Quick One Pound Coin Value Snapshot

Every so often, a standard £1 coin can quietly turn into a small fortune. When the right combination of year, design quirks and minting mistakes line up, collectors will pay well above face value.

This snapshot will help you spot those hidden gems in just a glance. We’ll break down the main rarity drivers before diving deeper.

Key Rarity Factors Include:

- Year: Certain low-mintage runs leave only a handful of coins in circulation.

- Design: Unique commemorative themes or anniversary issues stand out.

- Minting Errors: Misstrikes and die flaws tend to grab collector attention.

- Provenance: A documented history or original packaging can add a nice premium.

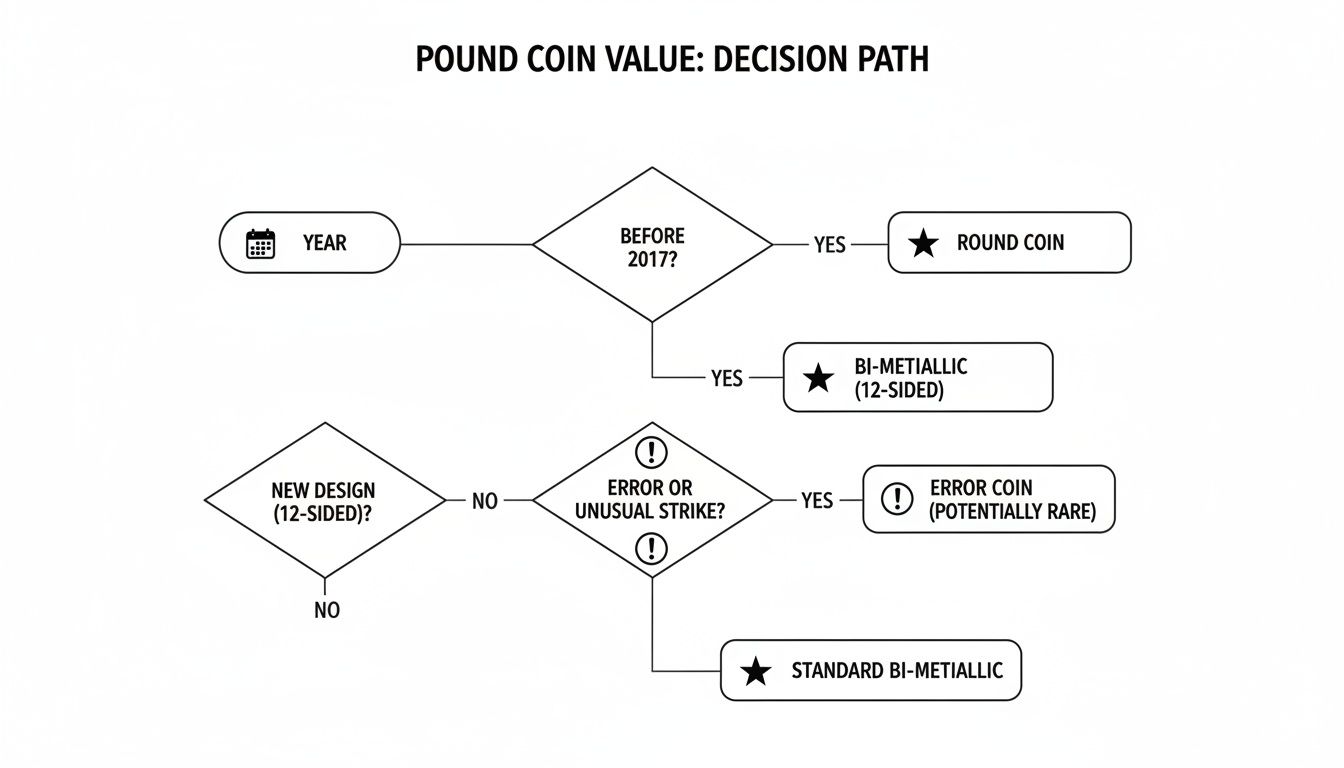

This decision-tree style graphic shows how each factor can push a coin’s worth well beyond its face value.

Key Rarity Factors Comparison

Below is a side-by-side overview of the key elements that can lift a £1 coin to collector status.

| Factor | Why It Matters | Value Impact |

|---|---|---|

| Year | Scarcity from low mintage | High |

| Design | Limited or special edition themes | Medium–High |

| Minting Errors | Misstrikes and die flaws catch the eye | Very High |

| Provenance | Verified history or original packaging | Medium |

Use this chart as your quick reference before digging into condition or market trends.

Next Steps

Start by photographing your coins under neutral lighting to capture every detail. Then:

- Consult reputable coin catalogues or online databases for price comparisons.

- Reach out to a certified appraiser or established dealer if you suspect high value.

- Monitor local auctions and specialist platforms to gauge current sale prices.

Quick Data Check

Stay in the loop with these ongoing tasks:

- Track weekly sale results on eBay, Delcampe, and major auction houses.

- Review the Royal Mint’s annual mintage figures to spot low-issue years.

- Visit coin forums and pricing guides to confirm collector demand.

- Log each find in a spreadsheet: include date, mint mark and sale history.

Start Now

Grab your loose £1 coins, sort them by year and design, then apply this snapshot process. You’ll quickly see which ones deserve a deeper look—and realistic price expectations—before you sell or consign.

Understanding One Pound Coin Value Concepts

Certain coins trade above £1 when collectors prize scarcity more than face value. It’s a bit like limited-edition art prints—fewer pieces mean higher demand. When a coin boasts a rare design, minimal mintage and pristine condition, its numismatic appeal can far outstrip that single pound.

At the simplest level, a coin’s worth starts with its face value or its metal content. Beyond that, enthusiasts add what we call a numismatic premium—the extra you pay for history, rarity and provenance.

- Face Value: The denomination everyone recognises.

- Intrinsic Metal Value: Based on the copper-nickel alloy.

- Numismatic Premium: Driven by scarcity, condition and story.

Building Scarcity And Demand Model

Imagine a one pound coin as a limited-edition poster. Each year’s mintage is its print run—the smaller it is, the fiercer the hunt.

Since its 21 April 1983 debut, the pound coin has seen production peaks and dips. That first batch of 443,053,510 coins remains the largest single-year issue. Special designs and security upgrades have driven mintage variations ever since. For a deeper dive, see CheckYourChange.

“A coin without scarcity is like a print without an edition number—it holds value only in its material.”

This captures why low-mintage years command premium bids and why condition is everything.

Applying The Value Framework

To nail down a rough value, work through four checkpoints: mintage, design, condition and provenance.

| Aspect | What To Check | Value Indicator |

|---|---|---|

| Mintage Volume | Annual run size versus other years | Low = High Scarcity |

| Design Uniqueness | Commemorative or anniversary motifs | Rare themes fetch more |

| Physical Condition | Wear, scratches or mint faults | Higher grade = higher price |

| Provenance And Packaging | Original box or paperwork | Boosts buyer confidence |

Begin by sourcing mintage figures from reputable catalogues. Then, under magnification, inspect portrait details, inscriptions and edges for special marks or errors.

Run through this cycle to refine your estimate:

- Note the year and flag any low-mintage issues.

- Assess surface quality with a 10x loupe.

- Research auction results for similar pieces.

- Factor in market trends and seasonal shifts.

This sequence builds a clear mental blueprint. Up next: linking these concepts to professional grading services and typical price ranges.

Next Steps To Grade And Value

With your valuation framework ready, turn to hands-on inspection. A loupe and a crisp white card will help you spot key details.

- Use a 10x magnifying glass to check edges and fields for hairline scratches or die cracks.

- Compare your coin to high-resolution reference photos to identify subtle finish variations or mint errors.

This live grading ties directly back to the rarity and condition factors in our model. It also shows when a coin deserves a professional opinion or is primed for the sales floor.

Keep this roadmap close. In the next section, we’ll dive into expert grading standards and reveal real-world price brackets.

Rarity Factors That Boost One Pound Coin Value

Collectors know that a one pound coin can be so much more than its face value. When the right mix of rarity drivers comes together, these coins can command surprising sums at auction or in specialist markets.

Key Drivers Of Coin Scarcity

Several factors turn an ordinary £1 piece into a sought-after treasure:

-

Low Mintage Years

Coins struck in limited runs almost always attract keen bidder interest. -

Special Designs

Commemorative issues—from royal anniversaries to landmark events—play to collectors’ passions. -

Minting Errors

Off-centre strikes, die cracks and other misprints can transform a common coin into a rarity. -

Documented Provenance

Original packaging, certificates and known ownership histories add a premium.

For more on pricing strategies, see our guide on rare coin pricing strategies at Cavalier Coins.

Price Range Estimates

You’ll often see these broad brackets when shopping or selling:

- Low Mintage Year Coins: £5 – £50

- Special Design Issues: £10 – £100

- Mint Errors: £20 – £500

- Provenance Premiums: £50 – £300

These figures offer a starting point, but condition, market mood and auction timing always influence the final hammer price.

Impact Of Low Mintage Years

Mintages plunged from hundreds of millions in the 1980s to just a few million in some recent releases. Here’s a quick glance at how production shapes scarcity:

Mintage Numbers For Select Years

The table below compares production volumes and relative rarity levels for key one pound coin issues.

| Year | Mintage Volume | Rarity Indicator |

|---|---|---|

| 1983 | 443,053,510 | Very Common |

| 2017 Shield | 3,400,000 | Rare |

| 2019 Kew Gardens | 4,200,000 | Rare |

| 2022 Elizabeth II Map | 1,800,000 | Very Rare |

Even a quick look shows why a 2017 Shield proof coin—limited to just 2 million—once sold for £85.

Special Designs And Mint Errors

Commemorative releases and misstrikes often steal the limelight:

- 1994 Kew Gardens and 2009 Olympic edge designs remain perennial favourites.

- Off-centre strikes or dual-strike errors can fetch £100+.

- A subtle die crack might add £50 or more to a coin’s value.

“Mistakes can sometimes be as rare and coveted as deliberate designs.”

Specialist forums and dealer channels report that error varieties vanish from listings almost instantly.

Provenance And Condition Premiums

A coin in its original mint packaging, complete with certificate, speaks volumes to buyers. Follow these steps to maximise value:

- Verify official packaging and certification.

- Trace previous owners or auction appearances.

- Check storage conditions to ensure pristine preservation.

In one notable sale, full paperwork lifted a coin’s price by £300 over an otherwise identical piece.

Case Study Deep Dive

Charities occasionally unearth gems in bulk donations. One UK organisation:

- Sorted 3,000 donated £1 coins by sight.

- Spotted three rare issues from 2017, 2019 and 2022.

- Partnered with a reputable dealer for quick valuations.

The result? Three coins sold at £300 each, adding £900 to fundraising totals without extra outreach.

Selling Channels And Timing

Choose your platform and calendar wisely:

- Auction houses shine during national numismatic fairs.

- Specialist dealers offer expertise but often levy higher fees.

- Online marketplaces provide mass exposure—just watch out for listing costs.

Top tips:

- Set reserve prices to guard against underbidding.

- Group similar rare coins into single lots for bulk appeal.

- Use high-resolution images and detailed descriptions to stand out.

By combining insights on scarcity, design quirks and provenance, you’ll zero in on the one pound coins that really deliver value beyond their face. Happy hunting!

Inspecting And Grading Coin Condition

Picking up a one pound coin is like opening a well-worn novel. On first glance it’s just another piece in your pocket. Yet, a few seconds under a loupe can reveal whether it holds hidden value beyond its face.

Condition grades—ranging from Good all the way to Uncirculated—shape a coin’s market price. Think of grading as judging the strength of a book’s spine and the crispness of its pages. This section borrows the antique-book analogy to guide you step by step.

Standard Wear Grades

Wear grades tell you how much of the original design remains. It’s like checking if a book’s cover is intact or if the pages are dog-eared.

| Grade | Detail Level |

|---|---|

| Good (G) | Major features flattened |

| Very Good (VG) | Some design visible, smoothing on high points |

| Fine (F) | Clear lines with slight surface wear |

| Very Fine (VF) | Light marks on portrait and lettering edges |

| Extremely Fine (EF) | Sharp relief, minimal contact marks |

| Uncirculated (UNC) | Full mint lustre, no signs of use |

Use a 10× loupe under bright, neutral light to compare coins against these definitions. For instance, crisp edge lettering but softened portrait relief usually sits between VF and EF.

Spotting Damage And Cleaning

Even the rarest date loses appeal if it’s been over-cleaned or scratched. A genuine coin wears evenly—unlike one that’s been buffed or corroded.

- Inspect for hairline scratches radiating from the centre field.

- Reject coins with an unnatural sheen or fine brush strokes in protected areas.

- Watch for corrosion pitting around rims and inside grooves.

Since the 2017 switch to a bi-metallic 12-sided design, coins last longer in pockets. Yet forgery rates spiked before then, making authenticity checks essential. Learn more about counterfeit trends on the Federal Reserve Economic Data site.

Authenticity And Counterfeit Checks

Simple tests can spot many fakes before you pay for grading.

“A genuine coin shows consistent wear and crisp detail rather than uneven surfaces.”

- Examine edge lettering or reeded edges under light for uniformity.

- Weigh the coin: it should match the official 8.75 g within a small margin.

- Feel the rim—cast counterfeits often have overly sharp or mushy edges.

Professional Grading Guidance

When you believe you’ve found a high-value piece, a third-party grade adds trust and can lift prices. Follow these steps before shipping off:

- Place coins in acid-free flips or sturdy holders.

- Complete submission forms with accurate coin details.

- Pay grading fees and select your preferred turnaround.

- Track progress online until your slabbed coins return.

Read also our guide on how to get coins graded for a full walkthrough and cost breakdown.

Condition And Value Impact

Just as collectors prize a book with an unbroken spine, numismatists pay more for coins showing no wear. A piece graded UNC often fetches 5× to 10× the price of a VF specimen. In fact, modern collectors regularly shell out £50+ for EF or UNC coins from low-mintage years.

- Store in acid-free holders to ward off tarnish.

- Steer clear of PVC flips that can leave green deposits.

- Rotate coins in display trays to reduce pressure marks.

Charities handling bulk donations can apply these tips to unearth potential windfalls. A quick grading checklist makes sorting thousands of coins surprisingly swift.

Inspecting Counterfeits Like A Pro

Whenever suspicion arises, line up your coin beside certified examples from reputable databases.

- Check weight—cast forgeries often stray by 0.2 g or more.

- Measure edge thickness; genuine pounds run a consistent 2.5 mm all the way around.

Next Steps To Secure Value

Once you’ve self-graded, photograph each side under consistent lighting and note any marks. Test the market on auction platforms or with dealer listings before finalising your sale. Well-documented condition reports can boost realised prices by around 20% at auction.

Mastering these inspection methods means you’ll spot the true gems among countless one pound coins.

Quick Grading Checklist

- Inspect both faces for even lustre and untouched finish.

- Verify weight and dimensions against Royal Mint specs.

- Confirm rim design and thickness match official security features.

- Use side-by-side photos from expert resources for comparison.

- Record every finding with date-stamped images.

With regular practice, your eye for detail sharpens. Start inspecting today.

One Pound Coin Examples And Price Ranges

If you sift through auction catalogues or dealer stocklists, you’ll soon realise that some £1 coins fetch far more than their face value. The reason? Rarity, demand and fascinating backstories.

Below, we showcase a handful of standout coins that routinely sell above £1. For each, you’ll see why collectors covet them and what price brackets to expect.

Key Examples Covered

- Rare date coins with low mintage and proof finishes

- Mint error varieties featuring misstrikes and die cracks

- Special commemorative releases marking events and anniversaries

Here you’ll find actual auction results and dealer estimates to help gauge your own coins’ potential value.

Examples Of Rare Date Coins

Let’s begin with date-based rarities. Think of these as rare stamps in the coin world—tiny runs that suddenly become prized.

The 2017 Shield Proof was struck in just 2 million examples. In uncirculated condition, sellers often ask around £85.

Meanwhile, the 2019 Kew Gardens issue, limited to 4.2 million, regularly trades between £15 to £30.

| Year | Auction Result | Dealer Range |

|---|---|---|

| 2017 Shield Proof | £85 | £75 to £95 |

| 2019 Kew Gardens | £20 | £15 to £30 |

“A 2017 Shield sale shows how date really matters.”

Auction patterns confirm that when supply is tight, premiums follow.

Error Coin Highlights

Errors give coins that “one-off” appeal—almost like a typo in a bestselling novel. Prices swing wildly depending on how dramatic the mistake is.

Off-centre strikes, where part of the design is missing, generally fetch £100 to £200.

Here are some common error types:

- Off-centre strike: adds £100+ when a band of the planchet remains blank

- Die crack: hairline fractures valued at £50 to £150

- Double strike: overlapping images commanding £200 to £500

Collectors often hunt these errors on specialist forums or dealer mailing lists.

Commemorative Edition Cases

Limited editions celebrate moments in history and spark extra collector interest. Take the 2015 Battle of Britain coin—only 5 million issued, trading around £12 to £20.

The 2022 Commonwealth Games edition, with just 2.5 million minted, typically changes hands for £8 to £15.

Comparing these variants—date, error type and design—paints a clear picture of why some £1 coins earn serious attention.

When you want to estimate a coin’s worth, look at:

- Auction archives

- Dealer price lists

- Past sale catalogues

If you spot a potential gem, a professional valuation is your next step. Photograph both faces under natural light and reach out to a reputable dealer for a quick check.

Charities and non-profits sorting bulk donations can use a simple grading checklist. Spotting a commemorative or error might net £50+ each.

Resellers often:

- Group similar coins into lots for bulk bidding

- Upload high-quality images and detailed descriptions

- Factor platform fees (around 5–15%) into reserve prices

Local coin fairs are another great avenue—face-to-face offers often bypass hefty commissions. Keep a spreadsheet of sale results to refine your pricing over time.

By profiling rare dates, mint errors and commemorative releases, you’ll have a road map to the hidden value in your £1 coin stash. Whether you’re a collector, charity or reseller, these examples will guide you toward coins worth more than their £1 face value.

Valuation And Selling Strategies For One Pound Coins

Turning a handful of one-pound coins into a tidy sum begins with pinpointing their true value. Exploring different appraisal routes not only helps you dodge hidden fees but also speeds up the process.

In the sections that follow, you’ll discover how to evaluate your coins, pick the right selling channel and even tailor your approach if you’re collecting, fundraising or flipping for profit.

Professional Valuation Options

Getting an expert’s eye can make all the difference. You might choose:

- Local Coin Dealers: Chat face-to-face, get immediate feedback and leave with a ballpark figure.

- Online Appraisal Services: Send clear photos (or the coins themselves) and receive a detailed digital report.

- Major Auction Houses: Often provide free initial valuations—but keep in mind you’ll sell through their platform if you decide to proceed.

Compare these factors carefully:

- Fees: £10–£50 per coin, according to the service level.

- Turnaround: From 24 hours for quick snapshots to 6 weeks for full written assessments.

- Credibility: Check for membership in the British Numismatic Trade Association or affiliations with recognised auction houses.

“Choosing an experienced valuer is like picking a guide on a misty moor – the right expert keeps you headed in the right direction.”

Always ask for references or client testimonials before you hand over any coins (or cash).

Choosing Selling Channels

Once you’ve nailed down a value, the next step is finding the perfect sales avenue. Each option comes with trade-offs:

Table 1 Comparison Of Key Sales Channels

| Channel | Fees | Pros | Cons |

|---|---|---|---|

| Auction Houses | 10–20 % commission | Wide bidder pool; professional marketing | Payment may take weeks |

| Specialist Dealers | 5–10 % margin | Fast payment; trusted network | Offers tend to be conservative |

| Online Marketplaces | 5–15 % listing/final fees | Broad audience; flexible listings | You handle shipping and queries |

| Coin Fairs | Stall + travel costs | Face-to-face deals; no online fees | Limited foot traffic; extra expenses |

Listing And Negotiation Tips

A standout listing can spark bidding wars and reduce haggling. Follow these guidelines:

-

Craft a punchy title such as “Rare 2017 Shield One Pound Coin – Uncirculated”.

-

Highlight key details in bullet form:

• Year and design features

• Mint marks and proven provenance

• Condition grade (EF, UNC, etc.) -

Photograph coins under neutral lighting against a plain background.

-

Capture both faces, the edge and any distinctive errors.

When it comes to negotiating:

- Set a reserve at around 80 % of your appraisal.

- Reply swiftly with clear, polite answers to buyer questions.

- Offer modest bundle discounts for multiple purchases.

“A well-informed seller builds buyer confidence and often achieves a premium price,” says a veteran dealer.

Scheduling And Timing Sales

Seasonality plays a surprising role in final bids. Many auction houses and fairs buzz in spring and autumn, while online activity often spikes around holidays. Aligning your sale calendar can boost bids by 15–20 %.

- Note major UK coin show dates, for example the London Coin Fair.

- Launch online auctions early in the week to avoid weekend slumps.

- Renew grading certificates shortly before listing to keep them valid.

Seasonality matters: a well-timed sale can stir competition and lift prices.

Tailored Advice For Collectors Charities And Resellers

Different motivations demand different tactics:

Collectors

- Visit specialist dealers and coin fairs to handle coins in person.

- Keep a spreadsheet of purchase dates, costs, appraised values and sale results.

Charities

- Use a simple grading checklist to train volunteers on key years and known errors.

- Group similar coins into lots and work with dealers offering charitable rates—this can net over £1,000 in just days of sorting.

Resellers

- Create compelling lots by grouping coins logically to attract larger bids.

- Monitor platforms like eBay and Delcampe weekly for hammer-price trends.

- Stay alert to fee changes to protect your margins.

Case Study

A UK reseller grouped 20 low-mintage coins, photographed each piece and wrote concise descriptions. With a combined reserve of £500, they sold the lot in 72 hours and took home £520 after a 10 % platform fee.

Check out our guide on how to sell a coin for step-by-step instructions on crafting listings and negotiating deals.

By combining solid valuations with smart sales strategies, you’ll ensure every one-pound piece realises its full potential. Whether you’re a devoted collector, working for charity or running a small coin-trading business, a thoughtful approach pays off.

Happy selling!

Frequently Asked Questions

We’ve pulled together the questions that crop up most when collectors wonder if a £1 coin might be worth more than its face value. From spotting rare issues to choosing the right selling channels, these answers will help you navigate the process and maximise your returns.

Top FAQs Answered

-

How Do I Spot a Rare or Valuable £1 Coin?

Look for low-mintage years, distinctive designs or minting mistakes. Check condition against trusted catalogues or reputable online databases. -

Do I Need a Professional Grade to Secure Top Prices?

A third-party grade boosts buyer confidence and often pushes sale prices higher. Budget around £20–£50 per coin and allow a few weeks for processing. -

Where’s the Best Place to Sell a Valuable £1 Coin?

Specialist dealers and established auction houses tend to deliver the highest returns. Online platforms and coin fairs, on the other hand, offer broader audience reach. -

What Fees Should I Budget For When Selling?

Auction commissions typically range from 10–20%. Factor in grading fees and any listing charges when setting your reserve price.

“A well-presented, authenticated coin can command up to 20% more at auction,” notes a leading numismatist.

Quick Tips

- Examine under neutral lighting with a 10× loupe to catch subtle mint errors.

- Compare against high-resolution images in established numismatic databases.

- Maintain a simple spreadsheet logging each coin’s mintage, design features and sale results.

Packaging And Submission

- Store coins in acid-free flips or rigid holders to prevent scratches.

- Label each item clearly with the year, design and your own grade estimate.

- Ship coins in padded envelopes or small boxes to avoid jostling.

Careful handling and clear labelling protect your coins and speed up grading and auction procedures. Use these pointers as a quick reference when you’re evaluating or listing a £1 coin with potential for a premium.

Ready to unlock true value in your collection? Visit Cavalier Coins Ltd to explore services and rare coins.