Ever seen the price printed on the cover of a book? That’s basically a coin’s face value—the official worth stamped on it by the government, like 50p or £2. It’s the amount you can legally spend in a shop, but for collectors, this number is just the first chapter of a much more exciting story.

The Starting Point of Every Coin's Story

So, what does face value really mean? At its heart, it’s the baseline, the guaranteed monetary worth a government gives to a piece of currency. This is the minimum amount the coin or banknote can be exchanged for in day-to-day life.

For anyone collecting coins in the UK, getting your head around this concept is fundamental. It’s the foundation from which you can start to figure out a coin’s true market worth, which often shoots well past its printed denomination.

The Story Beyond the Stamp

While the number stamped on a coin tells you what it's worth at the till, it rarely tells you its real story. That printed figure is just the beginning. A coin’s true journey, and its potential value, involves so much more.

The tale of any interesting coin is about much more than what's stamped on the surface. Its actual value is often hidden in other, far more fascinating details:

- The Metal It’s Made Of: The intrinsic or ‘melt’ value of a coin can sometimes be higher than its face value. This is especially true for older coins made from precious metals like silver or gold.

- Its Rarity and History: This is what we call numismatic value. It’s all about how many were made, the condition it’s in, and the historical events it’s tied to.

- Collector Demand: At the end of the day, a coin is worth what someone is willing to pay for it. For the right piece, that can be hundreds, or even thousands of times its face value.

Understanding the difference between face value and market value is the first step towards becoming a savvy collector. One tells you what a coin is, the other tells you what it could become.

This guide will show you why the number on a coin is often just the opening line in the story of its true worth. To get a feel for the journey a coin takes before it even enters circulation, check out our detailed guide on how coins are made.

Understanding the Three Types of Coin Value

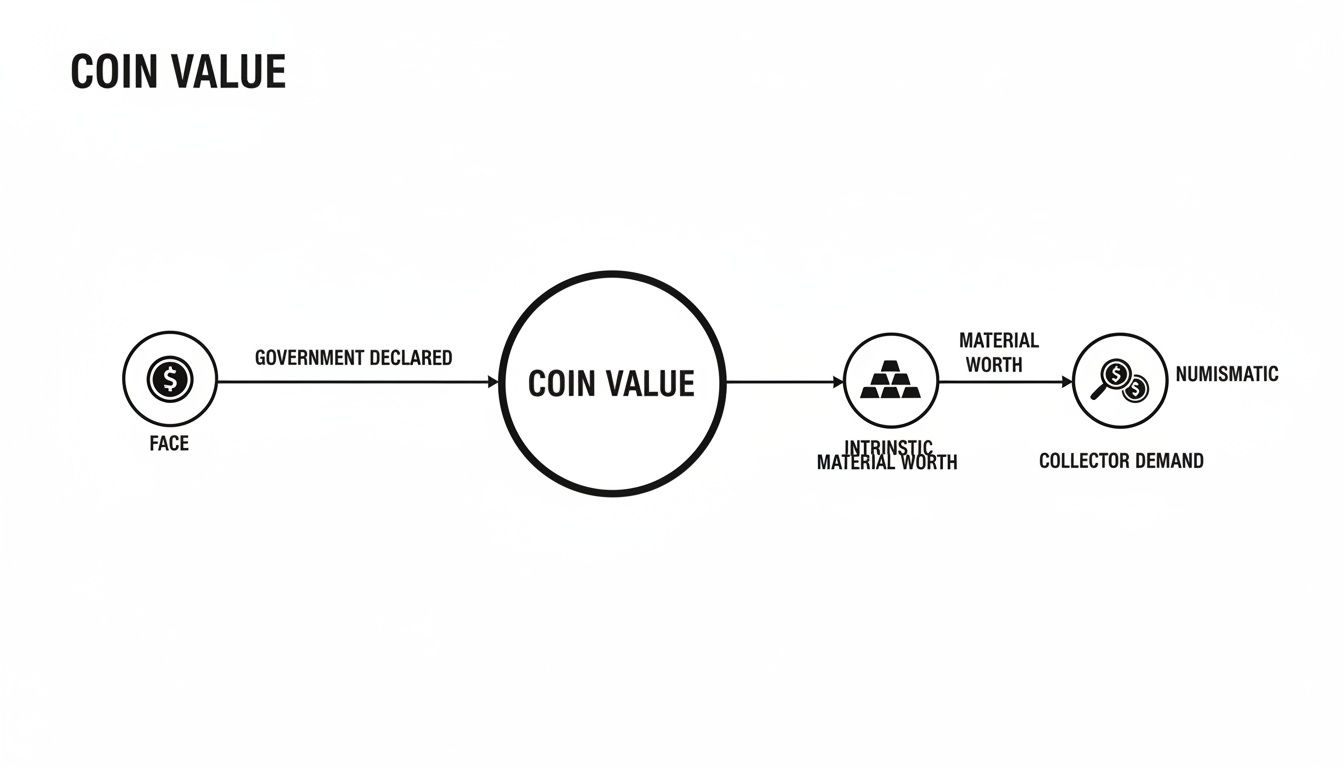

To really get your head around face value, it helps to see it as just one chapter in a three-part story. Every collectible coin can be looked at through three different lenses, and each one reveals a completely different side to its worth. Understanding all three is the key to unlocking a coin's full story and its true potential.

First up, as we’ve covered, is its face value. Think of this as the coin's official, government-stamped identity—the amount it's legally worth in a shop, like the "£1" on a pound coin. It’s the baseline, and for the change rattling around in your pocket, it’s usually the only value that matters day-to-day.

Beyond the Official Stamp

But things get more interesting from here. Next, we have intrinsic value. This is all about the raw materials. What’s the coin actually made of? Imagine melting down a classic British Gold Sovereign; its intrinsic value is simply the market price of that little lump of gold. For older coins struck from precious metals, this value can often dwarf what’s printed on them.

Finally, we arrive at the most exciting one for collectors: numismatic value. This is the collector's price tag, and it's driven by a whole different set of rules—things like rarity, historical importance, condition (what we call its 'grade'), and sheer demand. A coin's numismatic value often has little to do with its face value or what it's made of. It’s all about its desirability as a piece of history.

The famous 2009 Kew Gardens 50p is the perfect example. Its face value is 50 pence. Its metal value is even less. But because it's so incredibly rare—only 210,000 were ever minted—its numismatic value can soar past £150. It just goes to show how powerfully rarity and collector demand can eclipse a coin's basic worth. For a deeper dive, check out our complete walkthrough on how to value coins.

A coin's face value is its spending power. Its intrinsic value is its material worth. Its numismatic value is its story's worth to a collector.

To make these differences crystal clear, let's put them side-by-side. We'll use a modern UK Gold Sovereign as our example.

Comparing Face Value, Intrinsic Value, and Numismatic Value

This table really highlights how the three types of value can tell very different stories for the same coin.

| Type of Value | What It Represents | Example (UK Gold Sovereign) |

|---|---|---|

| Face Value | The official legal tender amount printed on the coin. | £1 (one pound sterling) |

| Intrinsic Value | The current market price of the gold content within the coin. | £400+ (variable, based on the spot price of gold) |

| Numismatic Value | The collector's price, based on rarity, date, and condition. | £450 - £10,000+ (highly variable) |

As you can see, a single coin can have three wildly different valuations. While its face value is a token £1, its actual worth is dictated by the gold it contains and, more importantly, its appeal to the collecting world. It’s a brilliant reminder of why you should never, ever judge a coin by its cover.

When Face Value Is All That Matters

With all the talk of rare finds and precious metals, it's easy to forget that sometimes, a coin is just... a coin. In the world of everyday transactions, the number stamped on the metal is the only one that counts. This is the simple, practical role of face value as legal tender.

For the coins jingling in your pocket right now, their value is exactly what it says on the tin. A £2 coin will buy you £2 worth of goods, and a 10p piece gets you 10p worth of sweets. There’s no hidden numismatic premium or secret metal value to worry about. Their spending power is their face value, plain and simple.

This is especially true for charities. When a non-profit receives a bucket of donated modern currency, they aren’t sifting through it for rare dates or minting errors. For them, the face value is precisely what they can take to the bank to fund their incredible work. In that context, a pound is a pound.

This diagram helps to show how a coin's three different types of value relate to one another.

As you can see, while the intrinsic and numismatic values can add layers of complexity, face value is always the official starting point.

Commemorative Coins and Legal Tender

Even in the collector’s world, face value has a funny part to play. Think about the brilliant uncirculated commemorative coins issued by The Royal Mint. They're often sold to collectors for a premium, far more than the monetary value printed on them, and they’re never meant to be spent.

For example, a special edition £5 coin might be sold for £14.99. But at the end of the day, it still has a legal tender face value of five pounds. While you could technically spend it in a shop for a fiver, you’d be instantly losing money on your purchase.

Face value acts as a government guarantee of a coin's minimum worth within its own economy, even if its collector or material value is much higher.

This official status as legal tender is what holds our entire monetary system together. It’s the promise that your money will be accepted for what it says it is, providing a stable foundation for buying and selling. So, while we hunt for those numismatic treasures, we all rely on the simple, unchanging truth of face value every single day.

How Market Value Outshines Face Value

This is where the real thrill of coin collecting begins. While face value gives a coin its official spending power, the numismatic value—or market value—is where the true potential lies. This is the value determined not by the government, but by the collectors and enthusiasts themselves.

Think of it this way: face value is the sticker price, but the market value is what a passionate buyer is actually willing to pay at auction. Several key factors can cause this value to climb far beyond the number stamped on the coin, turning a bit of pocket change into a treasured asset.

The Ingredients of High Market Value

So, what transforms a simple coin into a collector's dream? It all comes down to a special mix of rare characteristics. Learning to spot these is the key to uncovering hidden gems.

The main drivers behind a coin's numismatic worth include:

- Rarity: Simply put, how many were made? The fewer coins that were minted, the higher the demand from collectors trying to complete their sets.

- Condition (Grade): A coin in pristine, uncirculated condition will always fetch a higher price than one that’s been worn down by years of use.

- Minting Errors: Mistakes made during production—like misaligned text or incorrect designs—create unique and highly sought-after rarities.

- Historical Significance: Coins connected to a major event or a specific moment in history often carry a story that adds to their appeal and value.

- Collector Demand: At the end of the day, a coin is worth what someone is willing to pay. Popular themes or series can drive prices up significantly.

A fantastic UK example is the famous 2009 Kew Gardens 50p. With a tiny mintage of just 210,000, its rarity alone pushes its market value to over £150. That's an incredible 300 times its face value. This single coin perfectly shows how dramatically market forces can eclipse a coin’s official worth.

The Story of an Accidental Treasure

Another legendary tale from the world of collecting is that of the 1983 ‘New Pence’ 2p coin. Up until 1982, the Royal Mint stamped 2p coins with the words "New Pence." Afterwards, this was changed to "Two Pence." But in 1983, a small number were accidentally struck with the old "New Pence" design.

This simple mistake created an instant rarity. A 2p coin that should be worth, well, two pence, can now sell for over £1,000 if it’s one of the mistaken few from 1983.

These stories aren't just fascinating anecdotes; they reveal the incredible potential hiding in plain sight. They show that understanding what does face value mean is just the first step. The real excitement is in discovering the factors that give a coin a second, far more valuable, identity. For a deeper dive into what makes certain coins so valuable, you can explore our guide on understanding rare coin pricing.

The UK coin collecting market is a testament to this principle. The global industry, valued at around $35.54 million USD, is projected to more than double by 2035. Within this thriving market, some rare UK coins have appreciated by over 20% annually, showing just how significant the gap between face value and market value can become. You can find more details on these trends by exploring the full coin collecting market research.

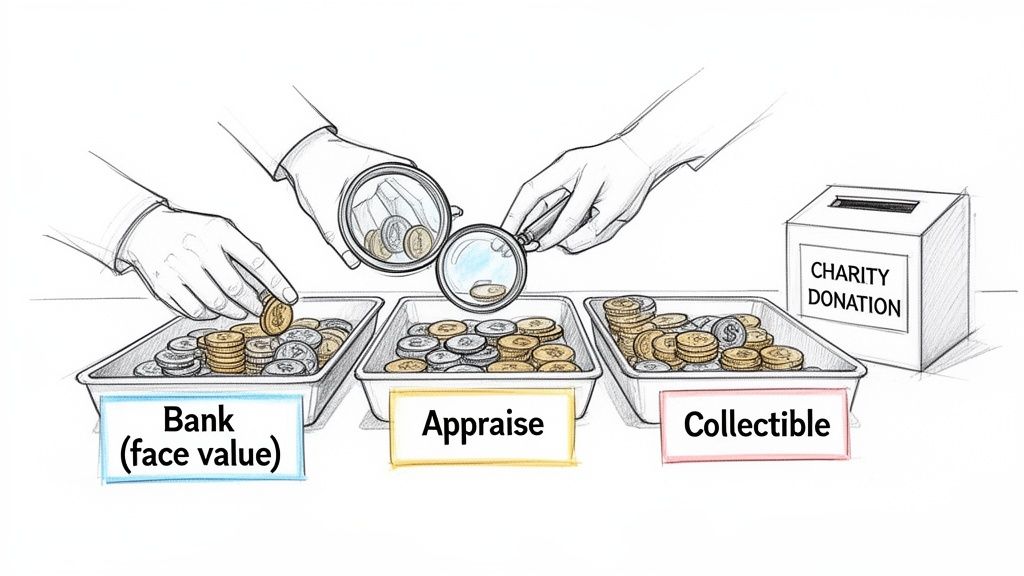

A Practical Guide for Collectors and Charities

It’s one thing to understand the theory behind face, intrinsic, and market value, but it's another thing entirely to put that knowledge into practice. Whether you’re just starting a collection, reselling for profit, or managing charity donations, knowing when to look beyond the number on a coin is what separates a missed opportunity from a smart decision.

This guide offers real, tangible advice to help you spot the difference between everyday spending money and a potential treasure. For different people, the question of what does face value mean leads to very different actions.

For the New Collector

Dipping your toes into collecting is an incredibly exciting journey. It’s tempting to search for treasure in every handful of change you get, but the real secret is to be strategic. The good news is, you don’t need to be an expert to spot something with potential.

Here are a few simple tips to get you started on finding coins worth more than their face value:

- Check the Date: Older is often better. Pre-decimal British coins, for instance, frequently contain silver, pushing their metal value well above what’s stamped on them.

- Look for Unusual Designs: Keep a sharp eye on commemorative 50p and £2 coins. Some, like the legendary Kew Gardens 50p, had incredibly low mintage numbers and are now highly sought after by collectors.

- Spot the Oddities: Train your eye to notice anything that looks a bit 'off'. Tiny minting errors, like misaligned text or incorrect details, can turn an ordinary coin into a valuable rarity.

For the Reseller

If you're a reseller or a bulk buyer, efficiency is the name of the game. When you’re faced with a mountain of coins, you need a system to quickly sift out the high-value pieces from the stuff that’s only worth its face value.

A great approach is to use a multi-stage sorting process. First, pull out anything that looks like it has precious metal content, like old silver or even pre-1992 copper coins. Next, isolate any known rare dates or popular commemorative issues. What's left over—the common, modern coins—can be bundled and sold by weight or face value. This leaves you with the high-potential pieces that deserve individual attention and valuation.

For a reseller, time is money. An effective sorting system that separates numismatic gems from face-value bulk is the foundation of a profitable business.

For Charities and Fundraisers

When a charity receives a donation of old currency, the main goal is to squeeze every last penny out of it for the cause. Most donated coins will simply be banked at face value, but there’s often hidden potential that gets completely overlooked.

That face value figure can be seriously misleading. A rare coin with a £1 face value might fetch many times that amount if it’s properly identified and sold through a dealer or auction instead of just being tossed in the bank bag.

Organisations should put a simple sorting protocol in place. Ask a volunteer with a basic knowledge of coins to give donations a quick once-over. Anything that looks old, unusual, or appears on a checklist of known rarities should be set aside for a professional appraisal. It's a tiny step that can turn a small donation into a significant one. Exploring proven strategies for charity fundraising can help organisations maximise these kinds of opportunities.

Common Questions About Coin Face Value

As you dive deeper into the world of coins, a few common questions always seem to surface. Getting your head around face value is the first step, but it’s the follow-up questions that really build a solid foundation of knowledge. This section tackles the most frequent queries we hear from collectors, both new and old.

Think of it as your go-to guide for clearing up any confusion. We'll cover everything from what to do with old currency to the key differences between face value, market value, and legal tender. Let’s get these questions answered so you can evaluate your coins with real confidence.

Can I Spend Old Pre-Decimal Coins at Their Original Face Value?

This is probably one of the most common questions we get, and the short answer is no. Pre-decimal coins—your old pennies, shillings, and florins—were officially taken out of circulation after the UK switched to the decimal system in 1971. This process is called 'demonetisation'.

Because they're no longer legal tender, you can’t pop into a shop and use them to buy anything. Their value today is entirely separate from what was stamped on them. Instead, it comes down to two other things:

- Collector (Numismatic) Appeal: Is it a sought-after date or in particularly good condition?

- Intrinsic (Metal) Worth: Many older coins were made from silver, which means their value as scrap metal is often far higher than their old face value.

Does a Higher Face Value Mean a Coin Is More Valuable?

Absolutely not. This is one of the biggest myths in coin collecting. The number printed on a coin is almost never a reliable guide to its real-world market value. A coin's true worth is driven by rarity, condition, its story, and how many people want to own it.

A classic example is the Kew Gardens 50p. It has a face value of just fifty pence, but it regularly sells for over £150 due to its scarcity. On the flip side, many commemorative £5 coins, despite their high face value, are often only worth £5 to another collector. This shows perfectly that face value and numismatic value are two completely different beasts.

What Is the Difference Between Legal Tender and Face Value?

While these two ideas are linked, they aren't the same thing. Face value is simply the monetary amount written on a coin or note—£1, 50p, and so on. Legal tender, however, is a formal legal status that defines how currency can be used to settle a debt.

For the coins jingling in your pocket, face value and legal tender status go hand in hand. But it gets interesting with commemorative coins. The Royal Mint issues many special coins that are technically legal tender but were never meant to be spent. They are sold to collectors at a premium, and their precious metal content or numismatic appeal often makes them far more valuable than the face value they carry.

How Do I Find Out the Market Value of My Coins?

Figuring out what your coins are actually worth is the most exciting part of the hobby, and it just takes a little research. A fantastic starting point is checking the 'sold' listings on online auction sites. This doesn't show you what people are asking, but what buyers are actually paying right now.

For a more structured approach, you can pick up a current coin catalogue like the Spink "Coins of England & the United Kingdom" guide, which gives you a solid baseline. But for the most accurate appraisal, especially considering your coin's specific condition, nothing beats getting in touch with a reputable coin dealer. They have the experience and market data to give you a true valuation.

At Cavalier Coins Ltd, we live and breathe numismatics. Whether you're hunting for a rare banknote, valuing a collection, or just starting your journey, our team is here to help. Explore our extensive selection of world coins and banknotes at https://www.cavaliercoins.com.