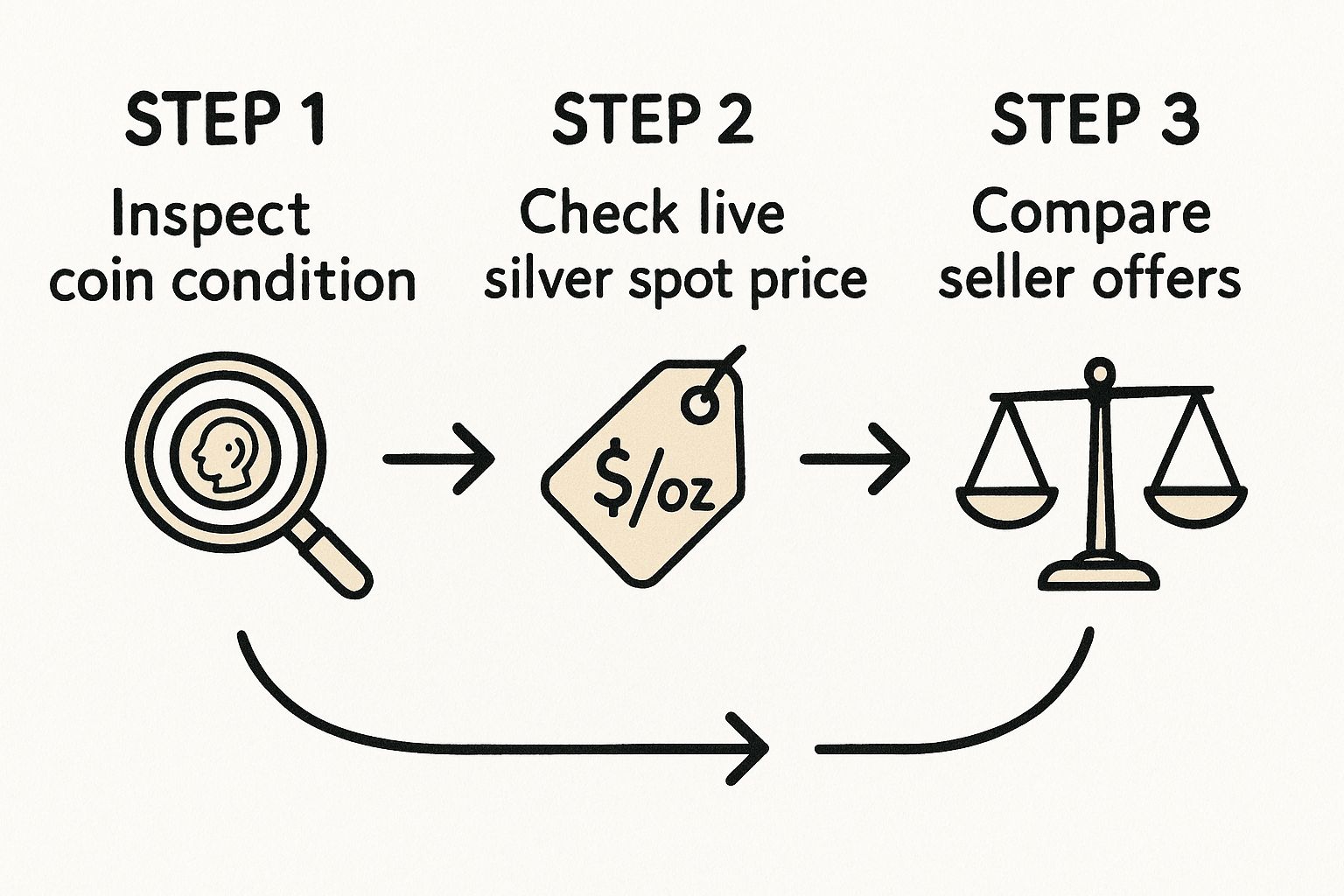

If you want to sell your silver coins well, it all comes down to three things.

First, you need to know exactly what you have – its condition and rarity. Second, you have to get a handle on the current silver spot price. And finally, you must find a buyer you can trust. Nail these three, and you're already on the path to a smooth and profitable sale.

Your Quick Guide to Selling Silver Coins

If you're after a simple, no-nonsense roadmap, you've come to the right place. Selling silver coins doesn't have to be a headache. By breaking it down into a few key actions, you can confidently work the market and sidestep the common traps that catch out so many first-time sellers.

The trick is to be methodical. Gather your information first, and then make your move. This guide distils what experienced sellers know into a plan you can follow from start to finish.

A Seller's Roadmap for Silver Coins

To make things even clearer, I've put together a simple table outlining the core stages of selling your silver. Think of it as a checklist to ensure you cover all your bases, from that first look at your coin to shaking hands (or clicking 'confirm') on the final deal.

| Stage | Key Action | Why It Matters |

|---|---|---|

| Assessment | Determine the coin's condition and rarity. | This establishes whether your coin's value is based on its silver content (bullion) or its collectability (numismatic value). |

| Valuation | Check the live silver spot price. | The spot price is the foundation for your coin's base value and changes daily, impacting your potential profit. |

| Sales | Compare offers from reputable buyers. | Different buyers (dealers, online platforms, collectors) offer varying prices. Shopping around ensures you get the best return. |

By following this sequence, you’re building a strong foundation for a successful sale. You start with the physical coin, move to its market value, and finish by vetting your buyers.

As you can see, each step naturally leads to the next. This logical flow is your best defence against selling your coins for less than they're truly worth. It’s a simple but powerful way to make sure you’re always making a fully informed decision.

Preparing Your Silver Coins for a Successful Sale

How you present your silver coins can make all the difference to the final price you get. Before you even think about listing them, taking a bit of time to get them ready can lead to a much smoother, and more profitable, sale. This isn't about trying to alter the coins, but about professionally showcasing their true value.

The very first step is a careful, hands-on assessment. Always handle your coins by their edges to avoid getting fingerprints on the surface – the oils from your skin can cause damage over time. Get a good light source and a magnifying glass and really look at each one. Take note of its condition, any noticeable scratches, signs of wear, or unique features like toning.

Documenting Your Collection

Think of accurate documentation as your best friend in the selling process. It builds a foundation of trust with potential buyers and is absolutely essential for setting a fair price. For every coin you plan to sell, you should jot down the key details.

- Coin Type and Year: For example, a "1922 Silver Peace Dollar" or a "2015 British Silver Britannia."

- Mint Mark: This is a tiny letter that shows where the coin was made. In some cases, it can dramatically increase a coin's value.

- Condition Notes: Be brutally honest here. Is it uncirculated, or does it have clear signs of wear? Make a note of any specific blemishes you spotted earlier.

- Provenance: If you know anything about the coin's history – maybe it came from a well-known collection – be sure to document that, too.

Creating this simple inventory doesn't just get you organised; it becomes an invaluable reference when you sit down to write your listings, ensuring you don't forget any details that could add value.

The Power of High-Quality Photographs

In the online marketplace, your photos do most of the talking. A blurry, poorly lit picture can make a beautiful, pristine coin look dull and unappealing, scaring off serious buyers. On the flip side, a sharp, well-lit image will make your listing pop and can attract much higher bids.

You don't need a fancy studio setup. A modern smartphone, a simple background like a sheet of white paper, and good, indirect natural light are usually all you need. Your goal is to capture crisp details on both the obverse (front) and reverse (back) of the coin. Sometimes, taking shots at a slight angle can really highlight the coin's lustre and the finer points of its design. For a deeper dive into getting the perfect shot, check out our guide on how to photograph coins like a pro.

This image shows a collection of various silver coins, highlighting their different designs, sizes, and levels of toning.

See how the lighting brings out the intricate details on some coins, while others display that natural patina many collectors actively look for? This is the kind of visual variety you should aim to capture in your own photos.

Understanding Market Context and Timing

The value of your coins isn't just about their physical condition; it's also tied directly to the ever-changing silver market. The price of silver has seen some incredible long-term shifts, often driven by wider economic conditions.

Historically, silver has climbed from lows of around £0.51 per troy ounce to an all-time high of approximately £29.26 – that's a growth of over 3600%. These price peaks, like the one we saw back in April 2011, often coincide with periods of economic uncertainty when investors flock to safe-haven assets. This investor sentiment has a direct impact on what your silver coins are worth at any given moment.

Key Takeaway: Whatever you do, resist the urge to clean your coins. It’s a classic rookie mistake. Many sellers think a bit of polish will increase a coin’s value, but the exact opposite is true. Cleaning causes microscopic scratches and strips away the natural patina, which can absolutely destroy a coin's numismatic value for a serious collector. Leave them as they are.

Finding the Right Place to Sell Your Coins

Deciding where to sell your silver coins is a crucial choice, one that directly shapes your final payout. The right platform connects you with the right buyer, whether that’s a seasoned numismatist hunting a rare piece or an investor focused purely on bullion weight. The goal is to match your coins to the audience most likely to recognise and pay for their true value.

A common starting point for many is a general online auction site. These platforms offer massive reach, putting your coins in front of a global audience. For common bullion coins like Silver Britannias or American Eagles, this broad exposure can stir up healthy competition and drive the final price higher.

But that sheer volume can also be a drawback. Your unique, collectable coin might just get lost in a sea of similar listings, never catching the eye of the specialist buyer who would have paid a premium. It’s a classic trade-off: visibility versus a targeted audience.

Navigating Online Marketplaces

Online auction sites like eBay are often the first port of call. They provide a structured environment with established payment and shipping systems, which can be reassuring for anyone new to selling. With some coin categories boasting sell-through rates as high as 1,525%, the potential is undeniable.

Here’s a typical search result page for "silver coins" on eBay UK, showing the sheer variety of listings, from raw bullion to graded collectables.

The screenshot alone shows how competitive it is. High-quality photos and detailed titles are absolutely essential if you want to stand out from the crowd.

To succeed here, your listing has to be impeccable. Think professional-looking photos, a comprehensive description, and a title packed with keywords a buyer would actually use. Remember, you’re not just selling a coin; you're competing against hundreds of others for a buyer's attention.

Exploring Specialised Dealers and Forums

For coins with real numismatic value, a specialised bullion dealer or a collector forum might be a far better bet. These platforms are built for a dedicated, knowledgeable audience actively looking for specific items.

- Bullion Dealers: Reputable dealers offer immediate payment based on the current spot price, plus any applicable premium. This route is fast, secure, and perfect for selling common bullion coins without the faff of creating individual listings.

- Collector Forums: Niche forums often have dedicated "buy/sell/trade" sections. Selling here puts you in direct contact with passionate collectors, but you'll need to build a solid reputation within that community first.

- Local Coin Fairs: Don't underestimate the power of a face-to-face deal. Coin fairs let you meet multiple dealers and collectors in one place, get instant offers, and completely sidestep the risks of shipping.

When timing your sale, especially in the UK market, it pays to watch the wider economic picture. The gold-to-silver ratio is a key indicator that many experienced sellers keep a close eye on. Historically hovering around 80-90 in the UK, this ratio compares the price of an ounce of gold to an ounce of silver. A high ratio suggests silver might be undervalued relative to gold, which can signal a good time to sell if you think a market correction is coming. Keeping this metric in mind can help you make a much more informed decision. For a deeper dive, you can discover more insights about the silver price history on Chards.co.uk.

A personal tip: I once sold a set of Victorian silver crowns through a collector forum. An auction site would have likely seen them as simple bullion. On the forum, however, two specialists got into a bidding war over their specific toning and condition, netting me 30% more than the melt value.

Ultimately, choosing your sales channel comes down to knowing what you've got. For standard bullion, casting the wide net of an auction site can work well. For anything rare or unique, targeting a specialist audience through dealers or forums will almost always bring a better return.

How to Price and List Your Coins Effectively

Putting together a listing that gets the right kind of attention—and the right price—is both an art and a science. It all starts with knowing your coin's baseline value, which is tied directly to the live silver spot price. This figure, the market price for one troy ounce of pure silver, is constantly on the move.

But here’s a rookie mistake I see all the time: valuing a coin just for its silver content. Many coins have a numismatic value that can blow their melt value out of the water. This extra premium comes from things like rarity, condition, historical weight, and how badly collectors want it.

Think of the spot price as your starting line. The numismatic premium is what gets you over the finish line in first place. A standard silver bullion coin might only fetch a few percent over spot, but a rare, beautifully preserved Victorian crown? That could sell for many, many times its weight in silver.

Researching Your Coin's Market Value

Before you even think about a price tag, you've got to do your homework. Dive into platforms like eBay or specialist collector forums and search for your exact coin. The trick is to filter the results to see what similar coins have actually sold for—not just the aspirational prices people are asking for.

This is how you get a real feel for the market's appetite. Pay close attention to how the coin's condition impacts the final price. An "Uncirculated" coin will nearly always bring in more money than one showing obvious signs of wear and tear. If you want to get deeper into this, we have an article on how to find a coin's value with expert strategies.

Timing the market can also make a huge difference. Just look at what happened in the UK between 2008 and 2011. As investors scrambled for tangible assets during the financial crisis, silver prices went through the roof, climbing from around £4-5 per troy ounce to a peak of over £26 in 2011. People who sold their silver coins then saw incredible returns, some over 400%. It just goes to show how tracking these cycles can seriously pay off.

Crafting a Title That Sells

Your listing title is your front door. It’s the single most important bit of text for catching a buyer’s eye, so it needs to be clear, descriptive, and loaded with the keywords a collector would actually search for. A lazy title is the fastest way to become invisible.

Let's look at a couple of good examples:

- For Bullion: "2023 1oz Silver Britannia Coin .999 Fine Silver Uncirculated UK Bullion"

- For Numismatic Coins: "1889 Victoria Jubilee Head Silver Crown, VF Condition, Scarce Date"

See what they did there? They’ve included the year, monarch, metal, condition, and crucial terms like "bullion" or "scarce." A buyer immediately knows what they're looking at and why it's worth clicking.

Writing a Compelling Description

If the title gets them in the door, the description is where you make the sale. Your photos show the coin, but your words tell its story and build that all-important trust. Honesty is everything here.

- Cover the basics: Repeat all the key details from your title to reinforce the facts.

- Describe the condition honestly: Use standard grading terms (like VF for Very Fine or EF for Extremely Fine) and point out any features, good or bad. Mention any toning, lustre, or small marks. Don’t hide anything.

- Add a personal touch: If you know anything about the coin’s history or where it came from, share it. That bit of provenance can make your listing stand out from the crowd.

Pro Tip: Never make a claim you can’t back up. If your coin hasn’t been professionally graded, don't call it "Mint State." It's much better to say something like, "Appears uncirculated" or "Has strong original lustre." Honesty builds a great reputation, and that’s priceless.

Once your listing is up, be ready to answer questions and manage any offers that come in. If you're not getting much traction, don't be afraid to tweak your price. In this game, being flexible and responsive is what seals the deal.

Shipping Your Silver Coins Securely

You’ve made the sale, and the buyer has paid. Now for the final hurdle: getting your silver coins safely into their hands. How you package and ship your items is the last impression you’ll make, and it’s a critical part of building a reputation as a trustworthy seller. Cutting corners here can lead to damaged goods, unhappy buyers, and a serious hit to your wallet.

The key is to think like a thief. Your package shouldn't scream "valuable items inside!" Plain, sturdy packaging is your best friend. Avoid reusing boxes or envelopes from well-known bullion dealers or jewellers—that’s basically an open invitation for trouble.

Discretion is paramount on the outside. Inside, however, security is the top priority. Never, ever let coins rattle around loose. Secure each one individually in a non-PVC coin flip or a small, self-sealing bag. If you're sending multiple coins, I find it helps to tape them together into a single block or secure them to a piece of firm cardboard so they can't shift during transit.

Choosing the Right Packaging and Courier

Your choice of packaging materials directly impacts the safety of your shipment. Think in layers. Once the coins are secured, wrap them generously in bubble wrap before placing them inside a sturdy, crush-proof box.

Fill any and all empty space with packing peanuts or scrunched-up paper. The goal is to make the contents completely immobile. A good test is to give the sealed box a firm shake; you shouldn't hear or feel a single thing moving around inside.

With your parcel ready, selecting the right courier is your next big decision.

- Royal Mail Special Delivery Guaranteed: This is the go-to for most UK sellers, and for good reason. It offers full tracking, requires a signature on delivery, and most importantly, provides the right level of insurance coverage for valuables like coins.

- Reputable Couriers (DPD, Parcelforce): These are also solid options, but you absolutely must check their policies. Some couriers have exclusions or serious limitations on insuring precious metals, so always read the fine print before you book anything.

A Seller's Close Call: A friend of mine sold a valuable set of graded silver coins and decided to use a standard courier to save a few pounds. The package vanished. Because he hadn't declared the contents accurately and paid for the correct insurance, the courier’s liability was capped at just £50. He lost nearly £800. Always, always pay for full insurance—it’s a tiny price for peace of mind.

Insurance and International Shipping Considerations

Insurance is completely non-negotiable when selling silver coins. The cost is a tiny fraction of your coin's value, but it protects you from the absolute nightmare of a lost or stolen package. Make sure you insure the shipment for the full sale price, not just the scrap value. This ensures you’re completely covered if the worst happens.

If you're opening up to international sales, you'll need to get comfortable with customs declarations. You have to be precise and honest. Declare the item as a "numismatic coin" or "collector's item" and state its accurate value. Falsifying this information can lead to the package being seized, destroyed, or returned to you, not to mention the potential for heavy fines.

Calculating your shipping costs accurately before listing your item is also vital for protecting your profit. Factor in the cost of your packing materials, the courier fee, and that all-important insurance. Many sellers simply build these costs into their asking price and offer "free" shipping.

For online marketplaces, getting these details right is crucial. You can find more platform-specific advice by exploring guides on selling coins on eBay. Ultimately, secure and professional shipping finalises a successful transaction and builds the kind of trust that brings buyers back.

Finalizing the Sale and Building Your Reputation

You've agreed on a price, the buyer has paid, and the package is in the post. Job done? Not quite.

What you do next is what separates a one-off sale from the first step in building a stellar reputation. This post-sale period is your chance to turn a good transaction into a great one and encourage that buyer to come back for more.

Once you see the tracking update to 'delivered', it's a smart move to send a quick, polite message. You're not chasing them for a review; you're just making sure the coin arrived safely and that they're happy with it. A simple note like this can head off any potential issues and shows you're a seller who genuinely cares.

Securing Payment and Managing Communications

First things first: never, ever ship a coin until the money is cleared and sitting in your account. It sounds obvious, but you'd be surprised how many new sellers get caught out by buyers asking them to ship before payment is finalised. It’s a classic scam tactic, so be patient and wait for confirmation.

Clear and timely communication is your best friend throughout this process. If Royal Mail is taking longer than expected, let your buyer know. A little honesty and transparency go a long way in building trust.

- Verify Payment: Always double-check through the platform’s official system that the payment has fully processed. Don’t rely on an email alone.

- Keep it Professional: Maintain a polite and professional tone in all your messages, even if a buyer is being a bit difficult.

- Keep Records: It's wise to keep a log of all your messages and transaction details. If a dispute ever pops up, this documentation will be invaluable.

When a buyer feels like they're in the loop and being treated with respect, they're far less likely to cause any problems.

The Art of the Follow-Up

A little thoughtful follow-up can make a huge difference. As soon as you've had a smooth transaction, leave some positive feedback for your buyer. It's a simple gesture, but it’s always appreciated and often prompts them to do the same for you, helping to build your seller rating.

For a particularly special or high-value coin, why not pop a short, handwritten thank-you note in with the package? It’s a personal touch that really makes you stand out from the bigger, faceless sellers and can turn a one-time buyer into a long-term customer.

I once sold a particularly rare coin to a collector who was absolutely thrilled with the purchase. About a week later, he messaged me asking if I had anything similar. Because I’d been communicative and professional, he trusted me enough to come back for a private sale, saving us both on platform fees. That relationship started with a simple follow-up.

Handling Disputes and Building Your Seller Profile

Even the most careful seller can run into the odd dispute. Perhaps the delivery gets delayed, or a buyer has a different opinion on the coin's condition. The key is to handle these situations calmly and professionally.

Listen to what the buyer has to say, and be ready to refer back to your original listing photos and messages. More often than not, a polite conversation is all it takes to find a solution without needing to escalate things. The goal is always to find a fair outcome that keeps your hard-earned reputation intact.

Positive reviews are the currency of trust in the online coin world. Every successful sale and glowing review adds to your credibility, giving future buyers the confidence to choose you. This is how you grow from being just another seller into a trusted name in the numismatic community.

Common Questions About Selling Silver Coins

When you're starting out selling silver coins, a few questions are bound to pop up. To be honest, even seasoned sellers run into tricky situations now and then. Let's walk through some of the most common queries to help you sidestep the usual pitfalls and sell with more confidence.

A big one that often trips people up is the coin premium. Why on earth would a one-ounce silver coin sell for more than the spot price of an ounce of silver? Simple: the premium is the value added on top of the metal itself.

This extra bit covers all sorts of things – the cost to mint the coin, ship it, and the dealer’s own margin. For collectible or numismatic coins, that premium can be significantly higher, reflecting its rarity, historical weight, and of course, its condition.

How Do I Choose Between Auction and Fixed-Price Sales?

This isn't a one-size-fits-all answer. Picking the right sales format is a tactical move that really depends on the specific coin you have in your hand.

- Auction Format: This is your best bet for rare, in-demand, or unique coins where it's tough to nail down the true market value. An auction whips up a bit of a frenzy, creating a competitive space that can push the final price way beyond what you might have expected. It’s perfect when collectors are all vying for that one special piece.

- Fixed-Price Format: If you're selling common bullion coins, like Silver Britannias or American Eagles, this is the way to go. Their value is pegged so closely to the silver spot price that you can just set a fair, competitive price and wait for the right buyer. It’s predictable and efficient.

Think of it this way: an 1890 Victorian Crown with beautiful, unique toning would almost certainly fetch its best price at auction. On the other hand, selling a tube of twenty modern 1oz silver bullion coins is far easier and quicker with a simple fixed-price listing.

What Documents Do I Need to Prove Authenticity?

Making sure a buyer knows your coin is the real deal is absolutely crucial for getting a good price and building trust. Most modern bullion coins don’t need a mountain of paperwork, but for high-value or older numismatic pieces, documentation is everything.

The gold standard here is getting the coin professionally graded and certified by a reputable third-party grading (TPG) service. Big names like NGC (Numismatic Guaranty Corporation) or PCGS (Professional Coin Grading Service) will encase the coin in a sealed, tamper-proof slab. This slab has a unique serial number and a definitive grade, offering an impartial, expert verdict on its authenticity and condition.

Expert Insight: If you have any of the original paperwork – a certificate of authenticity from the mint, a receipt from a well-known dealer, or even just some notes on its provenance (its ownership history) – make sure you include it. This paper trail adds a huge layer of confidence for buyers and can genuinely bump up the coin's appeal and final sale price.

Even if you don't have it formally graded, your photos can act as a form of proof. Take clear, high-resolution pictures where every detail, like mint marks, is sharp and visible. Being completely honest in your description and pointing out any little flaws also goes a long way in building your credibility as a seller. The more evidence you provide, the more comfortable a buyer will feel.

At Cavalier Coins Ltd, we provide a trusted platform for collectors and sellers alike. Whether you're looking to sell a single coin or an entire collection, explore our services to connect with a passionate community of numismatists. Find out more at Cavalier Coins.