Right now, in late 2024, if you were to look up the raw market value for pure 24k gold in the UK, you’d see a figure hovering around £70-£75 per gram. But that's not what you'll pay when you buy a gold bar or coin. The final retail price is always a bit higher, and there's a good reason for it.

Understanding the True Price of Gold Per Gram

When you ask, "how much is gold per gram?", you're actually asking two questions at once. The first is about the spot price—the live, minute-by-minute market rate for raw gold traded on global exchanges. The second is about the retail price, which is what you actually pay a dealer to have that gold in your hand.

Those two numbers are never the same.

Think of it like buying coffee. The "spot price" is the wholesale cost of raw, unroasted coffee beans traded on the commodities market. The "retail price" is what you pay at your local café for a finished latte. That price includes the cost of roasting, grinding, milk, the barista's time, the shop's rent, and of course, their profit margin.

Gold works in exactly the same way.

Spot Price vs Retail Price

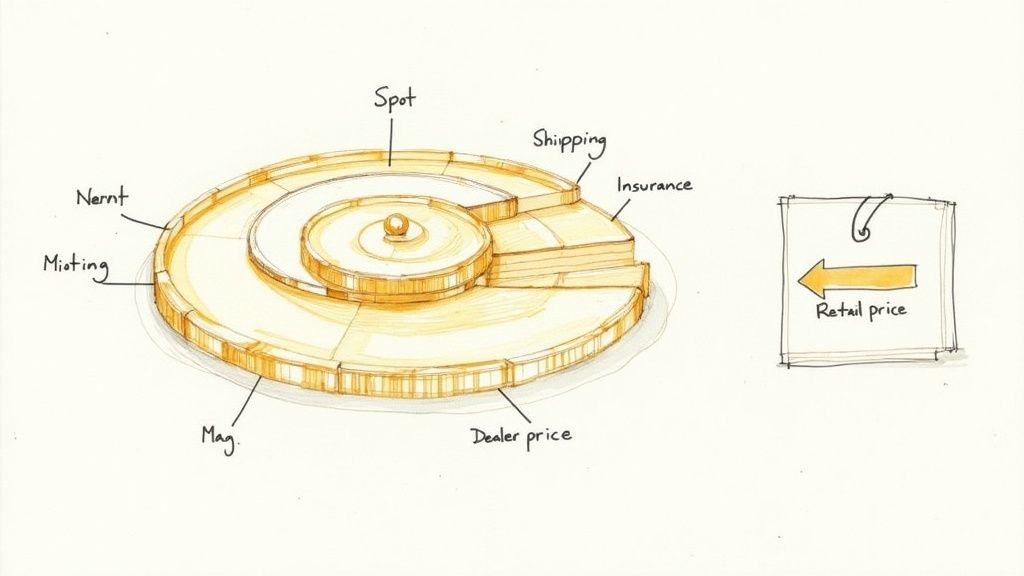

The journey from a digital price on a screen to a physical gold bar in your possession involves several steps, each adding a small cost. The gap between the spot price and the final retail price is called the premium. This premium is simply the cost of turning raw gold into a finished, tradable product.

The premium covers things like:

- Fabrication: The cost of minting a coin or casting and stamping a bar.

- Assaying: The process of verifying the gold's purity and weight.

- Packaging: Secure, protective casing for the product.

- Dealer Margin: The profit the retailer makes on the sale.

- Shipping and Insurance: The costs of getting the item to you safely.

This is also why a small one-gram gold bar costs significantly more per gram than a hefty one-kilogram bar. The fixed costs of manufacturing and handling are spread over a much smaller amount of gold, which naturally pushes the percentage premium higher.

A simple analogy is buying a single can of fizzy drink versus a 24-pack. The cost per can is always lower when you buy in bulk because the packaging and handling costs are more efficiently distributed. The same economic principle applies directly to buying physical gold.

Getting your head around this distinction is the first real step to becoming a savvy gold buyer. You're not just paying for the metal; you're paying for its transformation into a secure, verifiable, and tangible asset.

The table below breaks down these core factors that build up to the final price you pay.

Key Factors That Determine Your Final Gold Price Per Gram

Here's a closer look at the components that shape the price you pay for gold, moving from the base market rate to the final cost you'll see from a dealer.

| Factor | What It Represents | How It Impacts Your Price |

|---|---|---|

| Spot Price | The live, raw market value of pure gold. | This is the baseline cost of the metal content in your item. |

| Purity (Karat) | The percentage of pure gold in the item (e.g., 24k vs 18k). | Lower purity means a lower intrinsic value per gram. |

| Dealer Premium | The markup covering fabrication, shipping, and profit. | This is the primary reason the retail price is higher than the spot price. |

| Product Form | The type of gold (e.g., coin, bar, jewellery). | Collectible coins and intricate jewellery have higher premiums than simple bars. |

| Weight | The total mass of the gold item. | Smaller items generally have a higher premium per gram than larger ones. |

By understanding each of these elements, you can see exactly where your money is going and make much more informed decisions about what and when to buy.

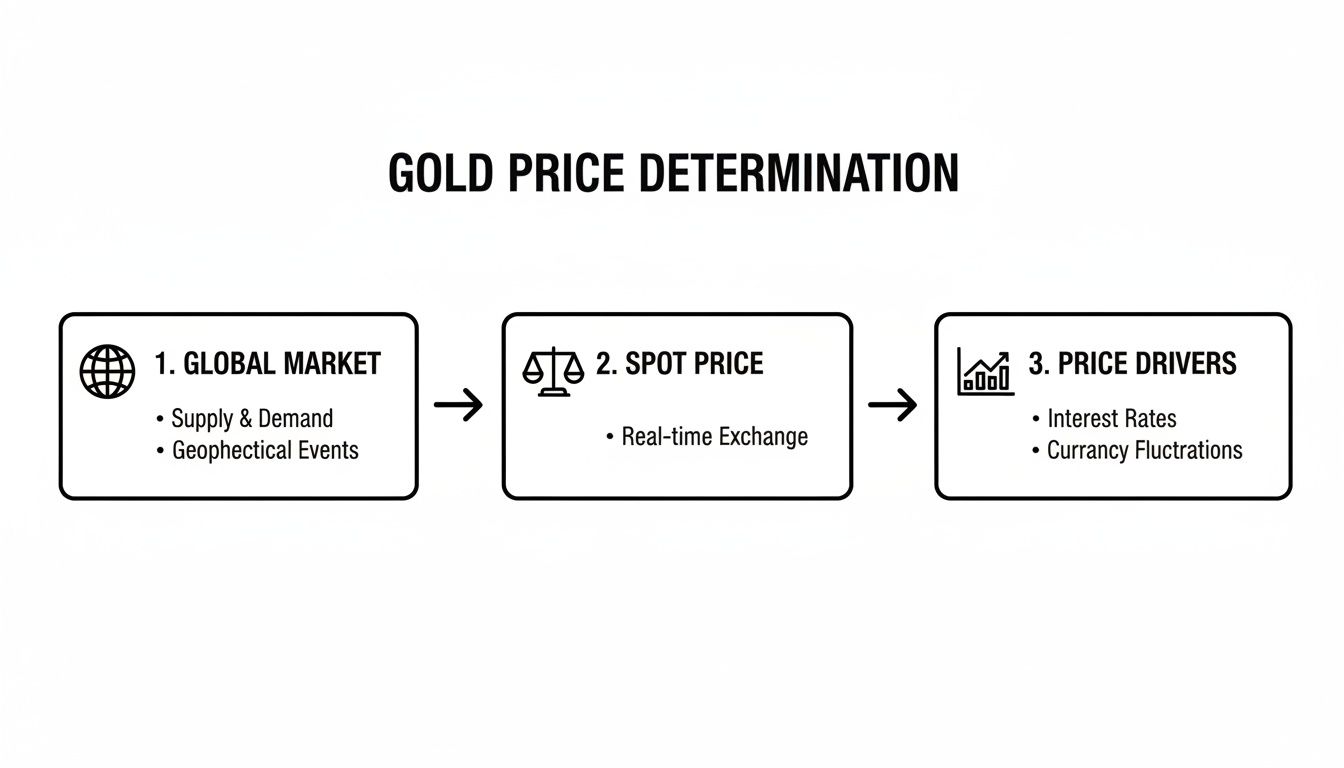

Decoding the Live Gold Spot Price

Any conversation about how much a gram of gold is worth has to start with one fundamental idea: the live gold spot price. This is the raw, wholesale rate for pure gold, the price it’s trading for right now on global markets. Think of it as the base cost of the metal before anything else gets added on.

It’s like the ‘factory gate’ price for gold. Just as coffee beans have a base price on the commodities market long before they’re roasted, packaged, and sold in a shop, gold has a live price set by huge trades between banks and major financial players.

This price is the bedrock for everything else. It’s a dynamic figure, flickering up and down every second, constantly reacting to the pulse of the global economy.

Where Does the Spot Price Come From?

The gold spot price isn't set by a single person or committee in a back room. It’s the result of all the buying and selling happening on major global commodities exchanges, with the London Bullion Market Association (LBMA) acting as a crucial benchmark for the whole industry. The price you see represents the current value for one troy ounce of pure, 24-karat gold, ready for immediate delivery.

Here's a look at the live precious metals prices from the LBMA, which really sets the standard for the worldwide market.

This screenshot shows the live auction prices, giving you a transparent peek at the wholesale rates that form the foundation of the spot price you see quoted online.

Because the spot price is quoted per troy ounce, we need to do a quick conversion to get to the price per gram. It’s simple arithmetic. Since there are 31.1035 grams in a troy ounce, you just divide the troy ounce price by that number.

For example, if the spot price is £2,200 per troy ounce, the calculation for the price per gram is:

£2,200 ÷ 31.1035 = £70.73 per gram

This straightforward calculation is the very first step any dealer, investor, or jeweller takes. It pins down the intrinsic metal value of an item, completely separate from any other costs.

What Makes the Gold Spot Price Fluctuate?

The spot price is never still; it’s always reacting to a massive range of economic news and geopolitical events. Getting a feel for these drivers helps you understand why the value of your gold is changing and gives you a better sense of when it might be a good time to buy or sell.

Here are some of the key drivers:

- Interest Rates and Central Bank Policy: When central banks cut interest rates, holding cash or bonds doesn't pay as well. This often pushes investors towards gold, boosting demand and nudging the spot price higher.

- Inflation Data: Gold has a centuries-old reputation as a safe harbour during inflationary times. When the cost of living climbs and currencies lose their buying power, people flock to gold to protect their wealth, which drives up its price.

- Geopolitical Instability: During times of political tension, conflict, or economic chaos, gold is seen as the ultimate 'safe-haven' asset. This flight to safety creates a surge in demand and a corresponding jump in the spot price.

- Currency Strength: On the world stage, gold is priced in US dollars. For us in the UK, the strength of the pound against the dollar is a big deal. A weaker pound means it costs more to buy a dollar's worth of gold, which has the effect of raising the price per gram here at home.

To get a handle on such unpredictable market movements, analysts often use advanced statistical methods. For instance, a Monte Carlo simulation can help model the thousands of potential price paths based on all these variables.

All these factors combine to create a value that is constantly in flux, making the spot price a true reflection of global confidence and economic health. It's the starting line for any gold transaction, representing the pure, unadulterated value of this timeless precious metal.

Calculating Gold Value from Karats to Cash

Knowing the live spot price gives you a fantastic starting point, but that figure is for pure, 24-karat gold. What about the gold you actually own, like a ring or a family heirloom? Most jewellery isn't made from pure gold simply because it’s too soft for everyday wear. Instead, it’s an alloy—a mixture of gold and other metals—measured in karats.

This is where things get interesting.

As the chart shows, the spot price is the foundation. Understanding the purity of your gold is the next crucial step in turning that market data into a real-world valuation for your specific item.

Understanding Gold Purity and Karats

The best way to think of the karat system is as a simple fraction out of 24 parts.

Pure gold is 24-karat (24k), which means all 24 parts of the metal are gold, giving it a purity of 99.9%. This is the standard you'll find in investment-grade bullion bars.

When other metals like copper, silver, or zinc are added to increase durability, the karat number drops. Each karat represents 1/24th of the whole, or about 4.167% gold content.

Here’s a breakdown of the common purities you'll come across in the UK:

- 22-karat (22k): Made of 22 parts gold and 2 parts alloy, making it 91.67% pure. It's a favourite for high-end jewellery and iconic coins like the British Sovereign.

- 18-karat (18k): With 18 parts gold and 6 parts alloy, this is 75% pure gold. It strikes a great balance between a rich gold colour and everyday strength, making it very popular for engagement rings.

- 14-karat (14k): At 14 parts gold to 10 parts alloy, this comes in at 58.5% pure gold. It’s extremely durable and more commonly seen in pieces from the US and mainland Europe.

- 9-karat (9k): This contains 9 parts gold and 15 parts alloy, resulting in 37.5% pure gold. It’s a very common standard for affordable, hard-wearing jewellery here in the UK.

Of course, before you can calculate anything, you need to be certain about what you're holding. It's always a good idea to research methods to accurately test gold purity to ensure you know exactly what you're working with.

The Simple Formula for Calculating Your Gold's Value

Once you know the purity of your gold, figuring out its intrinsic "melt value" per gram is surprisingly straightforward. All you need is the live 24k spot price per gram and the purity percentage of your item.

The Formula:

(Live 24k Spot Price per Gram) x (Gold Purity Percentage) = Value per Gram of Your Item

Let's walk through a real-world example. Imagine the current spot price for 24k gold is £70 per gram.

Here’s how you’d calculate the value for different items:

-

For an 18k Gold Ring (75% Pure):

- £70 (spot price) x 0.75 (purity) = £52.50 per gram

- This is the pure gold value contained within each gram of your 18k ring.

-

For a 9k Gold Chain (37.5% Pure):

- £70 (spot price) x 0.375 (purity) = £26.25 per gram

- As you can see, the lower purity directly corresponds to a lower intrinsic value.

This quick calculation allows you to look past the sentimental or original retail value of an item and understand its raw material worth. It's the same method dealers use to set a baseline price when buying scrap gold. It's especially useful for investors trying to price specific items, and our guide on selling Gold Sovereigns offers more detail on how purity affects coin valuation.

It’s important to remember this calculation gives you the scrap or melt value. It doesn't account for craftsmanship, brand recognition, or any numismatic value a coin might have, but it provides a solid, essential foundation for assessing any gold you own.

Why You Pay More Than the Spot Price

So, you've checked the live gold spot price and worked out the raw value of an item. But then you head over to a dealer's website, and the price tag is always a bit higher. This isn't a mistake or a hidden fee; it’s a fundamental part of buying physical gold, and it's called the premium.

Think of it like buying a high-end Swiss watch. You’re not just paying for the raw stainless steel and sapphire crystal. The price also reflects the intricate design, the master craftsmanship, the brand's reputation, and the guarantee that you're getting the genuine article. Gold works on a very similar principle.

The premium is simply the amount added to the spot price to cover everything involved in getting that raw, wholesale gold transformed into a finished product and delivered safely into your hands. It’s what bridges the gap between a number on a market screen and a tangible asset you can hold.

Breaking Down the Premium

That premium isn't just one arbitrary charge. It’s actually a bundle of real-world costs every dealer has to cover to stay in business. When you understand what goes into it, the final price per gram makes a lot more sense.

Here are the main ingredients that make up the premium:

- Minting and Fabrication: This covers the actual cost of making the item, whether it's striking a detailed coin at The Royal Mint or casting and stamping a simple gold bar.

- Assaying and Certification: Every reputable gold product is tested to verify its exact weight and purity. This quality control has a small associated cost.

- Secure Logistics: You can't just pop gold in the post. Insuring and transporting precious metals requires specialised, high-security services that cost more than standard shipping.

- Dealer Operating Costs: This includes everything from secure vault storage and staff salaries to the costs of running a website and marketing.

- Dealer Profit Margin: And of course, there’s a small profit margin that allows the dealer to keep the lights on and continue providing the service.

These costs, all rolled together, explain why you always pay a bit over the live spot rate. The premium is your assurance that you're getting a genuine, accurately weighed, and securely delivered piece of gold.

The premium on gold is best understood as the "cost of physical delivery." It covers every single step needed to turn a market price into a real, verifiable asset, securing its journey from the refinery all the way to your doorstep.

Why Premiums Vary So Much

Not all premiums are created equal. You’ll quickly notice that the markup can vary quite a bit from one gold product to another, and the two biggest reasons for this are the item's size and type. Getting your head around this is key to deciding what kind of gold is right for you.

A classic example is the difference between a tiny 1-gram gold bar and a hefty 1-kilogram bar. The little 1-gram bar will have a much, much higher premium as a percentage of its value. Why? Because the fixed costs of manufacturing, testing, and packaging are almost identical for both, but for the smaller bar, those costs are spread over a far smaller amount of gold.

The type of gold you're buying is just as important. A rare, collectible coin with a low mintage will always have a bigger premium than a mass-produced bullion coin like a Britannia. If you're curious about the distinction, our guide on what bullion means goes into more detail. Essentially, with a bullion coin, you're paying almost entirely for the metal's weight. With a collectible coin, you’re also paying for its rarity, history, and beauty—factors that add "numismatic value" on top of the metal price and push the premium higher.

A Look Back at Gold Prices in the UK

To get a real feel for the value of gold today, it helps to glance back over our shoulders. Gold’s modern price is built on a long and fascinating history, especially here in the UK where its price wasn't always dictated by the open market. In fact, it was once controlled by law.

For nearly two centuries, the UK was on the gold standard. This was a system where the value of the pound sterling was directly tied to a fixed amount of gold. It created an era of price stability that’s almost impossible to imagine in today’s world.

The Era of the Gold Standard

During this period, the price of gold was a matter of government policy, not fluctuating market demand. If we rewind to the early 18th century, the price was astonishingly low by modern standards. Records from the London market show that in 1718, gold was priced at £4.31 per fine troy ounce.

Since there are 31.1035 grams in a troy ounce, this works out to a mere £0.139 per gram—just 13.9 pence. You can explore more historical gold price data to see just how stable things were.

This fixed rate held steady for decades, acting as a reliable anchor for the entire economy. It meant your money was backed by a real, physical asset, which gave people a sense of security that feels very different from our modern system of free-floating currencies.

Back then, asking "how much is gold per gram?" would have been like asking how many pennies are in a pound. The answer was fixed and rarely changed, making gold a stable measure of value, not a fluctuating investment.

But the immense economic pressures of the 20th century, particularly the crushing costs of the First World War and the Great Depression that followed, made this system completely unsustainable.

Moving to a Market-Driven Price

The real turning point for UK gold prices came in 1931, when Britain finally left the gold standard. This single decision fundamentally changed how gold was valued. For the first time in generations, the price per gram was no longer dictated by the Bank of England.

It was unleashed onto the open market. By 1932, the price had already crept up to around £5.90 per ounce, or roughly £0.201 per gram. While that's still a tiny figure compared to today, it was a huge jump at the time and marked the dawn of a new era.

From that moment on, the price of gold in pounds sterling became subject to the very same forces that drive it today:

- Global Supply and Demand: How much gold is being mined versus how much is wanted by investors, central banks, and industries.

- Economic Uncertainty: During a recession or crisis, investors often rush to gold as a safe-haven asset, pushing its price higher.

- Currency Fluctuations: The strength of the pound against other world currencies, especially the US dollar, started to directly affect the local price of gold.

This shift from a fixed peg to a market-driven price is the most critical chapter in gold's recent history. It explains how gold transformed from a simple monetary anchor into the dynamic, globally traded investment we recognise today.

Modern Gold Price Trends and What They Mean for You

If you look at gold's performance over the last two decades, you'll see a powerful story unfold. Its journey hasn't been a slow, steady climb. Instead, it’s been marked by sharp, decisive surges, usually triggered by moments of global economic stress. These trends paint a very clear picture of why gold remains such a vital asset for UK investors.

Major global events have consistently acted as catalysts, pushing people towards the safety of gold. When traditional financial systems start to look shaky, gold's appeal as a store of value really shines. It becomes a reliable hedge against uncertainty and the devaluation of currencies like the pound.

Catalysts for Gold Price Growth

The pattern is clear, and it keeps repeating itself. When confidence in other assets falters, demand for gold surges, pushing the price per gram higher.

Three key events from recent history illustrate this perfectly:

- The 2008 Financial Crisis: As major banks teetered on the brink of collapse, investors scrambled for tangible assets. The result was a dramatic spike in the price of gold.

- The 2016 Brexit Vote: Uncertainty around the UK's economic future, and the pound's subsequent fall in value, made gold priced in GBP significantly more valuable almost overnight.

- The COVID-19 Pandemic: Unprecedented government spending and worldwide economic shutdowns created a perfect storm of uncertainty, sparking another powerful rally.

These moments really highlight gold's role as a financial safe harbour. Its value isn't just tied to jewellery or industrial use; it's deeply connected to global economic sentiment.

Gold's Explosive Performance in the UK

To truly grasp its modern value, you have to look at the numbers. Over the past 20 years, the gold price per gram in the UK has seen explosive growth. It's risen from a low of just £7.75 in the early 2000s to its current level around £81.34—a phenomenal 937.78% increase.

This surge wasn't a straight line. For instance, during the 2008 global financial crisis, gold per gram jumped from about £15 in 2007 to over £25 by 2011. And in 2020, amid COVID-19 lockdowns, prices soared from £40 per gram early in the year to £55 by year-end, which is a 37.5% gain in a single year. For a deeper dive, you can review this 20-year gold price chart from BullionByPost.

This incredible performance proves gold is far more than just a historical relic. It has actively protected and grown wealth for UK investors through some of the most turbulent economic times in living memory. Its ability to hold value when other assets are falling is precisely what makes it such an essential part of a balanced portfolio.

For the modern investor, gold's track record isn't about nostalgia; it's about proven resilience. Its price surges during crises demonstrate its enduring role as the ultimate 'Plan B' for protecting wealth against inflation and currency weakness.

This history is particularly relevant when you're thinking about physical assets. If you're looking to start or expand your holdings, understanding the different options is key, which is why our guide to buying gold coins in the UK can be an excellent next step. By analysing these modern trends, you can make more informed decisions and appreciate gold not just for its history, but for its proven, modern-day value.

A Few Final Questions on Gold Prices

When you're getting serious about buying gold, a few practical questions always pop up. Getting your head around these is the final step to investing with confidence, whether you're buying your very first piece or adding to a growing collection. Let's clear up some of the most common queries.

It’s worth remembering just how important gold has become, especially over the last decade. In the past 10 years alone, the gold price per gram in GBP has soared, rocketing from a low of £22.32 to a high of £83.04. That’s a staggering 254.35% gain.

Major events like the 2016 Brexit vote, the 2020 pandemic, and the spike in inflation in 2022 all threw fuel on the fire. If you’re curious about this incredible journey, you can explore the full gold price history over at BullionByPost.

Where Should I Check the Live Gold Price Per Gram in the UK?

For an accurate, up-to-the-second price in pounds sterling, your best bet is always a major UK bullion dealer's website. Places like The Royal Mint or BullionByPost have live charts that track the spot price, which is updated every few seconds and forms the bedrock for every transaction.

Steer clear of generic financial websites. They often show delayed data or, worse, quote prices only in US dollars, which isn't much help to a UK-based buyer. The dealers' charts are built specifically for us, giving you the most relevant information possible.

Key Takeaway: Always use a reputable UK bullion dealer's website for live pricing. Their charts are the industry standard for UK-based transactions and reflect the true cost in pounds sterling.

Is It Better to Buy Gold Bars or Gold Coins?

This really comes down to what you want to achieve with your investment, as they both have their own merits.

- Gold Bars: If you want the most gold for your money, bars are usually the way to go. They carry the lowest premiums over the spot price, especially the larger ones. This makes them the most cost-effective way to stack gold purely for its weight and value.

- Gold Coins: Coins like the British Britannia or the classic Sovereign have slightly higher premiums. The big advantage? They are Capital Gains Tax (CGT) exempt for UK residents. Plus, they're instantly recognisable and much easier to sell off in smaller chunks if you need to.

For anyone just starting, CGT-free coins are a brilliant entry point. The tax efficiency and flexibility they offer are hard to beat.

Do I Pay VAT When Buying Gold in the UK?

Thankfully, no. You do not pay VAT on investment-grade gold here in the UK. This is a huge advantage that makes gold a more appealing investment than other precious metals like silver or platinum, which both get hit with 20% VAT.

For gold to qualify for this tax break, it has to meet certain standards:

- A gold bar must have a purity of at least 99.5%.

- A gold coin needs to be at least 90% pure, minted after the year 1800, and count as legal tender in its country of origin.

This tax efficiency is a major reason why gold remains such a trusted long-term store of wealth for so many people.

At Cavalier Coins Ltd, we are passionate about helping both new and expert collectors find the perfect pieces to build their collections. Explore our extensive selection of rare coins and banknotes from around the world. https://www.cavaliercoins.com