So, you think you’ve stumbled upon a valuable coin. That initial thrill is fantastic, but it's quickly followed by a crucial question: where on earth do you get it properly valued?

In the UK, you’ve got four main avenues to explore. You could pop down to a local coin dealer, approach a professional auction house, consult an independent numismatist, or go for a formal third-party grading service. Each one has its place, and the right choice for you really hinges on what you're trying to achieve.

Comparing UK Coin Valuation Services

Figuring out where to take your coin collection depends entirely on your end goal. Are you just curious and after a quick, informal estimate? Or do you need a rock-solid, certified valuation for insurance purposes or a potentially life-changing sale? Each route offers a different mix of cost, speed, and formality.

Your local coin dealer is usually the easiest first stop. It's the perfect place to get a quick, no-obligation opinion on more common coins, often without spending a penny.

At the other end of the spectrum, a prestigious auction house like Sotheby's or Christie's is the way to go for exceptionally rare and high-value pieces where getting the absolute best price is everything. Independent specialists offer unbiased assessments, and formal grading services provide that all-important authentication that can seriously increase a coin's market value.

Cost Considerations For Different Services

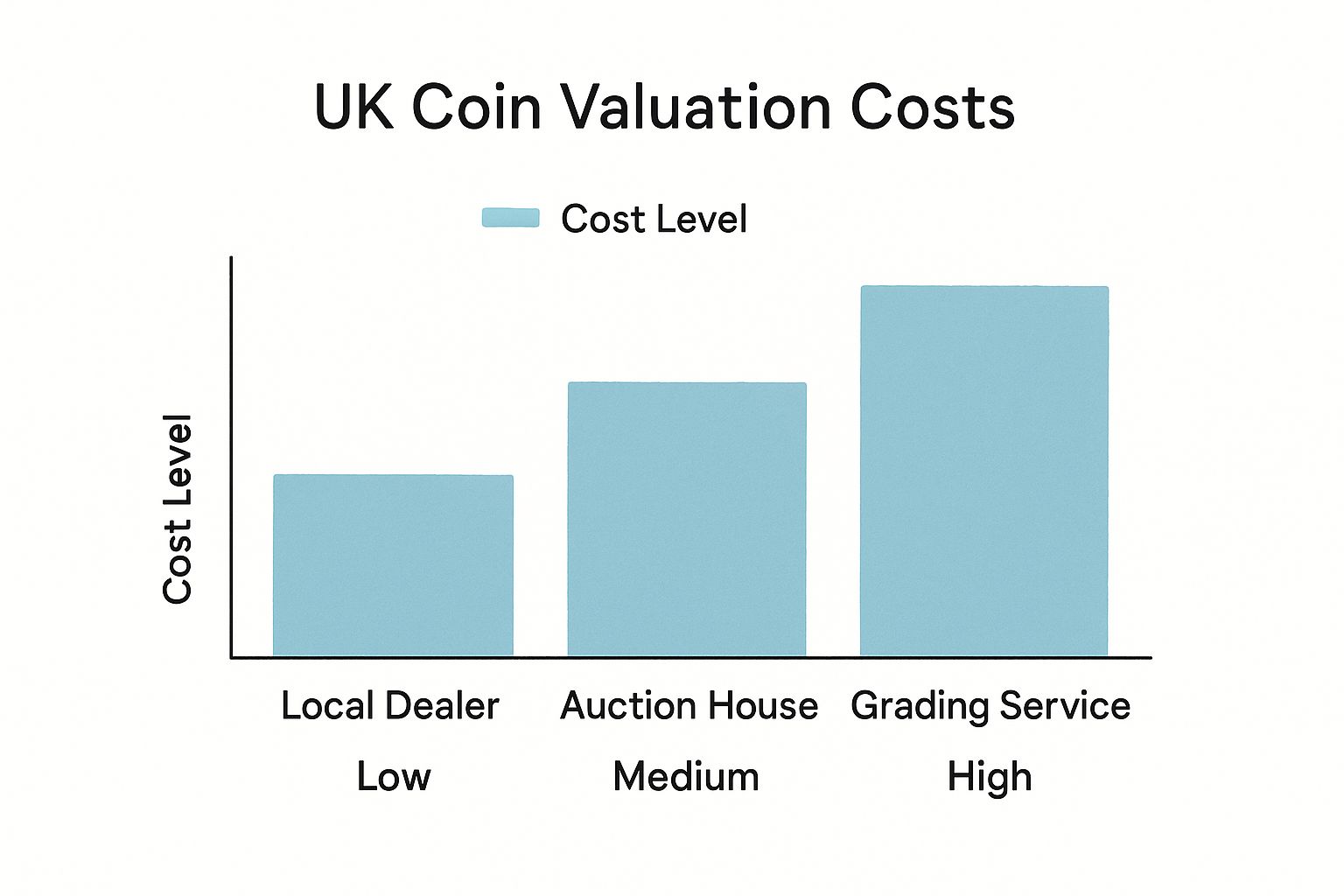

The money you’ll need to spend on a valuation can vary wildly. As you can see below, the cost can range from absolutely nothing to several hundred pounds, all depending on the level of detail and certification you're after.

This chart makes it clear: while visiting a local dealer won't hurt your wallet, professional grading services come with the highest price tag. That cost, of course, reflects the meticulous, detailed certification process they undertake.

To give you a clearer picture, I've put together a quick comparison of the main options.

Comparing UK Coin Valuation Services At A Glance

| Valuation Method | Best For | Typical Cost | Accuracy Level |

|---|---|---|---|

| Local Coin Dealer | Quick, informal estimates on common coins. | Often free, or a small fee. | Good, but reflects retail/purchase price. |

| Auction House | High-value, rare, or collectible items. | Usually free (appraisal), but commission on sale. | High (market-driven sale estimate). |

| Independent Numismatist | Unbiased, expert opinions for insurance or probate. | £50 - £150+ per hour. | Very High (impartial). |

| Third-Party Grading | Authentication and official grading for high-value coins. | £20 - £300+ per coin. | Highest (standardised and certified). |

This table should help you weigh up the pros and cons based on what matters most to you.

Understanding The Nuances Of Each Option

It's vital to remember that not all valuations are created equal because the person giving it might have a different motivation.

An auction house, for example, might offer a free appraisal because they're hoping you'll consign the coin with them for a future sale. A dealer's valuation will naturally come from a buyer's point of view, as their goal is often to acquire stock for their shop. An independent numismatist, on the other hand, is paid for their time and expertise, so their assessment is typically the most impartial you can get. For a deeper dive, you can find more expert coin collection valuation tips for UK coins that really break down how each service compares.

Key Takeaway: The best way to get your coin valued comes down to its potential worth and what you plan to do next. Are you selling, insuring it, or just satisfying your curiosity? Always keep the valuer's perspective in mind when you get their appraisal.

How to Prepare Your Coins for an Accurate Appraisal

Before you rush off to get an expert opinion on your coins, a little prep work can make a world of difference. How you present your collection doesn't just make you look professional; it can genuinely impact the final valuation. Getting this right is all about preservation.

The single most important rule is one that catches almost every new collector out: do not clean your coins. I can’t stress this enough. It feels like the right thing to do, but using polishes, abrasives, or even a simple cloth can strip away the natural patina. That subtle toning, which develops over decades, is a crucial part of a coin's history and character.

An aggressive clean can leave behind thousands of tiny scratches, permanently damaging the coin’s surface. I’ve seen it happen time and time again—a well-intentioned polish can turn a potential £1,000 coin into one worth only its base metal value. Any experienced numismatist can spot an improperly cleaned coin from a mile away, and it’s a huge red flag that will tank its value.

Handle With Extreme Care

The natural oils and acids on your skin are the enemy of a coin's delicate surface. Over time, they can cause irreversible damage, so proper handling is absolutely non-negotiable if you want to preserve its worth.

- Always hold a coin by its edges. The correct way is to grip it firmly between your thumb and forefinger, making sure your fingertips never make contact with the face (obverse) or back (reverse).

- Use a soft surface. When you need to put a coin down, never place it on a hard tabletop. Use a soft, lint-free cloth or a proper foam pad to prevent scratches and dings.

- Choose the right storage. Steer clear of cheap PVC plastic flips. Over time, they degrade and release chemicals that can ruin your coins. Instead, invest in archival-quality flips, capsules, or albums made from Mylar or other inert materials.

Gather Your Coin's History

The story behind a coin, what we call its provenance, can add a fascinating—and valuable—layer to its appraisal. While you might not know the full history, any little bit of information helps an appraiser. Did you inherit it from a grandparent? Is there an old receipt or a handwritten note tucked away with it?

This kind of background information helps build a narrative and can set your coin apart from others of the same type. Organising these details alongside the coin itself gives the expert a much more complete picture. For a really professional approach, learning how to catalogue coins properly will make a massive difference.

Expert Tip: Before heading to an appraisal, take some clear, well-lit photos of both sides of each key coin. This creates a personal record of its condition and is really useful if you need to send images ahead of an in-person meeting.

Ultimately, preparing your collection is all about protecting its integrity. By fighting the urge to clean, handling each coin correctly, and organising any history you have, you're making sure the expert sees its true, unaltered state. This simple diligence is the key to unlocking an accurate and fair valuation.

Working With Local Coin Shops and Dealers

Often, the most straightforward answer to "where can I get my coins valued?" is right around the corner at your local coin shop. It's the perfect place for a quick, face-to-face assessment without getting bogged down in the lengthy processes of formal grading or auctions. Think of it as the ideal first stop for an informal opinion on what your collection might be worth.

Of course, not all dealers are created equal, so it really pays to do a little homework first. A reputable dealer will be transparent, knowledgeable, and more than happy to walk you through their reasoning.

Finding a Reputable Dealer

The best place to start is by looking for members of respected trade organisations. In the UK, the British Numismatic Trade Association (BNTA) is the gold standard. Its members are held to a strict code of ethics, which gives you a significant layer of confidence and protection. A quick visit to their website lets you search for accredited members in your area.

Beyond official memberships, look for dealers with a solid local reputation. Check online reviews, see how long they've been in business, and don't be afraid to phone ahead to ask if they specialise in the types of coins you have. Putting together a list of questions before you go can make the whole experience much smoother.

For a bit more guidance, our article on finding trusted rare coin dealers near me offers a deeper dive into vetting local experts.

Red Flags to Watch For: Be wary of any dealer who pressures you into a quick sale, refuses to explain their valuation, or makes an offer without even properly examining your coins. A real professional will take the time to look at each piece carefully.

Understanding the Dealer's Valuation

This is crucial: you need to understand the context behind any number a dealer gives you. When you ask for a valuation, you have to be clear about what kind of value you’re after. A dealer's offer is based on what they are willing to pay for the coin right now – and that’s a very different number from its full market or insurance value.

It's a fundamental concept that many new sellers miss. The dealer has a business to run, so their offer will naturally be below the coin's retail price. It’s a bit like selling a car; you get less from a dealership than you would selling it privately, but you get convenience and immediate cash in return.

Here’s a quick breakdown of the different values you might hear about:

- Offer to Buy: This is the immediate cash price the dealer is willing to pay. It accounts for their overheads, expertise, and the profit margin they need to stay in business.

- Retail Value: This is the price the dealer would likely sell the coin for in their shop. It will always be higher than their offer to buy.

- Insurance Valuation: This is usually the highest figure, representing the full replacement cost of the coin. It’s for documentation and is not a realistic sale price.

Always ask the dealer to clarify which value they are providing. That one simple question can prevent a world of misunderstanding and help you manage your expectations.

Turning to Auction Houses and Grading Services

When you've got a coin that you suspect is something special—far more than just pocket change—it's time to bring in the professionals. For those truly high-value or exceptionally rare pieces, using professional grading services and major auction houses is the best way to authenticate their worth and unlock their true market potential.

Of course, this route isn’t for every coin; it's an investment in itself. But for the right one, it can lead to a much higher return and provide undisputed proof of quality and authenticity. This gives any potential buyer complete confidence.

The Power of Professional Grading

Think of professional grading services as the industry's official, third-party authenticators. Here in the UK, collectors often rely on globally recognised names like the Professional Coin Grading Service (PCGS) and the Numismatic Guaranty Company (NGC). Their job isn’t to give you a price, but to meticulously assess a coin’s physical condition.

The process is straightforward: you send your coin to their experts, who assign it a grade on a scale from 1 to 70. That grade, along with confirmation of its authenticity, is then sealed with the coin in a tamper-proof plastic case. This is what collectors call "slabbing". This slab serves as a permanent, secure record of the coin's quality.

For anyone serious about selling a high-value coin, a professional grade is pretty much non-negotiable. It simply removes all doubt for the buyer. If you're new to this, we have a detailed guide that explains how to get your coins graded step by step.

Approaching UK Auction Houses

If you're aiming to sell a significant coin, a major UK auction house is often your best bet. Esteemed names like Spink or Dix Noonan Webb (now Noonans) are specialists in bringing rare numismatics to a global audience of serious collectors. They can often achieve prices that private sales just can't touch.

Your first step is to contact their coin department for an auction estimate. This usually involves sending over some high-quality photos and any history you know about the coin. If they feel it's a good fit for one of their sales, they’ll provide a pre-auction estimate—a price range they believe it will fetch.

Key Insight: An auction estimate isn't a guaranteed sale price. It's an expert opinion on the coin's likely market value, designed to attract bidders. This figure is based on recent sales of similar items, current market trends, and your coin’s specific qualities.

It’s crucial to remember the three pillars that drive these valuations: rarity, condition, and market demand. A modern coin like the 2009 Kew Gardens 50p, for instance, commands a high price because of its tiny mintage. On the other hand, an ancient Roman coin's value is hugely dependent on its state of preservation. These factors all work together to determine a coin's final market worth.

Just remember that selling at auction comes with fees. You'll typically pay a seller's commission (a percentage of the final hammer price) and sometimes extra for things like photography and insurance. Always ask for a clear breakdown of all costs before you commit to putting your coin up for sale.

Getting a Feel for the Market with Online Tools and Communities

The internet is swimming with resources that can give you a quick idea of your coin’s value, but it's vital to know which ones to trust. Think of these online tools as your first port of call for a ballpark figure, not a professional, definitive valuation. They are the start of your research journey, not the end of it.

One of the most practical ways to gauge what people are actually paying for coins is to check eBay. The trick here is to completely ignore the active listings—those are just what sellers hope to get. Instead, dive into the advanced search filters and look exclusively at "Sold Items". This gives you a real-world snapshot of what collectors have paid for similar coins in recent weeks, which is a much more grounded view of the current market.

Tap into the Collective Wisdom of Fellow Collectors

Beyond raw sales data, UK-based numismatic forums and social media groups are an absolute goldmine. These communities are full of seasoned collectors, many of whom are more than happy to share what they know for free. You can pick up insights on rare varieties, historical context, and get a general sense of whether your coin is a common piece or something a bit special.

To get the best out of these groups, you need to do a bit of prep. A vague post asking "what's this worth?" will likely get ignored.

- Take brilliant photos: Good lighting is key. Use natural daylight against a plain background, and make sure you get clear shots of both the obverse (front) and reverse (back). A close-up of the date and any mint marks is essential.

- Provide the details: Note the coin's denomination, year, and any lettering you can see. If you can, including its diameter and weight can really help the experts pin down its identity.

Gathering this feedback before you see a professional is incredibly useful. It arms you with knowledge, turning your conversation with a dealer from a simple query into a well-informed discussion.

A Word of Advice: Remember that online opinions, however helpful, are still just opinions. They can't ever replace an in-person look, where an expert can spot the subtle details like lustre, toning, and tiny scratches that are completely invisible in photos.

Keep an Eye on a Changing Market

The coin market isn't static; values can shift based on new discoveries or updated mintage figures from The Royal Mint. For instance, new information has really shaken up the collectability of some modern UK coins. The 2022 £1 coin, with a mintage of just 7.735 million, is now the rarest one you'll find in your change. Meanwhile, the 2023 Salmon 50p has quietly become even scarcer than the famous Kew Gardens 50p.

These changes show why staying curious is so important. The coin you get back from the shop today could be a sought-after piece tomorrow. If you're interested in learning more about how mintage affects what's in your wallet, you can discover more insights about which £1 coins are worth collecting in 2025.

A Few Common Coin Valuation Questions

When you're new to the world of coin collecting, a few questions always pop up. It's completely normal. Understanding the costs, the jargon, and the best ways to get started will help you make much better decisions for your collection. Let’s tackle some of the most common queries.

How Much Does It Cost to Get a Coin Valued in the UK?

This really depends on what you need. The cost can vary quite a bit, so it's good to know what you're asking for.

For a quick, informal opinion, many local dealers will happily take a look for free. They’re often hoping you might sell the coin to them, so just bear that in mind. It's a great way to get a quick feel for what you have without any outlay.

If you're after a formal, written valuation for something like insurance or probate, that's a different story. You should expect to pay a fee, which is usually calculated in one of two ways:

- An hourly rate: This can be anywhere from £50 to £150, sometimes more, depending on how specialised the expert is.

- A percentage of the collection's value: For larger or particularly valuable collections, a fee of around 1-3% of the total worth is pretty standard.

Professional grading services like PCGS have their own pricing. Their fees are based on the coin's value, its type, and how quickly you want it back. This can range from about £20 for a modern coin up to several hundred pounds for something truly rare and valuable.

What Is the Difference Between a Valuation and a Grade?

This is a really important one, and a point of confusion for many newcomers. Simply put, a grade is an objective measure of a coin's physical condition, while a valuation is a subjective estimate of what it’s worth in the market.

Think of it like buying a house. The surveyor's report is the grade – it gives you the hard facts about the condition of the roof, the wiring, the foundations. The valuation is the estate agent's opinion on what that house might sell for today.

The grade is a crucial piece of information that heavily influences the valuation, but it isn't the valuation itself. A grade of 'MS-65' (Mint State 65) is a technical fact about the coin’s preservation; its value in pounds is an opinion based on that fact, plus rarity and current collector demand.

A grade is a technical assessment of condition. A valuation is an estimate of price. One informs the other, but they are not the same thing.

Can I Trust Online Coin Valuation Apps?

Those online tools and mobile apps can be fantastic for a bit of initial research. They're perfect for helping you identify a coin and get a very rough, ballpark idea of its value, especially if you're sifting through a big jar of mixed change.

However, they have major limitations. An app’s algorithm can't see the tiny details that make a huge difference to a coin's worth. It won't spot faint cleaning scratches, original mint lustre, attractive toning, or a rare die variety that an experienced human eye would catch instantly. These are the details that can separate a £5 coin from a £500 one.

My advice? Use them as a first filter. But never, ever rely on an app for a final verdict on a coin you think might have real value. Always follow up with an in-person, professional look.

Should I Get My Entire Collection Valued at Once?

For most collectors, getting every single coin formally appraised is not only expensive but often unnecessary. A much smarter approach is to do a bit of sorting yourself first.

Go through your collection and separate your coins into a few tiers. Create a 'best of' pile with anything that looks particularly old, is in exceptionally good condition, or is a known rare date. It’s this curated group that you should take to a dealer or specialist for an initial look.

A full, itemised valuation of an entire collection is usually only needed for specific reasons, like finalising an estate or setting up a detailed insurance policy.

At Cavalier Coins Ltd, we are passionate about helping both new and experienced collectors navigate the fascinating world of numismatics. Explore our extensive selection of rare coins and banknotes to build your collection today at https://www.cavaliercoins.com.