When you first start looking into rare coins, it's easy to wonder what separates a pocketful of change from a genuine treasure. The answer really boils down to three core factors: its rarity, its physical condition, and its provenance—the coin's life story, if you will.

Think of it like a first-edition book. Its value isn't just in the paper and ink. It’s about how few copies exist, whether the pages are crisp or torn, and the story of who has owned it over the years. The same logic applies directly to coins.

Unlocking the Secrets of Coin Valuation

Figuring out what makes a simple piece of metal transform into a valuable collector's item might seem complex, but it's built on a few logical principles. At its heart, the process is all about supply and demand. A coin that everyone wants but very few can have will naturally fetch a high price.

This guide is your roadmap to understanding how experts assess the value of rare UK coins. We’ll break down each critical element, giving you the foundational knowledge to see why some coins are worth a fortune while others are simply face value. Whether you're a new collector or just curious, you'll learn to see coins not just as currency, but as historical artefacts with unique stories to tell.

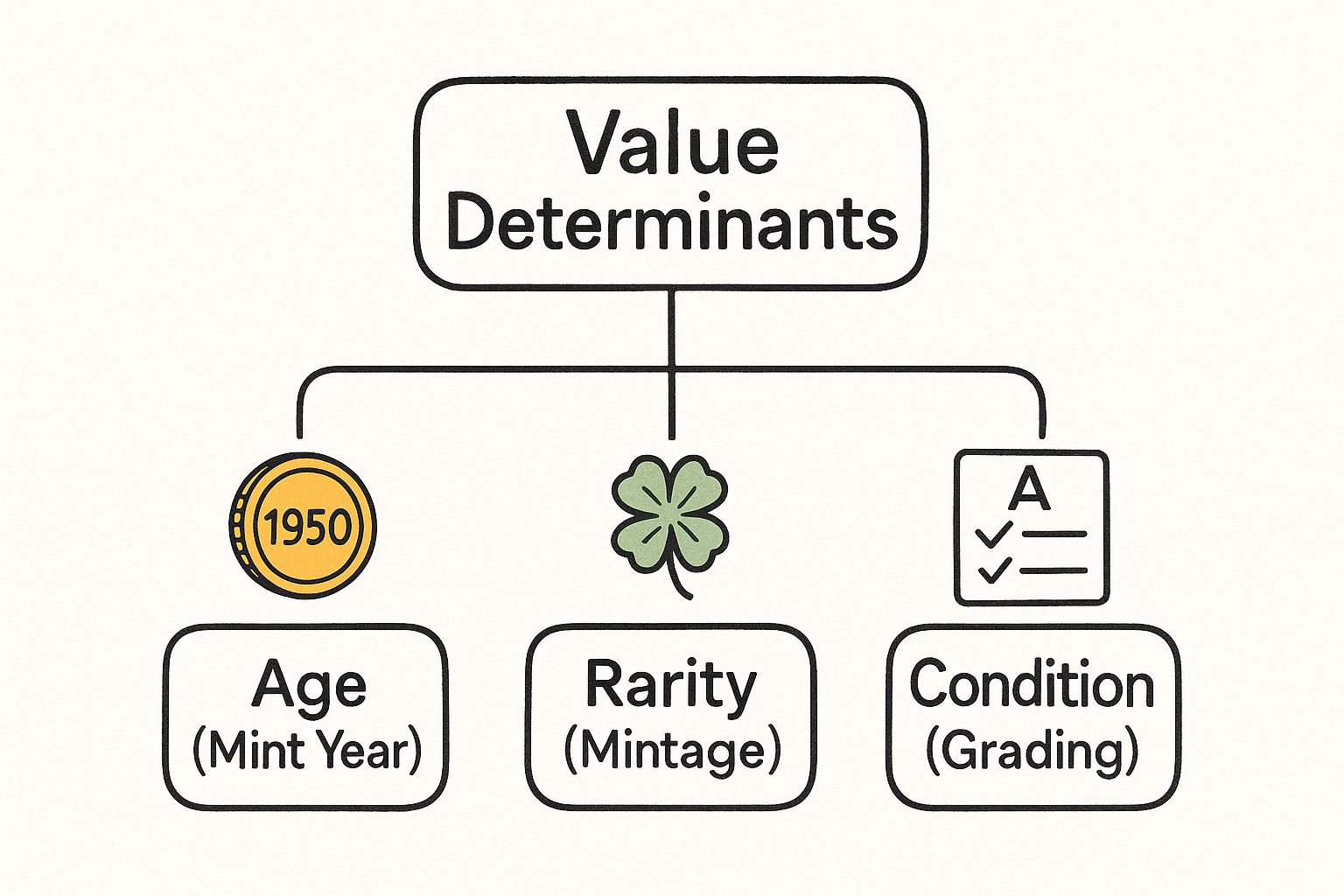

The Three Pillars of Coin Value

To get started, it's crucial to get to grips with the three main pillars that support a coin's market price. Each one plays a distinct role, and a coin's ultimate value is a delicate balance of all three. Understanding these is the first step towards an accurate valuation.

Below is a quick overview of these core factors, which we'll explore in more detail throughout this guide.

| Factor | Description | Impact on Value |

|---|---|---|

| Rarity & Mintage | The original number of coins produced by The Royal Mint. A lower mintage figure creates instant collectability. | High: A coin with a mintage in the thousands is exponentially rarer than one in the millions, driving prices up. |

| Condition & Grading | The physical state of a coin. An uncirculated coin with no signs of wear is far more desirable than a scuffed one. | Very High: Condition can be the single biggest multiplier of value. The difference between a "good" and "mint" state can be thousands of pounds. |

| Provenance & History | The story behind a coin, including its ownership history or connection to significant historical events. | Variable but Significant: A documented history in a famous collection can add a huge premium beyond its physical attributes. |

Each of these elements interacts with the others. A rare coin in poor condition will be worth less than a common coin in perfect condition, which is why a holistic view is so important.

This diagram helps visualise how these primary factors come together to determine a coin's final worth.

As you can see, a coin's age is often just the starting point. Its true value is really defined by how rare it is and how well it has been preserved over the years.

For a more detailed look at how professionals put these principles into practice, our guide on expert coin collection valuation tips for UK coins offers some fantastic insights.

How Rarity and History Create Value

When you’re trying to figure out what a rare UK coin is worth, you’ll quickly realise its story is just as important as the metal it’s made from. A coin’s mintage figure—the number originally struck—is a great starting point for judging scarcity, but it really only tells you half the story. The real key? Its survival rate.

Think of it like this. The Royal Mint could have produced millions of a certain coin, but time and history have a way of filtering them out. Wars, financial crises, and currency reforms have seen huge quantities of coinage melted down over the centuries. Silver and gold coins, in particular, were often recalled and repurposed for new currency, meaning only a tiny fraction of the original number might still exist.

This is how a once common coin becomes a genuine rarity. The few that escaped the melting pot are the accidental survivors, each one a little piece of history that’s otherwise been lost. Their value isn't based on how many were made, but on how few are left.

The Power of Key Dates

If you look at any long-running coin series, you’ll notice that certain years are much more valuable than others. In the collecting world, we call these 'key dates'. A key date is simply a year where the mintage was incredibly low, or a major historical event threw a spanner in the works of its production or circulation.

Learning to spot these key dates is a vital skill for any serious collector. For example, most George V pennies are worth very little, but find one from a specific key date, and you could be looking at hundreds, if not thousands, of pounds. This massive jump in value is always down to something unusual happening that year.

- Low Production Runs: The mint might have made fewer coins because of economic pressures, or perhaps they were gearing up for a new design.

- Historical Circumstances: A short-reigning monarch or an abrupt change in government could bring production to a sudden halt, creating an instant rarity.

- Errors and Varieties: Sometimes, a unique mistake at the mint only affects coins from a specific year, making that date a must-have for specialists.

The whole idea of a 'key date' proves that not all coins in a series are created equal. A single year can be the difference between a bit of old pocket change and a serious numismatic investment, which really hammers home the importance of doing your homework.

Getting to grips with these specific years is fundamental if you want to understand the true value of rare UK coins. It means looking beyond the design and digging into the unique circumstances of its creation. It’s this deeper context that separates casual coin-finding from serious collecting.

When History Creates Extraordinary Value

Every now and then, a coin’s value skyrockets not because of a low mintage, but because of the incredible story attached to it. These coins are tied to pivotal moments in history, turning them from simple money into genuine artefacts. There’s no better example of this than the legendary Edward VIII sovereign.

When King Edward VIII abdicated in 1936 to marry Wallis Simpson, his reign had lasted less than a year. Plans for his coinage were already well underway, but the abdication crisis meant they were never issued to the public. Only a handful of trial strikes and pattern coins were ever made, creating one of the greatest rarities in British coin history.

The 1937 Edward VIII Gold Sovereign is the most famous of these. With only 6 known examples in the world, its value has climbed to an estimated £1,000,000. The coin's staggering price tag comes almost entirely from its direct link to a huge constitutional crisis and a unique chapter in royal history. You can delve deeper into the story of this and other fascinating rarities in Atkinsons Bullion's guide to the rarest UK coins.

This coin perfectly illustrates how a powerful narrative can become a coin’s most valuable asset. Collectors aren’t just buying a piece of gold; they’re buying a piece of the story—a tangible link to an event that has fascinated people for decades. It's this potent mix of extreme rarity and historical drama that creates true, lasting value.

A Practical Guide to Coin Grading and Condition

While a coin's rarity and history give it the potential for value, its physical condition is what truly sets the price. You can think of it like collecting classic cars. Two vehicles might be the exact same rare model from the same year, but the one in showroom condition will always be worth vastly more than a rusted-out wreck. This principle applies directly to the value of rare UK coins.

In the world of numismatics, we call this process grading. It’s simply a standardised way of describing a coin's state of preservation. Even a tiny jump in grade, say from "Extremely Fine" to "Uncirculated," can cause a coin’s value to leap by hundreds, or even thousands, of pounds.

This all comes down to the fact that collectors prize originality above all else. A coin that looks like it just left The Royal Mint, with every detail sharp and its original lustre intact, is the ultimate prize.

Understanding the Coin Grading Scale

The UK grading scale runs from 'Poor' (where the coin is barely identifiable) all the way up to 'Uncirculated' (a perfect specimen). You don't have to be a seasoned expert to get a feel for where a coin might sit on this spectrum. It’s all about looking closely for signs of wear and tear.

Here's a simplified look at the key grades:

- Uncirculated (UNC): A coin with absolutely no signs of wear. It still has its full, original mint lustre – the same shine it had the day it was struck.

- Extremely Fine (EF): Shows only the slightest friction on its highest points. Most of the original lustre is still visible to the naked eye.

- Very Fine (VF): The main design is clear, but you can see light wear across the whole surface. The high points, like the monarch’s hair or details on a shield, will show some smoothness.

- Fine (F): This coin has seen moderate circulation. The major details are still there, but the finer elements have been worn away.

- Good (G) to Poor (P): These coins are heavily worn down, with designs and lettering that have become faint or are partially missing.

A common mistake beginners make is assuming that a shiny coin is in good condition. A coin can be brilliant but still show wear, or it may have been improperly cleaned, which dramatically reduces its value. True condition is about the preservation of detail, not just its shine.

The Role of Professional Grading Services

For a definitive, unbiased assessment, serious collectors turn to third-party grading (TPG) services like the Numismatic Guaranty Company (NGC) or Professional Coin Grading Service (PCGS). These companies act as impartial experts, giving a final verdict on a coin's authenticity and condition.

When you submit a coin, an expert grades it on a precise numerical scale from 1 to 70. It's then sealed in a secure, tamper-proof plastic holder, often called a 'slab', complete with a label detailing its certified grade.

This process, known as 'slabbing', delivers two massive benefits:

- Authentication: It provides a guarantee that the coin is genuine, removing any doubt for future buyers.

- Grade Lock-in: The grade is officially set in stone, which protects its value and makes it much easier to trade on the open market.

Having a rare coin professionally graded is one of the best ways to protect and maximise its value. For a more detailed exploration, our expert guide to British coin grading takes a much deeper dive into the specific standards used in the UK. It’s essential reading if you're serious about understanding what drives the market.

Exploring High-Value UK Coins from Past and Present

Understanding the theory behind coin valuation is one thing, but seeing it play out with real coins is where the magic happens. Certain UK coins have become absolute legends in the collecting world, their names instantly bringing to mind rarity and incredible value. These are the pieces that perfectly showcase how history, scarcity, and demand collide to create numismatic superstars.

By looking at these real-world examples, we can see the principles we've discussed come to life. The stories behind these coins are what truly capture the imagination, transforming them from simple pieces of metal into treasures people will go to extraordinary lengths to own.

The Legends of British Coinage

When you talk about the value of rare UK coins, a few iconic examples always leap to the front of the conversation. These are the coins that have cemented their place in numismatic folklore, usually thanks to a fascinating backstory or an almost mythical level of scarcity. They truly represent the pinnacle of British coin collecting.

The most famous of all has to be the 1933 Penny. Millions of pennies were struck every year back then, but an economic surplus in 1933 meant no new ones were actually needed for circulation. A tiny number—thought to be just seven—were produced for ceremonial purposes, like being placed under the foundations of new buildings.

Because of this unbelievable rarity, a 1933 Penny is one of the ultimate prizes. To prove the point, one sold at auction for a staggering £72,000 back in 2016. It’s a perfect example of how even a humble penny can achieve an extraordinary value when scarcity and history align.

Then there’s a much more recent legend: the 2009 Kew Gardens 50p. It was released to celebrate the 250th anniversary of the Royal Botanic Gardens with a mintage of just 210,000. In the world of modern coins you find in your change, that's an exceptionally small number, making it the rarest 50p design ever released to the public.

Its fame has snowballed over the years, and for many people, it's the first coin they think of when they hear the words "rare coin." A decent example found in circulation can easily sell for over £150 – a phenomenal return on its 50p face value.

Modern Classics and Commemorative Rarities

Value isn't just about age. Modern commemorative coins can become instant classics, driven by low mintage figures and intense collector demand from the get-go. The Royal Mint regularly issues special designs, especially for £2 and 50p coins, and some of them become hot property almost immediately.

These modern rarities prove that the core principles of supply and demand are as powerful today as they were a century ago. A limited production run for a popular theme can spark a collecting frenzy, pushing prices up in a heartbeat.

A great example is the 2002 Northern Ireland Commonwealth Games £2 coin. Its tiny mintage makes it the rarest commemorative £2 coin put into circulation, and it has held that top spot on scarcity lists for nearly two decades. You can keep an eye on which modern coins are the most sought-after by checking out the latest scarcity index updates on ChangeChecker.org.

The rise of modern collectibles like the Kew Gardens 50p proves that a coin doesn't need to be centuries old to be valuable. It's a powerful reminder that rarity is the true engine of value, regardless of the era.

Comparing Classic and Modern Rarities

While both old and new coins can be incredibly valuable, the factors driving their prices can be quite different. Getting your head around these distinctions is key to appreciating the rich and varied landscape of UK coinage. For a deeper dive into the market forces at play, our guide on how rare coin pricing works offers some fantastic context.

It's helpful to compare the two side-by-side to see what makes each type tick.

Classic Rarities vs Modern Collectibles

| Feature | Classic Rarity (e.g., Gold Sovereign) | Modern Rarity (e.g., Kew Gardens 50p) |

|---|---|---|

| Primary Value Driver | Its story and historical significance. How many survived is key. | Low mintage figures and immediate collector demand. |

| Condition's Role | Hugely significant. The jump between grades can mean thousands of pounds. | Very important, but many are found in good shape as they haven't been in circulation long. |

| Market Awareness | High among serious numismatists but low among the general public. | High public awareness, often fuelled by media stories and online communities. |

| Availability | Extremely limited. Examples might only appear at major auctions. | Scarce in your change, but available on secondary markets like eBay or from dealers. |

Whether it's a centuries-old legend or a modern commemorative piece, every valuable coin tells a story. These examples perfectly illustrate how the dynamic interplay of mintage, history, and demand creates the exciting and ever-changing market for rare UK coins.

Common Myths and Costly Mistakes to Avoid

Diving into the world of coin collecting is a fantastic journey, but it’s a path with its fair share of pitfalls. Falling for common myths can quickly turn a rewarding hobby into a very expensive lesson. Knowing what these traps are is your first line of defence in building a collection with confidence and protecting the value of rare UK coins.

One of the biggest misconceptions is that 'old equals valuable'. It’s an easy trap to fall into, but it’s rarely true. You can, for instance, pick up a genuine Roman coin that's over 1,700 years old for just a few pounds. Why? Because millions were originally minted and huge hoards have been discovered over the centuries, making them surprisingly common.

On the other hand, a modern coin like the 2009 Kew Gardens 50p, barely a decade old, can sell for over £150. Its value has nothing to do with age and everything to do with extreme scarcity. This is the perfect example of how rarity and demand are the real forces that determine a coin's worth.

The Irreversible Sin of Cleaning Coins

If you remember one thing, let it be this: never, ever clean your coins. It’s so tempting to want to polish up a dull, tarnished coin to see it shine, but you'd be committing the single most destructive act you can do to its value. Serious collectors don’t want shiny; they want originality.

Over decades or even centuries, a coin develops a natural layer of toning called a patina. This delicate surface is like a historical fingerprint, a testament to its age and authenticity. Cleaning brutally strips this away, leaving behind microscopic scratches that are glaringly obvious to an expert.

Cleaning a rare coin can instantly wipe out over 90% of its potential value. An experienced collector would much rather have a dirty, original coin than one that has been polished into a brilliant but unnatural state. The damage is permanent and can turn a potential treasure into little more than scrap metal.

Buying Ungraded and Spotting Fakes

In today’s market, buying valuable coins from unverified sellers without proper authentication is a huge gamble. While you can find great pieces on platforms like eBay, these sites are also minefields for the inexperienced. It's common to see sellers listing ordinary coins for outrageous prices, just hoping a newcomer will bite.

Be particularly sceptical of coins advertised as 'rare errors' without any solid proof. A lot of these are just post-mint damage—coins that have been scratched, dented, or worn down in circulation, not from a genuine mistake at The Royal Mint.

To keep yourself safe, stick to a few simple rules:

- Do Your Homework: Before you even think about buying, search for sold listings on eBay (not just the asking prices) to see what similar coins have genuinely fetched.

- Question Everything: If a deal seems too good to be true, it absolutely is. Be extra careful with sellers who have poor feedback or use blurry, unconvincing photos.

- Insist on Professional Grading: For any major purchase, look for coins that have been professionally graded and sealed in a protective case (or 'slab') by respected services like NGC or PCGS. This is your guarantee of authenticity and condition.

Spotting a fake takes practice. Look for mushy, indistinct details, incorrect weight, and weak or poorly formed lettering. Fakes just don't have the sharp, crisp strike of a genuine coin from an official mint. By staying cautious and informed, you can sidestep the expensive mistakes that trip up so many new collectors and ensure your collection grows into a source of pride and value.

Your Questions Answered on Valuing UK Coins

As you get deeper into coin collecting, certain questions always pop up. It's a natural part of the journey. Here, we'll tackle some of the most common queries head-on, giving you practical answers to help you feel more confident in valuing your UK coins.

How Do I Know If an Old UK Coin I Found Is Valuable?

The first thing to do is play detective. Identify the year and the monarch on the coin, then jump online and look up its mintage figures. A low number is always a promising first clue.

Modern commemorative coins, especially 50p and £2 pieces, are notorious for having some surprise rarities. Everyone's heard of the Kew Gardens 50p, and for good reason—its tiny production run makes it a modern classic.

Next, you need to be brutally honest about its condition. A coin that's been through the wars, even a rare date, won't command a high price. For a reliable starting point, check out resources like The Royal Mint's website or dedicated platforms such as Change Checker. They’re fantastic for spotting rare designs and seeing what other collectors are hunting for.

Is Rarity or Condition More Important for a Coin's Value?

Here’s the simplest way to think about it: rarity creates the potential for high value, but condition is what realises that value.

For a coin to be truly desirable to serious collectors, it needs to be scarce. But among those scarce coins, the one in the best possible shape will always fetch the highest price. It's the difference between a good find and a showstopper.

With more common coins, condition is everything. Only the most pristine, uncirculated examples have a chance of being worth much more than their face value. In short, rarity gets a coin a seat at the table, but condition determines how much it gets to eat.

Rarity gets a coin noticed, but condition is what gets it sold for a premium. An extremely rare coin in poor condition might be a curiosity, but a slightly less rare coin in perfect condition is often a better investment.

Where Should I Get a Rare Coin Valued or Sold?

For a proper, accurate valuation, you really need to speak to a professional. Reputable coin dealers, major auction houses, or members of the British Numismatic Trade Association (BNTA) are your best bet. They live and breathe the market and can give you an expert opinion based on current trends.

If you believe you have a genuinely high-value piece, selling through a specialist auction house is a great move. It puts your coin in front of a global audience of serious buyers who are willing to compete for it. For more common collectible coins, online marketplaces can work well, but remember the golden rule: clear, high-quality photos and an honest, detailed description are non-negotiable.

Can I Trust Online Coin Value Calculators?

Treat them with a healthy dose of scepticism. Online calculators can give you a very rough ballpark figure for common, circulated coins, but they fall apart when it comes to rare or high-grade items.

These automated tools simply can't grasp the nuances that make a coin valuable. They can’t see the subtle die varieties, understand the historical significance, or account for the ever-changing tides of market demand.

Think of them as a starting point for your research, nothing more. For a true assessment of the value of rare UK coins, there is no substitute for getting it appraised by a trusted expert who can hold it in their hands.

Whether you're just starting your collection or looking to add a centrepiece to it, Cavalier Coins Ltd offers a curated selection of rare and collectible coins from the UK and across the globe. Explore our collection today.