So, you've stumbled upon an old British coin and are wondering if you've hit the jackpot. How do you figure out its true value? It's about looking past its face value and understanding what makes a coin genuinely desirable to a collector. The actual worth can swing from a few quid to thousands of pounds, all depending on a few key factors.

Let's get you started on the right path to identifying those potential treasures.

Your First Look at Valuing Old British Coins

Found an old coin tucked away in a drawer? It’s a common story, and that small piece of metal you're holding is more than just currency—it's a tangible piece of history. Figuring out its value isn't about memorising complicated jargon; it's about knowing what to look for.

This guide is designed to cut through the noise and give you a straightforward way to discover what your coins might really be worth. We'll break down the elements that separate a common penny from a collector's prize.

Quick Guide to What Makes a British Coin Valuable

Before we dive deeper, it helps to have a quick reference for the core elements that drive a coin's value. These are the things that separate a common find from a truly collectible treasure.

| Factor | What It Means for Your Coin | Impact on Value |

|---|---|---|

| Rarity | How many were originally made, and how many are still around today? | Low mintage or survival rates dramatically increase value. |

| Condition (Grade) | How much wear and tear does the coin show? Is it worn smooth or sharp and new? | A pristine, "uncirculated" coin is always worth more than a heavily used one. |

| Demand | Are collectors actively looking for this specific coin, monarch, or year? | High demand from collectors pushes prices up, regardless of other factors. |

Think of these three pillars—rarity, condition, and demand—as the foundation for every coin's market price. Understanding how they work together is your first practical step.

What Really Drives a Coin's Value

Let's unpack those three core principles a bit more.

- Rarity: This is simple supply and demand. How many of your coin were ever minted? How many have survived the test of time? A coin with a tiny mintage, like the legendary 1933 George V Penny, is naturally scarce and, therefore, highly sought after.

- Condition (Grade): Look closely at the coin. How much wear can you see? A coin that looks like it just left the mint—what we call uncirculated condition—will always fetch a much higher price than the same coin that’s been rattling around in pockets for decades.

- Demand: This is all about popularity. How many people are out there trying to find this exact coin? Coins from popular series or those linked to major historical moments often have a huge following, which drives prices skyward.

The biggest mistake I see beginners make is underestimating just how much condition matters. A tiny, almost imperceptible difference in wear can be the difference between a coin worth £10 and one worth £1,000. It's that important.

Real-World Examples of Valuable British Coins

The idea of finding a valuable old coin isn't just a fantasy; it happens all the time at auctions and private sales. Just look at the prices some rare British coins have achieved.

Take the 1933 George V Penny in bronze. In top condition, it has fetched prices as high as $78,852, cementing its place as one of Britain's most valuable coins. Another incredible example is the 1917 Sovereign George V gold coin, which has been valued at around $50,400 in uncirculated condition.

If you're curious, you can explore more pricing insights on notable British coins to get a feel for what collectors are willing to pay for the right pieces.

Identifying the Coin in Your Hand

Before you can figure out what an old British coin is worth, you need to play detective. Every single coin tells a story through its design, lettering, and tiny marks. Learning to read that story is the first, most crucial step. It’s less about memorising facts and more about training your eye to spot the details that give a coin its identity.

Your first look should focus on the most obvious features. The monarch's portrait is the biggest clue, immediately helping you narrow down the time period. A quick glance can tell you if you're holding something from the Georgian, Victorian, or Edwardian era.

Decoding the Details

Once you've got a rough idea of the monarch, it's time to zoom in on the other key identifiers. These details work together to pinpoint the exact coin you have.

-

The Date: This is your most direct piece of information. The year a coin was minted is vital because some years are much rarer than others. A penny from one year might be incredibly common, while the exact same design from the following year could be a key date that collectors are desperate to find.

-

The Denomination: Look for words like "Shilling," "Penny," or "Crown." On much older hammered coins, the denomination often isn't written out. In those cases, identification comes down to the coin's size, weight, and specific design elements, like the classic cross and pellets on a medieval silver penny.

-

The Legend: This is the text running around the coin's edge, usually spelling out the monarch’s title. Even tiny variations in this lettering, known as the inscription, can point to different versions or even errors that are highly sought after by collectors.

For a really deep dive into one of Britain's most popular coins, our guide on the value of old British penny coins has loads of detailed examples. Mastering one denomination is a fantastic way to build a solid foundation for identifying others.

Spotting the Subtle Clues

Beyond the basics, there are tiny marks that can completely change a coin's story and its rarity. These are the details that often separate a common find from a truly valuable one.

A key thing to look for is a mint mark. This is usually a small letter or symbol that tells you where the coin was made. For example, many Victorian pennies have a tiny 'H' under the date, which means they were struck at the Heaton Mint in Birmingham, not the Royal Mint in London. For certain years, these 'H' mint mark pennies are far scarcer.

The coin's material is another big clue. With a bit of practice, you can learn to tell precious metals from base metals. Before 1920, British "silver" coins were made from 92.5% sterling silver, giving them a unique look and feel. Between 1920 and 1946, the silver content was slashed to 50%, and from 1947 onwards, they were made of cupronickel. A seasoned collector can often spot the difference just from the colour and lustre.

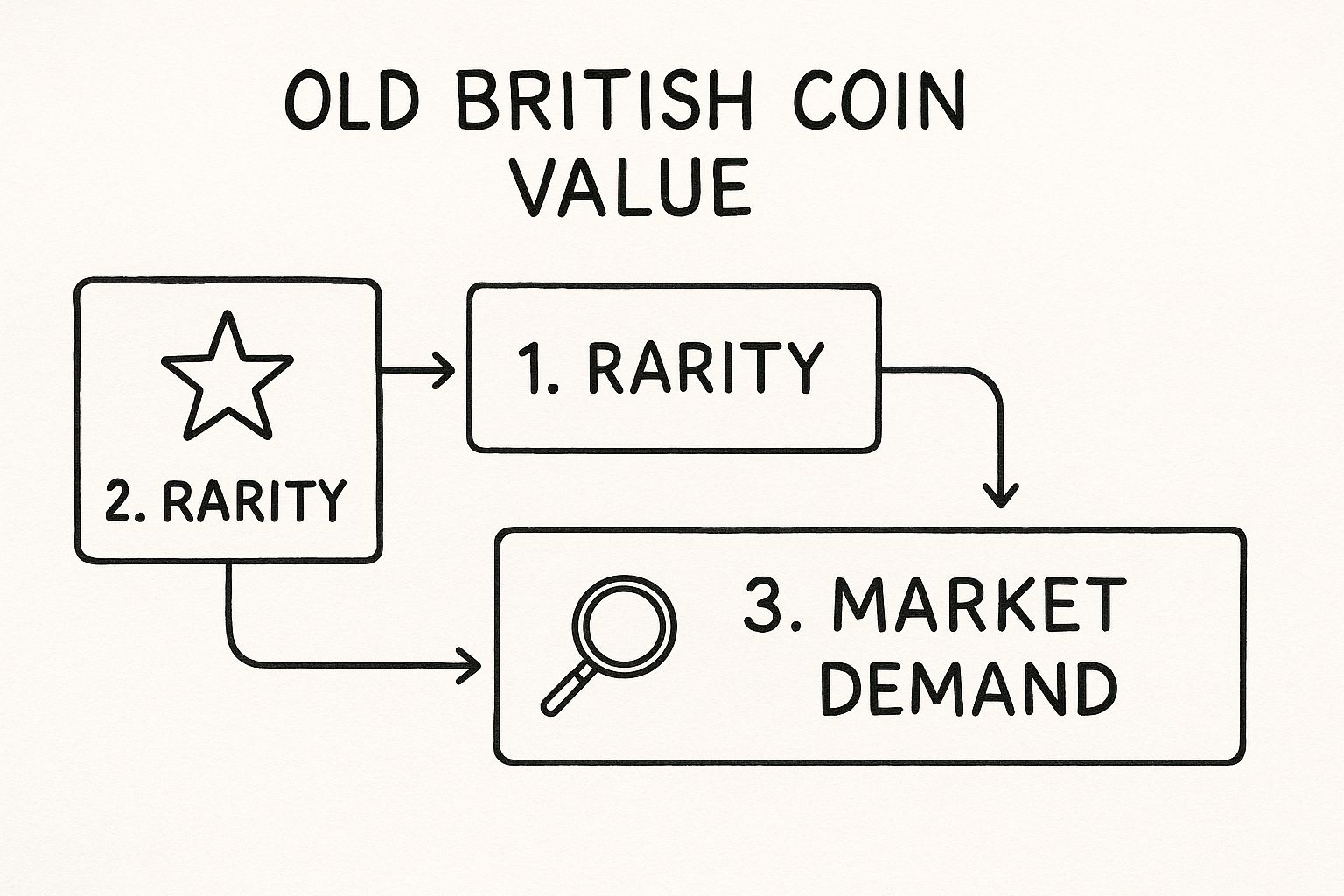

Once you've identified your coin, its ultimate worth comes down to three main pillars, as shown in the infographic below.

This visual shows how rarity, condition, and market demand all work together. These three forces are what truly drive the value of any old British coin.

Putting It All Together: A Practical Example

Let's say you've found two shillings that, at first glance, look almost identical. Both show Queen Victoria's portrait. But when you look closer, you see one is dated 1887 and the other is 1888.

The 1887 shilling has the famous "Jubilee Head" portrait, which was introduced for Queen Victoria’s Golden Jubilee. The 1888 coin has the same design. So far, so simple. But an experienced collector knows that different varieties exist. For instance, some coins from this period have subtle changes in the monarch's bust or a different arrangement of letters in the legend.

It's in these tiny, almost unnoticeable variations that true rarity is often hiding. A collector might have a dozen Victorian shillings, but they're always hunting for that one with a slightly different die marking that makes it a hundred times rarer than all the others.

This is precisely why careful identification is so important. Knowing the difference between a common William IV groat (a fourpence piece) and a Victorian one isn't just an academic exercise. The monarch, the date, and any unique marks combine to tell a specific story—a story that translates directly into its value on the collector's market. By sharpening these observational skills, you stop simply having a coin and start truly understanding it.

How Coin Condition Determines Its Worth

Once you’ve figured out what coin you have, the next, most crucial question is about its condition. This single factor, what we call the "grade," has an enormous impact on value. I’ve seen rare coins in pristine condition sell for thousands of pounds, while the exact same coin, worn down from years of changing hands, is worth little more than its scrap metal value.

Getting a handle on coin grading is absolutely essential if you want to value old British coins accurately. It’s what separates a true numismatist from someone just looking at old bits of metal.

From Uncirculated to Poor: The Spectrum of Coin Grades

In the world of coin collecting, we use a specific scale to talk about a coin's physical state. It might sound a bit technical at first, but it's really just a shorthand for describing how much wear and tear a coin has picked up since the day it was minted.

At the very top, you have Uncirculated (UNC), which is a perfect coin that looks like it just left the Royal Mint. At the opposite end is Poor (P), where a coin is so worn it’s difficult to even identify.

Here’s a quick rundown of the grades you’ll come across most often:

- Uncirculated (UNC): A flawless coin with zero signs of ever being in circulation. It still has its original mint lustre—that unique, satiny shine from the moment it was struck.

- Extremely Fine (EF): This coin has only the faintest whisper of wear, usually just on the highest points of the design like the monarch’s hair or the top of a shield. Most of that original mint lustre is still there.

- Very Fine (VF): The details are still nice and sharp, but you can see light, even wear across the surface. Important features, like the lettering and portrait, remain clear.

- Fine (F): This coin has clearly been around the block. The main design elements are worn but still totally visible. The high points are smooth, but the deeper, recessed parts of the design are still clear.

- Very Good (VG): Most of the prominent details have worn flat. You can still make out the main design and read the lettering, but it’s seen a lot of life.

Getting comfortable with these terms is the first step. For a much deeper dive, our coin grading guide for beginners and experts breaks it all down with detailed explanations and pictures.

What to Look For When Grading a Coin

Grading is really an art of observation. It's about training your eye to spot the subtle—and not-so-subtle—signs of wear. The key is to focus on the highest points of the coin’s design, as these are always the first places to show rubbing from being handled.

For a portrait, you’ll want to check the strands of hair, the earlobe, and the highest point of a crown. On the reverse side, look at the most raised parts of a shield, a lion, or the figure of Britannia. Any loss of crisp detail in these spots is your first clue that the coin has been in circulation.

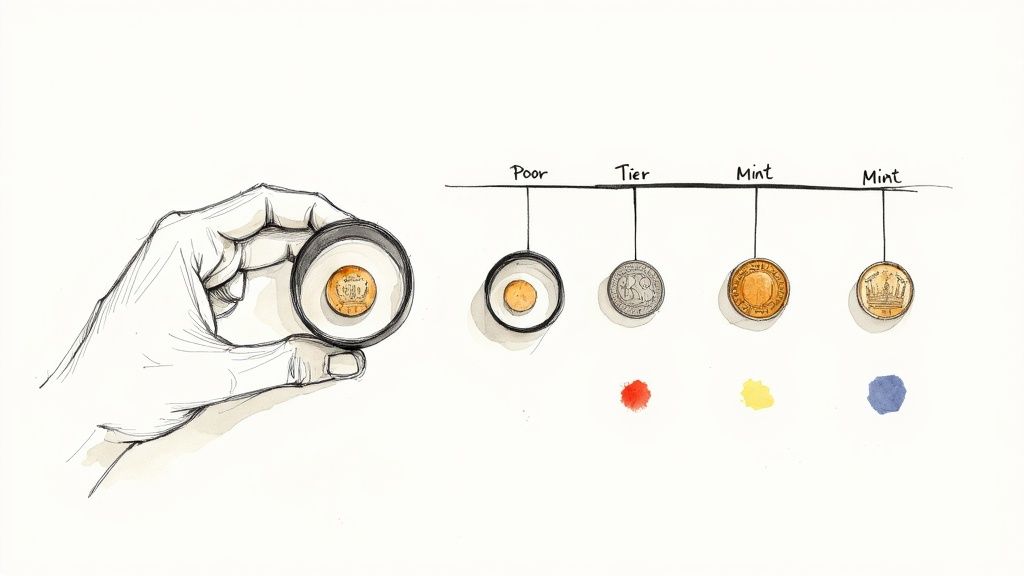

Take a look at this image—it’s a great visual for how wear affects a coin’s appearance across different grades.

See how the "MS" (Mint State) coin has perfectly sharp, crisp details? As you move down the scale towards "AG" (About Good), those same details become progressively smoother and less defined. That’s wear in action.

Beyond Wear and Tear: Damage Versus Patina

Condition isn’t just about circulation wear. Any sort of damage will hammer a coin’s value, often far more than natural wear from use. Collectors are after originality above all else.

The golden rule for any beginner is simple: never, ever clean your coins. What might look like dirt to you is often a natural patina or toning that has built up over decades or even centuries. Collectors cherish this original surface, and cleaning it is considered severe damage that can wipe out 90% of a coin's value instantly.

Be on the lookout for these common types of damage that will send a coin’s value plummeting:

- Scratches: These can be deep gouges or fine hairlines, often the result of someone trying to clean the coin abrasively.

- Rim Nicks: Any dents, dings, or signs of filing on the coin’s edge are a massive red flag for collectors.

- Corrosion: Pitting or that nasty green residue (we call it verdigris on copper coins) is a sign of environmental damage.

- Bending or Holes: If a coin has been bent, drilled for jewellery, or used as a makeshift tool, its numismatic value is completely destroyed. It’s just scrap metal at that point.

Alright, you’ve managed to identify your coin and you have a decent idea of its condition. Now for the exciting bit: putting a number on it. This is where we move from just looking at the coin to doing a bit of detective work, using the very same tools the professionals use to value old British coins.

The trick is to blend two different sources of information: the established prices you find in catalogues and the real-time data from recent sales. One gives you a solid baseline, while the other shows you what people are actually paying for that coin right now. Getting a feel for both is the key to having realistic expectations.

Starting with the Standard Catalogues

For as long as anyone can remember, the bible for British coin collectors has been the Coins of England & the United Kingdom guide. In the collecting world, everyone just calls it "Spink." Think of it as the encyclopaedia for British numismatics. Inside, you'll find a massive list of just about every coin ever struck, along with estimated values for different grades.

Using a guide like Spink is straightforward. You find the right monarch, then the denomination, and simply match up your coin’s date and grade to find its "catalogue value."

This catalogue value is a fantastic starting point, but it's not the final word. It usually represents a retail price—what you might expect to pay a dealer if you were buying the coin. The price you could sell it for will almost always be lower.

Getting your head around this is vital. A dealer is running a business and needs to make a profit, so their buying price has to leave room for that. A price guide gives you that retail ballpark figure, which is brilliant for insurance valuations or just getting a sense of a coin’s potential.

The Power of Real-World Auction Data

While catalogues give you a stable foundation, the most accurate picture of a coin's current market value comes from looking at recent auction results. This is where you can see what keen collectors are willing to bid in a live, competitive environment. Book prices might be updated once a year, but the auction market can shift from one week to the next.

Big auction houses like Noonans (who used to be Dix Noonan Webb) and Spink keep huge online archives of their past sales. These databases are an absolute goldmine. You can search for your exact coin and see high-quality photos, professional descriptions, and, most importantly, the "hammer price"—the final amount the coin actually sold for.

This process gives you a dynamic, up-to-the-minute feel for the market. You might discover, for example, that a particular type of Victorian shilling is consistently selling for 20% above its catalogue price, which tells you collector demand is red-hot. On the other hand, you might find another coin is struggling to reach its guide price, suggesting the market for it has gone a bit soft.

Top Resources for Valuing British Coins

Finding a coin's true value means knowing where to look. You don't need dozens of resources, just a few reliable ones. Here’s a quick breakdown of the print and online tools I turn to time and again to get an accurate value.

| Resource Name | Resource Type | Best For Finding | A Pro Tip for Using It |

|---|---|---|---|

| Spink Catalogue | Print Book / PDF | Comprehensive retail values for nearly all British coins across all grades. | Pay close attention to the footnotes; they often contain crucial information about rare varieties. |

| Auction Archives | Online Database | Real-world "hammer prices" from recent sales at houses like Noonans or Spink. | Look for multiple sales of the same coin to establish a reliable price range, not just a single outlier. |

| eBay Sold Listings | Online Marketplace | Current market values for common to mid-range coins. | Use the "Sold Items" filter to see what people actually paid, not just what sellers are asking for. |

These three sources give you a well-rounded view, from the official retail price to what someone clicked "buy" on yesterday.

Understanding Historical Context and Value Shifts

It's easy to forget that the value of old British coins has always been changing, not just for collectors but in terms of actual spending power. The massive shift from the old pounds, shillings, and pence system to decimal currency in 1971 completely changed how we think about these older coins.

For instance, the humble farthing, once worth a quarter of an old penny, had a decimal equivalent of just 0.1 pence. The groat, a fourpence coin, became 1.67 pence. This context is fascinating and really brings home how much monetary reforms have reshaped values. You can explore more about the fluctuating worth of pre-decimal British coins to see these changes laid out in detail.

By mixing the long-term, stable data from catalogues with the immediate, dynamic feedback from auction results, you can build a really accurate picture of what your coin is worth. This balanced approach stops you from either undervaluing a hidden treasure or getting your hopes up over a common piece, giving you the confidence to make smart decisions about your collection.

When You Need a Professional Appraisal

Learning to research coin values yourself is an incredibly rewarding part of the hobby. But there are moments when the complexity or sheer potential value of a coin calls for an expert opinion. DIY valuation is a fantastic skill, but knowing when to bring in a professional is just as important to accurately value old British coins and protect your investment.

Recognising these situations can be the difference between a great decision and a costly mistake. Some finds simply have too many nuances for online guides and catalogues to cover adequately.

Signs You Should Seek Expert Advice

Sometimes a coin just feels different. It might be an unusual error, a variety you can’t quite pin down, or it could be part of a larger, inherited collection that feels completely overwhelming. These are clear signals that it's time to consult a professional.

Consider getting an appraisal if you encounter any of these scenarios:

- You suspect a rare variety or error. If your coin has a strange die crack, a misaligned strike, or lettering that doesn't match standard references, an expert can confirm if it's a valuable error or just post-mint damage.

- You've inherited a large collection. An entire album or box of coins is a massive task to assess individually. A professional can quickly sort the common pieces from the potential highlights, saving you hundreds of hours.

- The coin could be extremely valuable. For any coin potentially worth thousands of pounds, a formal appraisal is absolutely essential for insurance and your own peace of mind.

- You plan to sell a significant piece. An expert valuation provides the documentation and confidence you need when approaching auction houses or high-end dealers.

Dealer Offers Versus Formal Valuations

It’s crucial to understand the two main types of professional assessment, as they serve very different purposes. Getting them mixed up is a common source of confusion and disappointment.

An informal offer from a dealer is simply the price they are willing to pay for your coin on that day. This figure naturally accounts for their business overheads and profit margin. It's a quick, practical way to sell, but it is not the coin's full market value.

A formal written valuation, on the other hand, is a detailed document usually prepared for insurance purposes. This report states the coin's full retail replacement value—what it would cost to buy that exact coin from a dealer. This figure will always be higher than a dealer's cash offer.

A formal appraisal is your objective benchmark. It provides a clear, unbiased assessment of retail value, which is indispensable for insurance claims, estate planning, or simply understanding the true calibre of your collection.

Finding a Reputable Numismatic Expert

The key to a trustworthy appraisal is finding a knowledgeable and ethical expert. Your best starting point in the UK is the British Numismatic Trade Association (BNTA). Members of the BNTA are held to a strict code of conduct, ensuring they provide fair and honest assessments.

When you're ready to take this step, our guide offers some expert coin collection valuation tips that can help you prepare for the meeting and know what questions to ask.

To get the most out of your time with an expert, make sure you prepare beforehand:

- Organise Your Coins: Group similar coins together and have your most important pieces easily accessible.

- Do Your Own Research: Arrive with a basic understanding of what you have. This shows the expert you're engaged and helps focus the conversation on what really matters.

- Don't Clean Anything: Whatever you do, resist the urge to polish your coins. Bring them as they are—cleaning destroys their patina and their value.

A professional appraisal isn't just about getting a price; it's about gaining certainty. For those special coins that stand out from the rest, an expert's eye can confirm their significance and unlock their true story, giving you the confidence you need to manage your collection wisely.

Frequently Asked Questions About British Coin Values

As you dive into the world of old British coins, a few questions always seem to surface. It’s natural to feel a bit lost at first, whether you're wondering about the change in your pocket or figuring out how to handle a potential family heirloom. Let's tackle some of the most common queries with clear, practical advice.

Getting a grip on these fundamentals will help you avoid costly mistakes and approach your collection with a lot more confidence.

Is the Change in My Pocket Worth Anything?

This is the big one, the question almost everyone asks. For the most part, the coins you get in your daily life are worth exactly what they say they are—their face value. But, and this is the exciting part, there are always exceptions that can turn your loose change into a genuine treasure hunt.

The coins to really keep an eye out for are the modern commemorative 50p and £2 pieces. Every so often, The Royal Mint releases a design with a surprisingly low mintage, making it an instant collectible. The most famous example is the 2009 Kew Gardens 50p. With only 210,000 ever minted, it's the holy grail of modern circulation coins. Finding one of those is a fantastic score, and collectors will pay a serious premium for it.

A great habit to get into is checking the mintage figures for any unusual commemorative coin you find. The Royal Mint publishes this data online, and a quick search can tell you if that interesting 50p is a common piece or a rare find worth tucking away.

What about the old pre-decimal currency? You’re extremely unlikely to find any still circulating. However, if you do come across any "silver" coins dated before 1947, they're made of actual silver. Coins from 1920-1946 are 50% silver, and anything pre-1920 is 92.5% sterling silver. This means their metal value alone is far greater than their original face value.

Should I Clean My Old Coins?

Let me be blunt: absolutely not. This is hands-down the biggest and most irreversible mistake a newcomer can make. It seems logical that a shiny, brilliant coin would be more valuable than a dull, toned one, but in the world of coin collecting, the exact opposite is true.

Cleaning a coin, no matter how carefully you think you're doing it, strips away its original surface. This natural layer, known as patina or toning, has developed over decades, sometimes centuries, and is seen by serious collectors as proof of a coin's authenticity and history. The process also creates thousands of tiny, microscopic scratches that can never be undone.

An original, uncleaned coin with attractive natural toning will always be more desirable—and more valuable—than one that has been harshly polished. Collectors see cleaning as damage, plain and simple. It can instantly obliterate a massive chunk of a coin's value. The best advice is to leave them exactly as you found them.

Metal Value Versus Numismatic Value

Getting your head around these two concepts is crucial for properly valuing any coin made from a precious metal.

-

Metal Value: This is often called the "bullion value" or "melt value." It’s the straightforward, intrinsic worth of the precious metal in the coin. For instance, the value of the silver in a pre-1920 shilling is determined by its weight and the day's market price for silver.

-

Numismatic Value: Sometimes called "collector value," this is what a collector is willing to pay for the coin itself, based on factors like its rarity, condition, historical importance, and current demand.

A very common, heavily worn silver coin might not be worth much more than its basic metal value. But for a rare date in superb condition, the numismatic value can soar to hundreds, or even thousands, of times more than the value of the metal it's made from.

Where’s the Best Place to Sell My Coins?

This really depends on what you have and what you're trying to achieve. There’s no single "best" place; the right avenue is determined by the coin’s value, your timeline, and how much effort you want to put in.

For common, lower-value coins, online marketplaces like eBay can be a great option. They give you direct access to a huge pool of casual buyers. The key is to take clear, high-quality photos and write an honest, detailed description of the coin's condition.

If you have something genuinely rare or valuable, a specialised coin auction house is almost always your best bet. Firms like Spink or Noonans have a global network of serious collectors who are prepared to pay top prices for the best items. Going this route will usually get you the highest final sale price.

The quickest and simplest option is selling directly to a reputable coin dealer. You'll get an immediate offer and cash in hand. Just remember that the dealer is running a business and needs to make a profit, so their offer will naturally be below the coin's full retail or auction value. For any coin of significant value, it’s always a good idea to get a couple of different opinions before you decide to sell.

At Cavalier Coins Ltd, we provide a trusted platform for both new and experienced collectors to build their collections with confidence. Whether you're searching for a specific rare piece or looking to start your numismatic journey, explore our curated selection of world coins and banknotes at https://www.cavaliercoins.com.