Before you can figure out what an old English coin is worth, you first have to figure out what it is. This is ground zero for any valuation. You need to get to know the coin by looking closely at the monarch, the date, and any other little symbols or markings.

This initial identification isn't just a box-ticking exercise; it's the absolute foundation of the whole process. A tiny detail you might overlook could be the difference between a common piece and a rare treasure, dramatically changing its value. Getting this right from the start means all your later research will actually be accurate and worthwhile.

Your Starting Point for Coin Identification

Forget about price guides and auction catalogues for a moment. Your journey starts with the coin right there in your hand. The most important clues are usually sitting right on the surface, just waiting for you to piece them together. Think of it like being a detective; you're looking for the evidence that tells the coin's unique story.

The first and most obvious feature is almost always the monarch's portrait. Can you tell which king or queen is on it? A coin of Queen Victoria, for example, will have a completely different portrait style and inscription to one of George III or an even earlier Anglo-Saxon penny. Look for the name or title, which is often in Latin, circling the portrait.

Key Details to Examine

Once you've got a good idea of the monarch, it's time to zoom in on the smaller details. This is where you separate the common coins from the genuinely scarce varieties. You need to pay very close attention to a few specific things:

- The Date: This is your most direct link to a specific year. If the date is worn down or hard to read, the monarch's portrait becomes even more critical for narrowing down the era.

- Inscriptions and Legends: What do the words on the coin actually say? You'll often see Latin phrases like "DEI GRATIA" (By the Grace of God), but small variations in the spelling or wording can signal a different issue or mint.

- Mint Marks: These are tiny letters or symbols that show where the coin was made. A coin struck at a regional mint is often much rarer than one produced at the main Tower of London mint.

A Georgian-era shilling and a Victorian one might share the same denomination, but everything from their design and inscriptions to the direction the monarch is facing will be different. A hammered coin from the medieval period looks nothing like a machine-struck coin from the 1800s. The difference is night and day.

Expert Tip: Don't forget to flip it over! The reverse (or "tails") side is just as important. The design you find there—whether it's a coat of arms, a seated Britannia, or a simple cross—is a vital piece of the identification puzzle.

Getting these fundamentals right is crucial because the very metal used for British money has changed so much over the centuries. Silver coins were the standard for hundreds of years, but by 1947, cupronickel took over for most circulating coins to save on costs. Today’s currency, with billions of pennies and two-pence pieces in circulation, is a world away from the silver and gold standards of the past.

You can learn more about this by exploring the rich history of British coin circulation. This history of constant change is exactly why correct identification is the most important first step you'll take when you set out to value old English coins.

How to Grade Your Coin's Condition

Once you've identified your coin, its condition—what we call its 'grade'—is the single most important factor driving its value. I’ve seen it time and time again: a pristine, uncirculated coin can be worth a small fortune, while the exact same coin, worn from its time in circulation, might be worth only a fraction of that.

Learning to accurately grade a coin is a fundamental skill. It’s what separates a casual enthusiast from a serious collector. You’re essentially training your eye to become a detective, looking for the subtle clues that tell the story of a coin's journey since the day it was struck.

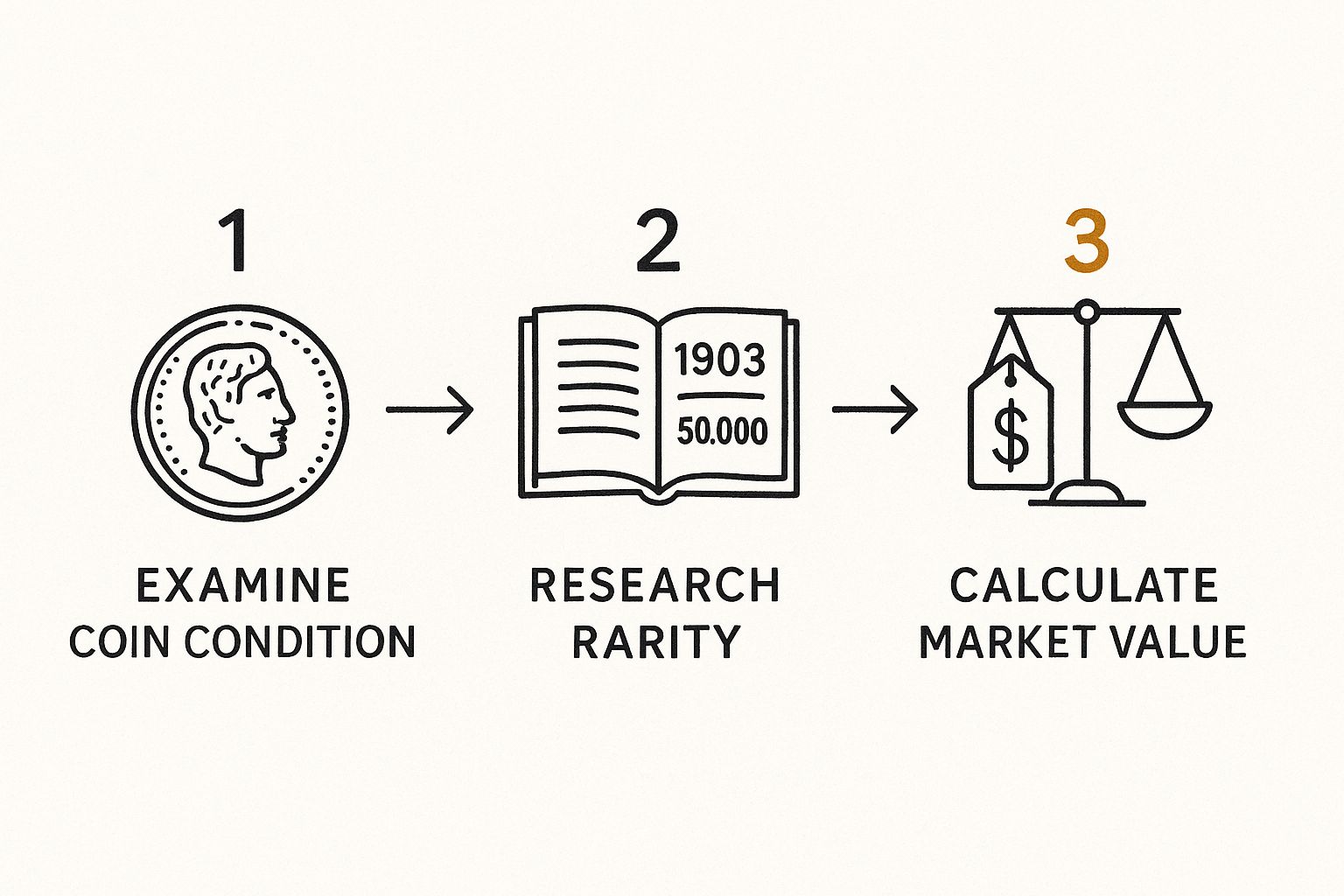

This simple chart illustrates how central grading is to the entire valuation process. It's the foundation upon which everything else is built.

As you can see, you can't properly research rarity or market price until you have a solid idea of the coin's condition. Getting this part right is crucial.

Understanding the UK Grading Scale

The UK uses a descriptive grading scale. While it might seem a bit subjective at first, each term—from ‘Fair’ (heavily worn but still identifiable) up to the coveted higher grades—corresponds to a very specific level of wear.

Here are the key upper-tier grades you'll encounter most often:

- Very Fine (VF): You'll see clear, sharp details, with wear confined to the very highest points of the design, like the monarch’s hair or the top of a shield.

- Extremely Fine (EF): The coin exhibits only the slightest friction, visible just on the absolute highest points. Crucially, much of the original mint lustre—that silky, cartwheel sheen of a brand-new coin—is still visible.

- Uncirculated (UNC): This is a perfect coin. It shows no signs of wear at all and looks just as it did the day it left the mint, with full, unbroken lustre.

A common pitfall for newcomers is mistaking a weakly struck coin for a heavily worn one. If the initial strike was poor, the fine details were never there in the first place. That’s a world away from a sharply struck coin whose details have been worn down over time.

To help you get a handle on these terms, here's a quick reference table.

UK Coin Grading Standards Explained

This simplified table breaks down the most common UK grading terms and what they mean in practice. It's a great starting point for assessing the coins in your own collection.

| Grade | Abbreviation | Description of Wear |

|---|---|---|

| Uncirculated | UNC | No signs of wear. Full mint lustre present, as it was on the day it was minted. |

| Extremely Fine | EF | Minimal wear, visible only on the highest points of the design. Much of the mint lustre remains. |

| Very Fine | VF | Light wear on high points, but all major details are sharp and clear. |

| Fine | F | Moderate wear across the entire coin, but the main design and legends are still clearly visible. |

| Very Good | VG | Significant wear. Major features are outlined but lack fine detail. |

| Good | G | Heavily worn. The design is visible but faint. The date and monarch should be identifiable. |

| Fair | Fair | Extremely worn. Only the basic coin type is identifiable; the date may be unreadable. |

Getting familiar with these grades will dramatically improve your ability to spot a bargain or avoid overpaying.

What to Look for When Grading

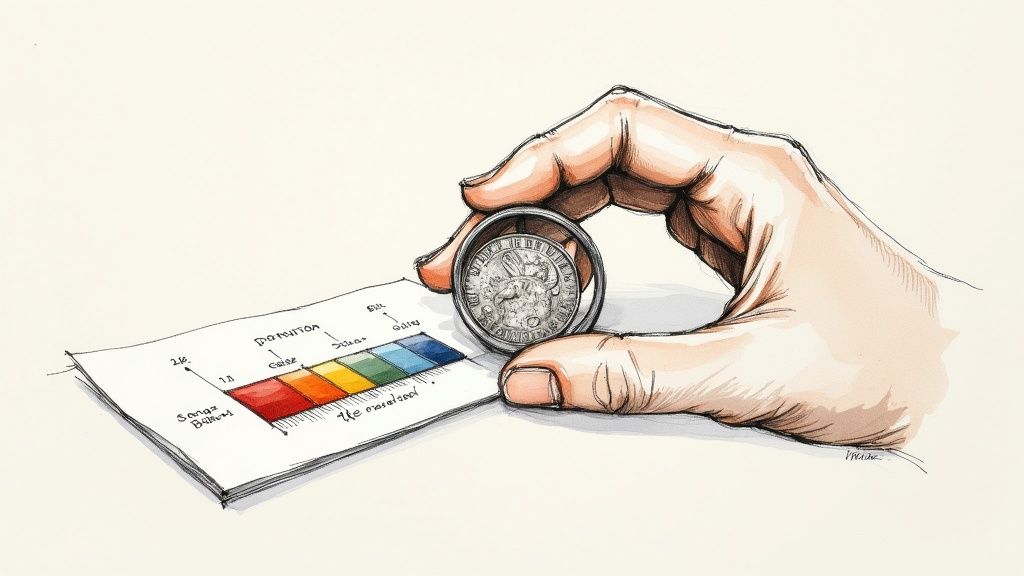

So, how do you actually do it? Start by holding the coin by its edges—never touch the face! Use a good, angled light source and a magnifying glass. Tilting the coin back and forth is the best way to see how light reflects off the surface, which will reveal both subtle wear and any remaining mint lustre.

Focus your attention on the highest points of the design. On a portrait, this is typically the monarch’s eyebrow, ear, and the hair just above it. On the reverse, it might be the top of a crown or the lion's breast on a coat of arms. These are always the first places to show wear.

For a much deeper look at the nuances of grading, our comprehensive UK coin grading guide provides detailed criteria and photos to help you master this essential skill. Honing your ability to tell a 'Good Fine' from a 'Very Fine' is where you can find incredible value and protect yourself from costly mistakes.

Uncovering Rarity and Historical Significance

What separates a five-pound curiosity from a five-figure treasure? More often than not, it’s a captivating mix of rarity and historical context. It's this combination that elevates a simple piece of metal into a tangible artefact, and understanding it is key when you value old English coins.

Rarity can be a slippery concept. You’d assume older means rarer, but some Roman coins are surprisingly common, while certain 20th-century pieces are nearly impossible to find. The true drivers are low original mintage numbers and even lower survival rates. A coin might have been struck in the millions, but if most were later melted down or simply lost to time, the few that remain become exceptionally scarce.

Factors That Create Numismatic Legends

Certain events and circumstances conspire to create truly legendary coins. These are the stories that fire up a collector's imagination and send values into the stratosphere. Keep an eye out for coins with these kinds of backstories:

- Short-Lived Monarchs: Coins from a king or queen with a brief reign are naturally rare. The classic example is Edward VIII; his abdication stopped production almost before it began, making his coinage exceptionally scarce.

- Error Strikes: Even the Royal Mint makes mistakes. A coin struck on the wrong type of metal, with mismatched dies, or featuring a dramatic design flaw can be unbelievably valuable to specialists who hunt for these oddities.

- Famous Provenance: A coin’s history of ownership—its provenance—can add enormous value. If you can trace a coin back to a famous collection or a notable historical figure, it carries a prestige that collectors will happily pay a premium for.

- Historical Events: Coins minted to commemorate a specific event, like the famous ‘VIGO’ coins struck from bullion captured at the Battle of Vigo Bay, offer a direct link to a pivotal moment in British history. That narrative makes them far more desirable.

A coin is much more than just metal; think of it as a primary source document from its era. The story it tells—of a changing dynasty, a military campaign, or an economic crisis—is what truly defines its importance.

Rarity isn't just a number; it's a story. The fewer coins that exist and the more compelling their history, the more collectors will compete for them. This intersection of scarcity and significance is where true numismatic value is born.

The effect of rarity on the market is staggering. Some of the most sought-after old English coins have achieved astonishing prices at auction, driven by their unique stories and extreme scarcity. For instance, the 1937 Edward VIII Gold Sovereign, with only a handful of known examples (around six), is valued at approximately £1,000,000.

Other legendary pieces, like the 1703 Queen Anne ‘Vigo’ Five-Guineas (£845,000) and the iconic 1839 ‘Una and the Lion’ Gold £5 Coin (£889,000), command huge sums simply because fewer than ten specimens might exist today. These values reflect a global demand that goes far beyond the metal itself, focusing squarely on historical importance. You can see more examples by reading this guide to the UK's rarest coins.

How to Research Your Coin's Rarity

Your first port of call for research should be a good catalogue, like the Spink 'Coins of England' guide. This is the industry bible and will give you estimated mintage figures for most issues. Pay very close attention to any notes about varieties or specific years that are known to be scarcer than others.

After that, dive into online auction archives. Seeing how many examples of your coin have come up for sale over the past decade gives you a real-world feel for its availability. If you can only find one or two records, you could be holding something genuinely rare.

Finding Accurate Market Prices

Alright, you’ve identified your coin and have a good handle on its grade. Now for the exciting part – figuring out what it's actually worth. This is where we move from being a coin detective to a market analyst, a crucial shift when you value old English coins. The secret here isn’t finding one magic price, but pulling together information from a few key places to get a realistic picture.

Any serious collector of British coins will tell you that your research needs a blend of the old and the new. The foundational text, one you absolutely must have on your shelf, is the Spink ‘Coins of England’ catalogue. I treat it as my bible. It provides standardised catalogue values for just about every known coin in various grades, giving you a solid, stable benchmark to start with.

But here’s the thing: catalogue values are just that—benchmarks. They don't always capture the pulse of a fast-moving, real-time market.

Blending Print Guides with Digital Data

To get a true feel for what collectors are willing to pay right now, you have to go online. This is where you see the theory meet reality. I spend a lot of time digging through the completed sales archives of major auction houses and online marketplaces.

What you're hunting for is the 'hammer price'. This is the price a coin actually sold for at auction, not the auctioneer's estimate or a dealer's retail price. It's a critical distinction. A dealer's asking price has their overheads and profit margin baked in. The hammer price, on the other hand, is a pure measure of collector demand at that very moment.

I see this mistake all the time: a collector spots a coin like theirs on a dealer's website with a high price tag and thinks they've struck gold. Always, always prioritise recent, verified sales data over retail listings. The hammer price is your most honest guide to a coin's current market value.

This research can also give you some fascinating context. The value of historic British coins has been a moving target for centuries, often shifting with royal whims or the price of metal. Coins like the Florin, Angel, and Ryal all had their official worth adjusted back in the 15th and 16th centuries. You can see how these pre-decimal coin valuations changed over time, and it helps explain why certain periods or issues generate more buzz among collectors today.

Understanding Market Fluctuations

Remember, coin values are never set in stone. They are constantly being pushed and pulled by two main forces:

- Bullion Prices: If your coin is gold or silver, its base value is tethered to the live spot price of that metal. When gold prices shoot up, the intrinsic value of a gold Sovereign climbs right along with it.

- Collector Demand: This is the magic ingredient—the numismatic premium. Tastes change. One year, everyone might be chasing coins from a particular monarch; the next, a different series becomes hot. This can drive prices up completely independently of the coin's metal content.

By combining the stable reference points from catalogues with the dynamic reality of auction results, and keeping an eye on market trends, you’re no longer just guessing. You’re making informed, data-driven decisions about your collection's value.

When to Seek a Professional Valuation

While doing your own research is one of the most rewarding parts of collecting, there are times when an expert's eye is simply essential. Certain situations demand a level of authority and certainty that only a professional numismatist can provide, moving beyond your personal assessment to official, documented proof.

A professional valuation becomes non-negotiable for any serious financial and legal matters. It gives you the credible, written evidence you need to move forward with confidence.

Formal Appraisals for Official Purposes

So, when is a formal, written appraisal the right move? Generally, you should get one for:

- Insurance Coverage: If you’ve built up a high-value collection, your standard home insurance policy almost certainly won't cut it. A professional appraisal is what you'll need to secure specialised cover that properly reflects your coins' replacement value.

- Estate Settlement: When an inheritance includes a coin collection, a formal valuation ensures everything is distributed fairly among heirs. It’s also a required step for probate and calculating any inheritance tax.

- Significant Sales: Before you even think about selling a particularly rare or valuable coin, an appraisal validates its authenticity and condition. This gives you serious negotiating power and gives potential buyers the confidence to pay a premium.

It's vital to know the difference between a dealer's informal opinion and a formal written appraisal. An off-the-cuff verbal valuation from a dealer is often just their offer to buy your coin. A formal appraisal, on the other hand, is a detailed service you pay for, which results in a legal document outlining your coin's characteristics and its true market value.

Finding a Reputable Expert

The key here is finding a numismatist you can trust. A great place to start is by looking for members of respected organisations like the British Numismatic Trade Association (BNTA). These professionals are all bound by a strict code of ethics.

Be prepared to pay for their expertise; costs might be a flat fee per coin or an hourly rate. Remember, this fee is for their unbiased, expert opinion—not an offer to buy—which guarantees the valuation is impartial. This professional opinion is the best tool you can have when you need to value old english coins for any serious purpose.

A professional appraisal isn’t just about putting a price on a coin. It’s about getting certified proof of its authenticity, grade, and place in the market. This documentation is invaluable for insurance, legal matters, and getting the best possible price when it’s time to part with a treasured piece.

For anyone thinking of selling, a professional valuation is the perfect first step. If you want more detailed guidance on what comes next, you can explore our complete success guide on how to sell coins in the UK. It will help you turn that valuation into a successful sale.

Common Questions About Coin Valuation

As you get more involved in numismatics, you'll find certain questions come up time and time again. Working out the value of old English coins can feel like a maze, but don't worry—most collectors run into the same stumbling blocks. Here, we'll clear up some of the most frequent queries so you can move forward with confidence.

Think of this as a quick reference for those nagging doubts. Getting these basics right from the start can save you from making some common, and sometimes expensive, mistakes.

How Do I Know if My Coin Is Real Silver?

This is easily one of the most common questions we hear, and thankfully, the date is your biggest clue.

For British coins, the key dates are 1920 and 1947.

- Before 1920: Coins described as 'silver' were made of 92.5% silver (Sterling silver).

- 1920 to 1946: The silver content was dropped to 50%.

- After 1946: So-called 'silver' coins were made from cupronickel, which contains no silver at all.

A simple visual check can often help. Look at the coin's edge, especially if it's a bit worn. Cupronickel coins frequently show a tell-tale reddish-brown or greyish core where the underlying copper and nickel alloy peeks through. Sterling and 50% silver coins tend to wear down more evenly without that distinct coppery tone.

If you’re still unsure, a reputable dealer can perform a quick, non-damaging test for you.

Crucial Takeaway: Whatever you do, never clean your old coins. Collectors pay a premium for the natural toning, or 'patina,' that builds up over decades or even centuries. Harsh cleaning strips away this original surface, leaves microscopic scratches, and can destroy a coin's value, sometimes by more than 90%. A dirty, original coin is always worth more than a brightly polished, damaged one.

What Is the Difference Between Face Value and Numismatic Value?

Understanding this difference is fundamental to coin collecting.

-

Face Value: This is simply the denomination stamped on the coin itself—'one shilling', 'one penny', etc. It’s what the coin was worth as legal tender back in its day.

-

Numismatic Value: This is what a collector is willing to pay for the coin today. This value is a mix of its rarity, condition (grade), historical significance, and current market demand.

For almost any old English coin you find, its numismatic value will be much higher than its face value. Think of the face value as a historical footnote; the numismatic value is its real-world worth in the collecting market.

Are All Error Coins Valuable?

Not always. Finding a coin with a minting mistake is exciting, but their effect on value can vary wildly. The value of an error really comes down to how obvious, rare, and desirable it is to other collectors.

For instance, a major error, like a penny accidentally struck on a silver ten-pence blank, would be exceptionally rare and incredibly valuable. On the other hand, a tiny die crack or a minuscule clip on the edge of a very common coin might add little to no extra value.

For an error to command a big premium, it generally needs to be dramatic and visually interesting. It's a highly specialised field where the market for specific types of errors ultimately decides their worth.

At Cavalier Coins Ltd, we share your passion for the history and artistry that goes into building a great collection. Whether you're just starting your journey or searching for that one elusive piece, we invite you to explore our curated selection of world coins and banknotes. Find your next treasure at https://www.cavaliercoins.com.