When you’re looking to sell a gold sovereign, its final price comes from a blend of two key things: the raw gold value (often called 'melt value') and its value to a collector, which we call the 'numismatic premium'. While the daily gold price gives you a solid starting point, things like the coin's year, where it was minted, and its physical condition can add a hefty premium, turning a simple piece of gold into a real collector's item.

What Determines the Price of a Gold Sovereign

Think of it like selling a vintage car. Sure, it has a basic scrap metal value, but its real worth is tied up in its history, rarity, and how well it's been kept. The same logic applies to your sovereign. Every single one has a floor price set by its gold content, but its ceiling price is all about how much a collector wants it. Getting your head around this dual nature is the first step to getting a fair deal.

At its heart, a full gold sovereign contains exactly 7.322 grams (or 0.2354 troy ounces) of pure gold. This is your baseline, and it moves up and down every day with the global gold market. But just multiplying this weight by the current spot price only tells you half the story.

The Two Pillars of Sovereign Value

To get a true feel for the potential selling price, you need to look at your coin from two angles:

- Bullion Value: This is the simple, raw value of the gold inside the coin. It's the absolute minimum you should ever expect to get, and it changes with the daily market price.

- Numismatic Value: This is the extra bit on top that collectors are willing to pay. This premium is driven by things that make a particular coin special or scarce – its age, where it was minted, and its physical condition.

A common, modern sovereign from a year when millions were made will probably sell for a price very close to its bullion value. On the other hand, a rare Victorian sovereign struck at a colonial mint like Sydney or Melbourne could fetch a price that leaves its simple gold weight in the dust.

To give you a quick overview, here are the main factors that shape your sovereign's price.

Key Factors Influencing Your Gold Sovereign's Selling Price

| Valuation Factor | Description | Impact on Price |

|---|---|---|

| Gold Spot Price | The live market price for one troy ounce of pure gold. This sets the baseline "melt value". | High Impact: The foundation of the coin's entire value. |

| Numismatic Premium | The additional value collectors will pay based on rarity, history, and demand. | Variable Impact: Can be negligible for common coins or massive for rare ones. |

| Condition/Grade | The physical state of the coin, from heavily worn to pristine (Mint State). | High Impact: A higher grade significantly increases numismatic value. |

| Rarity | Determined by the coin's date and mint mark. Low mintage years are more valuable. | Very High Impact: The single biggest driver of high numismatic premiums. |

Understanding these components is crucial. A small detail, like a tiny mint mark, can be the difference between a coin worth a few hundred pounds and one worth thousands.

Historical Context and Market Fluctuations

The value of these coins is anything but static; it has shifted dramatically over the years. Take the price of a gold sovereign in the UK, for example. It hit an all-time low of just £36.96 in 1999. Fast forward to 2024, and economic jitters pushed it to a record high of £455.96 – that’s an increase of over 1,130%. This really shows how wider economic trends can directly affect what your sovereign is worth.

The key takeaway is that your sovereign is both a precious metal asset and a potential historical artefact. Its final price depends on which of these identities holds more weight for your specific coin.

While a sovereign's price is driven first and foremost by gold, having a basic grasp of asset valuation methods can give you a better perspective on how value is determined in general. This knowledge will help you walk into any negotiation with clarity and confidence, making sure you get a price that reflects your coin's true worth.

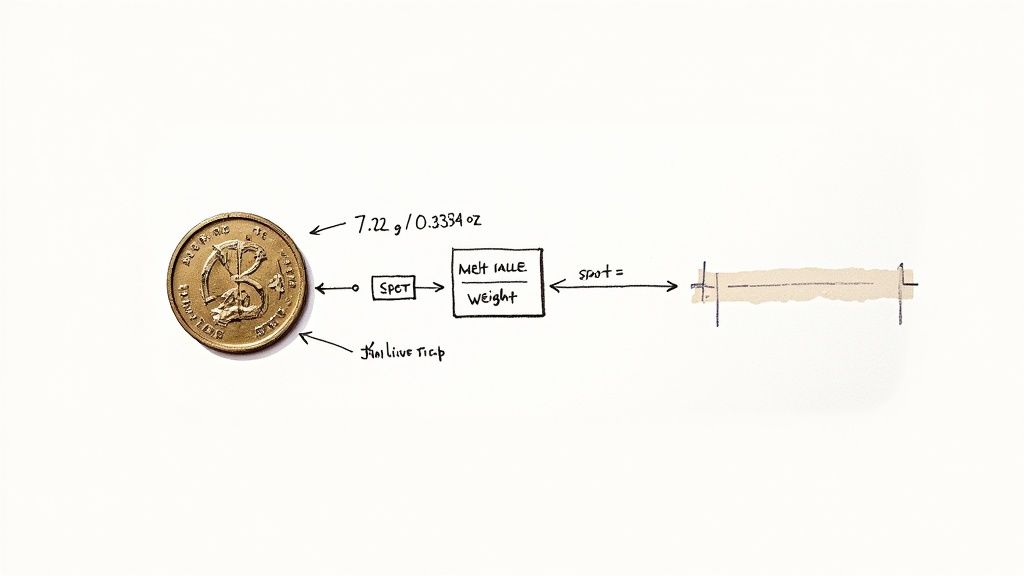

Calculating Your Sovereign's Baseline Gold Value

Before we get into the exciting world of rare dates and collector premiums, we need to start with the bedrock of your sovereign's worth: its actual gold content. Think of this as the foundation of a house. No matter the fancy features, the foundation gives it a fundamental value. For a gold sovereign, this is its absolute minimum price, dictated purely by the precious metal it's made from.

This baseline is often called the 'melt value' or 'bullion value'. It's a simple concept: what would the coin be worth if it were melted down into a plain lump of gold? Knowing this number is your first and most important tool. It gives you a floor price, a non-negotiable minimum that protects you from lowball offers.

The Core Components of Melt Value

Figuring this out is surprisingly straightforward. You only need two bits of information, and they're the same for every full gold sovereign ever minted.

- The Gold Content: Every full sovereign contains precisely 7.322 grams of pure, 24-carat gold. In the world of precious metals, this is measured as 0.2354 troy ounces. This number never changes.

- The Spot Price of Gold: This is the live market price for one troy ounce of gold. It’s constantly in flux, changing by the minute based on global economics, supply, and demand.

With just these two figures, you can work out the baseline selling gold sovereigns price at any given moment. The formula is beautifully simple:

Sovereign Melt Value = 0.2354 (troy ounces) x Current Gold Spot Price (£ per troy ounce)

This calculation gives you the raw, intrinsic value of the gold locked inside your coin. It's the starting line for any valuation and the first number you should have in mind when talking to a buyer.

A Practical Step-by-Step Calculation

Let's walk through a real-world example. Imagine the live gold spot price is currently £1,950 per troy ounce.

- Start with the gold content: We know every sovereign has 0.2354 troy ounces of pure gold.

- Check the current spot price: For our example, we're using £1,950. You can find the live price on any major financial news site or bullion dealer's homepage.

- Do the maths: Simply multiply the gold content by the spot price.

The sum looks like this: 0.2354 x £1,950 = £459.03.

So, in this scenario, your sovereign has a raw gold value of £459.03. This is your absolute bottom line. Any offer below this means the buyer is trying to pay you less than the metal itself is worth on the open market.

Why Dealers Offer More Than Melt Value

You might be thinking, "If this is the melt value, why would anyone pay more for a common, circulated coin?" The answer comes down to the sovereign's form. It isn't just a shapeless nugget of gold; it's an instantly recognisable, government-minted coin that’s easy to trade, verify, and store.

That convenience and trustworthiness give it a small premium over its raw material value. Dealers can easily sell it on to investors who prefer owning official coins rather than anonymous bars. So, even for the most common sovereigns, you should expect to be offered a price slightly above the melt value. This little bit extra is the dealer's nod to the coin's usefulness as a traded investment product.

Its intrinsic value is tied directly to its 7.32238 grams (0.2354 troy ounces) of 22-carat gold and the UK spot price. For instance, if gold’s spot price hit £2,378.05 per ounce, the sovereign's intrinsic value would be around £559.79 (0.2354 x £2,378.05). Of course, the final price you get will always move with market demand and dealer premiums. You can explore more about how values for specific years are determined.

This basic premium is just the beginning. In the next section, we'll dive into the much larger premiums driven by numismatics, where rarity and condition can send a coin’s value soaring far beyond its simple gold content.

Unlocking Value Beyond Bullion with Numismatics

Once we move past the basic value of its gold content, we step into the much more fascinating world of numismatics—the study and collection of coins. This is where the true potential of your sovereign is waiting to be discovered.

Think of it like this: the gold in your coin gives it a solid floor price, a value it will never fall below. But its history, rarity, and condition can build a skyscraper on top of that foundation. This extra value is what we call the numismatic premium, and it’s the magic ingredient that turns a simple piece of gold into a highly sought-after collector's item.

Getting your head around this premium is the key to getting the best possible price. For example, a common sovereign from a year when millions were produced will trade very close to its gold value. But a sovereign from a rare year, perhaps struck at a faraway colonial mint, could be worth many times more. It's like comparing a modern paperback to a signed, first-edition copy of a classic novel; they're both books, but scarcity and context create a massive difference in their worth.

Key Drivers of Numismatic Value

So, what determines whether your sovereign is just a standard bullion coin or a rare collectible? It comes down to a few key factors. These details can seem subtle, but they have a huge impact on the final price. You can think of them as the coin's unique DNA, telling a story that collectors are willing to pay a premium for.

The three most important elements are:

- The Date of Issue: Some years had much lower mintage figures than others, making those coins inherently rarer.

- The Mint Mark: Sovereigns weren't just made in London. They were also produced at branch mints across the British Empire, including Sydney (S), Melbourne (M), Perth (P), and Pretoria (SA). These tiny letters can significantly increase a coin's value.

- The Condition or Grade: A coin's physical state is a crucial value multiplier.

A Victorian sovereign from the Sydney mint, for instance, often fetches a higher price than a London-minted one from the same year, simply because fewer were made in Australia. Exploring different sovereign coin values really brings home just how much these small details matter.

Understanding Coin Condition and Grading

Of all the factors, perhaps the most influential is the coin's physical condition, known as its grade. Even a common-date sovereign can command a real premium if it’s in pristine, almost perfect condition. Collectors will always pay more for coins with sharp details, original shine (lustre), and minimal signs of wear.

The grading scale is simply a way to describe the level of wear a coin has experienced. While professional grading services use a very detailed 70-point system, a basic understanding of the main categories is a great starting point for any seller.

This image shows the standardised Sheldon coin grading scale, which ranges from Poor (P-1) to Perfect Mint State (MS-70).

The scale shows how even slight differences—like how much original mint lustre is left or how sharp the highest points of the design are—can push a coin into a completely different value bracket.

A few of the most common grades you'll come across are:

- Fine (F): Shows quite a bit of wear. The main design elements are visible, but the finer details have been smoothed over.

- Very Fine (VF): Most details are clear, but you can see obvious wear on the highest points of the design, like the monarch's hair or the dragon's back.

- Extremely Fine (EF): Light wear is visible, but only on the highest points. The details are still sharp, and some of the original mint lustre remains.

- Uncirculated (UNC) or Mint State (MS): The coin looks as it did the day it left the mint, with no signs of wear at all.

The price difference between a sovereign graded as 'Very Fine' and one graded as 'Uncirculated' can be staggering. A coin in EF condition might sell for a 20-30% premium over its gold value, while a true Uncirculated example could fetch a premium of 50% or more, even for a common date.

This is why it's so important to look closely at your coin's condition. A rare date in poor condition might be worth less than a common date in perfect shape. Ultimately, it’s the combination of rarity and grade that determines the true numismatic value and plays a critical role when assessing the final selling gold sovereigns price.

Choosing the Right Place to Sell Your Gold Sovereigns

Knowing what your gold sovereign is worth is one half of the equation; knowing where to sell it is the other. Making the right choice here is absolutely critical. It can be the difference between getting a fair market price and, frankly, leaving a good chunk of cash on the table.

Your decision really boils down to what you need. Are you after quick cash? The highest possible price for a rare collectible? Or just a simple, secure sale? Each route has its own trade-offs.

Think of it like selling a car. You could trade it in at a dealership for speed, sell it privately for a better price (but with more hassle), or send it to a classic car auction if you've got a rare model. It’s exactly the same with sovereigns. The best place to sell a common, modern sovereign is completely different from the ideal spot for a rare Victorian piece.

Local Jewellers and Pawn Shops

For many people, the first thought is to pop down to a local high street jeweller or pawn shop. And it's easy to see why. The biggest plus here is speed. You can walk in with your coin and, more often than not, walk out with cash in your pocket. It's the go-to option if you're in a real hurry for the money.

But that convenience comes at a price. These shops have high overheads to cover and aren't typically coin specialists. Because of this, their offers often fall well below the actual gold value—sometimes by as much as 10-20%. While they're fine for a quick sale, you'll rarely get the best return, especially if your sovereign has any collector value, which they probably won't recognise or pay for.

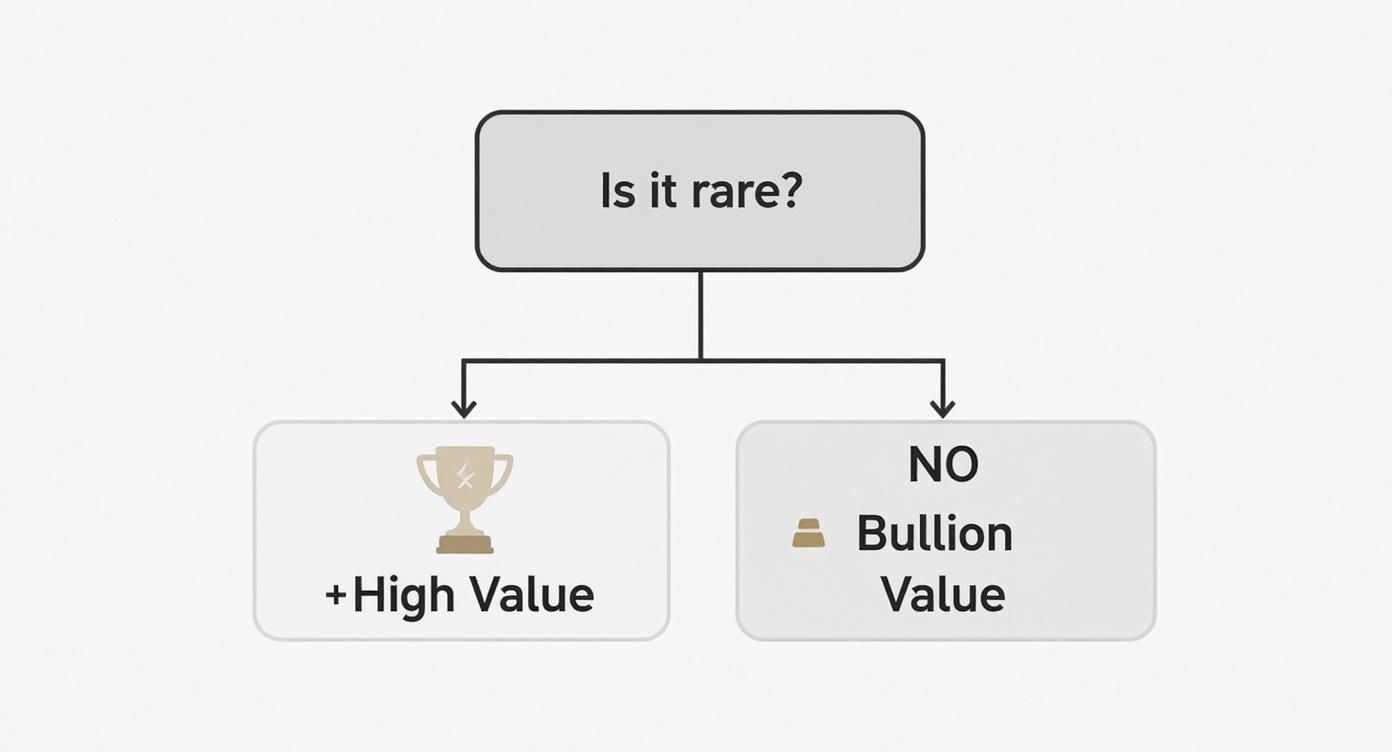

The flowchart below is a great way to visualise whether your coin's value is tied to its gold content or its rarity. This is the very first step in deciding where you should sell.

As you can see, figuring out if a coin is rare is the key fork in the road. It separates high-value collector's pieces from coins that are simply worth their weight in gold.

Online Bullion Dealers

For most common-date or standard bullion-grade sovereigns, a specialist online dealer is almost always your best bet. They operate on a much larger scale with lower costs, so their offers are far more competitive. Most reputable online dealers will pay around 95-98% of the live gold spot price for standard sovereigns.

The process is usually very straightforward and secure:

- You'll get an online quote, which is often locked in for a short time to protect you from price drops.

- You then post the coin to them using an insured and tracked delivery service.

- Once they receive and check the coin, the money is transferred straight to your bank, typically within one to three working days.

If you are shipping your coins, finding the best courier service is crucial for security and your own peace of mind. It’s not as instant as walking into a shop, but the significantly better price makes it the clear winner for most sellers of non-collectible sovereigns.

Auction Houses and Specialist Dealers

Now, if you have a hunch your sovereign is a bit special—maybe it has a rare date, an unusual mint mark, or is in stunning condition—then an auction house or a numismatic specialist is where you need to go. These experts have connections to a global network of collectors who are prepared to pay serious premiums for scarce coins.

The potential returns here can blow any bullion dealer's offer out of the water.

The trade-off is that it’s a much slower process and it isn't free. Auction houses charge a seller's commission, usually between 15% and 25% of the final sale price, and there might be extra fees for things like insurance or photography. It can take several months from when you hand over your coin to when you actually get paid. For more on this, our guide on where can I sell old coins has some great pointers.

To help you weigh your options, here’s a quick comparison of the different selling venues.

Comparison of Selling Venues for Gold Sovereigns

| Selling Venue | Typical Payout | Fees/Commission | Speed | Best For |

|---|---|---|---|---|

| Local Jeweller/Pawn Shop | 80-90% of spot price | None (low offer) | Instant | Urgent cash needs, convenience. |

| Online Bullion Dealer | 95-98% of spot price | None (built-in) | 1-3 working days | Common-date, bullion-grade sovereigns for a fair price. |

| Auction House | Market price (numismatic premium) | 15-25% | Months | Rare, high-grade, or key-date collectible sovereigns. |

| Specialist Coin Dealer | Negotiated (numismatic premium) | Negotiable | Varies (days/weeks) | Rare coins, expert appraisal, and a direct sale. |

Choosing the right venue is about matching your specific coin and your personal needs to the pros and cons of each option. Take your time, do your homework, and you'll be well-positioned to get the best possible price for your gold sovereign.

How to Get the Best Possible Price for Your Coins

Now that you have a solid grasp of what drives your coin’s value, it’s time to turn that knowledge into cash. Securing the best possible price for your gold sovereigns isn't about luck; it’s about sticking to a few crucial rules to make sure you don't leave money on the table.

The first and most important rule is simple, yet completely non-negotiable: never, ever clean your coins. It can be so tempting to polish a dull sovereign to bring back its shine, but doing so will almost certainly destroy its numismatic value. Cleaning leaves microscopic scratches and strips away the original patina—something collectors see as irreversible damage. A cleaned coin, especially a rare one, can lose a huge slice of its collector premium in an instant.

The Power of Multiple Valuations

To get the best price, you need to create a bit of competition. Never, ever accept the first offer you receive. Make it a rule to approach at least three different reputable buyers. This could be online bullion dealers, specialist numismatic shops, or even auction houses. The goal is to get a range of quotes.

This strategy does more than just find the highest bidder; it gives you leverage. When you have multiple offers in hand, you can negotiate with confidence, knowing exactly what the fair market rate is. It also gives you a peek into the dealer's 'spread'.

A dealer's spread is the difference between their buying price (what they offer you) and their selling price (what they charge their customers). A smaller spread usually points to a more competitive and fair dealer.

Getting several quotes is the single most effective way to ensure the selling gold sovereigns price you get is a true reflection of its current market worth.

Avoid Common Pitfalls and Red Flags

The coin market is generally very professional, but it always pays to be cautious. Knowing what to look out for can protect you from a bad deal. Be wary of any buyer who shows these behaviours:

- Ignoring a Coin's Rarity: If a dealer just offers you a flat rate for all your sovereigns without even looking at the dates and mint marks, they’re only interested in the gold content. You could be about to sell a rare coin for its basic melt value.

- Unsolicited Offers: Be highly sceptical of offers that pop up out of the blue in your email or on social media. Reputable dealers simply don't operate that way.

- High-Pressure Sales Tactics: A trustworthy buyer will give you time to think about their offer. Anyone pushing you for an immediate decision is a major red flag.

- Lack of Transparency: Dealers should be completely open about how they arrive at their price, referencing the current gold spot price and any premiums they’re applying.

If you suspect your coin has significant numismatic potential, think about getting it professionally graded. A grade from a trusted third-party service authenticates your coin and removes any doubt about its condition, often leading to a much higher final price. For a deeper dive into this, you can learn more about how to get coins graded in our detailed guide.

By resisting the urge to clean your coins, actively seeking multiple offers, and staying alert for red flags, you put yourself in the strongest possible position. This proactive approach allows you to negotiate from a place of confidence and secure a price that truly reflects your sovereign's value.

Got Questions About Selling Your Sovereigns? We’ve Got Answers.

Even after you’ve got the basics down, a few specific questions always seem to pop up when it's time to sell. It’s completely normal.

Here are some of the most common queries we hear, with straightforward answers to give you that final bit of confidence.

How Much Is a Queen Elizabeth II Sovereign Worth?

This is a great question, and the answer really depends on what kind of QEII sovereign you have. Is it a common 'bullion' coin, or something a bit more special?

Most modern sovereigns, especially those minted in huge numbers since the 1970s, are what we call bullion coins. Their value is tied directly to their gold content, so their price will move up and down with the live gold spot price, plus a small dealer's premium on top.

However, some QEII issues are in a completely different league. You need to keep an eye out for:

- Proof Coins: These are the show-stoppers. Struck specially for collectors, they have a stunning, mirror-like finish that's impossible to miss.

- Commemorative Issues: Sovereigns made to mark big events, like a royal jubilee, often carry extra value for collectors.

- Low Mintage Years: Simple supply and demand. In some years, The Royal Mint produced far fewer sovereigns, making them harder to find today.

How can you tell the difference? A brilliantly polished, flawless finish is a dead giveaway for a proof coin. Also, check how it’s stored. If it’s sitting in a smart presentation box from The Royal Mint, you're almost certainly looking at a collectible coin that needs a proper numismatic appraisal, not just a price based on its weight.

Do I Pay Tax When Selling Gold Sovereigns in the UK?

Here’s one of the best things about owning gold sovereigns in the UK. Because they are officially British legal tender, they are exempt from Capital Gains Tax (CGT). This is a massive advantage for any UK resident holding them.

What does this actually mean for you? It means every penny of profit you make when you sell your sovereigns is yours to keep. It doesn't matter how much their value has shot up since you first got them. This tax-free status makes sovereigns a brilliantly efficient way to hold gold compared to bars or foreign coins, which could land you with a tax bill.

This unique perk really adds to their appeal for investors and is a powerful reason why they remain so popular. When you sell, you keep 100% of the proceeds.

Is It Better to Sell Sovereigns Individually or as a Group?

The right strategy here comes down to what’s in your collection.

If you’ve got a handful of common-date sovereigns—say, several coins from recent years when millions were minted—selling them as a single group to a bullion dealer is often the easiest and most efficient way to go. The dealer will value them based on their total gold weight and give you a fair bulk price. Simple.

But, and this is a big but, that logic goes out the window if you have rare or high-grade coins in the mix.

It is absolutely vital to get each coin looked at on its own if you think any of them might have collector value. Tossing a rare 19th-century sovereign from the Sydney mint into a batch of modern bullion coins is a guaranteed way to lose a serious amount of money. Any coin with a rare date, a specific mint mark, or in exceptionally good condition needs to be sold on its own to a specialist dealer or at auction. That’s the only way to make sure you get the full collector premium it deserves.

At Cavalier Coins Ltd, we understand the nuances of both bullion and collectible coins. Whether you have a single rare sovereign or a larger collection, our expertise ensures you receive a fair and accurate valuation. Explore our services and learn more about selling your coins with us today.