At its heart, an uncirculated coin is one that has never seen the inside of a pocket, a purse, or a till. It's never been used for day-to-day transactions.

Imagine a brand-new car that has never left the showroom floor; it’s pristine, free from the dings, scratches, and general wear and tear of the open road. That’s an uncirculated coin. It’s a perfect snapshot of the minter's art, preserved from the very moment of its creation.

Understanding the Two Worlds of Uncirculated Coins

When we talk about what makes a coin uncirculated, it’s not really about its age but about its life story—or, more accurately, its lack of one. An uncirculated coin keeps its sharp, crisp details and that original factory shine, something collectors call mint lustre. It’s the very first thing that vanishes once a coin enters circulation, and it’s the key indicator of a coin’s untouched state.

However, not all uncirculated coins are created equal. They generally fall into two main categories, and each has a very different journey from the mint to the collector. Grasping this difference is the first step in appreciating a coin’s true history and its potential value.

Standard vs Specially Struck Coins

The two main types you’ll come across are:

- Standard Uncirculated: These are the regular coins that were meant for circulation, but they were pulled aside before they ever made it into public hands. They're taken straight from mint bags. While they haven't been spent, they might have minor imperfections like "bag marks"—small scuffs from jostling against other coins.

- Brilliant Uncirculated (BU): These coins are a different breed altogether, made specifically for collectors. They are struck using specially prepared, polished dies and are handled with much more care during production. The result is a superior finish and a more brilliant, flawless appearance.

An uncirculated coin is a time capsule. It captures the exact design and quality intended by the artist and the mint, frozen in time before the rigours of commerce could wear it down. This state of preservation is what numismatists find so captivating.

To give you a sense of scale, while there are approximately 27 billion coins in general circulation in the UK, those specifically set aside as 'uncirculated' are often packaged and sold directly to enthusiasts.

A great example of this is certain £1 coins struck after 2016. They were never released into public circulation at all and were only available in special commemorative sets. This instantly makes these uncirculated versions highly desirable. You can explore more details about these unique pound coins to understand their collector appeal. It’s this careful separation from everyday currency that maintains their pristine condition and elevates their status.

Let’s quickly break down the key differences between the coins you find in your change and their uncirculated cousins.

Circulated vs Uncirculated Coins At a Glance

The table below offers a simple comparison, highlighting the fundamental distinctions between the two.

| Characteristic | Circulated Coin | Uncirculated Coin |

|---|---|---|

| Condition | Shows signs of wear like scratches, dings, and fading. | Pristine, with sharp details and no signs of wear from handling. |

| Mint Lustre | Original shine is dull or completely gone. | Retains its original, brilliant mint lustre. |

| Origin | Found in everyday public transactions (shops, banks). | Obtained directly from mints, dealers, or collector sets. |

| Common Flaws | Scratches, rim dings, environmental damage, smooth surfaces. | May have minor "bag marks" from contact with other coins. |

| Purpose | Intended for commerce and daily use. | Produced or set aside for collectors and investors. |

As you can see, the journey—or lack thereof—is what defines the coin. One is a workhorse, the other a showpiece.

Tracing a Coin's Journey from Mint to Pocket

To really get to grips with what makes an uncirculated coin special, picture this: two identical coins, fresh from the press at the Royal Mint. Think of them as twins, born at the same instant with the same sharp details and brilliant shine. From here, though, their paths will fork dramatically, a divergence that will define their condition, and ultimately their value, forever.

Let’s name our first coin Alex. Straight away, Alex is tossed into a huge canvas bag with thousands of its siblings. This bag gets loaded onto a lorry, driven across the country, and ends up in a central bank vault. Before it has even started its life as money, Alex has already picked up a few tiny knocks and scuffs from rubbing against the other coins. Collectors have a name for these: bag marks.

From the bank, the journey continues. A local shop needs more change, and Alex is tipped into a cash till, rattling against all the other coins. Soon enough, it’s given to a customer who slips it into a pocket, where it jingles against keys and loose change. The delicate, freshly-minted surfaces are already starting to wear down.

The Life of a Circulated Coin

Over the next few months, Alex will pass through hundreds of hands. It’ll be fed into vending machines, accidentally dropped on the pavement, and clattered through high-speed sorting machines. Every single interaction acts like a tiny piece of sandpaper, slowly but surely smoothing away the intricate details of the original design.

You'll start to see:

- The high points, like the monarch’s portrait, becoming flattened.

- The sharp, crisp edges of the lettering softening and starting to blur.

- The original mint lustre—that unique shine—completely disappearing, replaced by a dull, uniform finish.

Alex is now what we call a circulated coin. It’s done its job as currency, but in the process, it has lost that pristine, as-new quality it had at birth. Its story is one of everyday use and inevitable wear.

The Path of Preservation

Now, let's turn to our second coin, Bella. Unlike Alex, Bella’s story is all about careful preservation. The moment she was struck, she was handled with extreme care—often by staff wearing gloves—and immediately sealed in a protective case or placed into a specially made collector's set.

Bella never sees the inside of a mint bag, let alone a shop till. She is shielded from all the friction, knocks, and environmental damage that Alex endures. Her journey is a short one: straight from the mint to a collector or a dealer, where she remains completely protected.

The real difference is simple: an uncirculated coin's story is about the life it hasn't lived. It's a perfect snapshot of the minter’s art, frozen in time at the very moment of its creation, entirely untouched by the world of commerce.

This comparison makes it crystal clear that the term ‘uncirculated’ has far more to do with a coin’s history than its age. One coin served its purpose in trade, while the other was kept back as a piece of art. This very distinction is the foundation of coin collecting, explaining why two coins that look identical at first glance can have such vastly different appeal and value.

Decoding the Grades of Uncirculated Coins

Just because a coin has never been through a till doesn't mean it’s perfect. Many people new to collecting are surprised by this. The term ‘uncirculated’ is really just a starting point, a broad category that has its own detailed grading scale to separate the good from the absolutely flawless.

Think of it like diamond grading. Two stones might both be freshly mined, but one could have tiny internal flaws while the other is pristine under magnification. It's the same with coins. The moment a coin is struck, its life begins, and even the process of being dropped into a mint bag with thousands of other new coins can leave its mark.

To account for these subtle differences, experts use a numerical system called the Mint State (MS) scale. This scale gives us a consistent way to talk about quality, and it ranges from MS-60 to MS-70.

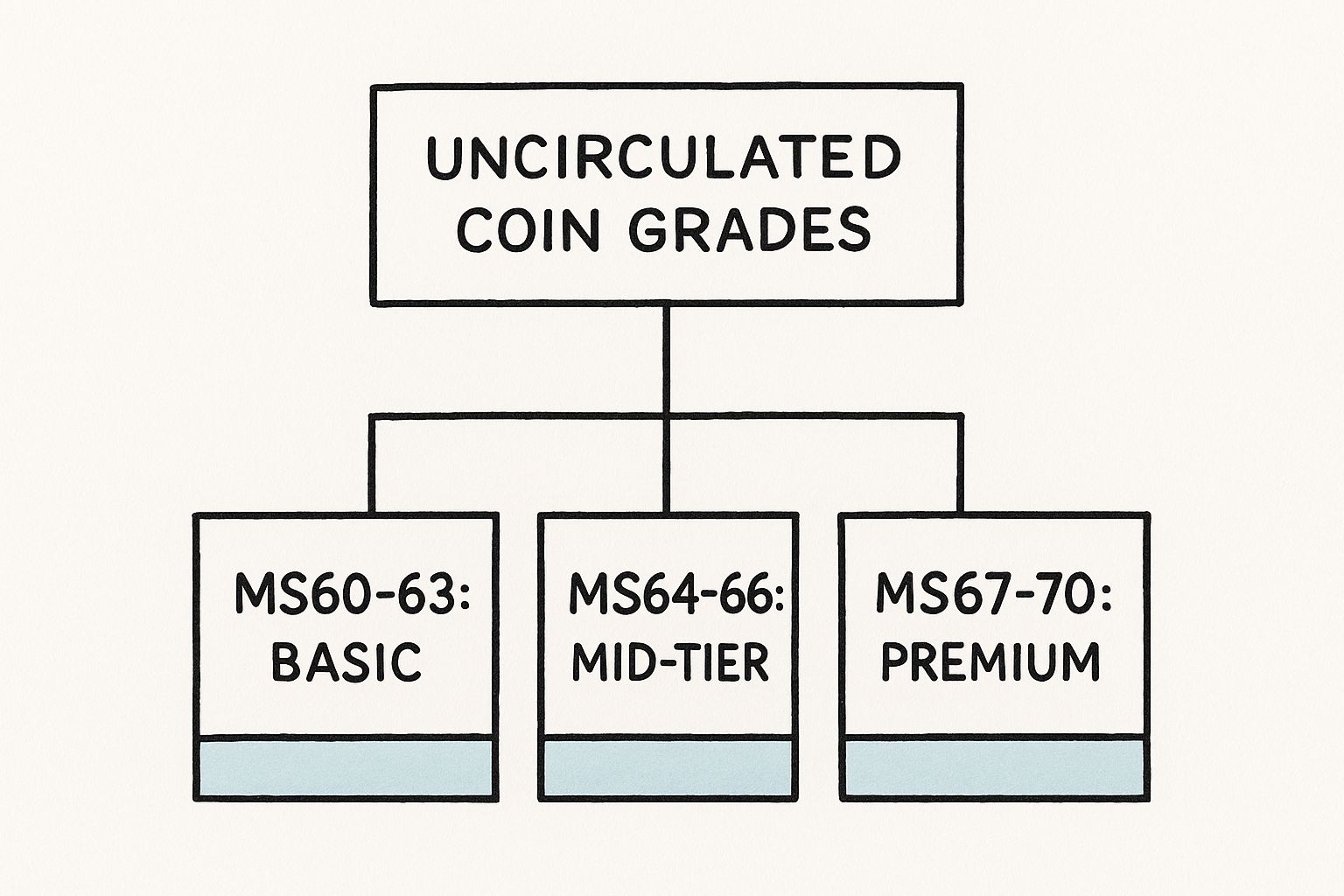

The Mint State Grading Scale

The MS scale is the industry standard for evaluating an uncirculated coin's condition. An MS-60 coin is your baseline—it has definitely never been in commerce, but it might have noticeable marks or a slightly weak strike. At the other end of the spectrum, an MS-70 coin is the pinnacle of perfection. It’s a flawless specimen with absolutely no visible imperfections, even under a powerful magnifying glass.

These tiny distinctions in grade can lead to massive differences in rarity and value. For an in-depth look at how these standards are applied, you can explore the details of the European coin grading system, which shares many principles with the MS scale.

The infographic below shows how these uncirculated grades stack up, breaking them down into practical tiers.

As you can see, while all coins from MS-60 to MS-70 are technically uncirculated, there’s a clear progression in quality and desirability as you move up the scale.

What Grades Mean in Practice

Getting your head around what these numbers actually represent is key to smart collecting. We're often talking about tiny imperfections, barely visible to the naked eye, that separate one grade from the next.

Let's break down the general tiers:

- MS-60 to MS-63 (Basic Uncirculated): These coins still have their original mint lustre, but they might show multiple, noticeable "bag marks". These are the little scuffs and abrasions from bumping against other coins during mint production and transport. The strike might also be a bit average.

- MS-64 to MS-66 (Mid-Tier Choice to Gem Uncirculated): Now we're getting into much nicer territory. In this range, the coins have a strong strike and excellent eye appeal. Any marks are smaller and far less distracting. An MS-65 "Gem" is a popular benchmark for a beautiful, high-quality collector's coin.

- MS-67 to MS-70 (Premium to Perfect Uncirculated): These are the superstars of the coin world. Coins graded MS-67 and above are nearly flawless, with exceptional lustre and only minuscule, hard-to-spot imperfections. An MS-70 is the perfect coin, a true rarity that commands the highest prices.

As a coin's grade climbs from MS-60 towards MS-70, its rarity—and often its market value—increases exponentially. The difference between an MS-65 and an MS-67 can be thousands of pounds for a rare coin, all based on microscopic details.

Exploring Uncirculated Bullion Coins for Investment

Beyond the world of standard collector's items, there's a fascinating middle ground where numismatics and investment meet: bullion coins. Think of iconic series like the Gold and Silver Britannia from The Royal Mint. These coins are treasured for two distinct reasons: their flawless, untouched condition and their core value in precious metal.

This gives them a really interesting dual nature when it comes to value. On one hand, their worth is tethered to the daily market price (the 'spot price') of gold, silver, or platinum. On the other, things like grade, rarity, and design can add a significant collector's premium on top of that raw metal value. It's a tangible asset that can help diversify an investment portfolio, but it's also a beautifully crafted collectible you can hold in your hand.

The Role of Precious Metal Content

A huge part of bullion's appeal is its direct link to the commodities market. A one-ounce Silver Britannia, for instance, will always be worth at least the going market price for an ounce of silver. This creates a solid value floor, making it a popular choice for anyone looking to physically own precious metals.

The term 'uncirculated coin' is a perfect fit for these special bullion issues. The Royal Mint, for example, produces around 100,000 uncirculated Silver Britannia coins each year. Since 2013, these silver coins have been minted to a fineness of 999/1000—that's 99.9% pure silver. This incredible purity makes them highly sought-after, both as serious investment assets and as pristine collectibles. You can find out more about the investment appeal of Britannia coins and their specific details.

How Condition Amplifies Bullion Value

While the metal content sets the baseline price, it's the uncirculated status that can really elevate a coin's value. A standard, run-of-the-mill bullion coin might only sell for a small premium over its metal value. But a perfect, top-grade (MS-70) example of that very same coin can fetch a much higher price from collectors who are hunting for absolute flawlessness.

The image below gives you a glimpse of the product page for a 2024 Silver Britannia, highlighting its dual identity as a bullion coin for both investors and collectors.

This is a great example of how mints market these coins directly, placing as much emphasis on their purity and investment potential as their collectible design. The uncirculated condition is a massive selling point, giving buyers the confidence that they are getting a piece straight from the source, untouched by the wear and tear of daily commerce.

How Scarcity Drives a Coin's Collector Value

Ever wondered why one uncirculated 50p coin is worth, well, 50p, while another can fetch hundreds of pounds? The answer almost always boils down to one simple thing: mintage figures.

This is just a fancy term for the total number of coins of a particular design that were ever struck and released. At its heart, it’s the classic principle of supply and demand, just played out in the fascinating world of numismatics.

When the supply of a coin is tiny but the demand from collectors is huge, its value can absolutely skyrocket. A coin isn't just a piece of metal; it’s a tangible piece of history, and its rarity is a massive part of its story. A coin with a massive production run is easy for anyone to find, but one with a tiny mintage becomes a genuine treasure hunt. This scarcity is what transforms a standard coin from simple pocket change into a sought-after collectible.

The Power of Low Mintage Numbers

The most famous modern example in the UK has to be the 2009 Kew Gardens 50p. With a mintage of just 210,000, it’s the rarest 50p coin ever put into circulation.

Now, compare that to the 22.7 million Royal Shield 50p coins minted in the very same year. It’s easy to see why the Kew Gardens piece is so special. That incredibly low production run has turned it into the holy grail for modern coin collectors.

Scarcity is the engine of collectability. The fewer of something that exists, the more people who want it will be willing to pay. In coin collecting, low mintage figures are the clearest indicator of future rarity and potential value.

This isn't a new phenomenon. Think back to the old round £1 coins. By March 2016, the UK had roughly 1.671 billion of them rattling around. Mints often control the release of uncirculated coins to avoid flooding the market and devaluing them. The new 12-sided 'Nations of the Crown' £1 coin, for instance, started with a huge mintage but later releases dropped off significantly, shifting from mass production to selective commemorative issues. You can even dig into UK coin circulation figures yourself to spot these trends.

Learning to identify these low-mintage opportunities is a crucial skill in this hobby. It’s what separates a casual collector from someone who builds a truly valuable collection.

To illustrate just how much of a difference a low mintage can make, let’s look at a few well-known UK coins.

Impact of Mintage on Potential Coin Value

| UK Coin Example | Mintage Figure | Impact on Collector Value |

|---|---|---|

| 2009 Kew Gardens 50p | 210,000 | Extremely high. Considered the rarest modern circulating 50p, its value is often hundreds of times its face value. |

| 2002 Northern Ireland Commonwealth Games £2 | 485,500 | Very high. As the rarest of the four Commonwealth Games designs, it commands a significant premium over the others. |

| 2011 WWF 50p | 3,400,000 | Moderate. While not as rare as Kew Gardens, its popular design and relatively low mintage still make it highly collectible. |

| 2019 Stephen Hawking 50p | Released as commemorative only | Varies. Not intended for circulation, its value is driven purely by collector demand and the numbers sold in presentation packs. |

As you can see, the lower the mintage, the more intense the collector interest becomes, which almost always translates to a higher market value over time.

For more guidance on making smart purchases, take a look at our article covering seven tips for buying collectable coins. It’s packed with practical advice for both new and experienced enthusiasts.

Building and Protecting Your Coin Collection

So, you're ready to start your journey into collecting uncirculated coins. It's an exciting time, but the first step is knowing where to find genuine pieces.

You can, of course, buy directly from mints like The Royal Mint. This is a surefire way to guarantee your coins are in pristine, untouched condition, fresh from the source. It’s often the best route for getting your hands on newly released commemorative and bullion coins.

Another brilliant option is to connect with reputable coin dealers. An established dealer is an expert in their field and can provide a solid guarantee of authenticity. They're also a fantastic resource for older uncirculated coins that you can no longer get directly from the mint.

Essential Storage and Protection Tips

Once you start acquiring coins, protecting your investment becomes priority number one. The value of an uncirculated coin is almost entirely tied to its condition, so proper storage isn't just a good idea—it's non-negotiable. Even a single fingerprint can cause permanent damage over time because of the natural oils on your skin.

To keep your collection safe, think about these storage solutions:

- Capsules: These are hard, clear plastic containers that snap shut around a single coin. They offer excellent protection against knocks, scratches, and exposure to the air.

- Flips: Inexpensive and flexible, these plastic pouches usually have two pockets—one for the coin and another for an info card. Just make sure they are made from PVC-free plastic to avoid any risk of chemical damage down the line.

- Slabs: These are the gold standard. Sonically sealed hard plastic holders used by professional grading services, they offer the ultimate protection and include all the grading information. They're typically reserved for more valuable coins.

Creating the Right Environment

Beyond the individual holder, the environment where you keep your collection is crucial for its long-term health. High humidity can lead to spotting and corrosion, while big swings in temperature can also be bad news for your coins.

Aim for a cool, dry, and stable environment. Storing your collection somewhere with low humidity and consistent temperatures is the best way to prevent toning, spotting, or other environmental damage that can seriously reduce a coin's value.

By being careful about where you buy your coins and how you store them, you can build a stunning collection and make sure its condition and value are preserved for years. For more in-depth strategies, check out our ultimate guide to coin collections in the UK for some extra expert advice.

Common Questions About Uncirculated Coins

As you start your journey into the world of numismatics, you'll find that certain questions pop up again and again. Getting to grips with the subtle differences between coin types is the first step toward building a collection you can truly be proud of. Let's tackle some of the most common queries people have about uncirculated coins.

Are 'Brilliant Uncirculated' and 'Uncirculated' the Same Thing?

It’s a great question, and while they're related, they aren't quite the same. Think of it this way: both types of coins have never been in public circulation, but a ‘Brilliant Uncirculated’ (BU) coin is like the premium edition, made to a much higher standard just for collectors.

BU coins are struck with specially polished dies and handled with extra care at the mint. This meticulous process gives them a stunning, brilliant lustre that you just don't see on standard uncirculated coins. Those, by contrast, are simply regular production coins that were pulled from the line before they ever had a chance to jingle in someone's pocket.

Can an Old Coin Still Be Uncirculated?

Absolutely! It’s one of the most exciting concepts in coin collecting. The term 'uncirculated' is all about the coin's condition, not its age. A coin struck in the 19th century can genuinely be uncirculated if, by some miracle, it was perfectly preserved from the moment it was minted and never spent.

These historical treasures are often described as being in ‘Mint State’ (MS) condition. Finding one is the holy grail for many collectors because very few coins from past eras survived without picking up some wear and tear. Their rarity makes them exceptionally valuable.

How Can I Tell If a Coin I Have Is Uncirculated?

Spotting a genuinely uncirculated coin is a skill that takes a bit of practice. You need to train your eye to look for key traits that vanish the second a coin enters circulation.

First and foremost, look for its original mint lustre. This isn't just about being shiny; it’s a specific, satiny glow that seems to radiate from the coin’s centre. It's a unique texture that even a little bit of handling will quickly wear away.

Next, get up close and personal with the design details. On an uncirculated coin, every fine point should be crisp and sharp. Pay close attention to the highest points of the design—like the monarch's cheek on a portrait or the fine lines on a coat of arms. If you see any flatness or smoothing, that's a tell-tale sign of wear.

A quick tip: even a brand-new uncirculated coin can have minor flaws. Small dings or scratches, known in the hobby as 'bag marks', can happen when coins bump against each other during the minting and bagging process. What you're looking for is a complete absence of wear from actual handling.

At Cavalier Coins Ltd, we provide authenticated uncirculated coins for every level of collector. Explore our curated selection of rare and pristine coins from around the world at https://www.cavaliercoins.com.