The number stamped on a UK commemorative coin rarely tells the whole story of its value. Think of it less like currency and more like a rare vinyl record—its worth isn't in the plastic it's pressed on, but in how few were made and the music everyone wants to hear.

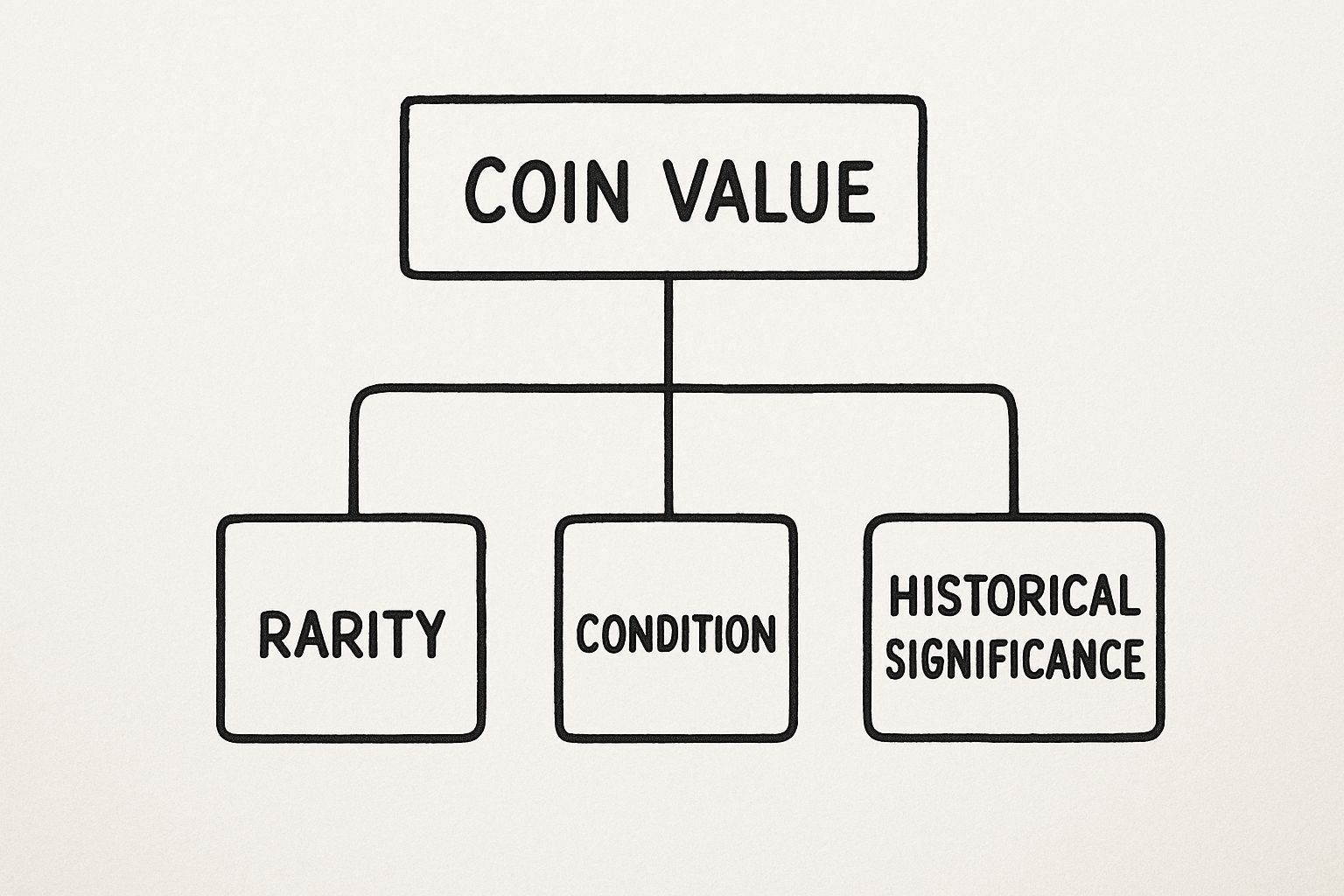

What Actually Determines a Coin's Value

Forget the face value for a second. Whether it says 50p or £5, that number is often just a symbolic starting point. The real story behind a UK commemorative coin's worth is a mix of four key ingredients that, when combined, give each piece a unique financial fingerprint.

Getting to grips with these core principles is the first step in figuring out if you're holding onto pocket change or a pocket-sized treasure. The value isn't just about what the coin is, but what it represents to the collecting world. It’s a delicate balance of physical traits and market buzz, where a change in one factor can completely alter the final price.

The Four Pillars of Coin Valuation

To really understand what makes one coin worth a few quid and another worth a few hundred, we need to look at the four main pillars that collectors and dealers live by.

- Rarity (Mintage): Simply put, how many were made? A coin with a tiny production run, like the legendary Kew Gardens 50p, is incredibly hard to come by, which naturally pushes its value sky-high.

- Condition (Grade): How well has the coin survived? A pristine "Brilliant Uncirculated" coin, free from the scuffs and scratches of daily life, will always fetch a higher price than the same coin that’s been rattling around in someone’s wallet.

- Metal Content: What's it made of? A coin struck from gold or silver has a built-in value based on the current market price of that precious metal. This provides a solid floor for its worth, regardless of its rarity.

- Collector Demand: Is it a hot ticket item? Sometimes, a coin's theme, a bit of media attention, or its connection to a major historical event can create a frenzy of interest, causing prices to climb even for coins that aren't exceptionally rare.

This isn't a random list; there's a clear hierarchy here. Rarity, condition, and historical significance form the very foundation of a coin's value.

For a quick overview, here’s how these factors stack up against each other.

Key Factors Influencing Coin Value At a Glance

| Factor | Description | Impact on Value |

|---|---|---|

| Rarity (Mintage) | The total number of coins produced by the mint. | High: Lower mintage numbers almost always lead to higher values. |

| Condition (Grade) | The physical state of the coin, from mint-perfect to heavily worn. | High: Uncirculated or "as new" coins command the highest prices. |

| Metal Content | The intrinsic value of the precious metals (gold, silver, platinum) in the coin. | Variable: Provides a baseline value that fluctuates with commodity markets. |

| Collector Demand | The popularity of the coin's theme, series, or historical significance. | High: Strong demand can dramatically increase value, even for common coins. |

These elements don't exist in a vacuum; they influence one another to set the final market price.

As you can see, it's the interplay between these factors that truly defines what a coin is worth to the collecting community.

The Royal Mint has a long and storied history of producing these special coins. It all started back in 1935 with the original Crown (worth five shillings) and has evolved into the modern £5 coins we see today, marking everything from royal weddings to Olympic games. To get a better sense of this rich history, you can explore the evolution of UK commemorative coins. This historical context is often what sparks a collector's interest in the first place, feeding right back into that all-important demand.

Why Mintage Figures Dictate Rarity

In the world of coin collecting, the thrill of the chase often comes down to a single, crucial number: mintage. This figure tells you exactly how many of a specific coin The Royal Mint produced and released for us to find. It’s the classic rule of supply and demand, and honestly, it’s the most powerful factor in determining how rare a coin truly is.

Think of it like a first-edition book or a limited-run vinyl record. The fewer copies made, the more desirable they become to fellow enthusiasts. A high mintage figure, often running into the millions, means a coin is common and you’ll likely see it again. But a low mintage figure? That’s what turns a simple piece of metal into a genuinely scarce and sought-after collectible.

The Kew Gardens 50p Legend

The most famous example of mintage creating a superstar coin has to be the 2009 Kew Gardens 50p. With a tiny mintage of just 210,000, it stands as the rarest commemorative 50p ever to enter general circulation. To give you some perspective, the 2008 Britannia 50p had a mintage of over 22 million.

That staggering difference means that for every single Kew Gardens 50p out there, you could find over one hundred Britannia coins. It’s this statistical imbalance that fuels its eye-watering market price, which often climbs over £150. The design is lovely, of course, but its value is almost entirely down to that incredibly small production run.

A coin's mintage isn't just a number; it's the bedrock of its value. Low mintage creates a natural scarcity that demand alone cannot replicate, turning pocket change into a prized possession for collectors across the country.

Getting your head around this principle is the first step to properly assessing uk commemorative coin values. It’s what separates a coin worth its face value from one worth hundreds of times more.

How to Find Mintage Figures

Thankfully, The Royal Mint is very open about its production numbers. You can easily find official mintage figures for UK coins, which lets you quickly identify which ones are the real rarities. When you’re looking up a coin, the mintage figure should always be the very first thing you check.

Here are a few key points to keep in mind when you’re looking at these numbers:

- Circulation Mintage: This is the big one. It’s the number of coins made for public use—the ones you might actually find in your change.

- Brilliant Uncirculated (BUNC) Mintage: These are coins made specifically for collector sets and were never meant for tills and pockets. Their mintage figures are separate and usually much lower.

- Proof Mintage: These are the absolute highest quality coins, struck multiple times for a perfect, mirror-like finish. They have their own, often very limited, mintage numbers.

It's vital to know which figure you're looking at. A coin design might have a circulation mintage in the millions, but a proof version with a mintage of only a few thousand. This creates two completely different markets and values for what is essentially the same coin.

Beyond the Big Names

While the Kew Gardens 50p grabs all the headlines, plenty of other coins have their value driven by low mintage. For instance, several coins from the 2012 London Olympics 50p series had mintages of just over one million, making them much tougher to find than many of their counterparts in the set.

The 2011 WWF 50p and the 2017 Sir Isaac Newton 50p are other great examples of coins whose values have quietly crept up over the years, all thanks to their relative scarcity. By learning to check the mintage figures, you’re giving yourself the most powerful tool for spotting those hidden gems. It lets you see past the hype and focus on the one thing that truly supports a coin's long-term collectible value.

How to Assess Your Coin's Condition

Think about finding two identical vintage comics. One is crisp and vibrant, looking like it's never been opened. The other is creased, faded, and has clearly been well-loved. The story inside is the same, but their value is worlds apart. This logic applies directly to coins, where its condition—or 'grade'—is a huge factor in determining its worth.

A coin that’s been passed over shop counters, rattled around in pockets, and dropped on the pavement will inevitably show signs of its journey. All those tiny scratches, dings, and softened details are known as 'wear'. The more wear a coin has, the less appealing it is to serious collectors, which has a massive impact on potential uk commemorative coin values.

For any collector, a coin in perfect condition is like a snapshot in time, capturing the artist’s original vision just as it left the mint. This is exactly why a flawless coin can command a price many times higher than an identical one that’s been in circulation.

Uncirculated Versus Circulated Coins

The most basic distinction in a coin's condition is whether it has ever been in general circulation. This one difference can send a coin's potential value down two completely different paths.

Circulated coins are the ones you find in your change. They've been used as money, and because of that, they'll show different degrees of wear and tear. Even a coin that looks shiny to the naked eye can have microscopic scratches that bring its grade down.

Uncirculated coins, on the other hand, have never been used in a transaction. They were pulled from the production line before they could enter public life and were preserved in their original, mint state. These coins keep their full lustre and the sharp, intricate details of their design.

The second a coin is used to buy something, it crosses a critical line. No amount of cleaning or polishing can ever bring it back to a true 'uncirculated' state. In fact, trying to clean a coin almost always damages its surface and massively reduces its value.

Understanding Key Condition Grades

The world of coin grading has its own language. Getting to grips with a few key terms will help you assess your collection more accurately and understand what dealers are actually looking for.

- Proof: This isn't really a grade but a specific method of manufacture. Proof coins represent the peak of minting quality. They are struck multiple times with specially polished dies to create a flawless, mirror-like background and a frosted, detailed design. They're produced in very small numbers, specifically for collectors.

- Brilliant Uncirculated (BUNC): These coins are a higher standard than your average circulating coins but aren't as painstakingly crafted as Proofs. They are struck once and immediately packaged to prevent any handling marks, preserving their original mint shine.

- Circulated Grades: This category covers a huge spectrum, from 'Good' (heavily worn but still identifiable) to 'About Uncirculated' (showing only the faintest traces of wear on the highest points of the design).

The Royal Mint also encourages collectors to look for coins with certificates and proof finishes, which can add to a coin's desirability and fetch a premium on the secondary market. These official presentations guarantee a coin's condition and origin, making them highly attractive to discerning buyers.

Practical Tips for Handling Your Coins

How you handle your coins is just as important as how they were minted in the first place. A single fingerprint can permanently etch itself onto a coin’s surface because of the oils and acids on your skin, destroying its value in an instant.

Just follow these simple rules to protect your potential treasures:

- Handle with Care: Always hold a coin by its edges, between your thumb and forefinger. Never touch the flat obverse (heads) or reverse (tails) sides.

- Use Soft Surfaces: When you're looking at your coins, place them on a soft, clean cloth or pad to prevent any accidental scratches.

- Proper Storage: Keep coins in individual, inert plastic holders or capsules. Stay away from old PVC flips, as they can degrade over time and release chemicals that damage the coin's surface.

For anyone looking to get deeper into the details of assessing a coin's physical state, our expert guide to British numismatic coin grading offers a much more detailed breakdown of the specific standards we use here in the UK. This knowledge is essential if you're serious about collecting.

Precious Metals Versus Everyday Change

Let's be clear: not all commemorative coins are created equal. The biggest difference between a special 50p you find in your change and a premium collector's piece often boils down to one simple thing: what it's made of.

This single factor creates two totally separate markets for coins that might even share the exact same design, sending their values in wildly different directions.

On one hand, you have coins made from standard ‘base metals’—the same cupro-nickel and nickel-brass alloys jingling in your wallet. On the other, you have special editions crafted from precious metals like sterling silver, fine gold, or even platinum. This is where we need to talk about intrinsic value: the baseline worth of a coin based purely on the market price of the metal it contains.

The Intrinsic Value Floor

Think of intrinsic value as a safety net for a coin's price. The metal in a standard circulating 50p is worth next to nothing; its value is almost entirely down to rarity and condition. A Gold Proof version of that same 50p, however, has a value floor set by the daily price of gold.

This means its worth can never really drop below the value of the gold it contains. It’s a crucial concept that separates everyday collectibles from true investment-grade pieces. In many cases, the precious metal value alone can be hundreds of times greater than the coin's face value, giving collectors a tangible asset that isn’t tied to numismatic trends.

A coin made of gold or silver has two identities. It's a collectible piece of art, but it's also a tangible piece of precious metal. This dual nature gives it a stable foundation of value that base-metal coins simply don't possess.

Two Tiers of the Same Coin

The Royal Mint is brilliant at this. They often release popular designs in different metals to cater to both casual collectors and serious investors. A perfect example is the beloved Beatrix Potter series. Millions of Peter Rabbit 50p coins, made from standard cupro-nickel, were released straight into circulation.

At the same time, The Royal Mint also struck limited-edition versions of that exact same design in sterling silver and 22-carat gold. The circulated version might sell for a few pounds, but its silver and gold cousins are worth a great deal more from the moment they leave the mint.

Let’s look at a direct comparison:

- Circulated Peter Rabbit 50p: Made of cupro-nickel. Its value is driven by collector demand and condition, typically fetching between £1 and £4.

- Silver Proof Peter Rabbit 50p: Struck in .925 sterling silver. Its value starts with the spot price of silver and is then boosted by its low mintage and superior Proof quality, often selling for £50 or more.

This two-tiered system is common for many popular UK commemorative coins. If you'd like to dig deeper into the materials, our guide on what coins are made of explains the difference between base and precious metals in more detail.

Understanding Crowns and Bullion

This idea becomes even clearer when you look at larger commemoratives like the UK Crown, which was re-tariffed to £5 in 1990. While cupro-nickel versions are minted for the general market, the premium editions are where intrinsic value really comes into play.

Since that change, The Royal Mint has consistently issued these £5 coins in sterling silver and 22-carat gold for serious collectors. Their gold proof versions, for example, often contain over 36 grams of pure gold, giving them an intrinsic metal value that completely dwarfs their £5 face value. This is exactly why checking a coin's composition is a non-negotiable step in figuring out what it's truly worth.

The Power of Collector Demand and Hype

Rarity and condition build a solid foundation for a coin's value, but they don't paint the full picture. A coin, no matter how scarce, is ultimately only worth what someone is willing to pay for it. This is where the powerful, often unpredictable, force of collector demand comes into play, adding a fascinating human element to the valuation puzzle.

Demand is what transforms a simple piece of metal into a cultural icon. It’s driven by emotion, nostalgia, and a sense of shared interest. Some themes just grab the public’s imagination more than others, creating a wave of interest that can send prices soaring—sometimes even for coins with relatively high mintages.

The Themes That Drive Desire

Just think about the coins that create the biggest buzz. More often than not, they connect with a huge existing fanbase or a moment of national pride. Designs that feature beloved characters or celebrate major events forge an instant connection with a massive audience, many of whom might not be traditional coin collectors.

Popular themes that consistently stir up high demand include:

- Beloved Characters: The Beatrix Potter and Paddington Bear series are perfect examples. These coins are snapped up not just by numismatists, but by fans of the books and films, which massively expands the potential market.

- Major Sporting Events: The London 2012 Olympics 50p series sparked a nationwide collecting craze. People were frantically checking their change, hoping to complete the full set of 29 different designs.

- Royal Occasions: Coins marking royal weddings, jubilees, or significant anniversaries hold a timeless appeal, linking collectors to pivotal moments in British history.

This kind of demand can be so strong that it challenges the old rule that low mintage is everything when it comes to uk commemorative coin values. A coin with a popular design and a mintage in the millions might still fetch a higher price than a rarer coin with a less exciting theme.

To illustrate this, let's look at a couple of well-known examples where the value driver isn't as straightforward as just looking at the mintage numbers.

High Demand vs Low Mintage Examples

| Coin Example | Primary Value Driver | Estimated Market Value Range |

|---|---|---|

| 2009 Kew Gardens 50p | Low Mintage (210,000) | £150 - £250 |

| 2016 Peter Rabbit 50p | High Collector Demand | £3 - £5 |

The Kew Gardens 50p is the classic example of pure scarcity driving value. With only 210,000 ever minted, it's the holy grail for many 50p collectors. In contrast, the 2016 Peter Rabbit 50p has a mintage of 9.7 million, yet its immense popularity means it still sells for many times its face value, outperforming lots of other coins that are technically much rarer.

Riding the Wave of Media Hype

In our connected world, demand can be supercharged by media attention, creating what many call the 'hype factor'. A single news article, a viral social media post, or a TV feature mentioning a coin's rarity can trigger a sudden and dramatic spike in demand.

A coin's journey into the mainstream media can transform its value almost overnight. This hype creates a short-term gold rush, where perceived value skyrockets as thousands of new buyers enter the market at once, all hunting for the same piece.

This often leads to a temporary price bubble. When stories about the Kew Gardens 50p first hit the national press, for example, its value absolutely exploded as everyone started digging through their pockets. While the price has since settled at a high level because of its genuine rarity, that initial peak was fuelled almost entirely by sudden, widespread hype.

Understanding this dynamic between true scarcity and popular appeal is crucial. It explains why some coins become legends while others with similar mintage figures fade into obscurity. By keeping an eye on cultural trends and media buzz, you can get a much better feel for the market's pulse and the forces that truly shape a collection's worth.

Your Practical Guide to Valuing a Collection

Knowing the theory is one thing, but putting it all into practice is where the real fun begins. It’s time to play detective with your own collection and figure out what you’re really sitting on. This isn't about guesswork; it's about following a clear framework to find realistic, current market prices.

The first move is always the same: identify your coin. Jot down its year, what denomination it is (like a 50p or £2), and the specific event or person it’s commemorating. Once you have that locked down, you can dig into its mintage, take a hard look at its condition, and find out what people are actually paying for it.

Researching Realistic Sale Prices

Here's one of the biggest traps new collectors fall into: confusing asking prices with actual sale prices. Anyone can list a common coin for thousands of pounds online, but that doesn't mean anyone will ever pay that. To find a genuine valuation, you need to look at what has already sold.

This is where online marketplaces become your best friend. A site like eBay is an incredible resource because of one simple feature: the "Sold Items" filter. It's your window into what's happening in the market right now.

- Start by searching for your exact coin (for example, "2016 Peter Rabbit 50p").

- In the filter options on the results page, tick the box for "Sold Items".

- Now, browse through the prices of coins that look to be in a similar condition to yours.

This simple trick cuts straight through all the hopeful, over-inflated listings. It shows you the true pulse of collector demand and gives you a solid, evidence-based starting point for your coin's value.

Bringing All the Factors Together

With that market data in hand, you can now connect it to the core principles we’ve discussed. Look up the official mintage figures from The Royal Mint to get a sense of its true rarity. Then, be brutally honest about its condition. Is it a perfect, untouched Brilliant Uncirculated coin, or has it been jingling around in pockets for years?

Cross-referencing a coin's mintage and condition with recent, verified sale prices gives you a complete and accurate picture of its value. This evidence-based approach takes the emotion and guesswork out of the equation, replacing it with cold, hard market data.

This process builds a much more rounded view of your coin’s standing in the collecting world. For a deeper dive into this entire process, our complete guide on how to value coins offers even more tips and resources to help sharpen your appraisal skills.

Knowing When to Consult a Professional

While doing your own research online is fantastic for most circulating commemorative coins, sometimes you need an expert eye. If you think you’ve stumbled upon something genuinely rare, a valuable error coin, or have a collection of high-value proof sets made from precious metals, getting a professional appraisal is a very smart move.

A qualified numismatist or a reputable dealer can provide a formal valuation, which can be essential for insurance or if you're thinking of selling a major collection. They have the deep experience needed to spot subtle variations and can offer a level of certainty that you just can't get from self-research alone. It gives you complete peace of mind about your collection’s worth.

Frequently Asked Questions About Coin Values

As you dive deeper into collecting, you'll find that certain questions crop up time and time again. Even with a good grasp of mintage, condition, and demand, the practical side of things can throw you a curveball.

Think of this section as your go-to guide for those common queries. We’ll cut through the noise and give you straight answers to help you manage, protect, and maybe even profit from your collection.

Should I Clean My Commemorative Coins?

In a single word: no. If there’s one piece of advice every new collector needs to hear, it’s this. It can be incredibly tempting to want to polish up a tarnished silver coin or give a grubby 50p a good scrub, but cleaning almost always destroys its value.

Any attempt to clean a coin with polishes, chemicals, or even a soft cloth will leave behind microscopic scratches on its surface. To a seasoned collector or grader, this damage—often called 'hairlines'—is instantly noticeable and can plummet a coin's value. Collectors prize coins in their original, untouched state.

A coin's natural patina—that gentle toning it acquires over decades—is actually a desirable feature. It’s proof of its age and authenticity. Cleaning it off is like stripping the original finish from an antique table; you're not restoring it, you're erasing its history and its worth.

How Do I Sell My Coin Collection?

When the time comes to sell, you've got a few solid options. The right path for you will really depend on the value of your coins and how quickly you need the funds.

- Online Marketplaces: Sites like eBay offer a massive audience. The trick is to check the 'Sold Items' filter to see what similar coins have actually sold for, not just what people are asking. High-quality photos are non-negotiable.

- Reputable Dealers: A specialist coin dealer can give you a fair, on-the-spot price for your collection. It’s often the fastest and most straightforward way to sell, particularly for higher-value pieces.

- Auction Houses: If you're sitting on a truly rare or significant collection, a numismatic auction house is your best bet. They connect you with serious, high-end collectors who are willing to compete for top-tier items, maximising your return.

Are Error Coins Valuable?

Absolutely. In fact, error coins can be some of the most valuable finds out there. These are coins that picked up a mistake during the minting process—perhaps they were struck off-centre, created with the wrong design (a 'mule'), or had a rotated die.

Their value is all about their rarity. A classic example is the undated 20p from 2008, where a redesign mix-up led to the date being left off entirely. These coins are now legendary and fetch a handsome price. If you suspect you've found an error coin, getting it verified by an expert is crucial. Their uniqueness means they don't fit into standard price guides, and their scarcity makes them a prime target for dedicated collectors.

At Cavalier Coins Ltd, we live and breathe numismatics and love nothing more than helping collectors find that perfect piece. Whether you’re just starting out or hunting for a rare treasure, our expertise and curated selection are here to guide you. Come and explore our rare and unusual coins from around the world at https://www.cavaliercoins.com.