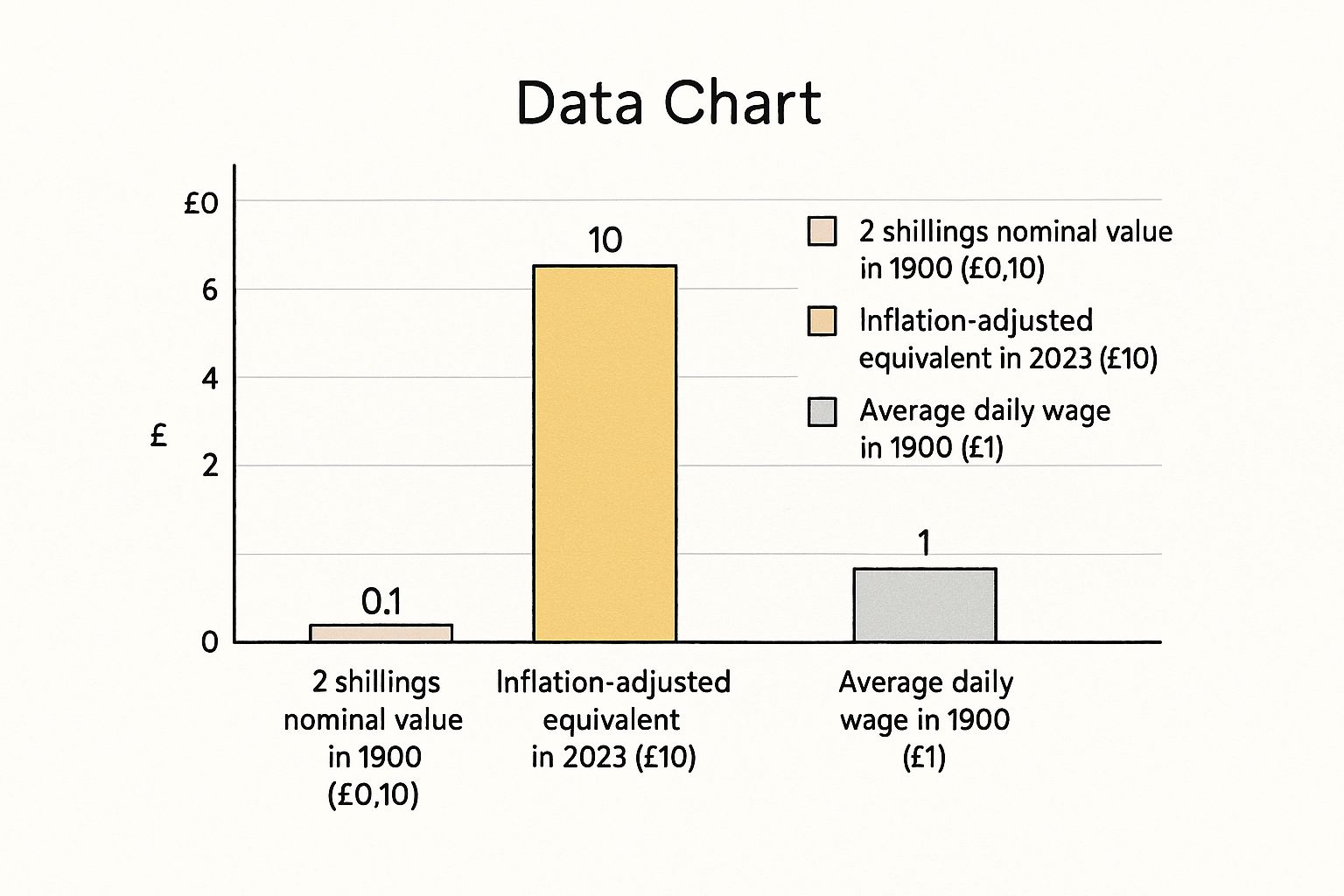

This chart gives a fantastic visual comparison of the two shilling's face value back in 1900, what it would be worth today adjusted for inflation, and the average daily wage at the time.

It really puts into perspective just how much purchasing power the coin once held and makes its historical context much easier to grasp.

Later Dates and Modern Collectibles

Rarity isn’t just confined to old Victorian coins. Even some of the more modern cupronickel florins have collectible appeal, especially when found in top condition. Take the 1966 two-shilling coin, for example, which has become a notable collector's item.

While millions were minted, finding one in pristine, uncirculated condition is a real challenge, and that scarcity drives up its value among numismatists. To get a better feel for coins from this period, you can explore this insightful video about UK monetary history and see how they're valued today.

Beyond the Coin: Factors That Shape Market Value

A coin’s condition and rarity are the cornerstones of its value, but the story doesn't end there. The final price a coin fetches is rarely decided in a vacuum. A whole host of external market forces come into play, explaining why the two shillings value can shift, sometimes quite dramatically, over time.

It’s a bit like the classic car market. A rare vintage motor has its own inherent value based on its model and condition, of course. But the price it achieves at auction is heavily swayed by current collector trends, the general health of the economy, and even pop culture moments that suddenly renew interest. Coins are much the same.

The Silver Safety Net

For any florin struck before 1947, the most powerful external factor is the ever-changing price of silver. These coins possess an intrinsic bullion value—the base worth of the precious metal they're made from. This acts as a price floor, meaning the coin will always be worth at least its silver content, no matter what’s happening in the collector's market.

In fact, during a major spike in silver prices, the bullion value of a common-date, lower-grade florin can actually overtake its numismatic (collector) value. This is precisely why savvy investors keep one eye on the precious metal markets and the other on coin auction results.

The bullion value is the ultimate safety net for pre-1947 two shilling coins. While collector demand dictates how high the price can soar, the silver market decides how low it can possibly fall.

The Influence of Collector Demand

Just like any collecting hobby, from art to stamps, trends in the coin world come and go. A sudden surge in demand for Victorian-era coins, for example, can temporarily push up the prices of all florins from that period. This demand is often sparked by a few key things:

- Market Trends: Certain monarchs or historical periods can simply become more fashionable among collectors for a time.

- Economic Health: When the economy is strong, people often have more disposable income to spend on their hobbies, which naturally drives prices up across the board.

- New Discoveries: Sometimes, new academic research or the discovery of a rare variety can ignite a flurry of interest in a coin series that was previously overlooked.

Provenance and Pedigree

Finally, we have a coin’s provenance—its documented history of ownership. This can add a significant premium to its value, especially for rarer pieces. A coin that was once part of a famous, well-curated collection carries a special kind of prestige.

Picture two identical, rare florins. One has no known history. The other is proven to have been in the collection of a world-renowned numismatist for 50 years. That second coin, with its distinguished "pedigree," will almost always command a higher price. It's no longer just a coin; it's a tangible piece of collecting history.

Common Questions About Two Shilling Coins

As we wrap up our deep dive into the florin, you might still have a few questions buzzing around. This last section is all about giving you clear, straightforward answers to the queries we hear most often about the two shilling coin. Think of it as a final checklist to lock in your understanding and bust a few common myths.

Getting these details right is so important. A simple mistake—especially about cleaning or metal content—can completely change your assessment of the two shillings value.

Are All Two Shilling Coins Made of Silver?

This is easily one of the most common—and most important—questions we get. The short answer is a definite no. The metal used to make florins changed dramatically over its long life, and knowing which is which is absolutely critical to figuring out its baseline value.

There are three key periods you need to know:

- 1849 – 1919: Coins from this era are 92.5% silver, which you'll know as Sterling silver. This high silver content gives them a very real, intrinsic bullion value.

- 1920 – 1946: The silver content was slashed to 50%. They're still valuable for their silver, of course, but contain a lot less of the precious stuff than the earlier versions.

- 1947 – 1970: From this point on, every two shilling coin was struck in cupronickel (a simple copper-nickel mix) and contains no silver at all. Their value is purely down to collector demand.

Memorising these date ranges is the first, most essential step in valuing any florin that comes your way.

What Is the Best Way to Sell a Two Shilling Coin?

How you should sell your coin really depends on what you've got. There’s no single best way, so you need to match your sales strategy to the coin's rarity and condition. Most of the time, one of three paths will be your best bet.

For the common cupronickel florins or silver coins that are heavily worn, the value is often quite low. But for older silver florins or those with rare dates, a good local or online coin dealer can give you a fair, on-the-spot offer.

Online auction sites are another great route for reaching a huge pool of collectors. To do well here, though, you absolutely must take sharp, high-quality photos and write a description that's both accurate and detailed. If you're lucky enough to have an exceptionally rare or high-grade coin, a specialist numismatic auction house will almost certainly get you the best possible price.

Is a Florin the Same as a Two Shilling Coin?

Yes, they're just two names for the very same coin. The official denomination was always "two shillings," but from the moment it appeared in 1849, people affectionately called it the "florin."

The name 'florin' was tied to the original idea for a coin worth one-tenth of a pound, making it a key part of the coin's identity as an early step towards a new decimal currency system. So, whether you call it a florin or a two shilling piece, you’re talking about the exact same thing.

A critical warning for all new collectors: Never, ever clean your old coins. It is the single biggest mistake you can make and will permanently destroy their collector value.

Cleaning a coin strips away its natural patina—that subtle toning that builds up over decades and is actually highly valued by collectors. It also leaves behind countless microscopic scratches, ruining the original mint lustre forever. A cleaned coin is what numismatists call "impaired," and it will always be worth far less than an untouched coin in the same condition. Just leave the dirt and toning as they are; they're part of the coin's story.

At Cavalier Coins Ltd, we're passionate about helping collectors at every stage of their journey. Whether you're looking to identify a rare find, add to your collection, or sell valuable pieces, we offer the expertise and extensive inventory you need. Explore our curated selection of world coins and banknotes today at https://www.cavaliercoins.com.