Before you even think about selling, a bit of focused preparation can make a huge difference to your final payout. The very first move? Sort your collection and get a simple inventory down on paper. This groundwork gives you a clear plan, whether you’re a seasoned collector or have just inherited a box of old coins.

Your First Steps to Selling Silver Coins

The journey to getting the best price for your silver coins doesn't start with finding a buyer. It starts with truly understanding what you have in your hands. A little organisation now prevents some very costly mistakes later, like accidentally selling a rare, valuable coin for its scrap metal value alone. The goal is to build a clear picture of your assets before anyone else lays eyes on them.

Categorise Your Collection

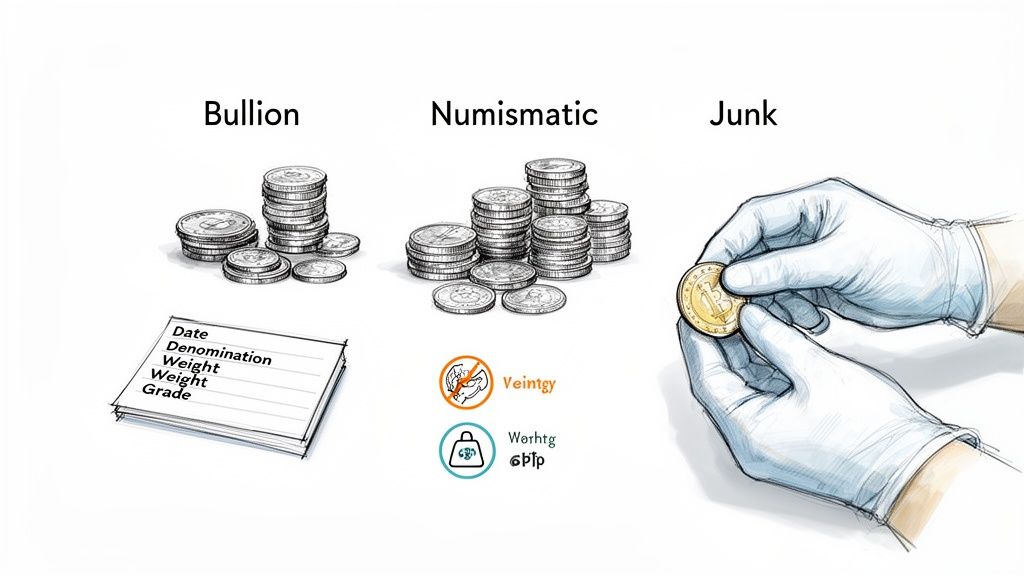

First things first, sort your coins into three main groups. This simple step is crucial because it helps you figure out how to value each coin and where the best place to sell it might be.

- Bullion Coins: These are the modern investment pieces, like the British Silver Britannia or Canadian Silver Maple Leaf. Their value is tied almost entirely to their silver content, fluctuating with the daily silver spot price.

- Numismatic Coins: This is where things get interesting. These are the collectible coins, where value comes from rarity, condition (its grade), historical importance, and what other collectors are willing to pay. A rare Victorian Crown in fantastic condition, for example, could be worth many, many times its weight in silver.

- 'Junk' Silver: Don't let the name fool you. This term is industry shorthand for older, circulated coins that contain silver but don't usually have any special collector value. Think pre-1947 British coins like shillings and florins. They're typically traded in bulk based on their combined silver weight.

Create a Detailed Inventory

Once you've sorted your piles, creating an inventory is the single most important thing you can do. A basic spreadsheet is all you need. Systematically documenting every coin helps you track its value and gives you a professional-looking list to show potential buyers or appraisers.

For each coin, try to log the following details:

- Country of Origin (e.g., United Kingdom, Canada)

- Denomination (e.g., Crown, Shilling, Dollar)

- Year of Minting

- Mint Mark (if you can spot one)

- A quick note on its condition (e.g., "Sharp details, light wear")

- Quantity of each type

Pro Tip: How you handle your coins is non-negotiable, especially with potential numismatics. Always hold coins by their edges, never flat on the faces. The oils and acids from your fingerprints can permanently damage a coin's surface, which can seriously knock down its value. Soft cotton gloves are what the pros use.

This initial prep work transforms you from just a coin owner into an informed seller. With a well-organised inventory in hand, you're in a much stronger position to figure out what your collection is really worth and navigate the selling process with confidence.

Essential Terms for Silver Coin Sellers

Getting to grips with the language of coin dealing will help you understand valuations and hold your own when talking to buyers. Here’s a quick-reference guide to the key terms you'll come across.

| Term | Definition | Why It Matters |

|---|---|---|

| Spot Price | The current market price for one troy ounce of raw silver. | This is the baseline value for all your silver. Bullion and 'junk' silver values are directly calculated from it. |

| Premium | The amount a coin sells for above its spot price or melt value. | For numismatic coins, the premium is everything. It reflects rarity, demand, and condition—where the real profit lies. |

| Melt Value | The intrinsic value of the silver in a coin if it were melted down. | This is the absolute floor price for any silver coin. You should never sell for less than this. |

| Numismatic Value | The value of a coin to a collector, based on factors beyond its metal content. | This is the difference between a coin being worth £20 and £2,000. Identifying this is key to maximising your return. |

| Grade | A standardised measure of a coin's physical condition. | A coin's grade (from Poor to Mint State) is one of the single biggest factors affecting its numismatic value. |

| Mint Mark | A small letter or symbol on a coin indicating where it was made. | Mint marks can significantly impact rarity and value. A coin from one mint might be common, while the same year from another is incredibly rare. |

Understanding these terms is the first step toward getting a fair price and not leaving money on the table.

Figuring Out What Your Silver Coins Are Really Worth

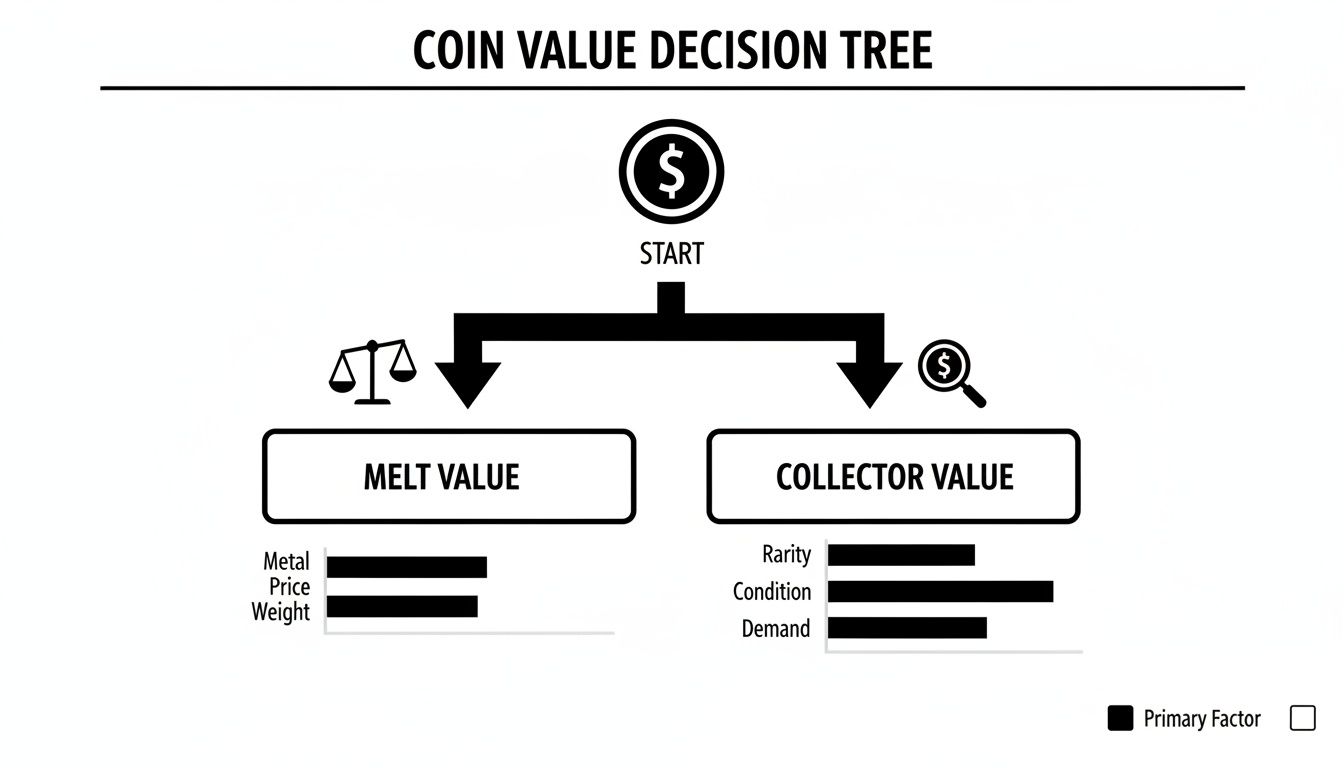

Before you can even think about selling your silver coins, you have to get a firm, realistic grip on what they're actually worth. A coin's value isn't just one simple number; it's a story told by two very different components, and any smart seller needs to understand both.

On one hand, you've got the raw, physical value of the silver itself. On the other, you have the potential for a much higher value assigned by keen collectors. Getting this right from the start is the key difference between an okay sale and a brilliant one.

The Foundation: Melt Value

Every single silver coin has a fundamental starting price, which we call its melt value or intrinsic value. It's simply what the silver in the coin would be worth if you were to melt it down. This is the absolute rock-bottom price you should ever consider, and it's where every valuation begins.

Working this out is much easier than you might think. You only need to know three things to get a very accurate estimate.

- The Current Silver Spot Price: This is the live market price for one troy ounce of pure silver. It changes constantly throughout the day, so always check the latest figure.

- The Coin's Weight: You'll need an accurate digital scale for this. Measure in grams or, if you can, troy ounces (one troy ounce is 31.103 grams).

- The Coin's Purity: This is the percentage of actual silver in your coin. For instance, British silver coins struck before 1920 are made of Sterling silver, which is 92.5% pure. Those minted between 1920 and 1946 are only 50% pure silver.

Once you have these figures, the calculation gives you a solid, reliable baseline. It grounds you in the real-world value of the metal you're holding. As you get a handle on the value of your coins, it's also a good idea to understand how to calculate profit margins for your business. This wider financial perspective helps you build a smarter selling strategy, making sure you've covered all your bases before deciding on a final price.

Beyond the Metal: Numismatic Value

Now, this is where things get exciting and where the real potential for profit kicks in. Numismatic value is the extra amount a collector is prepared to pay, over and above the simple melt value. This "collector value" is driven by a handful of factors that make a coin truly desirable.

Several key elements create a coin's numismatic appeal:

- Rarity: How many were made in the first place? And more importantly, how many are thought to still be around today? A coin with a tiny mintage, like a specific year's half-crown, will always fetch a higher price.

- Condition (Grade): This is, without a doubt, one of the biggest drivers of value. A flawless, uncirculated coin can be worth hundreds, sometimes even thousands of times more than the exact same coin in poor, heavily worn condition.

- Historical Context: Does the coin have a good story? Was it minted during a major historical event, or does it feature a one-off design that was only used for a year or two?

- Provenance: Can you trace the coin's ownership history back in time? A coin that once belonged to a well-known collection will always carry a certain prestige and a higher price tag.

Getting your head around these factors is crucial. A common George VI shilling from the 1940s might only ever be worth its silver content, but a rare pattern coin for Edward VIII from 1937 could be a life-changing find.

A Practical Guide to Grading Your Coins

Coin grading is simply a standardised way of describing a coin's condition, with a scale that runs all the way from Poor (P-1) to a perfect Mint State (MS-70). While the official stamp of approval comes from professional grading services, you can absolutely learn to assess your own coins to get a good idea of their potential.

Start by looking at the coin under a bright light, ideally with a magnifying glass. Pay close attention to the highest points of the design—the King's cheek, the lion's mane—as these are the first places to show signs of wear. For a much more detailed breakdown, have a look at our article on how to value coins properly.

Thinking about when to sell can also be a powerful move. Over the decades, people selling silver coins in the UK have seen some incredible returns. Looking at historical data, the price of silver per troy ounce in GBP shot up from a low of just £0.51 to a peak of £29.26. That's a massive 3623.55% increase, and prices have been hovering around £28.78 recently. It just goes to show that timing the market can make a huge difference.

Finding Reliable Price Data and When to Get an Appraisal

If you want reliable pricing information, your best bet is to look at recent, real-world sales. Check the results from reputable auction houses and look at the "sold" listings on platforms like eBay. This shows you what collectors are actually willing to pay right now, which is far more useful than relying on an old price guide.

Finally, if you have a gut feeling that you might be holding something special—a particularly rare or high-value coin—then paying for a professional appraisal is a very smart move. An expert can authenticate your coin, give it an accurate grade, and provide a certified valuation. This gives buyers the confidence to pay top price, and that small upfront cost could easily unlock thousands in extra profit.

Choosing the Right Place to Sell Your Coins

Once you’ve got a good handle on what your silver coins are worth, the next big question is where to actually sell them. This decision can make a huge difference to your final profit, how quickly you get paid, and how much work you have to put in.

There's no single "best" place; it all comes down to what you're selling and what your goals are. Selling a high-grade, rare Victorian Crown is a completely different game to offloading a bag of common pre-1947 silver shillings. The first needs a platform full of serious collectors, while the second is better suited for a quick sale based on metal value.

Let’s walk through the main options you have here in the UK.

The Local Coin Dealer

For many, popping down to the local coin shop is the most obvious first step. The big advantage here is getting an immediate, in-person appraisal and a cash offer right there and then.

You simply can't beat this route for speed and convenience. It’s a brilliant choice for selling bullion coins like Britannias or for cashing in a load of ‘junk’ silver where the value is almost all in the metal itself. The dealer does all the work, and you walk out with the money.

Of course, this convenience comes at a cost. A dealer is running a business and needs to make a profit, so their offer will naturally be below the full retail value. You’re essentially paying for a fast, zero-hassle service.

This decision tree helps you think about whether your coins are valued more for their silver or for their collector appeal, which is key to picking the right channel.

As you can see, while every silver coin has a base melt value, it's the rarity and condition that can push it into a higher price bracket for collectors.

Online Marketplaces Like eBay

Platforms like eBay can open your collection up to a huge global audience, which can be a massive plus. If you have coins that collectors are chasing, an online auction can spark a bidding war that pushes the price well beyond what a single dealer might offer.

The Royal Mint's long history has created a very lively secondary market in the UK, and you can see this clearly on eBay. Recent data from the platform showed over 250,000 silver coin listings sold, pulling in a staggering £45 million. Prices for 1oz Silver Britannias often land between £28-£32, which includes a nice collector premium of 5-10% over their basic melt value.

The catch? It’s a lot of work. You’re in charge of everything: taking top-notch photos, writing descriptions that sell, managing the listing, answering endless questions, and then securely packaging and shipping the coins. On top of that, the fees can really add up. eBay and the payment processor will often take a combined cut of around 13% of the final sale price.

A Real-World Scenario: Let's say you have a bag of circulated 1950s shillings. A dealer might offer you 85% of their melt value for a quick, easy sale. On eBay, you might get a price closer to the full melt value, but once you subtract the fees and factor in your own time, that dealer's offer suddenly starts to look a lot more attractive.

Specialist Auction Houses

If you're sitting on something truly rare, high-value, or historically important, a specialist numismatic auction house is the way to go. These places attract serious, deep-pocketed collectors and investors who are ready to pay top pound for exceptional coins.

Auction houses handle the professional cataloguing, photography, and marketing, making sure your coin is seen by the right people. Their expert reputation gives buyers the confidence to bid high. But this white-glove service isn't free. The seller's commission can be anywhere from 15% to 20% of the final hammer price. It’s also the slowest option by far, as you’ll have to wait for the next scheduled auction, which could be months away.

Direct Online Bullion Companies

A popular and modern approach is to sell directly to an online bullion company, like us here at Cavalier Coins. This route offers a great mix of convenience and competitive pricing, and it works especially well for bullion and common-date silver coins.

The process is usually dead simple: you get a quote online, post your coins securely, and receive a fast payment by bank transfer. The prices are often better than a local shop because online businesses have lower overheads. It takes the guesswork and hassle out of private selling while giving you a fair, transparent price based on live market rates.

For a deeper dive into all your options, take a look at our guide on where to sell old coins for the best results in 2025.

Comparing Silver Coin Sales Channels

To help you decide, here’s a quick breakdown of the pros and cons of each method. Think about your specific coins and what you value most—be it top price, speed, or simplicity.

| Sales Channel | Best For | Potential Return | Speed | Effort Required |

|---|---|---|---|---|

| Local Coin Dealer | Bullion, junk silver, convenience | Lower | Immediate | Very Low |

| Online Marketplace | Collectable coins, reaching a wide audience | High (before fees) | Medium (1-2 weeks) | Very High |

| Auction House | High-value, rare, or historic coins | Highest | Very Slow (months) | Low |

| Direct Online Buyer | Bullion, common coins, fair pricing | Good | Fast (days) | Low |

Ultimately, the best sales channel is the one that aligns with the type of coins you have and your personal priorities as a seller.

Preparing Your Coins to Attract the Best Buyers

How you present your silver coins can make all the difference to the final sale price. A bit of effort here builds buyer confidence and helps your coins stand out, whether you’re selling online or face-to-face with a dealer. Think of this as getting your coins ready for their spotlight moment.

Let’s get the single most important rule in numismatics out of the way first: do not clean your coins. It’s a gut reaction for many people – wanting to make something old look shiny and new. But in the world of coins, this is a catastrophic mistake.

Collectors and dealers prize a coin's original surface and the natural toning, or 'patina', that develops over many decades. It's seen as proof of its authenticity and journey through time. Polishing a coin, even with a soft cloth, creates tiny scratches called "hairlines" that instantly obliterate its collector value. A rare coin worth hundreds of pounds can be reduced to its melt value with one well-meaning but misguided polish.

Photography That Tells a Story

Once you've fought off the urge to clean, your next job is to play photographer. When you're selling online, your photos are your entire sales pitch. They need to be sharp, well-lit, and, above all, honest.

You don't need a professional studio setup. A modern smartphone camera, a couple of desk lamps, and a simple, neutral background like a sheet of white or grey paper are all you really need to get started.

For each coin, make sure you capture these key shots:

- A clear image of the obverse (the "heads" side).

- A clear image of the reverse (the "tails" side).

- An angled shot to really show off the coin's lustre and surface quality.

- Close-ups of any important features like mint marks, the date, or any other unique characteristics.

Good lighting is non-negotiable. Try positioning your lamps at about the 10 o'clock and 2 o'clock positions relative to the coin. This helps to kill harsh shadows and bring out all the fine details of the design. Learning how to take good product shots will give you a real edge. For more coin-specific advice, we have a whole guide on how to photograph coins like a pro packed with insider tips.

Writing Listings That Are Compelling and Accurate

Your written description is the other half of your sales pitch. The aim is to give a potential buyer all the information they need, simply and clearly. A solid description builds trust and saves you from answering a dozen questions later on.

Start with a title that’s packed with keywords. "Old Silver Coin" won't cut it. A much better title is something like: "UK 1889 Victoria Jubilee Head Silver Crown - VF Condition".

In the main description, be sure to include these key details:

- Denomination and Country: e.g., British Half-Crown

- Year and Monarch: e.g., 1915, George V

- Metal Content: e.g., .925 Sterling Silver

- Weight and Diameter: Including this, if you know it, adds a layer of credibility.

- Condition: Honesty is key. Use standard grades like Fine (F), Very Fine (VF), or Extremely Fine (EF) if you feel confident. If not, just describe what you see, for instance, "clear details, some wear on high points".

- Provenance: If you know anything about the coin's history ("from my grandfather's collection," for example), adding that personal touch can make a real difference.

Key Takeaway: Honesty is always the best policy. Be upfront about any flaws you can see, like scratches, rim dings, or signs of a past cleaning. A buyer who gets a coin that's exactly as you described it is a happy one. A buyer who discovers an issue you didn't mention is not.

Secure Packaging and Shipping

Once the deal is done, getting the coin safely to its new owner is the final hurdle. Please don't just drop a coin into a standard paper envelope! Use a padded mailer and make sure the coin itself is secured in a non-PVC plastic flip or a small cardboard holder to stop it from rattling around and getting damaged.

For anything of real value, always use insured shipping. Services like Royal Mail Special Delivery provide tracking, insurance, and require a signature, which gives both you and the buyer complete peace of mind. It’s a small extra cost that protects your profit and ensures a smooth transaction.

Finalizing the Sale and Avoiding Common Pitfalls

You've done the hard work, agreed on a price, and are now on the home straight. But don't relax just yet. These last few steps are absolutely crucial for making sure the transaction goes smoothly, your money is safe, and you're not left with any loose ends. This is where your careful planning really pays off, turning a promising agreement into a done deal.

Getting paid safely has to be your number one priority. If you're selling online, stick with a trusted payment service that provides seller protection. For face-to-face deals, arranging to meet at a bank is a smart move. It allows you to deposit the cash on the spot and lets the bank staff verify it's genuine. Never, ever post your coins until you have absolute confirmation that the funds are cleared and sitting securely in your account.

Keeping Records for Tax Purposes

Once the deal is done, there's a little bit of admin to take care of. Keeping organised records is a must, especially when it comes to taxes here in the UK. Make a note of what you sold, the date of the sale, the price you got, and any fees you paid (like postage or auction commissions).

For most people selling silver coins, the main thing to be aware of is Capital Gains Tax (CGT). Here's the lowdown:

- Legal Tender Exemption: This is a big one. UK legal tender coins, like the popular Silver Britannia, are completely exempt from CGT. That's a huge advantage if you're selling these particular coins.

- Annual Allowance: For any other coins (think old pre-decimal silver or foreign pieces), you'll only need to worry about CGT if your total gains from all assets you've sold in a tax year go over the annual exemption allowance.

- Calculating Gains: Your gain is simply the sale price minus what you originally paid for the coin. This is precisely why holding onto purchase receipts and records is so important.

If you're selling a particularly large or valuable collection, it never hurts to have a quick chat with a tax professional. They can give you clear advice and proper peace of mind.

Spotting Scams and Unfair Deals

Unfortunately, wherever there's value, there are people looking to take advantage. Staying sharp and knowing what to look out for will protect you from common tricks that could seriously eat into your profits.

One of the biggest mistakes people make is simply not knowing what their coins are worth. This often happens when sellers are in a hurry and just grab the first offer that comes along. Always try to get a couple of quotes, especially for numismatic coins, to get a real feel for the current market value.

Another trap to watch for is hidden or excessive fees. Some buyers might tempt you with a great-sounding price, only to deduct hefty percentages for "processing," "appraisal," or shipping later on. Before you agree to anything, ask for a crystal-clear breakdown of all costs. Any reputable buyer will have no problem being transparent about their fee structure.

A key indicator of a fair market is liquidity. The UK plays a central role in the global precious metals trade. In the London Bullion Market, for instance, trading volumes showcase immense activity, with the London Bullion Market Association (LBMA) reporting averages that often exceed 200 million ounces of silver cleared daily. This high volume helps ensure that sellers using reputable channels can access fair valuations and swift settlements. Discover more insights about the UK's role in the silver market.

Crossing the finish line with confidence just comes down to a simple final checklist:

- Confirm Secure Payment: Don't do anything until the money is confirmed as cleared in your account.

- Document Everything: Keep a detailed record of the sale for your own files.

- Ship Securely: Always use a fully insured and trackable service. Royal Mail Special Delivery is the go-to for a reason.

- Stay Vigilant: If an offer seems too good to be true, it probably is. And always question vague or unclear fees.

By taking care of these final details, you can be sure that all your effort in preparing and valuing your coins results in a profitable and stress-free sale.

Your Silver Coin Questions, Answered

When you're looking to sell silver coins, a few questions always pop up. It's completely normal. From whether you should give them a quick polish to understanding the tax man's cut, getting the right answers is key to a smooth and profitable sale. Here, we'll tackle the most common queries we get, giving you the clear, expert advice you need to avoid any costly slip-ups.

Should I Clean My Silver Coins Before Selling Them?

In a word: no. This is probably the most important piece of advice we can give. It might seem counterintuitive, but cleaning your coins, even with the softest cloth, can slash their value.

That cleaning action creates tiny, microscopic scratches called "hairlines" that permanently damage the coin's surface. Collectors and dealers prize that original, untouched finish. The natural toning, or patina, that develops over decades is actually proof of a coin's age and authenticity. Wiping that away can instantly demote a valuable numismatic coin to being worth only its silver content.

If your coins have some loose dirt on them, the absolute most you should ever consider is a quick rinse under distilled water and a gentle pat dry with a completely lint-free cloth. But honestly, when in doubt, just leave them as they are.

How Can I Tell if My Coin Is Real Silver?

There are a few simple, non-damaging tests you can do at home to spot the more obvious fakes.

- The Magnet Test: This is your first port of call. Real silver isn't magnetic. If a regular household magnet snaps firmly onto your coin, it's a clear sign that it isn't silver.

- The Ping Test: Try gently tapping the edge of the coin with your fingernail or another coin. A genuine silver coin gives off a beautiful, high-pitched ring that lasts for a second or two. Base metals, on the other hand, will just produce a dull, lifeless thud.

- Know Your Dates: A little bit of history goes a long way with British coins. All silver coins minted before 1920 are made from 92.5% sterling silver. The ones struck between 1920 and 1946 have a 50% silver content.

It's important to remember that for any coin with significant potential value, the only way to be 100% sure is through a professional appraisal. Experts have tools like X-ray fluorescence (XRF) scanners that give a definitive analysis without harming the coin.

Do I Have to Pay Tax When I Sell Silver Coins in the UK?

The tax situation for selling silver coins in the UK really comes down to what type of coin you're selling. Getting this right is crucial.

The good news first: British legal tender coins, like the Silver Britannia, are completely exempt from Capital Gains Tax (CGT). This is a huge advantage, making them a very tax-efficient asset. Any profit you make is entirely yours to keep.

For all other silver coins—think old pre-decimal shillings and florins, or silver coins from other countries—you may be liable for CGT. This tax only kicks in if your total profit from selling all chargeable assets in a tax year goes above the annual CGT allowance. It's vital to keep good records of what you paid for the coins and what you sold them for. If you're selling a large or particularly complex collection, having a chat with a tax professional is a very smart move.

Is It Better to Sell Coins Individually or as a Collection?

This is a great strategic question, and the best answer really depends on what's in your collection. There’s no single rule, but we can offer some clear pointers.

If you have standout pieces—rare "key-date" coins, examples in exceptionally high-grade condition, or interesting varieties—you will almost certainly get a better return by selling them individually. Serious collectors are hunting for these specific items and will pay a premium that gets completely lost if they're bundled in with more common coins.

On the other hand, if your collection is mostly common-date bullion coins or circulated 'junk silver', it's far more effective to sell them together as a single lot. This approach is perfect for bulk buyers and investors who are focused on the total silver weight. It also saves you a massive amount of time on listing, packing, and shipping. A good tactic is to sift through your collection first, pull out any stars for individual sale, and then group the rest.

Ready to get a fair and transparent offer for your silver coins? At Cavalier Coins Ltd, we make the process of selling your collection simple and rewarding. Contact us today to receive a free, no-obligation valuation!