Figuring out rare coin values in the UK is a lot more straightforward than you might imagine. It's almost never about age alone, but a fascinating mix of rarity, condition, and what collectors are actually looking for. A modern 50p can be worth a small fortune, while a Victorian penny might be worth next to nothing.

What Really Makes a UK Coin Valuable

Have you ever found an old coin in your change and wondered if you’ve stumbled upon a hidden treasure? It’s a common thrill, but the idea that "older is always better" is probably the biggest myth in coin collecting.

The real story behind a coin's worth is far more interesting. It’s a bit like being a detective; you’re not looking for a single clue but piecing together the evidence. Let's walk through the key factors that experts use to separate pocket change from genuine treasure.

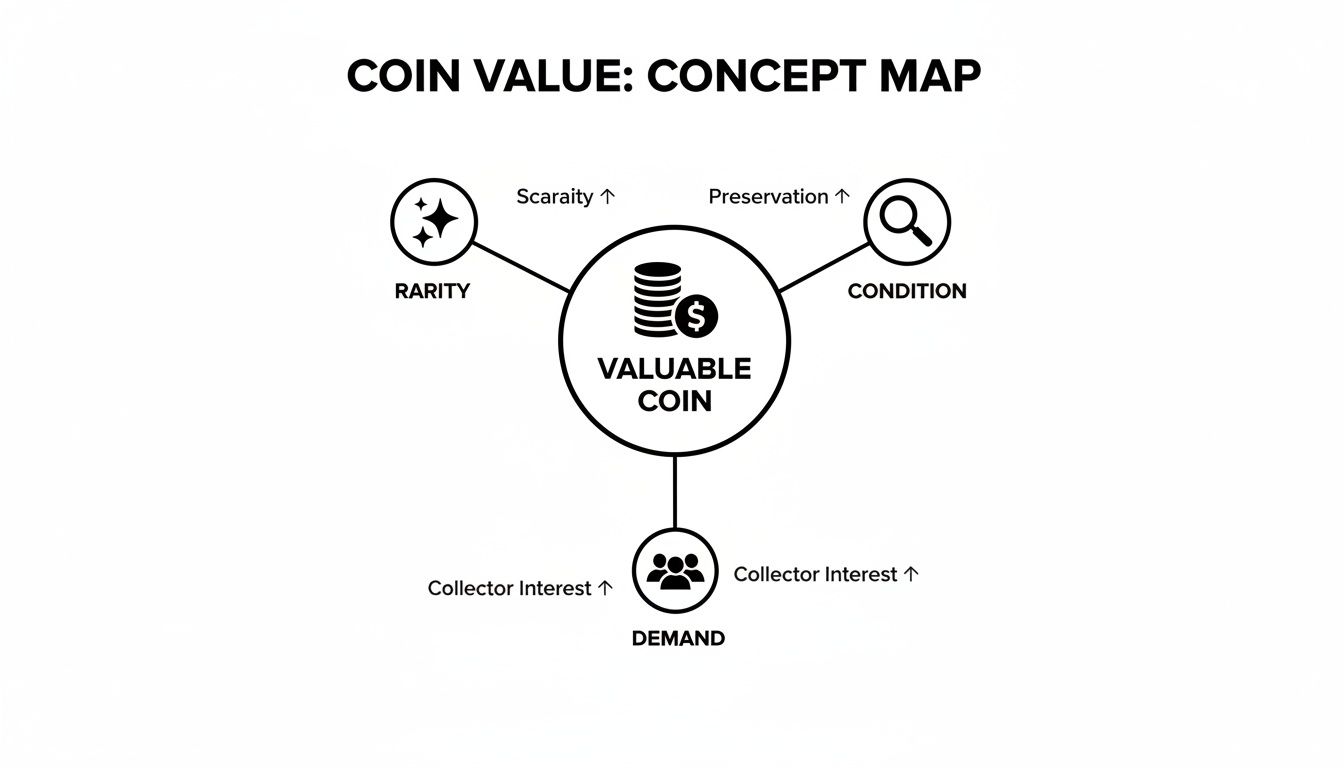

The Core Factors of Coin Value

To really understand what makes a coin worth more than its face value, we need to look well beyond the date stamped on it. These are the elements that work together to create its market price:

- Rarity: This is the big one. How many were originally minted? Even more importantly, how many have survived in good shape? A coin with a notoriously low mintage, like the famous 2009 Kew Gardens 50p, is scarce from the get-go.

- Condition (or Grade): A coin in crisp, uncirculated condition will always fetch a much higher price than one that’s been rattling around in pockets and tills for decades. Even the tiniest scratches or marks can have a huge impact on its final value.

- Collector Demand: At the end of the day, a coin is only worth what someone is willing to pay for it. Popular themes, like the Beatrix Potter or Olympic Games series, create a frenzy of demand among collectors. This pushes prices up, even for coins that aren't exceptionally rare.

- Unique History (Provenance): A coin's backstory can add immense value. Was it part of a famous old collection? Does it have a well-documented history? This "provenance" acts like its official biography, making it far more desirable to serious collectors.

Beyond the Basics: Minting Errors

Sometimes, the most valuable thing about a coin is its imperfection. A mistake during the minting process can create a unique and highly sought-after variety that was never meant to exist.

These "error coins" might have off-centre designs, the wrong wording, or even be struck on the wrong type of metal. Knowing what to look for is crucial for identifying rare coin errors, as these oddities can dramatically increase a coin’s worth.

The Four Pillars of Coin Valuation

Ever wondered what separates a coin worth a few quid from one that fetches a small fortune? It all boils down to four core principles. Think of them as the four legs of a table—if one is shaky or missing, the whole thing comes crashing down.

By looking at each pillar—Rarity, Condition, Demand, and Provenance—you can start to build a real expert's eye for what drives the value of a coin.

It’s the powerful combination of these elements, not just one in isolation, that truly creates a high-value piece.

Pillar 1: Rarity

Rarity isn't just about how many were made. A small mintage is a brilliant start, of course, but true rarity also depends on how many of those coins actually survived. A unique minting error, a forgotten design, or even a specific historical event can make a seemingly ordinary coin exceptionally scarce.

Take the legendary 1933 George V penny. Officially, no pennies were struck for circulation that year because there were already plenty knocking about. However, a tiny handful—maybe as few as seven—were created for ceremonial purposes. This makes its survival rate next to nothing, turning it into one of Britain’s most famous and sought-after rarities.

Pillar 2: Condition

The physical state of a coin, what we call its grade or condition, is absolutely critical. Think of it this way: you could have two copies of the same book. One is a battered library book with dog-eared pages, and the other is a crisp, unread first edition. The story inside is identical, but their values are worlds apart. It's the same with coins.

A coin that's been jangling around in someone’s pocket for fifty years will be worn, with its fine details smoothed away. On the other hand, an Uncirculated (UNC) coin looks just as it did the day it left the Royal Mint, with sharp details and its original lustre. That’s what collectors are really looking for.

Key Takeaway: Whatever you do, never, ever clean your coins. Cleaning creates thousands of tiny scratches and strips away the original surface, or patina. This causes permanent damage and can slash a coin's value by over 90%, even if it’s a rare one.

To get you started, here’s a quick rundown of the grading terms we use in the UK.

UK Coin Grading Standards Explained

This table breaks down the main grades you'll see used by dealers and collectors across the UK. It’s a simplified guide, but it’s the perfect starting point for learning how to assess the state of your own coins.

| Grade | Abbreviation | Description of Wear |

|---|---|---|

| Fine | F | Shows significant wear. The main design is clear, but all the finer details are gone. |

| Very Fine | VF | Light wear is visible across the entire coin, but most of the key details are still sharp. |

| Extremely Fine | EF | The design is very sharp, with only the slightest wear on the highest points of the coin. |

| Uncirculated | UNC | Perfect condition. The coin looks exactly as it did when it left the mint, with no wear at all. |

This is just scratching the surface, of course. For a much more detailed look at the subtleties of assessing a coin's condition, our complete guide on the grades of coins is the perfect next step.

Pillar 3: Demand

A coin can be incredibly rare and in perfect condition, but if nobody actually wants it, it’s not going to be worth much. Collector demand is the engine that drives the market. It can be sparked by anything from historical anniversaries and popular culture to specific collecting themes.

Think about the frenzy that surrounded the Beatrix Potter and Olympic Games 50p coins. The huge public interest pushed the value of certain designs way beyond what you'd expect based on their mintage numbers alone. Likewise, a coin tied to a famous monarch's reign or a major national event can capture people’s imagination and send prices soaring.

Pillar 4: Provenance

The final pillar, provenance, is the coin's backstory—its documented history. A clear, traceable chain of ownership that links a coin to a famous collection or a notable historical figure can elevate its status from simply being rare to becoming legendary.

Good provenance is the ultimate proof of authenticity. It also adds a compelling story that collectors find absolutely irresistible. For the truly top-tier items, like that 1933 penny, a verifiable history isn't just a nice-to-have; it's a fundamental part of its immense value.

How to Spot Valuable Coins in Your Collection

Right, this is where the real fun starts. With a solid grasp of rarity and condition, you can finally start rummaging through that change jar or old family coin box with a more experienced eye. Spotting a valuable piece isn’t about luck; it’s about knowing exactly what you’re looking for—certain dates, odd designs, or those tell-tale low mintage figures that make a coin special.

And don't just think of dusty old pre-decimal coins. Some of the most sought-after treasures are modern commemoratives that you could genuinely find in your pocket money today. Let’s break down a few of the most famous examples and see why they became so valuable in the first place.

Modern Marvels: The 50p Coins to Watch For

The humble fifty pence piece has exploded into a collecting phenomenon all on its own. This is mostly down to a popular run of commemorative designs, some of which were minted in such small numbers that finding one in your change is a genuinely rare event.

-

The Kew Gardens 50p (2009): This is the undisputed king of modern rare coins. With a mintage of just 210,000, it is the scarcest 50p ever put into general circulation. The design, featuring the famous Chinese Pagoda at Kew Gardens, became a legend due to this extreme rarity meeting huge collector demand.

-

The Olympic Series (2011): To celebrate the London 2012 Olympics, the Royal Mint released 29 different designs. While millions of each were struck, the coin explaining the football offside rule had the lowest mintage and is now the one everyone wants from the set.

-

The Beatrix Potter Series (2016-2018): These charming coins were an instant hit, but they weren't all made in the same quantities. The 2018 Peter Rabbit and Flopsy Bunny coins had much smaller mintages (1.4 million each) than the earlier releases, making them significantly trickier to find and more valuable as a result.

Collector's Tip: When you're checking 50p coins, the date is everything. For series like Beatrix Potter, the year can be the difference between a coin worth 50p and one worth many times more.

Valuable £2 Coins Beyond the Standard Design

Just like the 50p, certain commemorative £2 coins have become hot property because of low production numbers linked to specific events or regions. These are often the ones that get snapped up by collectors almost as soon as they hit circulation.

This screenshot from the Change Checker Scarcity Index perfectly shows how mintage figures directly create a coin's rarity ranking.

As the index makes clear, the Commonwealth Games £2 coins dominate the top spots, confirming their status as the rarest circulating £2 designs by a country mile.

The reason some modern £2 coins are so scarce is down to intentionally low mintages for regional or event-specific issues. Take the 2002 Northern Ireland Commonwealth Games £2—it has a recorded mintage of just 485,500. This tiny figure puts it right at the top of any scarcity list. In fact, all four designs from the 2002 Commonwealth Games take up the "rarest" slots.

Compare that to the standard "Technology" £2 coin, which has a combined mintage of over 416 million, and you can see the enormous difference. This numbers game directly fuels market prices and explains the tiny probability of finding one of the rare ones in your change.

Pre-Decimal Legends: What to Look For

While modern coins are an exciting treasure hunt, the world of pre-decimal currency is where you’ll find Britain’s most legendary rarities. These coins are prized not just for being scarce but for their incredible historical context.

A perfect example is the 1933 George V Penny. As mentioned earlier, its immense value comes from a virtually non-existent mintage; perhaps only seven are known to exist. Finding one of these is the coin collecting equivalent of winning the lottery.

Other pre-decimal coins to keep an eye out for include:

- Gothic Crown (1847): A stunningly intricate design from Queen Victoria's reign. Its low mintage and sheer beauty create massive demand among collectors.

- Short Cross Penny (1180-1247): While many of these are fairly common, coins from certain mints or made by specific 'moneyers' (the people who physically struck the coins) can be incredibly rare. The names are on the reverse, so you'll need to look closely.

- Key Date Shillings: In any monarch's reign, specific years had very low mintages due to wars, economic problems, or other historical events. These are known as "key dates," and they are what collectors hunt for.

Whether you're looking at a modern 50p or a penny from centuries ago, the method is always the same. Check the date, study the design for anything unusual, and then cross-reference what you have with the official mintage figures. This careful, methodical approach is how you turn a simple coin search into a successful discovery.

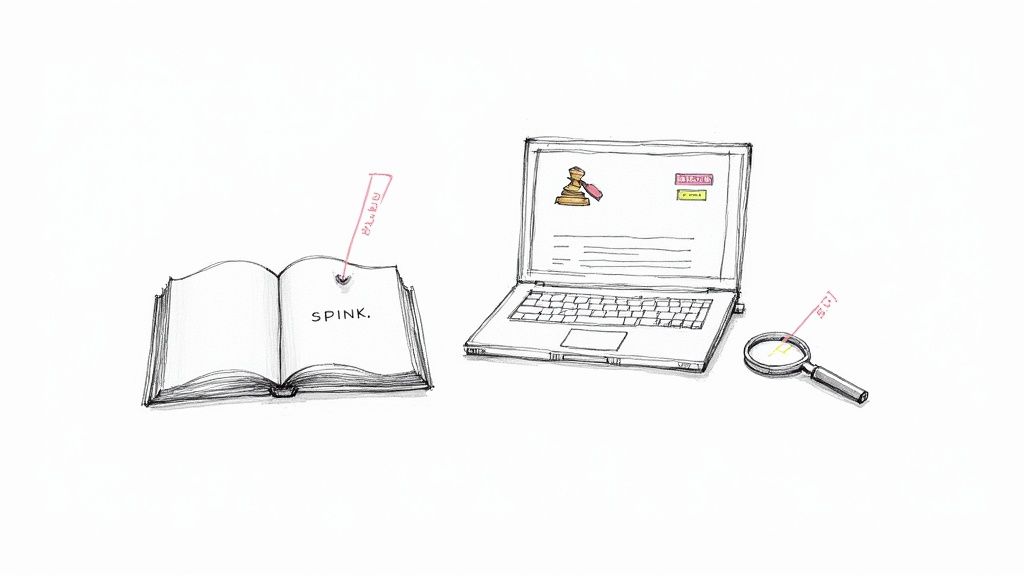

Using Professional Tools to Verify Coin Values

That thrilling moment when you think you’ve found a rare coin is just the beginning. The next step is the most important one: figuring out what it’s actually worth, and doing it with confidence. Just typing its name into a search engine can be a recipe for disappointment, as online marketplaces are often filled with wildly optimistic sellers asking for fantasy prices.

To get a true feel for rare coin values in the UK, you need to use the same resources the professionals do. This means looking past the noise of asking prices and focusing on two things: authoritative price guides and, most importantly, actual recent sales data. It’s like the difference between an estate agent’s brochure and the land registry records; one shows you what someone hopes to get, the other shows you what people are really paying.

The Spink Catalogue: The Collector’s Bible

For anyone serious about collecting British coins, the annual Coins of England & the United Kingdom catalogue is the undisputed bible. Known simply as ‘Spink’ to collectors, it’s been the go-to reference since it was first published back in 1929.

This isn't just a price list. It’s a complete guide, packed with mintage figures, historical context, and details on all the different varieties for almost every coin struck in the British Isles.

When you find your coin in Spink, you'll see estimated values for different grades, from Fine (F) up to Uncirculated (UNC). These "book values" are carefully compiled from auction results and dealer stock, giving you a solid baseline for what your coin might be worth. Just remember, they are a guide. The market is always shifting, and a fierce bidding war at an auction can easily push a price well beyond its book value.

Looking Beyond the Book: Real-World Prices

While Spink gives you a great starting point, the most accurate valuation comes from what people are paying right now. The golden rule here is to look at sold listings, not what people are asking for. An active listing only tells you a seller's hopes and dreams, which can often be based on nothing more than wishful thinking.

Here’s where to find genuine market data:

- Major Auction House Archives: Reputable auctioneers like Spink, London Coins, or Dix Noonan Webb all publish their past auction results online. A quick search of their archives will show you precisely what collectors were willing to pay for a coin like yours in a competitive sale.

- eBay's 'Sold Items' Filter: eBay can be a fantastic tool if you use it correctly. Once you search for your coin, just use the filter on the left-hand side to show only ‘Sold Items’. This cuts through all the overpriced listings and shows you what similar coins have actually sold for recently.

Expert Tip: When you're comparing your coin to sold examples, pay very close attention to the grade. The price difference between a coin in Very Fine (VF) condition and one in Extremely Fine (EF) can be enormous, often doubling or even tripling its value.

To help you navigate these resources, here's a quick comparison of what each one is best used for.

Comparing UK Coin Valuation Resources

| Resource Type | Primary Use | Pros | Cons |

|---|---|---|---|

| Spink Catalogue | Establishing a baseline "book value" and identifying varieties. | The undisputed industry standard; comprehensive and trusted. | Published annually, so prices can lag behind a fast-moving market. |

| Auction House Archives | Finding what collectors paid for high-quality, verified examples. | Provides real, verified sales data from a competitive environment. | Data is for specific sales; may not reflect private dealer prices. |

| eBay 'Sold Items' | Checking the current market rate for common to mid-range coins. | Huge volume of data, showing what the general public is paying. | Grades are self-assessed by sellers and can be unreliable. |

Ultimately, a combination of these resources will give you the most accurate and well-rounded picture of your coin's true market value.

Avoiding Fakes and Misinformation

Unfortunately, where there's high value, there are often fakes and scams. Unreliable price websites and sensationalised news articles just add to the confusion, making it hard to get a straight answer. The best defence is always a healthy dose of scepticism.

Always cross-reference your information between several trusted sources. If you think you have a particularly valuable coin, or you're thinking of making a big purchase, getting it professionally authenticated is a must. You can learn more about how to get coins graded and certified, which removes all doubt about a coin's authenticity and condition.

By using a trusted guide like Spink as your foundation and backing it up with live market data from auction sales, you can build a valuation for any UK coin that you can truly be confident in.

Choosing the Right Way to Sell Your Coins

That electrifying moment when you realise a coin in your possession is actually valuable is a brilliant feeling. But turning that potential into pounds in your pocket is another matter entirely. The route you take to sell your coins can make a huge difference to the final price, how quickly you get paid, and how much effort you have to put in.

There isn't a single "best" method. It really boils down to what you value most: getting the absolute top price, a quick and hassle-free sale, or finding a happy medium between the two.

Let's walk through the three main avenues for selling rare UK coins: going to a specialist dealer, consigning to a major auction house, or using online marketplaces. Each has its own rhythm and rules, and understanding them will help you pick the path that’s right for your coins and your own goals.

Selling Directly to a Coin Dealer

For speed and simplicity, nothing beats selling directly to a reputable coin dealer. If convenience is your top priority, this is often the best choice. A good dealer will examine your collection, give you a straight offer, and if you agree, you can often leave with the money that same day. No fussing with photos, no listing fees, and no trips to the post office.

Of course, that convenience isn't free. A dealer is running a business and needs to make a profit. They’re buying your coin with the intention of selling it on to another collector, so their offer has to leave room for their overheads and margin. You should expect an offer that is a percentage of the coin's full retail value, not the full amount.

Consigning to a Specialist Auction

If your number one goal is to squeeze every last drop of value from your coin, a specialist numismatic auction is hard to beat. This is especially true for exceptionally rare or high-grade pieces. Premier auction houses like Spink or London Coins have a global audience of serious collectors ready to compete, which can often push the final price far beyond its catalogue estimate.

The trade-off? It’s a much slower process and comes with some hefty fees. You'll typically hand your coin over months before the auction date. When it sells, you'll pay a seller's commission, usually somewhere between 10% to 20% of the final hammer price, and you might also be charged for insurance or photography. While a sale isn't guaranteed, a good auction house will only take on coins they are confident will perform well.

Using Online Marketplaces like eBay

Online marketplaces like eBay represent a middle ground. They give you direct access to a vast, worldwide audience of buyers from your own home. You're in complete control of the listing, the pricing, and the description. It can be a fantastic option for common to mid-range valuable coins where there’s a large pool of interested collectors.

The main challenge here is the sheer amount of work involved, plus the costs. You're the photographer, the copywriter, the customer service rep, and the shipping department all in one. You also need to get your head around the fees. To avoid any nasty surprises, understanding eBay's fee structure is vital for figuring out what you’ll actually pocket.

Key Decision Point: Let the coin's value and your own priorities guide you. For that one-in-a-million rarity, an auction house is the clear winner. For a handful of more common but valuable coins you want to sell quickly, a dealer is a solid bet. If you don't mind putting in the time to potentially earn more on mid-value items, online marketplaces are a great alternative.

Whichever route you choose, presentation is everything. This means taking clear, well-lit photos of both the obverse and reverse and writing an honest description covering the coin’s date, denomination, and condition. For a more detailed walkthrough of these methods, our guide on how to sell rare coins offers more practical, step-by-step advice.

Where Do You Go From Here?

You now have a solid roadmap for figuring out what your rare UK coins are really worth. That journey, from finding an interesting coin in your change to understanding its value, is a methodical one – and now you know how to walk the path.

It all starts with identification. That means separating the potential treasures from the everyday shrapnel by looking closely at dates and designs. From there, you need to honestly assess its condition, always remembering that the grade is one of the biggest drivers of its final price. Then comes the research, using proper tools and real auction results, not just hopeful asking prices you see online.

Only then can you decide what to do next.

Whether you're looking to sell a great find for a tidy profit or carefully build a collection you're proud of, you now have the knowledge to make smart, informed choices. Remember, the real magic of coin collecting is in the thrill of the chase.

Putting Your Knowledge Into Practice

Your adventure into the world of coins is just getting started. Here’s a simple plan to get you going:

- Start Small: Get into the habit of checking the change you get back every day. Keep an eye out for those key dates and special commemorative designs we’ve talked about.

- Organise Your Finds: If you spot something that looks promising, put it somewhere safe. A small bag or container will protect it from getting more scratches and dinks.

- Practise Your Research: Use online resources like auction archives to look up the coins you find. Do this even for common ones – it’s great practice for getting a feel for the market.

Honestly, the most important step is simply to start looking. So go on, grab that jar of loose change you’ve been ignoring and see what stories are waiting inside.

Your Top UK Coin Value Questions Answered

When you're getting to grips with the world of UK coin collecting, a few questions always seem to pop up. Whether you're just starting out or have been collecting for years, getting straight answers can save you from making a costly mistake. Let’s tackle some of the most common queries we hear.

Should I Clean My Old UK Coins Before Selling Them?

The answer to this is a firm, unequivocal no. It's the first rule of coin collecting, and for a very good reason.

Cleaning a coin, even with something as seemingly innocent as a soft cloth, will permanently damage its surface. It creates tiny, microscopic scratches that an experienced collector or dealer will spot in a heartbeat. You simply can't undo it.

Collectors prize a coin's original surface, what we often call its 'patina'. This is the natural toning that develops over many decades, and it's a key part of the coin's history and authenticity. Wiping that away is like stripping the original finish off an antique piece of furniture—you instantly destroy a huge chunk of its character and value.

Expert Advice: Always leave your coins exactly as you found them. A coin with natural tarnish and its original surface intact will always be worth far more than a shiny, cleaned coin that has been permanently damaged.

Where Can I Find Official Mintage Figures for a UK Coin?

Knowing how many coins were struck is the first step to figuring out how rare it is. Thankfully, this information is quite accessible if you know where to look.

- For modern decimal coins (from 1971): Your best bet is to go straight to the source. The Royal Mint website publishes the official, definitive mintage figures for all the circulating and commemorative coins it produces.

- For older, pre-decimal coins: A good catalogue is an essential tool. The industry bible is the Spink 'Coins of England & the United Kingdom' catalogue. You'll find it on the shelf of every serious collector and dealer.

- For a quick check: Online resources like Change Checker do a great job of compiling mintage data in an easy-to-digest format. They are particularly brilliant for spotting the rarity of modern commemorative 50p and £2 coins.

What Is the Difference Between Book Value and Market Value?

Getting your head around this is absolutely key to understanding what your coin is really worth. They sound similar, but they're two very different things.

Book value is the estimated price you'll see listed in a printed guide, like the Spink catalogue we just mentioned. These figures are based on extensive research and historical sales data, making them a fantastic starting point and benchmark. The only catch is that because they're published annually, they can sometimes lag behind fast-moving market trends.

Market value, on the other hand, is the real-world price a coin is achieving right now between a buyer and a seller. Think of it as the 'live' price. It reflects immediate collector demand, what’s hot and what’s not, and what similar coins have sold for very recently. To find the true market value, you need to look at the sold prices from recent auctions or on marketplaces like eBay. This tells you what people are actually willing to pay today.

At Cavalier Coins Ltd, we provide enthusiasts with access to a vast selection of rare and interesting coins and banknotes from around the world. Whether you are looking to build your collection or find a specific piece, explore our curated offerings at https://www.cavaliercoins.com.